Operating Agreement Document for Pennsylvania

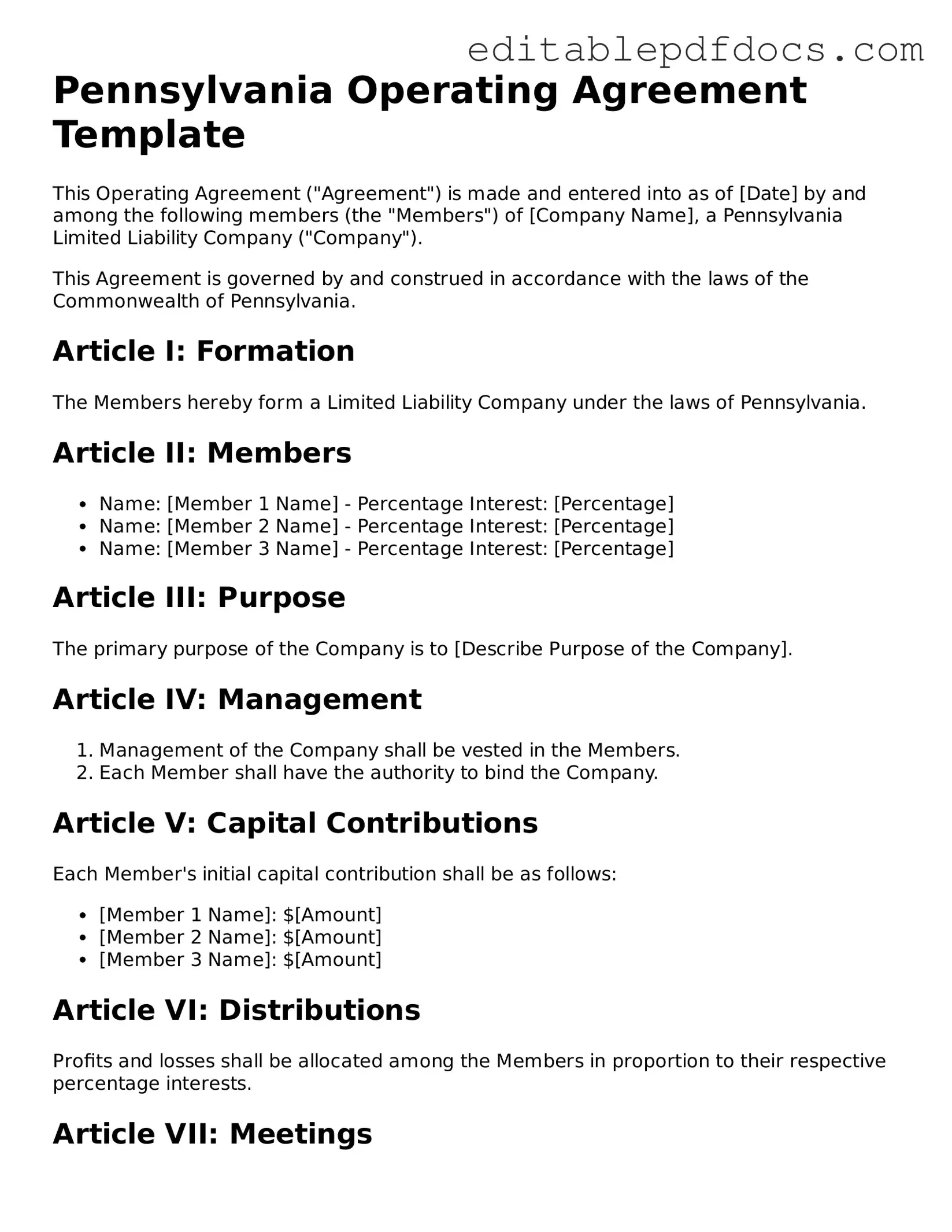

The Pennsylvania Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal workings of the LLC, detailing the management structure, member roles, and financial arrangements. By establishing clear guidelines, the Operating Agreement helps to prevent misunderstandings among members and provides a framework for resolving disputes. Key components include the distribution of profits and losses, procedures for adding or removing members, and the decision-making process. Additionally, the agreement may specify the duration of the LLC and address the handling of member contributions. Having a well-drafted Operating Agreement is essential for ensuring compliance with state regulations and protecting the interests of all parties involved.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Pennsylvania Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Pennsylvania Uniform Limited Liability Company Act (15 Pa.C.S. § 8901 et seq.). |

| Flexibility | Members have the flexibility to customize the terms of the agreement to suit their specific needs and business goals. |

| Member Rights | The agreement defines the rights and responsibilities of each member, including profit distribution and decision-making processes. |

| Legal Protection | Having an Operating Agreement helps protect members' personal assets by clarifying the LLC's status as a separate legal entity. |

Dos and Don'ts

When filling out the Pennsylvania Operating Agreement form, it’s important to approach the task with care. Here are some key dos and don’ts to keep in mind:

- Do read the instructions carefully before starting.

- Do provide accurate information about all members and their roles.

- Do clearly outline the management structure of your business.

- Do specify the financial contributions of each member.

- Do include provisions for resolving disputes among members.

- Don't leave any sections blank; every part of the form is important.

- Don't use ambiguous language; clarity is key.

- Don't forget to have all members sign the agreement.

- Don't overlook the need for periodic reviews and updates to the agreement.

Following these guidelines will help ensure that your Operating Agreement is comprehensive and effective, laying a solid foundation for your business operations.

