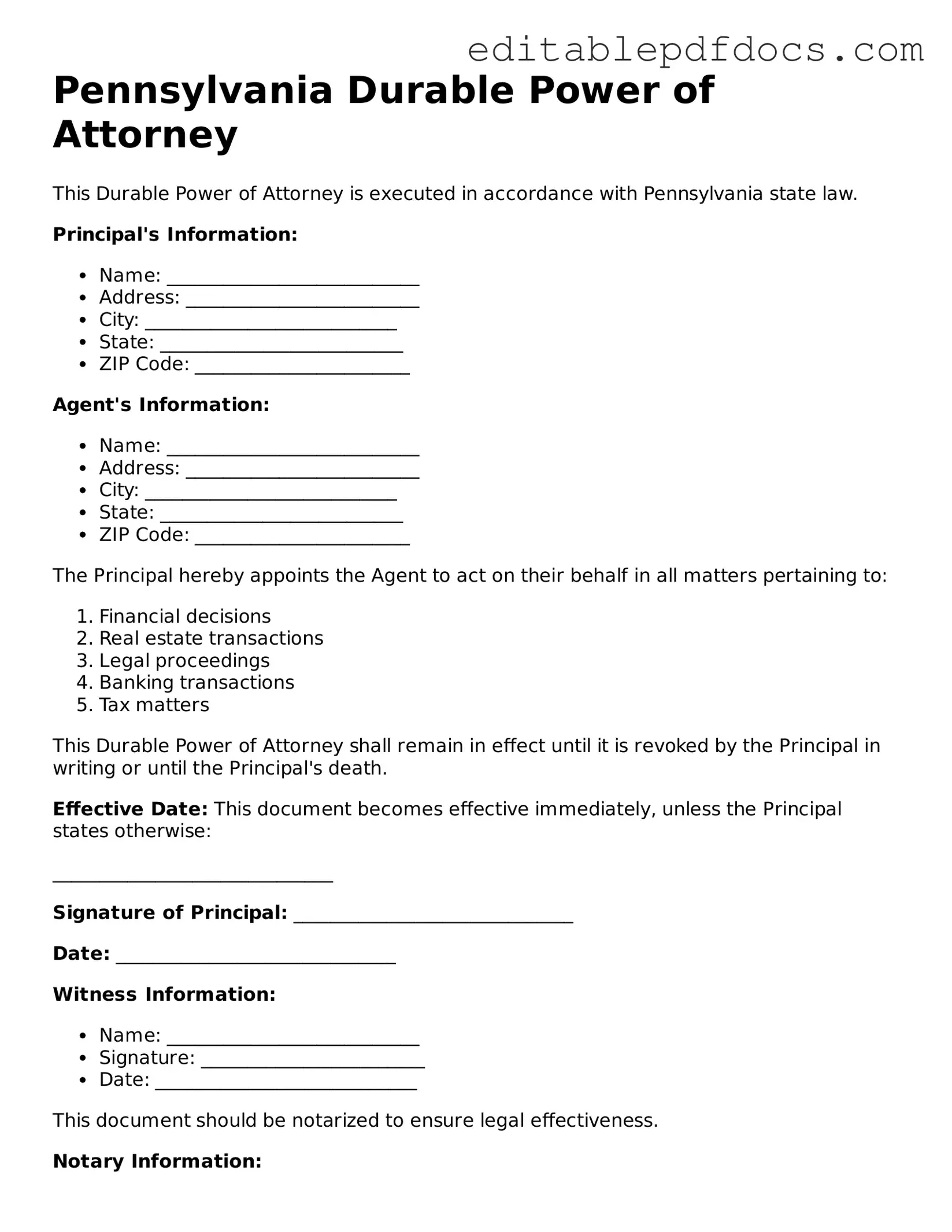

Durable Power of Attorney Document for Pennsylvania

In Pennsylvania, the Durable Power of Attorney form is a crucial legal document that empowers individuals to designate someone they trust to make financial and legal decisions on their behalf, especially in the event of incapacitation. This form is not just a piece of paper; it serves as a safeguard for your financial well-being and ensures that your wishes are respected when you may no longer be able to express them. By granting someone the authority to act on your behalf, you can maintain control over your affairs, even when circumstances change. The form allows for flexibility, enabling you to specify the powers granted, whether they pertain to managing bank accounts, handling real estate transactions, or making healthcare decisions. It is essential to understand that the Durable Power of Attorney remains effective even if you become incapacitated, which distinguishes it from other types of powers of attorney. As you consider creating this important document, think about who you trust to act in your best interests and how you want your affairs managed. Taking this step can provide peace of mind for you and your loved ones, ensuring that your financial and legal matters are handled according to your preferences.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Durable Power of Attorney allows an individual to designate someone else to make financial and legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | This form is governed by the Pennsylvania Consolidated Statutes, specifically Title 20, Chapter 56. |

| Durability | The "durable" aspect means that the authority granted remains in effect even if the principal becomes mentally incapacitated. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are still competent to do so. |

Dos and Don'ts

When filling out the Pennsylvania Durable Power of Attorney form, it's essential to approach the process with care. Here are nine important do's and don'ts to keep in mind:

- Do ensure that you understand the powers you are granting to your agent.

- Don't rush through the form; take your time to read each section carefully.

- Do choose a trusted individual as your agent, someone who will act in your best interest.

- Don't select an agent who may have conflicting interests or who is not reliable.

- Do clearly specify any limitations on the powers granted to your agent.

- Don't leave any sections blank; incomplete forms can lead to confusion or disputes.

