Fill a Valid P 45 It Template

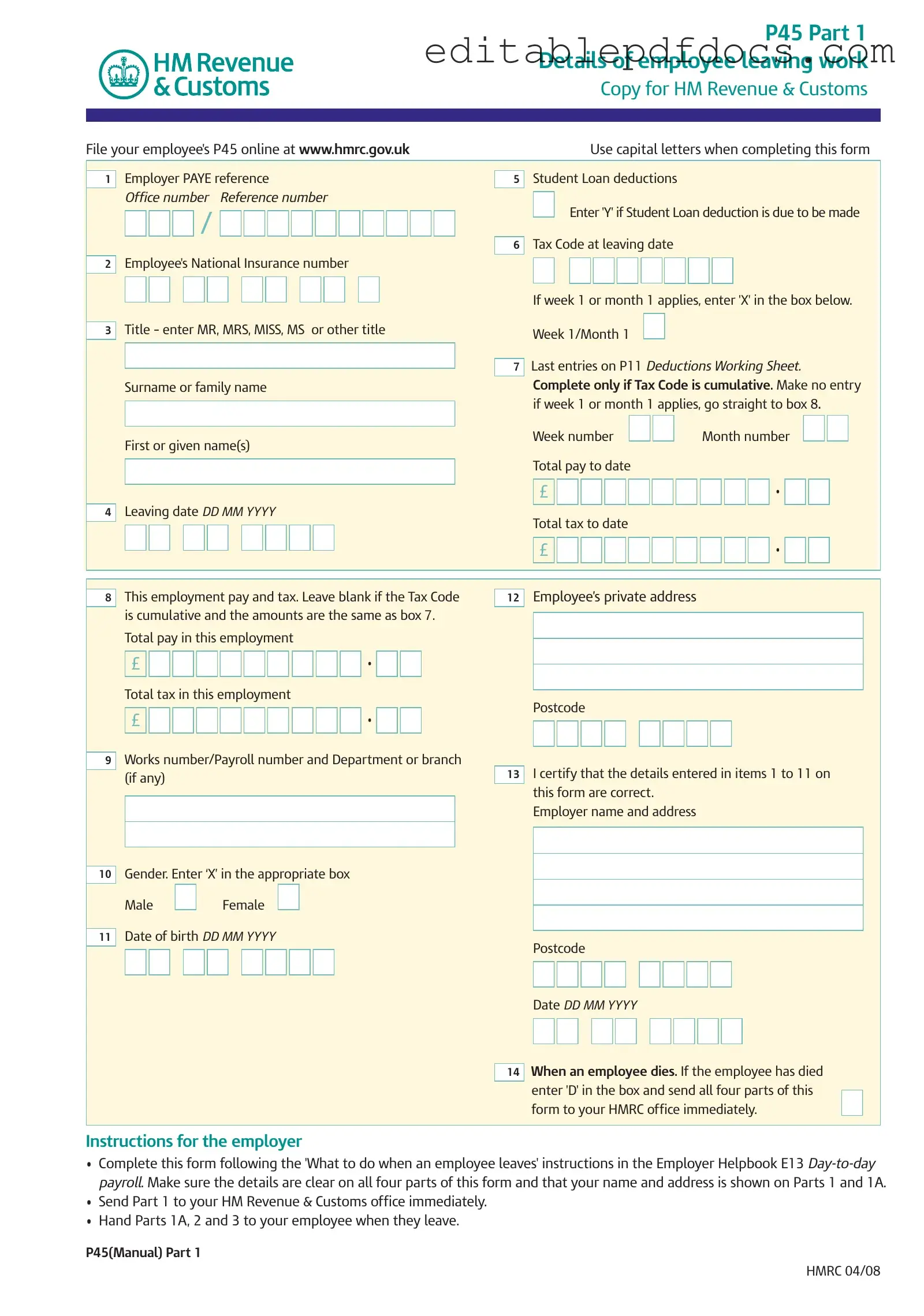

The P45 form plays a crucial role in the employment landscape of the UK, serving as a formal record when an employee leaves a job. This document is divided into three parts, each designed for different stakeholders: the employer, the employee, and the new employer. Part 1 is submitted to HM Revenue & Customs (HMRC), while Parts 1A and 2 are handed to the employee, with Part 3 going to the new employer. Key details captured on the P45 include the employee's personal information, National Insurance number, tax code, and total pay and tax deductions for the employment period. The form also addresses specific scenarios, such as student loan deductions and the implications of leaving under a week 1 or month 1 tax code. Understanding how to correctly complete and manage the P45 is essential for both employers and employees to ensure accurate tax reporting and compliance. Moreover, the form provides guidance for employees on what to do next, whether they are moving to a new job, claiming benefits, or planning to become self-employed. Navigating the P45 process efficiently can help prevent unnecessary tax complications and ensure a smooth transition for all parties involved.

Document Details

| Fact Name | Fact Description |

|---|---|

| Purpose of the P45 Form | The P45 form is used to provide details about an employee who is leaving a job, including their pay and tax information up to the leaving date. |

| Parts of the P45 | The P45 consists of three parts: Part 1 is for HM Revenue & Customs, Part 1A is for the employee, and Part 2 is for the new employer. |

| Student Loan Deductions | Employers must indicate if Student Loan deductions are applicable. This is marked in the relevant sections of the form. |

| Governing Law | The P45 form is governed by UK tax law, specifically the Income Tax (Earnings and Pensions) Act 2003 and regulations set forth by HM Revenue & Customs. |

Dos and Don'ts

When filling out the P45 form, there are important dos and don'ts to keep in mind. Here’s a straightforward list to guide you.

