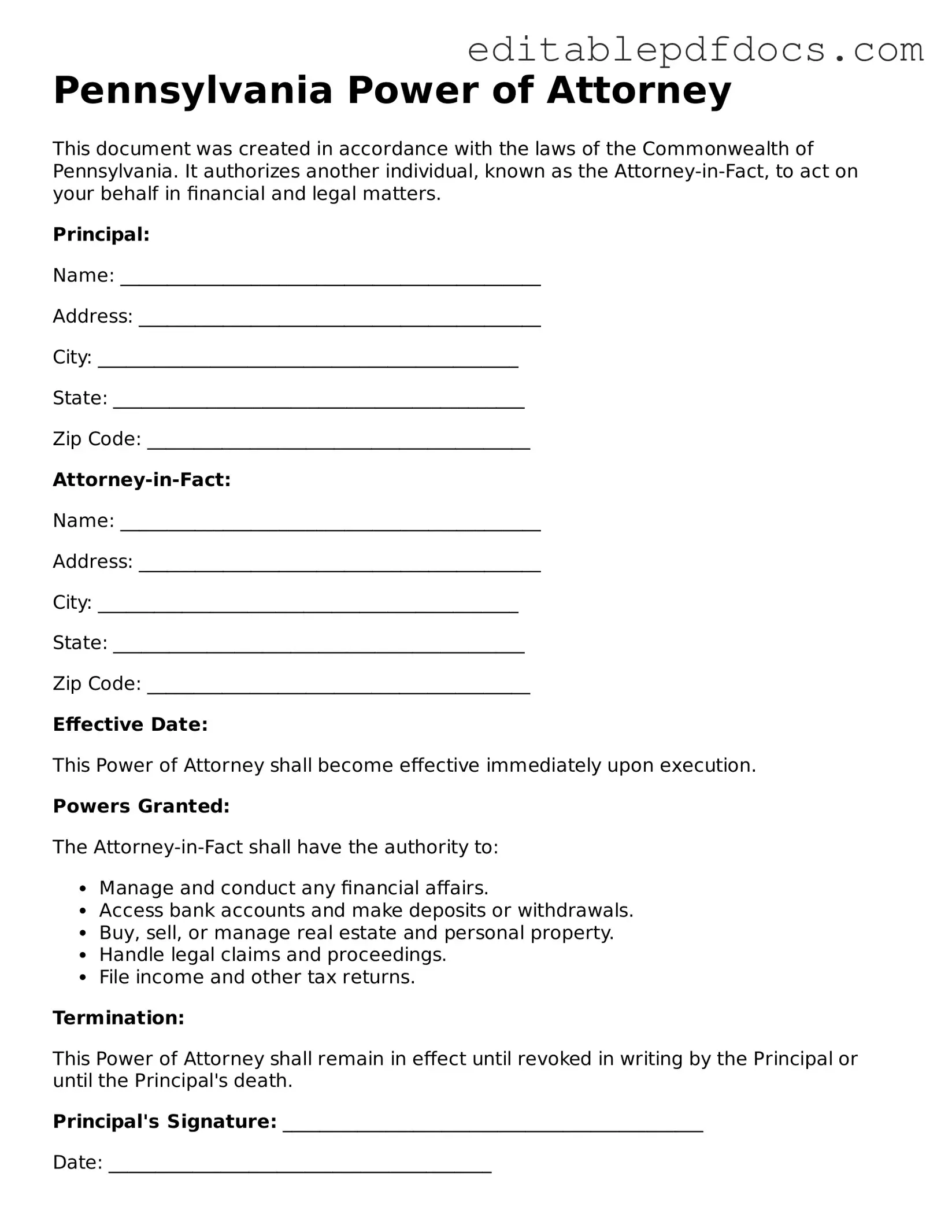

Power of Attorney Document for Pennsylvania

The Pennsylvania Power of Attorney form is a crucial legal document that empowers individuals to designate another person, known as an agent or attorney-in-fact, to make decisions on their behalf. This form is particularly important for managing financial affairs, healthcare decisions, and other significant matters when one is unable to act due to illness, disability, or absence. In Pennsylvania, the form can be tailored to fit the specific needs of the principal, allowing for broad or limited powers depending on the situation. It is essential to understand the different types of powers of attorney available, such as durable, medical, and springing, each serving unique purposes. Additionally, the form must adhere to specific requirements, including notarization and witness signatures, to ensure its validity. By carefully considering the implications and responsibilities involved, individuals can create a Power of Attorney that provides peace of mind and clarity during challenging times.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) in Pennsylvania allows an individual to grant authority to another person to act on their behalf in legal and financial matters. |

| Governing Laws | The Pennsylvania Power of Attorney is governed by the Pennsylvania Consolidated Statutes, specifically Title 20, Chapter 56. |

| Types of POA | In Pennsylvania, there are different types of POA, including General, Limited, and Durable, each serving specific purposes and durations. |

| Execution Requirements | To be valid, the Power of Attorney must be signed by the principal and witnessed by two individuals or notarized. |

Dos and Don'ts

When filling out the Pennsylvania Power of Attorney form, it is essential to approach the task with care and attention to detail. Here are some important do's and don'ts to keep in mind:

- Do read the entire form thoroughly before beginning to fill it out.

- Do ensure that you understand the powers you are granting to the agent.

- Do provide your full legal name and the name of your agent clearly.

- Do sign the document in the presence of a notary public or two witnesses, as required.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank; fill in all required information.

- Don't use vague language when specifying the powers granted.

- Don't forget to keep a copy of the signed document for your records.

