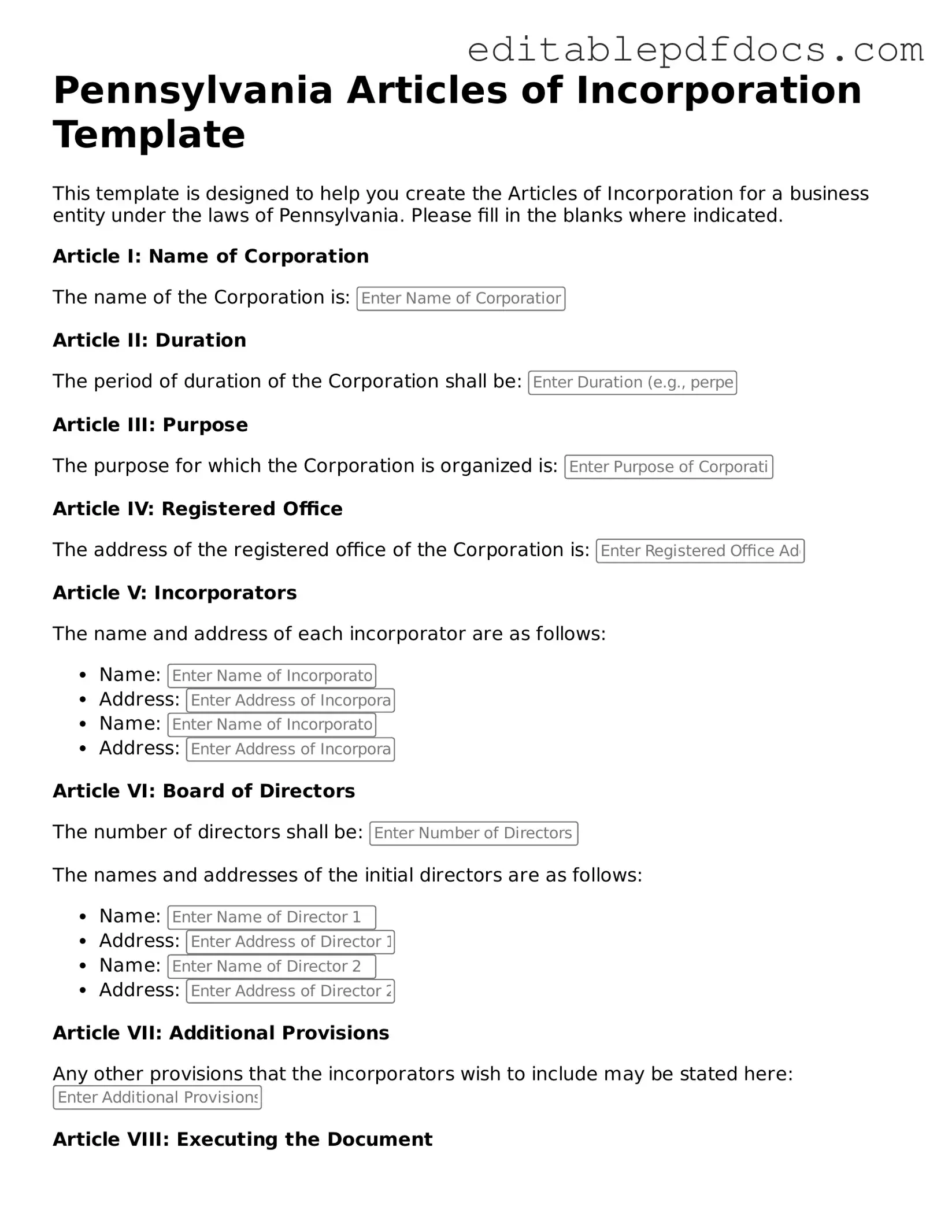

Articles of Incorporation Document for Pennsylvania

When starting a business in Pennsylvania, one of the first and most crucial steps is to complete the Articles of Incorporation form. This document serves as the foundation for your corporation, outlining essential details such as the corporation's name, its purpose, and the address of its principal office. Additionally, it requires information about the registered agent, who will be responsible for receiving legal documents on behalf of the corporation. The form also mandates the inclusion of the number of shares the corporation is authorized to issue, which is vital for establishing ownership structure. Furthermore, the Articles of Incorporation must specify whether the corporation will be for-profit or nonprofit, guiding its operational framework. Ensuring that each section is accurately filled out is not just a bureaucratic necessity; it is a vital step toward legal recognition and protection of your business interests. The importance of precision in this document cannot be overstated, as any errors or omissions could lead to delays in approval or even legal complications down the road. Taking the time to understand and carefully complete this form is an essential investment in the future of your enterprise.

File Information

| Fact Name | Details |

|---|---|

| Governing Law | The Pennsylvania Articles of Incorporation are governed by the Pennsylvania Business Corporation Law of 1988. |

| Purpose | The form is used to legally create a corporation in Pennsylvania. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for establishing a corporation in the state. |

| Information Required | The form requires the corporation's name, registered office address, and the names of the incorporators. |

| Incorporators | At least one incorporator must sign the Articles of Incorporation. |

| Fee | A filing fee must accompany the Articles of Incorporation, which varies based on the corporation's structure. |

| Effective Date | The corporation can specify an effective date for the Articles, which can be immediate or delayed. |

| Non-Profit Option | There is a specific form for non-profit corporations, which has different requirements. |

| Online Filing | Corporations can file the Articles of Incorporation online through the Pennsylvania Department of State’s website. |

Dos and Don'ts

When filling out the Pennsylvania Articles of Incorporation form, attention to detail is crucial. Here are ten important guidelines to follow, including things you should and shouldn't do:

- Do ensure that you have a unique business name that complies with Pennsylvania's naming requirements.

