Free Owner Financing Contract Document

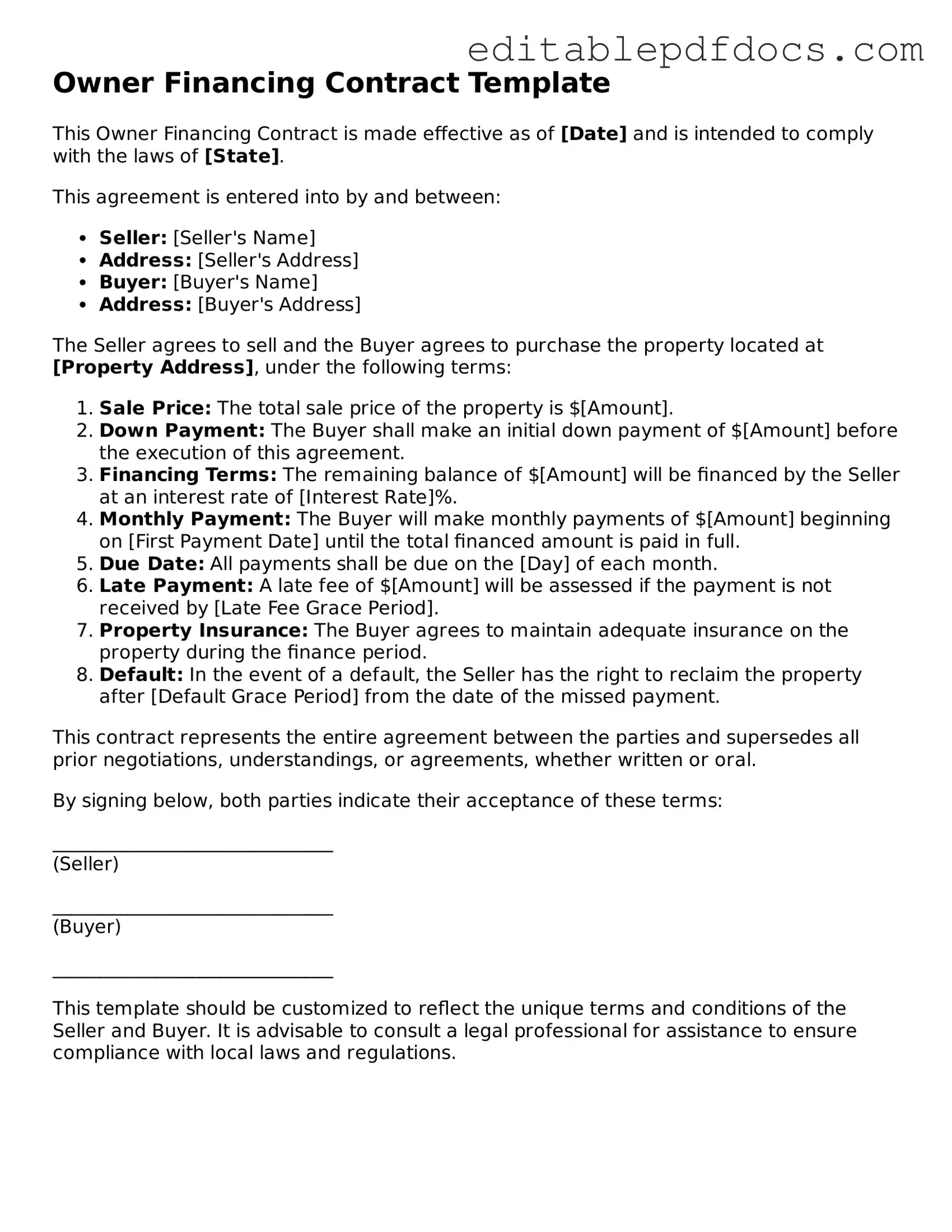

When navigating the world of real estate transactions, many buyers and sellers encounter various financing options, one of which is owner financing. This approach allows the seller to act as the lender, providing a unique opportunity for buyers who may not qualify for traditional loans. An Owner Financing Contract form is a crucial document that outlines the terms of this arrangement. It typically includes essential details such as the purchase price, down payment, interest rate, repayment schedule, and any consequences for defaulting on payments. Additionally, it addresses the responsibilities of both parties, including property maintenance and insurance requirements. This form also often includes clauses that protect the seller’s interests, such as the right to reclaim the property if the buyer fails to meet their obligations. Understanding the components of this contract is vital for both buyers and sellers, as it ensures that both parties are on the same page regarding their rights and responsibilities throughout the financing period.

File Information

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller finances the purchase of the property for the buyer. |

| Parties Involved | The contract typically involves two parties: the seller (also known as the owner) and the buyer. |

| Payment Terms | Payment terms, including interest rate, down payment, and monthly payments, are clearly outlined in the contract. |

| Governing Laws | The contract is governed by state laws, which can vary. For example, in California, it is subject to the California Civil Code. |

| Default Clauses | Default clauses are included to specify what happens if the buyer fails to make payments. |

| Property Description | The contract must include a detailed description of the property being sold, including its address and legal description. |

| Title Transfer | Title transfer typically occurs once the buyer has fulfilled the payment obligations, ensuring clear ownership. |

| Amortization Schedule | An amortization schedule may be provided to help the buyer understand how payments are applied over time. |

| Legal Considerations | It is advisable for both parties to consult legal professionals before signing to ensure their rights are protected. |

| Flexibility | Owner financing can offer flexibility in negotiations, allowing for customized terms that suit both parties' needs. |

Dos and Don'ts

When filling out the Owner Financing Contract form, it's important to approach the task with care and attention. Here are some guidelines to consider:

- Do read the entire form carefully before starting.

