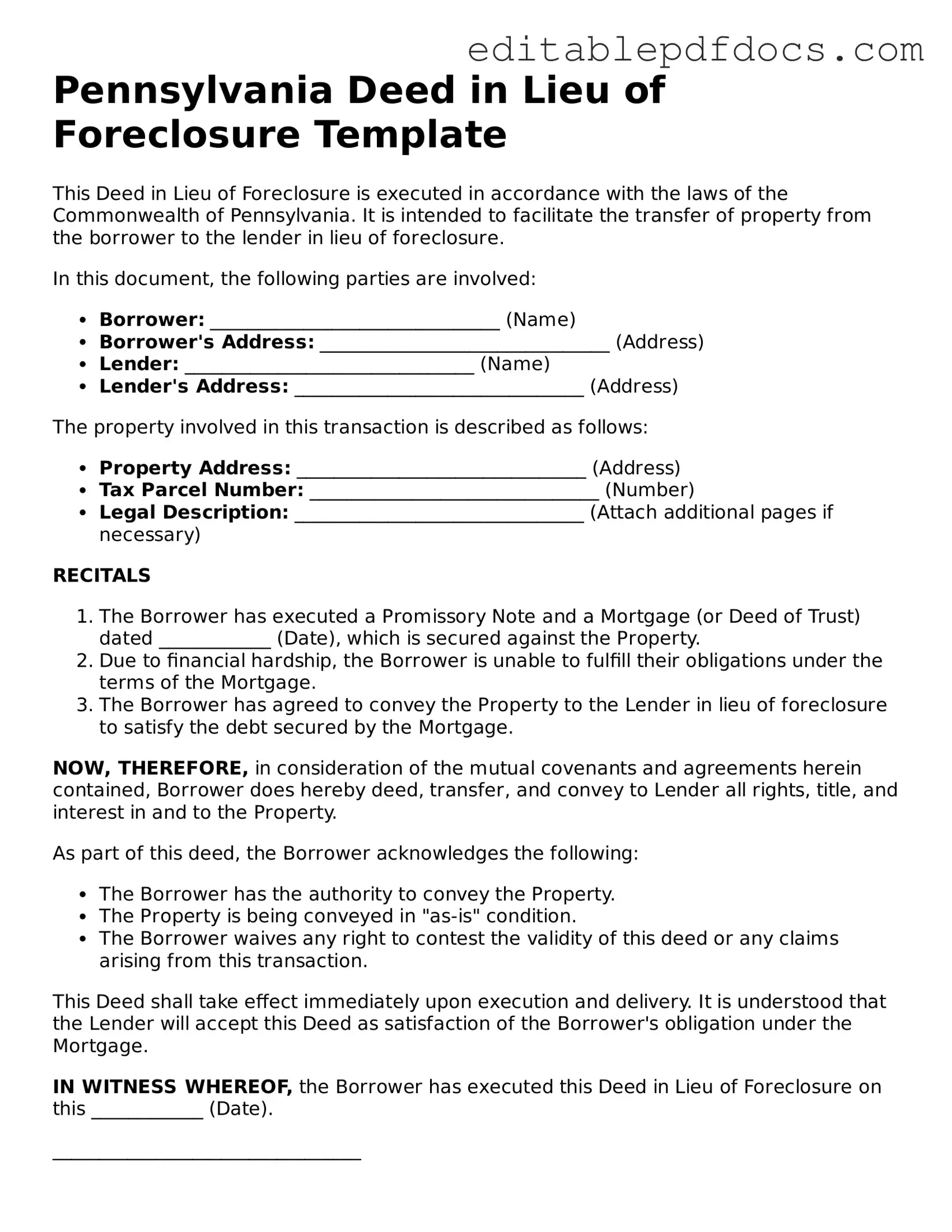

Deed in Lieu of Foreclosure Document for Pennsylvania

The Pennsylvania Deed in Lieu of Foreclosure form serves as a critical tool for homeowners facing the prospect of foreclosure. This legal instrument allows a property owner to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often costly foreclosure process. By executing this deed, the homeowner can mitigate the financial and emotional toll associated with foreclosure. The form typically requires essential information, including the names of the parties involved, a clear description of the property, and any existing liens or encumbrances. Additionally, it outlines the terms under which the transfer occurs, including potential release from further liability on the mortgage debt. This arrangement not only benefits lenders by expediting the recovery of their investment but also provides homeowners with an opportunity to exit their financial obligations with dignity. Understanding the nuances of this form is essential for both parties, as it can significantly impact their financial futures and legal standing.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The process is governed by Pennsylvania state law, particularly under the Pennsylvania Uniform Commercial Code and relevant real estate statutes. |

| Eligibility | Typically, the borrower must be facing financial hardship and unable to continue making mortgage payments to qualify. |

| Benefits | This option can help borrowers avoid the lengthy and costly foreclosure process, and it may have a less severe impact on their credit score. |

| Process | The borrower must negotiate with the lender, complete the necessary paperwork, and ensure that all liens on the property are addressed. |

| Potential Drawbacks | Borrowers may still face tax implications, as the forgiven debt could be considered taxable income by the IRS. |

| Alternatives | Other options include loan modification, short sale, or bankruptcy, which may be more suitable depending on individual circumstances. |

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it is essential to approach the process carefully. Here are seven important actions to take and avoid:

- Do ensure that all personal information is accurate and up to date.

- Do consult with a legal professional if you have questions or concerns.

- Do read the entire form thoroughly before signing.

- Do keep copies of all documents for your records.

- Don't rush through the process; take your time to understand each section.

- Don't leave any required fields blank; complete all sections as instructed.

- Don't sign the form without having it reviewed by a trusted advisor.

