Free Operating Agreement Document

When forming a limited liability company (LLC), one of the most crucial documents to consider is the Operating Agreement. This essential form serves as the backbone of the LLC, outlining the rights and responsibilities of its members. It details how the company will be managed, how profits and losses will be distributed, and the procedures for adding or removing members. Additionally, the Operating Agreement can specify the decision-making processes, including voting rights and meeting protocols, ensuring that all members are on the same page. By clearly defining these aspects, the agreement helps to prevent misunderstandings and disputes among members. Furthermore, while some states do not require an Operating Agreement, having one in place can provide significant protection and clarity, reinforcing the LLC's status as a separate legal entity. In essence, the Operating Agreement is not just a formality; it is a vital tool for establishing a solid foundation for your business venture.

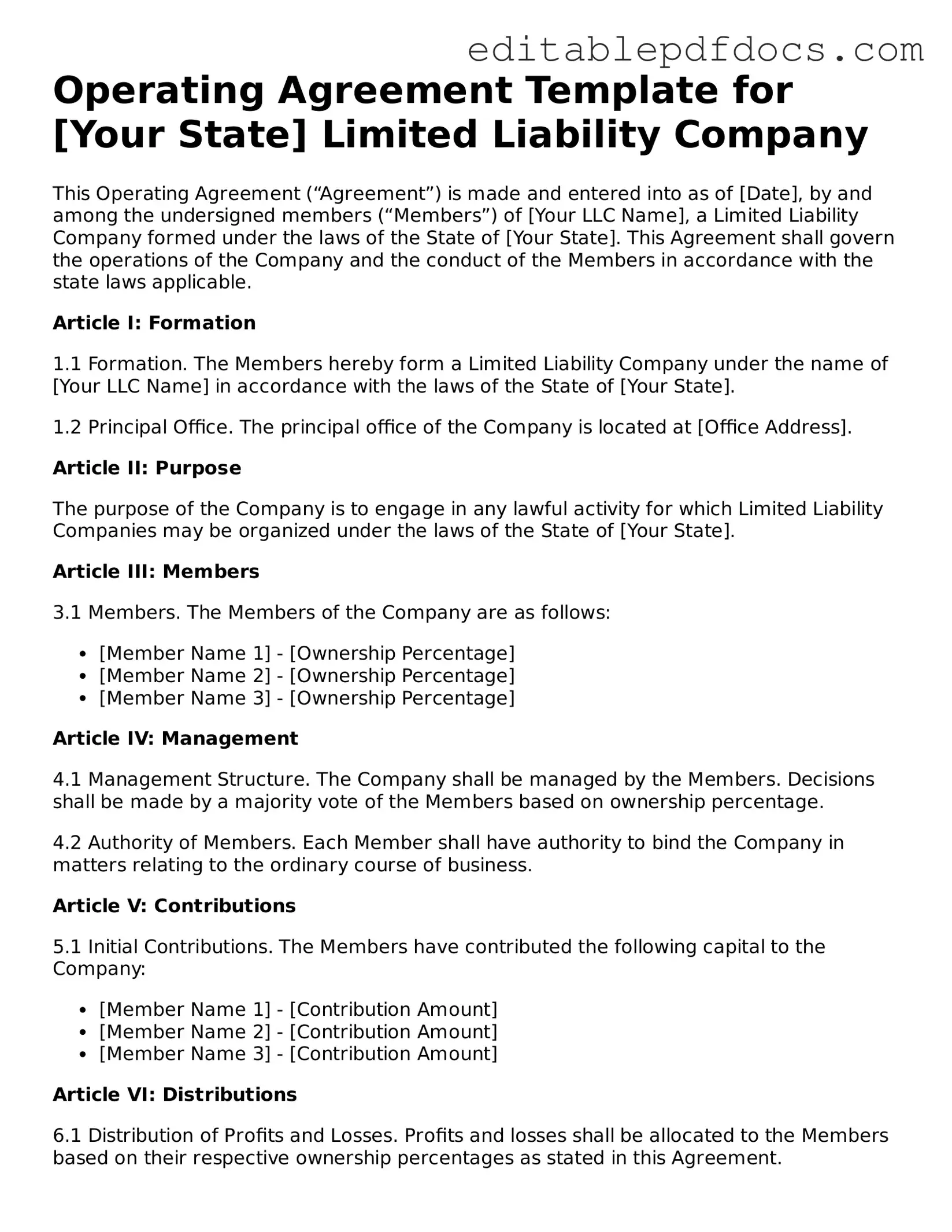

File Information

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a key document used by LLCs to outline the management structure and operating procedures. |

| Purpose | This document serves to protect the limited liability status of the members and clarify the business’s operational framework. |

| Membership Details | The agreement specifies the rights and responsibilities of each member, including ownership percentages and voting rights. |

| State Requirements | Some states require LLCs to have an Operating Agreement, while others do not. Always check state-specific regulations. |

| Amendments | Provisions for amending the Operating Agreement are typically included, allowing members to adapt to changing circumstances. |

| Dispute Resolution | Many agreements include clauses for resolving disputes among members, which can help avoid costly litigation. |

| Tax Treatment | The Operating Agreement can influence how the LLC is taxed, detailing whether it will be treated as a partnership or corporation. |

| Governing Law | The agreement should specify the governing law, which is typically the state in which the LLC is formed. |

| Confidentiality | Provisions regarding confidentiality may be included to protect sensitive business information from being disclosed. |

| Duration | The Operating Agreement may outline the duration of the LLC, whether it is perpetual or for a specified term. |

Operating Agreement - Adapted for Each State

Operating Agreement Types

Dos and Don'ts

When filling out the Operating Agreement form, it’s important to be thorough and accurate. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about all members.