- Do ensure all personal information is accurate and up-to-date.

- Do consult with a professional if you have any questions.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

- Don't sign the form without fully understanding its terms.

Documents used along the form

When entering into an owner financing agreement, several other documents may be necessary to ensure clarity and legal compliance. Each of these documents serves a specific purpose and contributes to the overall understanding of the transaction between the buyer and seller. Below are five common forms and documents often used alongside an Owner Financing Contract.

- Promissory Note: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late payments. It serves as a legal promise by the buyer to repay the seller.

- Deed of Trust: This document secures the loan by placing a lien on the property. It provides the seller with a legal claim to the property if the buyer defaults on the loan.

- Disclosure Statement: This form informs the buyer of any relevant information about the property, such as its condition, any existing liens, or other encumbrances. Transparency is crucial in these transactions.

- Real Estate Purchase Agreement: This form is essential for formalizing the sale of a property and outlines the necessary terms and conditions for both buyer and seller. For more information, consult Minnesota PDF Forms.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, financing details, and any closing costs. It ensures that both parties are aware of their financial obligations.

- Amortization Schedule: This schedule breaks down each payment over the loan term, showing how much of each payment goes toward interest and how much goes toward the principal. It helps buyers understand their financial commitment over time.

These documents work together to create a comprehensive framework for owner financing transactions. Each plays a vital role in protecting the interests of both the buyer and the seller, ensuring that the agreement is clear and enforceable.

Consider Popular Types of Owner Financing Contract Templates

Terminate Real Estate Agent Contract Letter - This document promotes accountability by documenting the agreement's cessation in writing.

For those navigating real estate transactions, understanding the importance of a thorough complete Real Estate Purchase Agreement checklist can significantly enhance your buying or selling experience. This document protects the interests of both parties involved by clearly defining terms and obligations.

Similar forms

Purchase Agreement: This document outlines the terms of the sale between the buyer and seller, including price and payment details. It serves as the foundation for the transaction, similar to how an Owner Financing Contract specifies the financing terms.

Lease Option Agreement: This allows a tenant to lease a property with the option to buy it later. Like owner financing, it provides a pathway to homeownership while establishing clear terms and conditions.

Promissory Note: A promissory note is a written promise to pay a specified amount of money. It complements the Owner Financing Contract by detailing the borrower's commitment to repay the loan.

Deed of Trust: This document secures a loan by placing a lien on the property. It works in tandem with an Owner Financing Contract to protect the lender’s interests.

Mortgage Agreement: Similar to a deed of trust, this document outlines the terms of a loan secured by real estate. Both agreements ensure that the lender has a claim to the property if the borrower defaults.

Real Estate Sales Contract: This contract specifies the sale terms, including contingencies and closing details. It is similar to an Owner Financing Contract as both involve negotiations on price and payment methods.

Installment Sale Agreement: This agreement allows the buyer to make payments over time while taking possession of the property. Like owner financing, it facilitates gradual ownership without immediate full payment.

Buyer’s Agency Agreement: This document establishes a relationship between a buyer and their agent. It shares similarities with owner financing by ensuring clear expectations and responsibilities throughout the purchasing process.

- Real Estate Purchase Agreement: Similar in purpose, it outlines the terms under which a property is bought. Both documents specify purchase price, contingencies, and closing dates. For more information, you can refer to the formcalifornia.com/editable-real-estate-purchase-agreement-form.

Seller Financing Addendum: This is an additional document that outlines specific seller financing terms to a purchase agreement. It directly relates to owner financing by detailing how the seller will provide financing to the buyer.

Common mistakes

Filling out an Owner Financing Contract form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to clearly identify all parties involved. It’s essential to include the full names and addresses of both the buyer and seller to avoid any confusion later.

Another common mistake is neglecting to specify the purchase price. Without this critical detail, the contract lacks clarity, which can lead to disputes. Buyers and sellers must agree on a price before moving forward.

Many people also overlook the importance of detailing the financing terms. This includes the interest rate, payment schedule, and duration of the loan. Vague terms can create misunderstandings, so it’s vital to be as specific as possible.

Additionally, some individuals forget to include a description of the property being financed. This description should be clear and precise, including the address and any pertinent details. Failing to do so can complicate the transaction.

Another mistake is not addressing contingencies. Buyers and sellers should outline any conditions that must be met for the contract to be valid. This could include inspections, financing approvals, or other necessary steps.

Some people neglect to include a clause for default. It’s important to specify what happens if either party fails to uphold their end of the agreement. This can protect both parties in the event of a breach.

Inadequate signatures can also be an issue. All parties must sign the contract for it to be legally binding. Not obtaining the necessary signatures can render the contract void.

Many individuals fail to keep a copy of the completed contract. It’s crucial to have documentation for future reference. Without a copy, parties may struggle to recall the agreed-upon terms.

Another oversight involves not consulting a legal professional. While it may seem straightforward, having an attorney review the contract can help identify potential issues and ensure compliance with local laws.

Lastly, some people rush through the process. Taking the time to carefully review each section of the contract can prevent errors and misunderstandings. A thorough review is essential for a successful transaction.