Documents used along the form

When considering a Power of Attorney (POA) in Pennsylvania, it’s important to understand that it often works in conjunction with several other documents. Each of these forms plays a vital role in ensuring that your wishes are honored and that your affairs are managed smoothly. Here’s a list of commonly used documents that complement a Power of Attorney.

- Advance Healthcare Directive: This document outlines your medical preferences in case you become unable to communicate them. It allows you to appoint someone to make healthcare decisions on your behalf.

- Living Will: A living will specifies what types of medical treatment you do or do not want if you are terminally ill or in a persistent vegetative state. It provides guidance to your healthcare providers and loved ones.

- Durable Power of Attorney: Similar to a standard POA, this document remains effective even if you become incapacitated. It grants someone the authority to manage your financial affairs.

- Motor Vehicle Bill of Sale: When transferring ownership of a vehicle, be sure to reference the necessary Ohio motor vehicle bill of sale form instructions to complete the transaction legally.

- Financial Power of Attorney: This specific type of POA focuses on financial matters, allowing your agent to handle banking, investments, and other financial transactions on your behalf.

- Will: A will outlines how you want your assets distributed after your death. It can also name guardians for minor children, making it a crucial part of estate planning.

- Trust Agreement: A trust allows you to transfer assets to a trustee who manages them for the benefit of your beneficiaries. This can help avoid probate and provide more control over asset distribution.

- HIPAA Release Form: This document allows designated individuals to access your medical records. It ensures that your healthcare providers can share your information with those you trust.

- Beneficiary Designations: These forms specify who will receive your assets, such as life insurance or retirement accounts, upon your death. Keeping these updated is essential for effective estate planning.

- Property Deed: If you own real estate, a property deed outlines ownership. It may be necessary to update this if you wish to transfer property to a trust or another individual.

Understanding these documents and how they work together with a Power of Attorney can help you make informed decisions about your future. Each form serves a unique purpose, ensuring that your wishes are respected and your loved ones are taken care of. Consulting with a legal professional can provide additional clarity and guidance tailored to your specific situation.

Consider Some Other Power of Attorney Templates for US States

Florida Durable Power of Attorney - Important for organizing personal affairs and ensuring wishes are honored.

The Employment Verification form is a document used by employers to confirm a candidate’s previous employment history. By utilizing resources like PDF Documents Hub, organizations can easily access templates and guidelines to ensure that the information provided by job applicants is accurate and complete. To proceed with the verification process, fill out the form by clicking the button below.

Power of Attorney Washington - It may require notarization to be legally valid in some states.

Similar forms

- Living Will: A living will outlines a person's preferences regarding medical treatment in situations where they are unable to communicate their wishes. Like a Power of Attorney, it allows individuals to express their desires regarding healthcare decisions.

- Healthcare Proxy: This document designates someone to make medical decisions on behalf of an individual if they are incapacitated. Similar to a Power of Attorney, it grants authority to another person to act in the best interest of the individual.

- FedEx Bill of Lading: This essential document details the shipment of goods, ensuring proper handling and delivery. Anyone involved in freight shipping should understand the FedEx Bill of Lading, which serves as a record of terms and conditions. For easy access and management of these documents, check out Fillable Forms.

- Durable Power of Attorney: A durable power of attorney remains effective even if the person becomes incapacitated. This is similar to a standard Power of Attorney but specifically ensures that authority continues under certain circumstances.

- Financial Power of Attorney: This document specifically grants authority over financial matters. Like a general Power of Attorney, it allows one person to handle another’s financial affairs, but it focuses solely on finances.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds assets for the benefit of another. This is similar to a Power of Attorney in that it involves managing someone else’s interests, but it usually pertains to property and assets.

- Guardianship Documents: Guardianship documents appoint a person to make decisions for someone who is unable to do so due to incapacity. This is akin to a Power of Attorney, as both involve granting authority to another individual to act on behalf of someone else.

Common mistakes

Filling out a Pennsylvania Power of Attorney (POA) form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to clearly identify the principal and the agent. It's essential to provide full names and addresses to avoid confusion. If the agent is not properly named, they may not have the authority to act on behalf of the principal.

Another mistake involves not specifying the powers granted to the agent. Some people opt for a broad range of powers, while others may want to limit the agent's authority. Without clear delineation, the agent may overstep their bounds or, conversely, may not have the authority to perform necessary actions. Clarity is key in this section.

Many individuals also overlook the need for witnesses or notarization. In Pennsylvania, a POA must be signed in the presence of a notary public. Neglecting this step can render the document invalid. It's crucial to ensure that all signatures are properly witnessed to uphold the document’s legality.

Another common error is not updating the Power of Attorney when circumstances change. Life events such as marriage, divorce, or the death of an agent can impact the validity of the document. Regularly reviewing and updating the POA ensures that it reflects the current wishes and circumstances of the principal.

Some people mistakenly believe that once a Power of Attorney is signed, it cannot be revoked. This is not true. A principal retains the right to revoke the POA at any time, as long as they are mentally competent. Failing to understand this can lead to unnecessary complications if the principal wishes to change their agent or the powers granted.

Additionally, individuals often neglect to discuss their intentions with the chosen agent. Clear communication about the principal's wishes is vital. If the agent is unaware of the principal's preferences, they may make decisions that do not align with the principal’s desires.

Another mistake is using outdated forms. Laws and requirements can change, so it's essential to ensure that the form being used is the most current version. Using an old form can lead to legal challenges or confusion regarding the powers granted.

Finally, many people fail to consider the implications of their choices. Choosing an agent is a significant decision that should not be taken lightly. The agent will have considerable authority, so it’s important to select someone trustworthy and capable. Evaluating the relationship and the individual’s ability to handle such responsibilities can prevent future issues.