Documents used along the form

When forming a business in Pennsylvania, an Operating Agreement is a crucial document for outlining the management structure and operational procedures of the entity. However, several other forms and documents are often used in conjunction with the Operating Agreement to ensure compliance and smooth operation. Below is a list of these important documents.

- Articles of Organization: This document is filed with the Pennsylvania Department of State to officially create a Limited Liability Company (LLC). It includes basic information about the LLC, such as its name, address, and registered agent.

- Bylaws: For corporations, bylaws serve as the internal rules governing the management of the company. They outline the roles of directors, officers, and shareholders, as well as procedures for meetings and decision-making.

- Sample Tax Return Transcript: This form provides a summary of an individual’s tax information as filed with the Internal Revenue Service. For more information, you can visit https://topformsonline.com/.

- Operating Agreement Addendum: This document is used to modify or add to the existing Operating Agreement. It is helpful when changes in membership or management occur, ensuring that all parties are aware of new terms.

- Membership Certificates: These certificates serve as proof of ownership for members of an LLC. They outline the member's ownership percentage and can be important for both internal records and external transactions.

- Tax Forms: Depending on the structure of the business, various tax forms may need to be filed with the IRS and the state. This includes forms for income tax, sales tax, and employment tax, ensuring compliance with tax regulations.

- Operating Procedures Manual: This document outlines the day-to-day operations of the business. It can include policies on employee conduct, customer service, and safety protocols, helping to maintain consistency across the organization.

- Non-Disclosure Agreements (NDAs): These agreements protect sensitive information shared between parties. They are essential when discussing business strategies or proprietary information with employees or partners.

Each of these documents plays a vital role in the establishment and operation of a business in Pennsylvania. Together, they create a comprehensive framework that helps ensure legal compliance and smooth management of the entity.

Consider Some Other Operating Agreement Templates for US States

Creating an Operating Agreement - It helps to define the LLC’s financial and operational framework.

Operating Agreement Llc Florida - An Operating Agreement can provide clarity on issues related to taxes and liabilities.

In today's competitive environment, having a reliable protection mechanism for sensitive information is paramount, which is why many individuals and businesses turn to a New York Non-disclosure Agreement (NDA) form. This legally binding document ensures that parties involved are committed to safeguarding proprietary knowledge and trade secrets. For those interested in creating such a document, valuable resources can be found at https://nyforms.com/non-disclosure-agreement-template/, offering templates and guidance to ensure confidentiality in various transactions and interactions throughout New York.

Creating an Operating Agreement - It covers how to handle new business opportunities or formations.

Similar forms

- Partnership Agreement: Similar to an Operating Agreement, a Partnership Agreement outlines the roles, responsibilities, and profit-sharing arrangements among partners in a business. Both documents serve to clarify the expectations and obligations of each party involved.

- Bylaws: Bylaws govern the internal management of a corporation. Like an Operating Agreement, they define the structure of the organization, including the duties of officers and procedures for meetings, ensuring smooth operations.

- Shareholder Agreement: This document is used by corporations to outline the rights and obligations of shareholders. It is similar to an Operating Agreement in that it addresses issues such as ownership interests and decision-making processes.

- LLC Membership Agreement: This agreement is specific to Limited Liability Companies (LLCs) and serves a similar purpose as an Operating Agreement. It details the rights and responsibilities of members, including capital contributions and distributions.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of collaboration between two or more parties. It is akin to an Operating Agreement in that it specifies the roles, contributions, and profit-sharing arrangements of the parties involved.

- Emotional Support Animal Letter: This letter verifies that an individual requires an emotional support animal for mental health assistance. To understand the process of obtaining this essential document, visit Fillable Forms.

- Franchise Agreement: This document establishes the terms under which a franchisee can operate under a franchisor's brand. Like an Operating Agreement, it defines the relationship and responsibilities between the parties, ensuring compliance with established standards.

Common mistakes

When filling out the Pennsylvania Operating Agreement form, individuals often encounter several common mistakes that can lead to complications down the road. Understanding these pitfalls can help ensure that the agreement is completed accurately and effectively.

One frequent error is failing to include all members' names and addresses. Each member of the LLC must be clearly identified in the agreement. Omitting a member can create confusion regarding ownership and responsibilities, which may lead to disputes later.

Another mistake is neglecting to specify the management structure. The agreement should clearly outline whether the LLC will be member-managed or manager-managed. This distinction is crucial, as it defines who has authority to make decisions on behalf of the LLC.

People sometimes overlook the importance of detailing profit and loss distribution. The Operating Agreement should explicitly state how profits and losses will be allocated among members. Without this clarity, misunderstandings can arise, potentially leading to conflict.

In addition, individuals may forget to include provisions for adding or removing members. Life circumstances can change, and the agreement should address how new members can join or how existing members can exit. This foresight can prevent future complications.

Another common oversight is not addressing dispute resolution methods. Including a process for resolving disagreements can save time and resources. Without this, members may find themselves in lengthy and costly disputes.

People often skip the step of reviewing state laws that pertain to Operating Agreements. Each state has its own regulations, and being unaware of these can lead to non-compliance. Ensuring that the agreement aligns with Pennsylvania laws is essential for its validity.

Finally, failing to have the agreement signed and dated is a critical mistake. An unsigned document may not hold up in legal situations. All members should sign and date the agreement to confirm their acceptance of its terms.