- Do use capital letters when completing the form.

- Do ensure that all details are clear and accurate.

- Do send Part 1 to HM Revenue & Customs immediately.

- Do keep Parts 2 and 3 together and do not alter them.

- Don't leave any required fields blank unless instructed.

- Don't forget to certify that the details entered are correct.

Following these guidelines will help ensure that the process goes smoothly and that you avoid unnecessary complications.

Documents used along the form

The P45 form is an important document used when an employee leaves a job in the UK. It provides crucial information about the employee's tax status and earnings. Alongside the P45, several other forms and documents are often utilized to ensure a smooth transition for both the employee and the employer. Below is a list of these documents, each briefly described for clarity.

- P60: This form summarizes an employee's total pay and deductions for the tax year. It is issued by the employer at the end of the tax year and is essential for tax returns.

- P50: This document is used to claim a tax refund after leaving a job. Employees who have overpaid tax can request this form from HM Revenue & Customs (HMRC).

- General Power of Attorney: This form allows the principal to authorize an agent to handle various financial transactions on their behalf, providing them with significant authority. For more details, refer to nyforms.com/general-power-of-attorney-template.

- P85: If an employee is leaving the UK to work abroad, they should complete this form. It informs HMRC about their departure and can help in reclaiming any tax owed.

- P11D: Employers use this form to report benefits and expenses provided to employees. It is important for tax calculations and is submitted to HMRC at the end of the tax year.

- Jobseeker's Allowance (JSA) Claim Form: If an employee is unemployed after leaving their job, they may need to fill out this form to apply for financial support from the government.

- Employment Support Allowance (ESA) Claim Form: This form is used by individuals who are unable to work due to illness or disability. It allows them to claim financial support while they seek employment.

These forms and documents are essential for ensuring that tax matters are handled correctly and that employees receive any benefits they may be entitled to after leaving a job. Proper completion and submission of these forms can help avoid complications with HMRC and ensure a smoother transition for the employee.

Popular PDF Forms

What Does Ucc 1-308 Mean in Simple Terms - It is a formal declaration that can deter unauthorized claims against individuals.

The USCIS I-864 form, also known as the Affidavit of Support, is a legally binding document that ensures an immigrant's financial support in the United States. By signing this form, sponsors commit to providing financial assistance if the immigrant cannot support themselves. Resources such as Templates and Guide can help sponsors understand their responsibilities and fulfill their obligations, which is vital for ensuring that new arrivals can thrive and integrate into American society.

Dispute Documents Netspend - Be proactive in safeguarding your financial interests with this dispute form.

Similar forms

- P60 - This document summarizes an employee's total earnings and tax deductions for the year. Similar to the P45, it provides essential information for tax filing and confirms employment status.

- P11D - This form details expenses and benefits provided to employees. Like the P45, it is crucial for tax purposes, ensuring that all taxable benefits are reported.

- P85 - Used when leaving the UK for work abroad, this form helps employees claim tax refunds. Both the P45 and P85 assist with tax matters related to employment changes.

Motor Vehicle Power of Attorney Form: For individuals managing vehicle-related matters, refer to our comprehensive Motor Vehicle Power of Attorney resources to facilitate necessary transactions efficiently.

- P50 - This form is for claiming tax back when employment ends. Similar to the P45, it is essential for ensuring that employees do not overpay taxes after leaving a job.

- P14 - This document was used to report employee earnings and tax information to HMRC. The P45 serves a similar purpose, detailing tax deductions at the end of employment.

- P46 - This form is completed by new employees to provide tax information to their new employer. Like the P45, it helps ensure correct tax codes are applied from the start of employment.

- Form CT600 - While primarily for corporations, it also details tax obligations similar to how the P45 outlines an individual's tax situation upon leaving a job.

- Jobseeker's Allowance Claim Form - This form is used when applying for unemployment benefits. It requires information similar to what is found on the P45, particularly regarding previous employment and earnings.

Common mistakes

Filling out the P45 IT form can be straightforward, but several common mistakes can lead to issues. One frequent error is not using capital letters as instructed. The form clearly states that capital letters should be used when entering details. Neglecting this guideline can create confusion and may result in delays when processing the form.

Another mistake is failing to accurately complete the National Insurance number section. This number is crucial for tracking an employee's contributions and tax records. If it is incorrect or missing, it can lead to complications with HM Revenue & Customs (HMRC) and may affect the employee's future tax filings.

Many people also overlook the importance of the leaving date. Entering the wrong date can have significant implications for tax calculations. It is essential to ensure that this date reflects the actual last day of employment to avoid discrepancies in tax deductions.

Additionally, some individuals forget to check the box for week 1 or month 1 if applicable. This designation is vital for determining how tax is calculated during the employee's transition between jobs. If this step is skipped, it can result in the employee being taxed incorrectly.

Lastly, not certifying the details can be a critical oversight. The form requires a certification that the information provided is correct. Failing to sign or date this section can render the form invalid, leading to further complications for both the employer and the employee.