- Do provide a clear and concise purpose for your corporation, reflecting its intended business activities.

- Do include the registered office address, which must be a physical location in Pennsylvania.

- Do designate a registered agent who will receive legal documents on behalf of your corporation.

- Do review the form for accuracy before submission, as errors can lead to delays or rejection.

- Don't use prohibited words in your corporation name, such as "bank" or "insurance," unless you meet specific legal requirements.

- Don't forget to include the names and addresses of the initial directors, as this is a requirement.

- Don't overlook the filing fee; ensure you include the correct payment with your submission.

- Don't rush through the form. Take your time to ensure all sections are completed properly.

- Don't ignore the importance of keeping a copy of the filed Articles of Incorporation for your records.

Documents used along the form

When incorporating a business in Pennsylvania, several additional forms and documents may be necessary to ensure compliance with state regulations. Below is a list of commonly used forms that complement the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. Bylaws typically cover topics such as board meetings, voting procedures, and the roles of officers.

- Chick-fil-A Job Application: For those interested in employment at Chick-fil-A, completing the Fillable Forms is an essential step in the hiring process.

- Registered Agent Consent: A form that confirms the registered agent's agreement to serve as the corporation's official point of contact for legal documents and notices.

- Initial Report: Some states require an initial report after incorporation. This document provides basic information about the corporation, including its address and the names of its directors.

- Employer Identification Number (EIN) Application: This form, also known as Form SS-4, is submitted to the IRS to obtain an EIN, which is necessary for tax purposes and hiring employees.

- Business License Application: Depending on the type of business and its location, a specific business license may be required. This application varies by municipality and business type.

- Statement of Purpose: This document describes the nature of the business activities the corporation will engage in. It may be required by the state to clarify the corporation's objectives.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders, including how shares can be transferred and how decisions are made within the corporation.

- Annual Report: Many states require corporations to file an annual report to maintain good standing. This report typically includes updated information about the business and its financial status.

Incorporating a business involves multiple steps and documentation. Understanding these forms will help streamline the process and ensure compliance with Pennsylvania regulations.

Consider Some Other Articles of Incorporation Templates for US States

Florida Company Registration - The Articles of Incorporation serve to protect the owners' personal assets from corporate liabilities.

The Employment Application PDF form is a critical document often utilized by job seekers to present their qualifications and experiences to potential employers. This form collects key information that helps employers make informed hiring decisions. To ease the process, visit PDF Documents Hub and fill out the form today!

Starting an Llc in California - After submission, the state will review and approve the Articles, granting official status.

Similar forms

The Articles of Incorporation is a foundational document for creating a corporation, but it shares similarities with several other important documents in the business and legal realm. Here are five documents that bear resemblance to the Articles of Incorporation:

- Bylaws: Bylaws serve as the internal rules that govern a corporation's operations. Like the Articles of Incorporation, they outline essential details about the organization, including the roles of directors and officers, meeting protocols, and voting procedures.

- Operating Agreement: This document is crucial for limited liability companies (LLCs). Similar to the Articles of Incorporation, it establishes the management structure and operational guidelines of the LLC, detailing member responsibilities and profit distribution.

- Room Rental Agreement: For those renting rooms, the detailed New Jersey Room Rental Agreement guidelines provide essential terms and conditions for both landlords and tenants.

- Partnership Agreement: For partnerships, this agreement defines the terms of the partnership, including roles, contributions, and profit sharing. Like the Articles of Incorporation, it formalizes the relationship between parties involved and sets the groundwork for governance.

- Certificate of Good Standing: This document is often required to prove that a corporation is legally recognized and compliant with state regulations. While the Articles of Incorporation establish the corporation, the Certificate of Good Standing confirms its ongoing compliance, ensuring it remains in good standing with the state.

- Business License: A business license grants permission to operate legally within a specific jurisdiction. Similar to the Articles of Incorporation, it is a legal requirement for businesses and ensures that they meet local regulations and standards.

Understanding these documents can help individuals navigate the complexities of forming and managing a business. Each plays a vital role in ensuring that organizations operate smoothly and in compliance with the law.

Common mistakes

Filling out the Pennsylvania Articles of Incorporation form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is failing to choose an appropriate name for the corporation. The name must be unique and not too similar to existing businesses. It’s crucial to check the Pennsylvania Department of State’s database to ensure your chosen name is available.

Another mistake involves not including the required information about the corporation's purpose. Many people write vague descriptions or leave this section blank. A clear and specific purpose helps clarify the corporation's activities and can prevent issues down the line.

Some applicants overlook the necessity of providing the correct number of shares the corporation is authorized to issue. This detail is important because it determines the ownership structure. Not specifying this can lead to confusion among shareholders.

Additionally, individuals often forget to include the names and addresses of the initial directors. This information is essential for establishing the corporation’s governance. Omitting it can lead to questions about who is responsible for managing the company.

Many people also fail to include the registered office address. This address is where official documents will be sent. If this information is missing or incorrect, it can result in legal complications or missed communications.

Another common mistake is neglecting to sign the Articles of Incorporation. Without a signature, the form is incomplete and cannot be processed. Ensure that all required parties sign where necessary.

Some applicants miscalculate the filing fees. It’s important to check the current fee schedule and include the correct payment. Underestimating the fees can lead to delays in processing your application.

Finally, many individuals do not keep copies of the submitted documents. Retaining a copy of the Articles of Incorporation is vital for future reference. It can be helpful for compliance purposes or if any issues arise after filing.