Motor Vehicle Bill of Sale Document for Pennsylvania

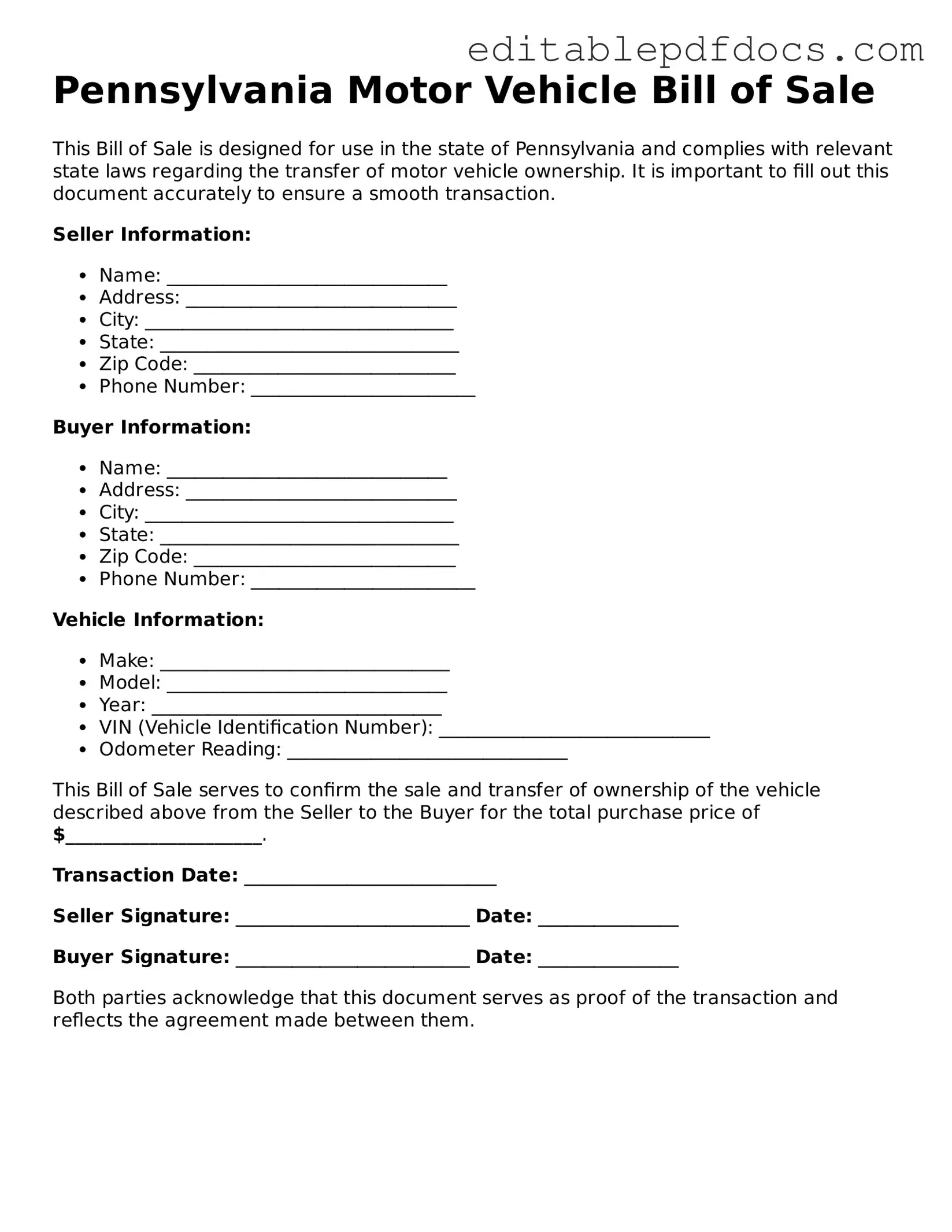

The Pennsylvania Motor Vehicle Bill of Sale form is a crucial document for anyone involved in the buying or selling of a vehicle within the state. This form serves as a legal record of the transaction, providing essential information that protects both the buyer and the seller. Key details included in the form are the names and addresses of both parties, the vehicle's identification number (VIN), make, model, year, and the sale price. Additionally, it may contain information regarding any liens on the vehicle, ensuring that the buyer is aware of any outstanding financial obligations. Completing this form accurately is vital, as it not only facilitates a smooth transfer of ownership but also assists in the proper registration of the vehicle with the Pennsylvania Department of Transportation. Whether you are a seasoned car dealer or a first-time seller, understanding the significance of this document can help you navigate the complexities of vehicle transactions with confidence.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Pennsylvania Motor Vehicle Bill of Sale is used to document the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by Pennsylvania Vehicle Code, Title 75, Chapter 11. |

| Required Information | Both parties must provide their names, addresses, and signatures, along with vehicle details like make, model, and VIN. |

| Notarization | Notarization is not required for the Bill of Sale in Pennsylvania, but it can provide additional protection. |

| Use for Registration | The Bill of Sale can be used to register the vehicle with the Pennsylvania Department of Transportation. |

| Tax Implications | Sales tax may be applicable based on the sale price of the vehicle, which must be reported during registration. |

| Record Keeping | Both buyer and seller should keep a copy of the Bill of Sale for their records. |

| Transfer of Ownership | The Bill of Sale serves as proof of the transfer of ownership from the seller to the buyer. |

Dos and Don'ts

When filling out the Pennsylvania Motor Vehicle Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should do and five things you should avoid:

- Do: Provide accurate information about the vehicle, including the make, model, year, and VIN.

- Do: Include the sale price clearly to avoid any confusion.

- Do: Sign and date the form to validate the transaction.

- Do: Keep a copy of the completed Bill of Sale for your records.

