Deed Document for Pennsylvania

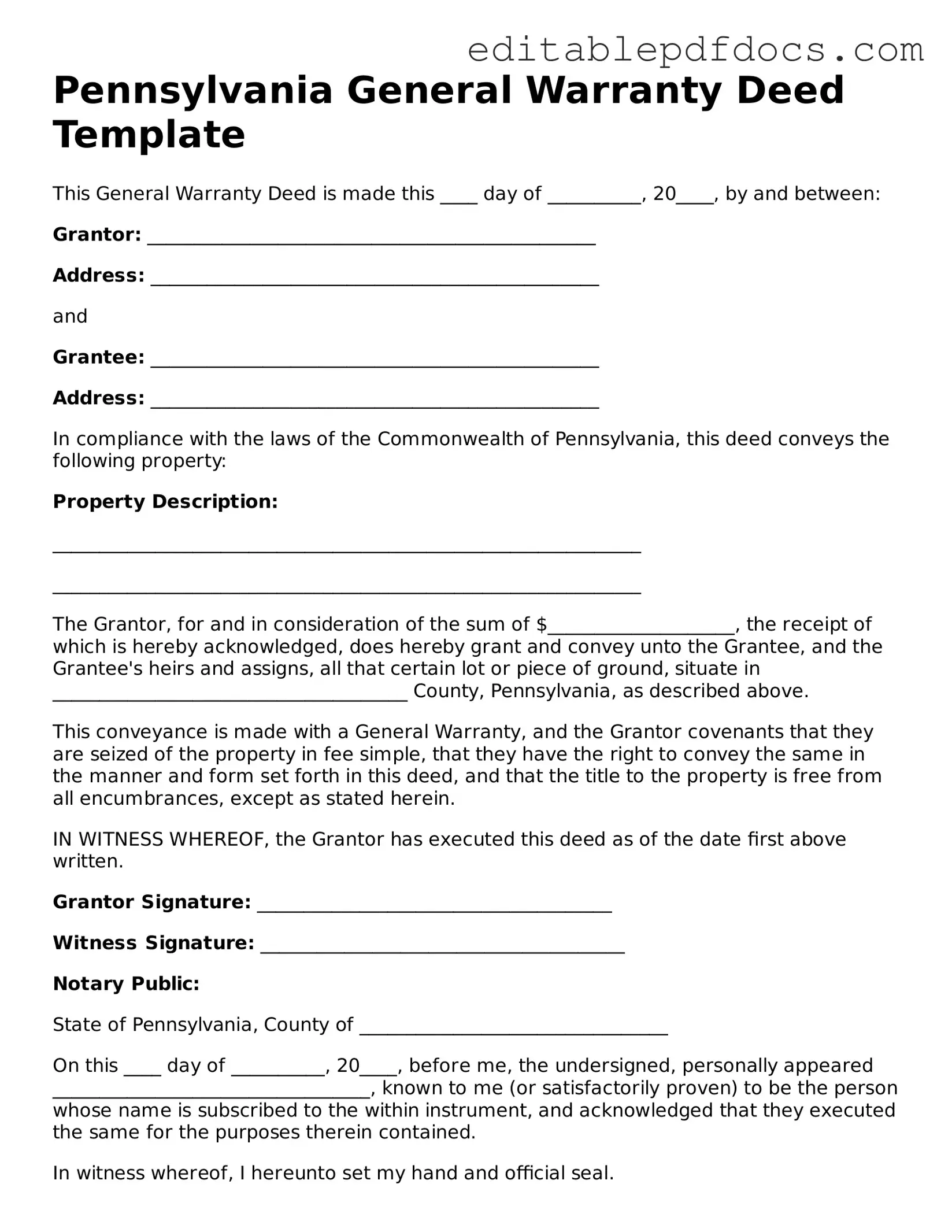

In Pennsylvania, the deed form serves as a crucial document in real estate transactions, facilitating the transfer of property ownership from one party to another. This legal instrument outlines essential details, including the names of the buyer and seller, a description of the property, and the terms of the transfer. Various types of deeds exist in Pennsylvania, such as warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and providing varying levels of protection to the buyer. Understanding the nuances of these forms is vital for anyone involved in a property transaction. Additionally, the deed must be properly executed, which typically involves signatures from both parties and notarization, ensuring the document is legally binding. Once completed, the deed must be recorded with the county's office to provide public notice of the ownership change, safeguarding the interests of all parties involved. Whether you are a first-time homebuyer or a seasoned investor, grasping the key elements of the Pennsylvania deed form is essential for a smooth and successful property transfer.

File Information

| Fact Name | Details |

|---|---|

| Governing Law | The Pennsylvania Deed form is governed by the Pennsylvania Consolidated Statutes, Title 21, Chapter 2. |

| Types of Deeds | Pennsylvania recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special purpose deeds. |

| Required Information | The form must include the names of the grantor and grantee, a legal description of the property, and the date of the transaction. |

| Signature Requirements | The grantor must sign the deed in the presence of a notary public to ensure its validity. |

| Recording | To protect the rights of the grantee, the deed must be recorded in the county where the property is located. |

| Transfer Tax | Pennsylvania imposes a realty transfer tax on property transfers, which must be paid at the time of recording. |

Dos and Don'ts

When filling out the Pennsylvania Deed form, it’s important to be thorough and accurate. Here’s a list of things you should and shouldn’t do to ensure a smooth process.

- Do double-check the names of all parties involved. Make sure they are spelled correctly and match official documents.

- Do include a legal description of the property. This information is crucial for identifying the exact location of the property being transferred.

- Do sign the deed in the presence of a notary. Notarization is required for the deed to be legally binding.

- Do keep a copy of the completed deed for your records. Having a copy can help if any issues arise in the future.