- Do sign the form in the presence of a notary public to ensure its validity.

- Don't forget to provide copies of the signed form to your agent and any relevant institutions.

- Do review and update the document regularly to reflect any changes in your situation.

By following these guidelines, you can help ensure that your Durable Power of Attorney is effective and aligns with your wishes.

Documents used along the form

In Pennsylvania, individuals often utilize a Durable Power of Attorney to designate someone to manage their financial and legal affairs. This form is typically used alongside other important documents to ensure comprehensive planning for health care, estate management, and other legal matters. Below is a list of forms and documents frequently associated with the Durable Power of Attorney.

- Living Will: This document outlines an individual's wishes regarding medical treatment in situations where they are unable to communicate their preferences, particularly at the end of life.

- Health Care Power of Attorney: Similar to the Durable Power of Attorney, this form specifically grants someone the authority to make medical decisions on behalf of an individual if they become incapacitated.

- Last Will and Testament: This legal document specifies how a person’s assets should be distributed upon their death and may also appoint guardians for minor children.

- Revocable Living Trust: This arrangement allows individuals to place their assets into a trust during their lifetime, which can be managed by a trustee and distributed according to their wishes after death.

- Employment Verification Form: This document is essential for confirming an individual's employment history and status, facilitating the hiring process and ensuring candidates meet qualifications. For more information, check out Fillable Forms.

- Advance Directive: This document combines both a Living Will and a Health Care Power of Attorney, providing guidance on medical decisions and appointing a representative for health care matters.

- Authorization for Release of Medical Records: This form allows individuals to designate who can access their medical records, ensuring that their health information is shared with the appropriate parties.

These documents work together to create a comprehensive plan for managing an individual's affairs during incapacity or after death. It is advisable to consider each document's role and how they complement the Durable Power of Attorney in a holistic estate plan.

Consider Some Other Durable Power of Attorney Templates for US States

How to File for Power of Attorney in Florida - This form can help ensure that the principal's bills and obligations are taken care of, thereby protecting their assets.

Free Power of Attorney Form Tennessee - By setting up this form, you empower someone to make critical decisions when you're unable to voice your preferences.

In Texas, having a properly executed Motorcycle Bill of Sale is crucial for both buyers and sellers, as it secures the transfer of ownership for the motorcycle while also serving as an essential document to register the vehicle with the state. To learn more about this important form and avoid any ambiguities during the transaction, you can visit https://topformsonline.com/.

Power of Attorney in Phoenix - A Durable Power of Attorney allows you to appoint someone to act on your behalf, even if you become incapacitated.

Similar forms

- Health Care Proxy: This document allows you to appoint someone to make medical decisions on your behalf if you become unable to do so. Like a Durable Power of Attorney, it grants authority to another person, but it specifically focuses on health care matters.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you cannot communicate. While a Durable Power of Attorney can give someone the authority to make decisions, a Living Will directly expresses your preferences.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document grants someone the power to manage your financial affairs. However, it may be more limited in scope and can be tailored specifically to financial matters.

Florida Sales Tax Form: The Florida Sales Tax form, officially known as the Sales and Use Tax Return DR-15CS, is essential for properly reporting sales and collecting tax. To ensure compliance, you can open the pdf detailing guidelines on sales, exempt sales, and taxable amounts.

- Trust Agreement: A Trust Agreement allows you to place your assets into a trust for management by a trustee. While both documents involve delegating authority, a trust often has a broader purpose, including asset protection and estate planning.

- Will: A Will outlines how your assets should be distributed after your death. Although it does not grant authority while you are alive, it is similar in that it involves designating individuals to act on your behalf, albeit in different contexts.

Common mistakes

Filling out a Pennsylvania Durable Power of Attorney form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One of the most frequent errors is not clearly identifying the principal. It's essential to provide the full legal name and address of the person granting authority. Missing this information can create confusion about who the document pertains to.

Another common mistake is failing to specify the powers granted. The form allows for broad or limited powers, and not clearly stating what the agent can do can lead to misunderstandings. For example, if the document does not mention financial decisions, the agent may not have the authority to handle banking matters, which could hinder timely actions.

People often overlook the importance of naming a successor agent. If the primary agent cannot serve due to illness or other reasons, having a backup is crucial. Failing to name a successor can leave the principal without representation when it is most needed.

Not signing the document properly is another significant error. In Pennsylvania, the principal must sign the form in the presence of a notary public. If the signature is missing or the notarization is incomplete, the document may be deemed invalid. It’s vital to ensure that all signatures are in place and properly witnessed.

Many individuals also forget to date the document. A Durable Power of Attorney is only effective if it is dated correctly. Without a date, it can be challenging to determine when the powers were granted, which can lead to disputes later.

Another mistake is not discussing the document with the agent beforehand. It’s essential to communicate with the chosen agent about their responsibilities and ensure they are willing to accept the role. Surprises can create tension and may lead to the agent declining to act when needed.

Some people fail to review the document periodically. Life changes, such as marriage, divorce, or the birth of a child, can affect the appropriateness of the powers granted. Regularly reviewing and updating the Durable Power of Attorney ensures it reflects the current wishes of the principal.

Another error is not considering the implications of granting broad powers. While it may seem convenient to give the agent extensive authority, it’s crucial to consider the potential for misuse. Limiting powers to specific areas can provide peace of mind while still allowing for necessary actions to be taken.

Lastly, individuals sometimes neglect to store the document safely. Keeping the Durable Power of Attorney in a secure but accessible location is vital. If the document cannot be found when needed, all the planning may be in vain.