Documents used along the form

When navigating the process of a deed in lieu of foreclosure in Pennsylvania, several other documents may come into play. Each of these forms serves a specific purpose and can help streamline the process for both the borrower and the lender. Understanding these documents can enhance clarity and ensure that all parties are on the same page.

- Mortgage Agreement: This document outlines the terms of the loan secured by the property. It includes details such as the loan amount, interest rate, and repayment schedule. The mortgage agreement establishes the legal relationship between the borrower and the lender.

- Notice of Default: A notice of default informs the borrower that they have failed to meet the terms of the mortgage, typically due to missed payments. This document is often a precursor to foreclosure proceedings and serves as a formal warning.

- Release of Mortgage: Once the deed in lieu of foreclosure is executed, a release of mortgage is necessary to formally cancel the original mortgage. This document is recorded with the county to indicate that the borrower is no longer liable for the debt associated with the property.

- Property Title Transfer Document: This document facilitates the transfer of ownership from the borrower to the lender. It is essential for ensuring that the lender has clear title to the property after the deed in lieu of foreclosure is completed.

- Employment Verification Form: This form is essential for confirming a person's employment status and history, which can be particularly important in scenarios like applying for loans or rental agreements. For a template, you can refer to the Job Comfirmation Letter.

- Settlement Statement: Also known as a HUD-1 form, this document provides a detailed breakdown of all costs associated with the transaction. It includes fees, prorated taxes, and any other financial obligations that must be settled during the transfer of ownership.

By familiarizing oneself with these documents, individuals can better prepare for the deed in lieu of foreclosure process. Each form plays a crucial role in ensuring that the transaction is completed smoothly and legally.

Consider Some Other Deed in Lieu of Foreclosure Templates for US States

Deed in Lieu Vs Foreclosure - When utilized effectively, this option can facilitate a smoother exit strategy from an unaffordable mortgage.

Florida Deed in Lieu of Foreclosure - Some lenders may extinguish the remaining debt once the Deed in Lieu is signed, depending on the agreement.

California Voluntary Foreclosure Deed - Homeowners should review all implications with their financial advisor to ensure informed decision-making.

In situations where you may be unable to make financial decisions, having a Florida Durable Power of Attorney in place can provide peace of mind. This important legal document allows you to designate a trusted person to oversee your financial affairs, ensuring that they are managed according to your preferences. For those interested in creating this essential legal instrument, click here for the pdf to access the necessary form.

Foreclosure Process in Georgia - The borrower relinquishes their rights to the property to mitigate financial loss.

Similar forms

- Mortgage Satisfaction Release: This document serves to officially release a borrower from their mortgage obligations once the loan has been paid in full. Like a Deed in Lieu of Foreclosure, it signifies the end of the borrower's responsibility for the property.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the full amount owed on the mortgage. This document is similar because it allows the homeowner to avoid foreclosure, though it involves selling the property rather than transferring it back to the lender.

- Power of Attorney: To authorize someone to manage your legal affairs, consider using a comprehensive Power of Attorney form guide to streamline the decision-making process.

- Loan Modification Agreement: This document modifies the terms of an existing loan to make it more manageable for the borrower. While a Deed in Lieu of Foreclosure relinquishes ownership, a loan modification aims to keep the borrower in their home by adjusting payment terms.

- Foreclosure Notice: This is a formal notice that a lender sends to a borrower when they are in default. While it initiates the foreclosure process, it is conceptually similar to a Deed in Lieu of Foreclosure as both documents relate to the borrower's inability to meet mortgage obligations.

- Quitclaim Deed: This document transfers any interest a person may have in a property without guaranteeing that the title is clear. Similar to a Deed in Lieu of Foreclosure, it conveys ownership but does not involve a purchase or sale.

- Property Transfer Agreement: This agreement facilitates the transfer of property ownership from one party to another. Like the Deed in Lieu of Foreclosure, it involves the transfer of property rights but is not necessarily tied to a default situation.

- Release of Liability: This document releases a borrower from personal liability for a mortgage debt. It can be similar to a Deed in Lieu of Foreclosure in that both aim to free the borrower from financial obligations, though they do so in different contexts.

- Deed of Trust: This document secures a loan by placing the property in trust until the borrower repays the loan. While it establishes a lender's rights, it is similar to a Deed in Lieu of Foreclosure in that both involve the transfer of property interests as part of a financial arrangement.

Common mistakes

Filling out the Pennsylvania Deed in Lieu of Foreclosure form can be a complex process. Many individuals make common mistakes that can lead to delays or complications. Understanding these pitfalls can help ensure a smoother experience.

One frequent mistake is failing to provide accurate property information. When filling out the form, it’s essential to include the correct address, legal description, and parcel number. Missing or incorrect details can result in the deed being rejected or delayed. Always double-check this information against official documents to ensure accuracy.

Another common error involves not obtaining the necessary signatures. All parties involved in the transaction must sign the deed. This includes the borrower and any co-owners. Neglecting to secure all required signatures can render the deed invalid, leading to further complications in the foreclosure process.

People often overlook the importance of including a notary. A notary public must witness the signing of the deed for it to be legally binding. Failing to have the deed notarized can result in legal challenges down the line. It’s crucial to schedule a notary appointment and ensure that all signatures are properly witnessed.

In addition, some individuals do not fully understand the implications of the deed. A Deed in Lieu of Foreclosure transfers ownership of the property back to the lender, which can affect credit scores and future borrowing ability. It’s important to consider these consequences before proceeding. Seeking advice from a financial advisor can provide clarity on the potential long-term effects.

Lastly, many people neglect to follow up after submitting the form. Once the Deed in Lieu of Foreclosure has been submitted, it’s vital to confirm that the lender has accepted it. Keeping communication lines open with the lender can help avoid misunderstandings and ensure that the process is completed efficiently.