- Do: Ensure both the buyer and seller have a copy of the signed document.

- Don't: Leave any sections blank, as this may lead to issues later.

- Don't: Use incorrect or outdated information about the vehicle.

- Don't: Forget to print clearly to avoid misunderstandings.

- Don't: Sign the form without verifying all details are correct.

- Don't: Rely solely on verbal agreements; always document the sale.

Documents used along the form

The Pennsylvania Motor Vehicle Bill of Sale form is essential for documenting the sale of a vehicle. However, several other forms and documents may be needed to ensure a smooth transaction and proper registration. Below is a list of additional documents commonly used in conjunction with the Bill of Sale.

- Vehicle Title: This document proves ownership of the vehicle. The seller must sign the title over to the buyer during the sale. It is crucial for the buyer to have the title to register the vehicle in their name.

- Application for Title: After purchasing a vehicle, the buyer must complete this application to obtain a new title in their name. It includes details about the vehicle and the buyer’s information.

- Vehicle Purchase Agreement: This important document outlines the terms of the sale and protects both parties involved. For more details, you can access the Vehicle Purchase Agreement form.

- Odometer Disclosure Statement: Federal law requires this form to disclose the vehicle's mileage at the time of sale. Both the seller and buyer must sign it to verify the accuracy of the mileage.

- Sales Tax Form: This document is used to report the sales tax owed on the vehicle purchase. The buyer usually submits it along with the title application to ensure compliance with state tax regulations.

Having these documents ready can help facilitate a seamless vehicle transfer process. It is important to ensure all forms are accurately completed to avoid any issues during registration or future ownership disputes.

Consider Some Other Motor Vehicle Bill of Sale Templates for US States

What to Put on a Bill of Sale - Confirms that the seller has the right to sell the vehicle.

When preparing to ship goods, it's important to understand the significance of the FedEx Bill of Lading, which ensures that all details are properly documented. This form can be easily accessed and completed, allowing for a smoother shipping experience. For further assistance and resources, you can visit PDF Documents Hub to find more information related to the documentation needed.

Wa Vehicle Bill of Sale - A Motor Vehicle Bill of Sale is a legal document that records the sale of a vehicle.

Similar forms

- Real Estate Bill of Sale: Similar to the Motor Vehicle Bill of Sale, this document transfers ownership of real property. Both forms require details about the buyer, seller, and the item being sold, ensuring clarity in the transaction.

- Boat Bill of Sale: Like the Motor Vehicle Bill of Sale, this document is used to transfer ownership of a boat. It includes essential information such as the vessel's identification number and the terms of the sale.

- Motorcycle Bill of Sale: This document serves a similar purpose for motorcycles. It provides proof of ownership and outlines the details of the transaction, just as the Motor Vehicle Bill of Sale does for cars.

- Employment Verification Form: To confirm a person's work history, consider using the efficient Employment Verification documentation guide for seamless processing.

- Aircraft Bill of Sale: When purchasing an aircraft, this document is necessary. It establishes ownership and includes specifics about the aircraft, paralleling the information found in a Motor Vehicle Bill of Sale.

- Personal Property Bill of Sale: This general document is used for various types of personal property. It shares similarities in its purpose of transferring ownership and detailing the transaction.

- Mobile Home Bill of Sale: This document is specific to mobile homes. Like the Motor Vehicle Bill of Sale, it records the transfer of ownership and includes pertinent details about the property.

- Trailer Bill of Sale: Similar to the Motor Vehicle Bill of Sale, this form is used for the sale of trailers. It ensures that both parties understand the terms and conditions of the sale.

- Equipment Bill of Sale: This document is used for heavy equipment transactions. It functions similarly to the Motor Vehicle Bill of Sale by documenting the sale and transfer of ownership.

- Livestock Bill of Sale: This form is used for the sale of livestock. It captures the essential details of the transaction, much like the Motor Vehicle Bill of Sale does for vehicles.

- Business Asset Bill of Sale: When selling business assets, this document is crucial. It outlines the terms of the sale and ensures both parties are clear on what is being transferred, akin to the Motor Vehicle Bill of Sale.

Common mistakes

Filling out the Pennsylvania Motor Vehicle Bill of Sale form can seem straightforward, but many people make common mistakes that can lead to complications down the road. One frequent error is failing to include all necessary information about the vehicle. This includes the Vehicle Identification Number (VIN), make, model, and year. Omitting any of these details can create confusion and may even invalidate the sale.

Another mistake is not providing accurate information about the seller and buyer. Both parties must include their full names, addresses, and signatures. Incomplete or incorrect names can lead to disputes later on. Always double-check that the names are spelled correctly and that all addresses are current.

Some individuals neglect to date the form. The date of the sale is crucial for establishing the timeline of ownership. Without a date, it may be difficult to prove when the transaction occurred, which can complicate registration and title transfer processes.

Additionally, many people overlook the importance of having witnesses or notarization. While Pennsylvania does not require a bill of sale to be notarized, having a witness can add an extra layer of protection for both parties. It’s a good practice to have someone present during the signing to verify that the transaction took place.

Another common pitfall is not understanding the implications of the sale price. Sellers should clearly state the amount paid for the vehicle. This amount is often used for tax purposes, and inaccuracies can lead to issues with the Pennsylvania Department of Transportation.

People often forget to keep a copy of the completed bill of sale for their records. This document serves as proof of the transaction and can be invaluable if any disputes arise later. Always make sure to have a signed copy for both the buyer and seller.

Lastly, failing to follow up with the title transfer can create significant headaches. After the bill of sale is completed, it’s essential for the buyer to apply for a new title in their name. Neglecting this step can lead to complications with vehicle registration and ownership rights in the future.