- Don't leave any fields blank. Every section of the form must be filled out completely to avoid delays.

- Don't use abbreviations or informal language. Stick to formal terms to ensure clarity and legal compliance.

- Don't forget to pay the necessary fees. There are often recording fees associated with filing the deed, so be prepared for that expense.

Following these guidelines will help you navigate the process more effectively. Take your time and ensure everything is in order for a successful property transfer.

Documents used along the form

When transferring property in Pennsylvania, several forms and documents may accompany the Pennsylvania Deed form. These documents help ensure the transaction is legally sound and properly recorded. Here’s a brief overview of some commonly used forms:

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable transfer taxes. It must be submitted to the county tax office during the property transfer process.

- Affidavit of Residence: This affidavit verifies the residency status of the property owner. It may be necessary for tax purposes or to confirm eligibility for certain exemptions.

- Title Search Report: A title search report provides a history of the property’s ownership and any claims against it. This document helps buyers ensure that the title is clear before completing the sale.

- Settlement Statement (HUD-1): This document outlines all costs associated with the real estate transaction. It details the financial aspects of the sale and is typically reviewed at closing.

- Bill of Sale for Trailers: If you are transferring ownership of a trailer, you will need to complete a Bill of Sale for Trailers to ensure all necessary details regarding the trailer’s transfer are properly documented.

- Power of Attorney: If the property owner cannot be present for the transaction, a power of attorney allows another individual to act on their behalf. This document must be properly executed to be valid.

- Notice of Settlement: This notice informs all parties involved that the settlement has occurred. It is often sent to relevant stakeholders, including lenders and title companies, to confirm the completion of the transaction.

Having these forms ready can streamline the property transfer process in Pennsylvania. Each document plays a vital role in ensuring that the transaction is transparent and legally binding.

Consider Some Other Deed Templates for US States

Tennessee Quitclaim Deed - Researching public records can reveal the history of past Deed transfers.

For those navigating the complexities of a divorce, utilizing the Florida Divorce Settlement Agreement form is essential, as it provides a clear outline of each party's rights and responsibilities. This form is designed to ensure that both parties can reach an equitable settlement, thereby avoiding misunderstandings and disputes in the future; you can get it here to facilitate your process.

Blank Deed Form - Pdf - Title insurance can help protect buyers in case issues arise concerning the validity of a deed after purchase.

Florida Deed Form - Requires accurate legal descriptions to avoid confusion.

Similar forms

- Bill of Sale: This document transfers ownership of personal property from one party to another, similar to how a deed transfers real property ownership.

- Lease Agreement: A lease outlines the terms under which one party can use another party's property, similar to how a deed establishes ownership rights.

- Trust Agreement: This document creates a trust, allowing a trustee to hold property for the benefit of beneficiaries, akin to how a deed establishes ownership and rights over property.

- California Boat Bill of Sale: This form is essential for documenting the transfer of ownership for a boat in California. It acts as proof of sale between the buyer and seller, providing necessary details about the vessel and the transaction. For convenience, you can access Fillable Forms to simplify the process.

- Quitclaim Deed: This is a specific type of deed that transfers interest in property without warranties, similar to a general deed but with fewer guarantees.

- Warranty Deed: This document guarantees that the grantor has clear title to the property, providing more security than a quitclaim deed, but still serves the same purpose of transferring ownership.

- Property Transfer Agreement: This document outlines the terms for transferring property ownership, similar to a deed but often used in more informal or private transactions.

- Affidavit of Title: This document is a sworn statement confirming the ownership of property, similar to a deed as it establishes legal ownership.

- Mortgage Document: This document secures a loan with real property, establishing a legal claim similar to how a deed establishes ownership rights.

- Power of Attorney: This document grants one person the authority to act on behalf of another in legal matters, including property transactions, much like a deed transfers ownership rights.

Common mistakes

When filling out the Pennsylvania Deed form, many individuals inadvertently make mistakes that can lead to complications in property transfer. One common error is not providing accurate names for all parties involved. This includes ensuring that the names match exactly as they appear on legal documents. If there are discrepancies, it could result in delays or even legal disputes later on.

Another frequent mistake is failing to include the correct property description. The deed must clearly identify the property being transferred, including its boundaries and any relevant details. A vague or incomplete description can lead to confusion and potential challenges to ownership.

Many people overlook the requirement for signatures. All grantors (those transferring the property) must sign the deed. In some cases, individuals may think that a single signature is sufficient, but if there are multiple owners, each must provide their signature to validate the document.

Not having the deed notarized is a significant error. Pennsylvania law requires that the deed be acknowledged before a notary public. This step is essential to ensure that the document is legally binding and can be recorded in the county's land records.

Another mistake is neglecting to indicate the consideration, or the value exchanged for the property. This is often stated in the form of a monetary amount, but if left blank or inaccurately filled out, it can lead to questions regarding the legitimacy of the transaction.

People sometimes forget to check for any liens or encumbrances on the property before completing the deed. If there are existing debts or claims against the property, these must be addressed before the transfer can be successfully completed. Ignoring this can lead to financial liabilities for the new owner.

Inaccurate or missing tax identification numbers can also create issues. Both the grantor and grantee should include their tax identification numbers to ensure that the transaction is properly recorded and that tax obligations are met.

Some individuals may not realize the importance of including the date of the transaction. This date is crucial for establishing the timeline of ownership and for any legal purposes that may arise in the future. Omitting this detail can complicate matters down the line.

Lastly, failing to review the completed deed for errors before submission is a common oversight. A thorough review can catch mistakes that may have been made during the filling process. A small error, such as a misspelled name or incorrect address, can have significant consequences.

By being mindful of these common pitfalls, individuals can help ensure that their Pennsylvania Deed form is filled out correctly and that the property transfer proceeds smoothly.