Fill a Valid Payroll Check Template

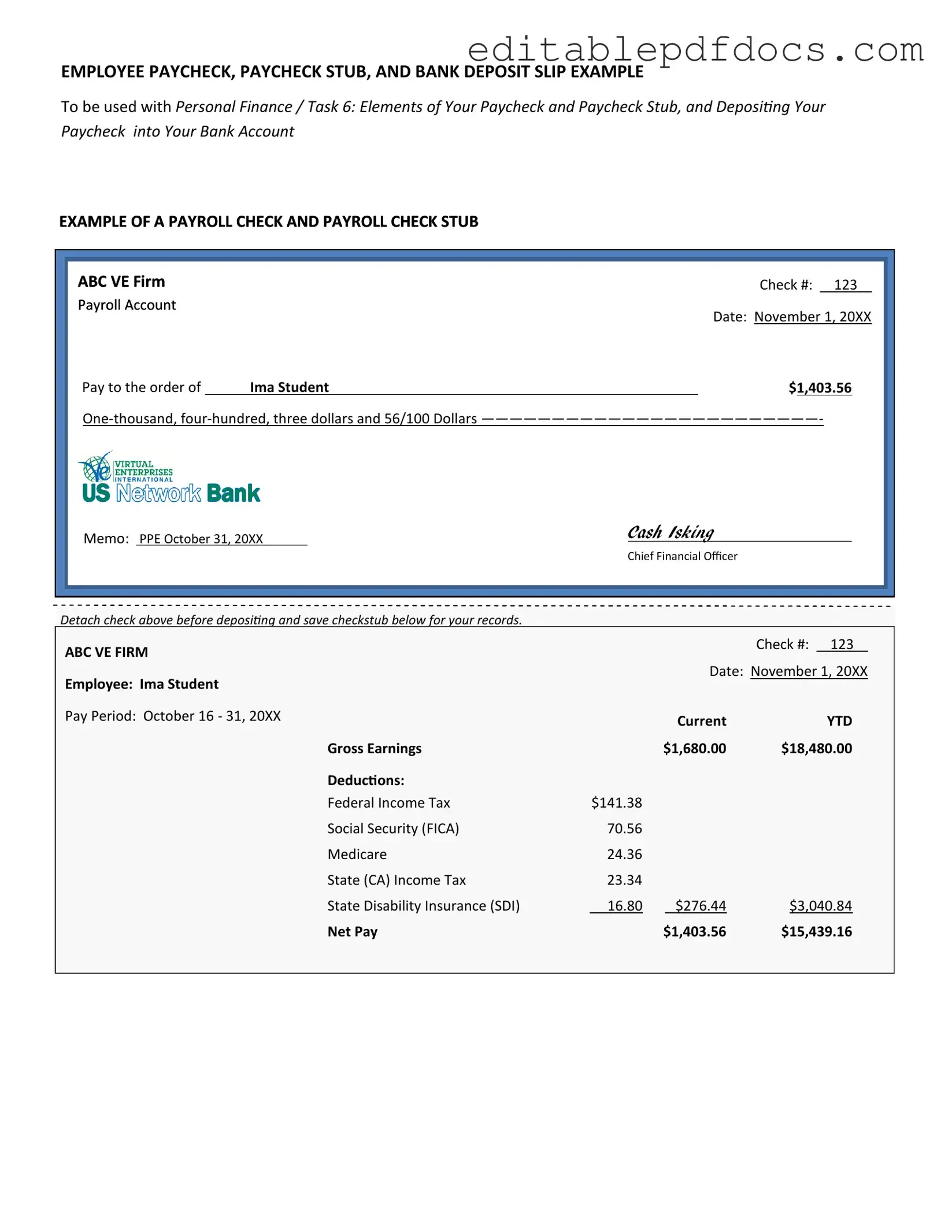

When managing a workforce, ensuring that employees are compensated accurately and on time is crucial for maintaining morale and productivity. The Payroll Check form serves as a vital document in this process, facilitating the distribution of wages to employees. This form typically includes essential details such as the employee's name, identification number, and the amount to be paid, along with deductions for taxes and other withholdings. Furthermore, it often contains information regarding the pay period, ensuring clarity about the time frame for which the payment is being made. In addition to these fundamental elements, the Payroll Check form may also incorporate company-specific branding and signatures, adding a layer of professionalism and authenticity to each transaction. Understanding the nuances of this form is essential for both employers and employees, as it not only serves as a record of payment but also plays a significant role in financial planning and compliance with labor laws.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to document employee compensation, detailing wages, deductions, and net pay. |

| Frequency of Use | This form is typically generated on a regular basis, such as weekly, bi-weekly, or monthly, depending on the employer's payroll schedule. |

| State-Specific Requirements | Some states may have specific requirements for payroll documentation, including the need to itemize deductions as per state labor laws. |

| Governing Laws | In the U.S., payroll practices are governed by federal laws such as the Fair Labor Standards Act (FLSA) and state-specific labor laws. |

| Tax Information | The form must include pertinent tax information, including federal and state withholding, Social Security, and Medicare contributions. |

| Record Keeping | Employers are required to keep payroll records for a specified duration, often up to three years, to comply with federal and state regulations. |

Dos and Don'ts

When filling out the Payroll Check form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do: Double-check all personal information for accuracy.