- Do clearly outline the roles and responsibilities of each member.

- Do specify how profits and losses will be distributed.

- Do include procedures for resolving disputes among members.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank.

- Don't use vague language; be specific in your descriptions.

- Don't forget to have all members sign the agreement.

Documents used along the form

An Operating Agreement is an essential document for LLCs, outlining the management structure and operational guidelines. Along with this agreement, several other forms and documents are commonly used to ensure smooth business operations. Below is a list of these documents, each serving a specific purpose.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the business name, address, and the names of the members.

- Member Information Form: This form collects details about each member, including their contributions and ownership percentages. It helps clarify roles and responsibilities within the LLC.

- Bylaws: While not always required, bylaws can provide additional rules regarding the management of the LLC. They often cover meetings, voting procedures, and other governance issues.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the business.

- Employment Verification Form: A vital document for confirming a candidate's employment history and ensuring the accuracy of the information provided. To learn more, visit PDF Documents Hub.

- Initial Meeting Minutes: Documenting the first meeting of the members is crucial. These minutes outline decisions made, including the adoption of the Operating Agreement and other foundational matters.

- Tax Identification Number (TIN) Application: This application is necessary for obtaining a TIN from the IRS. A TIN is required for tax purposes and to open a business bank account.

- Business License: Depending on the type of business and location, a business license may be required. This document allows the LLC to operate legally within its jurisdiction.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared among members or with external parties. It ensures confidentiality regarding business operations and trade secrets.

These documents work together to create a solid foundation for an LLC. Understanding each one’s purpose can help ensure compliance and facilitate effective management of the business.

More Templates

Wedding Venue Contracts - Serves as a record of your agreement once signed by both parties.

The Asurion F-017-08 MEN form is a critical document used for managing various service requests and claims within Asurion's customer service framework. This form streamlines the process for filing and tracking issues, ensuring a more efficient experience for users. To enhance your service experience, consider filling out the form, including the Asurion F-017-08 MEN form, by clicking the button below.

Western Union Money Transfer Receipt PDF - Use our service to support family or friends abroad.

Free Lease Agreement Florida Template - Late fees and charges for returned checks help enforce timely payments by tenants.

Similar forms

-

Bylaws: Bylaws govern the internal management of a corporation. Like an Operating Agreement, they outline the roles of directors and officers, decision-making processes, and procedures for meetings. Both documents are essential for establishing clear operational guidelines.

-

ADP Pay Stub: The ADP Pay Stub form serves as a detailed record of an employee's earnings, deductions, and taxes for a specific pay period. Understanding this document is crucial for tracking your financial health and ensuring you are compensated accurately. To begin filling out your form, click the button below. For more information, visit the Adp Pay Stub form.

-

Partnership Agreement: A Partnership Agreement details the relationship between partners in a business. Similar to an Operating Agreement, it specifies the roles, responsibilities, and profit-sharing arrangements among partners, ensuring everyone is on the same page.

-

Shareholder Agreement: This document is used by corporations to outline the rights and obligations of shareholders. Like an Operating Agreement, it addresses issues such as voting rights, share transfers, and dispute resolution, providing a framework for managing shareholder relationships.

-

Limited Liability Company (LLC) Formation Documents: These documents are required to legally form an LLC. They often include information about the management structure and member contributions, similar to how an Operating Agreement defines the operational aspects of the LLC.

-

Joint Venture Agreement: This agreement outlines the terms of a partnership between two or more parties for a specific project. Like an Operating Agreement, it defines each party's contributions, responsibilities, and profit-sharing, ensuring clarity and mutual understanding.

Common mistakes

Filling out an Operating Agreement form is a crucial step for any business entity, particularly for LLCs. However, many individuals make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure that your Operating Agreement is both effective and compliant.

One frequent mistake is failing to include all members in the agreement. It’s essential to list every member of the LLC, including their ownership percentages. Omitting a member can lead to disputes later, especially regarding profit distribution and decision-making authority.

Another common error is not specifying the management structure. Some people assume that the default management structure will suffice, but it’s vital to clarify whether the LLC will be member-managed or manager-managed. This distinction affects how decisions are made and who has the authority to act on behalf of the business.

Additionally, many individuals overlook the importance of detailing the roles and responsibilities of each member. Clearly defining who does what can prevent misunderstandings and conflicts. Without this clarity, members may assume different responsibilities, leading to confusion and inefficiency.

Some people also neglect to include a process for resolving disputes. An Operating Agreement should outline how conflicts will be handled, whether through mediation, arbitration, or another method. Without a clear process, disputes can escalate and disrupt business operations.

Another mistake is not addressing the exit strategy for members. Life circumstances change, and members may want to leave the business. Including a buyout clause or outlining the procedure for a member’s departure can protect the remaining members and ensure a smooth transition.

Furthermore, failing to update the Operating Agreement can be detrimental. As the business evolves, changes in membership, management, or operations may necessitate revisions. Regularly reviewing and updating the agreement ensures it remains relevant and effective.

Some individuals may also ignore state-specific requirements. Each state has its own regulations regarding Operating Agreements. It’s crucial to familiarize yourself with your state’s laws to ensure compliance and avoid potential legal issues.

Another common oversight is not considering tax implications. The Operating Agreement can influence how profits and losses are allocated among members, affecting tax liabilities. Consulting with a tax professional can help clarify these implications and ensure the agreement aligns with your financial goals.

Finally, many people rush through the process of drafting their Operating Agreement. Taking the time to carefully consider each section and its implications can save time, money, and headaches in the future. A well-thought-out agreement serves as a solid foundation for your business.