- Do: Use clear and legible handwriting or type the information.

- Do: Ensure that the pay period dates are correct.

- Do: Include all necessary signatures where required.

- Do: Review the total amount being paid before submitting.

- Don’t: Leave any required fields blank.

- Don’t: Use correction fluid or tape on the form.

- Don’t: Forget to keep a copy for your records.

- Don’t: Submit the form without verifying the payment method.

By following these guidelines, you can help ensure that your Payroll Check form is filled out correctly, minimizing potential issues down the line.

Documents used along the form

When managing payroll, several forms and documents complement the Payroll Check form. Each serves a specific purpose in ensuring accurate record-keeping and compliance with employment regulations. Here’s a list of essential documents often used in conjunction with payroll checks.

- W-4 Form: This form is completed by employees to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from each paycheck.

- Shipping Documentation: Accurate shipping documentation is essential for the smooth movement of goods. This includes the Fillable Forms that help in recording and tracking shipments in compliance with industry standards.

- Pay Stub: A pay stub provides a detailed breakdown of an employee's earnings for a specific pay period. It includes information on gross pay, deductions, and net pay.

- Time Sheet: Employees use time sheets to record hours worked during a pay period. This document is crucial for calculating wages accurately.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their pay directly into their bank account, streamlining the payment process.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state tax withholding. Employees fill it out to indicate their state tax preferences.

- Employee Handbook: This document outlines company policies, including payroll procedures, benefits, and employee rights. It serves as a reference for both employees and employers.

- Payroll Register: A payroll register is a summary of all payroll transactions for a specific period. It includes details like employee names, wages, and deductions, aiding in financial reporting.

- Form 941: This is the Employer's Quarterly Federal Tax Return. Employers use it to report income taxes, Social Security tax, and Medicare tax withheld from employees’ paychecks.

- Employment Agreement: This contract outlines the terms of employment, including salary, benefits, and job responsibilities. It ensures both parties understand their obligations.

These documents play a vital role in the payroll process, ensuring that both employees and employers have a clear understanding of their rights and responsibilities. Proper management of these forms helps maintain compliance and promotes transparency in the workplace.

Popular PDF Forms

Salary Advance Agreement - Get financial assistance to help bridge the gap until your next paycheck.

The application process for public housing in New York City is crucial for those seeking affordable living options, and more information can be found in the official guidelines provided at nyforms.com/nyc-housing-application-template/, which details necessary steps and considerations for prospective applicants.

Erc Bma - Collaboration with real estate firms improves the quality of analysis.

Similar forms

Pay Stub: A pay stub provides employees with a detailed breakdown of their earnings for a specific pay period. Similar to the Payroll Check form, it outlines gross pay, deductions, and net pay, ensuring transparency in the payment process.

Florida Sales Tax Form: For business owners in Florida, the print the form is essential for accurate reporting of sales and use tax, ensuring compliance with state regulations.

W-2 Form: The W-2 form summarizes an employee's annual wages and the taxes withheld from their paycheck. Like the Payroll Check form, it serves as an official record for employees, detailing their earnings for tax purposes.

Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account. It shares similarities with the Payroll Check form in that both are essential for processing employee compensation efficiently.

Time Sheet: A time sheet records the hours worked by an employee during a specific period. It is similar to the Payroll Check form as it provides necessary information that determines the amount to be paid, ensuring accurate payroll calculations.

Common mistakes

Filling out a Payroll Check form can seem straightforward, but many individuals make common mistakes that can lead to delays or issues with payment. One frequent error is providing incorrect personal information. This includes misspellings of names, wrong Social Security numbers, or incorrect addresses. Such mistakes can complicate payroll processing and may even result in tax complications.

Another mistake is failing to report all hours worked accurately. Employees might forget to include overtime or additional hours, leading to underpayment. It's essential to keep a detailed record of hours worked to ensure proper compensation.

Some individuals neglect to check the payment method. Whether opting for direct deposit or a physical check, it's crucial to ensure that the chosen method is clearly indicated. Confusion here can delay payment and cause unnecessary frustration.

Inaccurate calculations of deductions can also occur. Employees should carefully review their tax withholdings and other deductions, such as retirement contributions or health insurance premiums. Miscalculating these amounts can affect take-home pay and tax obligations.

Another common oversight is not signing the Payroll Check form. Without a signature, the form may be deemed incomplete and could be rejected by the payroll department. Always double-check that all required signatures are present before submission.

People often forget to update their information when life changes occur. For instance, marriage, divorce, or the birth of a child can impact tax filing status and deductions. Keeping personal information current is vital to ensure accurate payroll processing.

Additionally, some employees do not keep a copy of their submitted Payroll Check form. This can create problems if discrepancies arise later. Retaining a copy provides a reference point for any future discussions regarding payment or deductions.

Another mistake is overlooking deadlines. Payroll departments often have strict cut-off dates for submissions. Missing these deadlines can result in delayed payments, which can cause financial strain.

Some individuals also fail to communicate with their employer regarding any discrepancies or questions about the Payroll Check form. Open communication can prevent misunderstandings and ensure that any issues are resolved quickly.

Lastly, not reviewing the completed form before submission can lead to multiple errors. Taking a few extra moments to check for accuracy can save time and prevent complications down the line. Attention to detail is key when filling out the Payroll Check form.