Fill a Valid Netspend Dispute Template

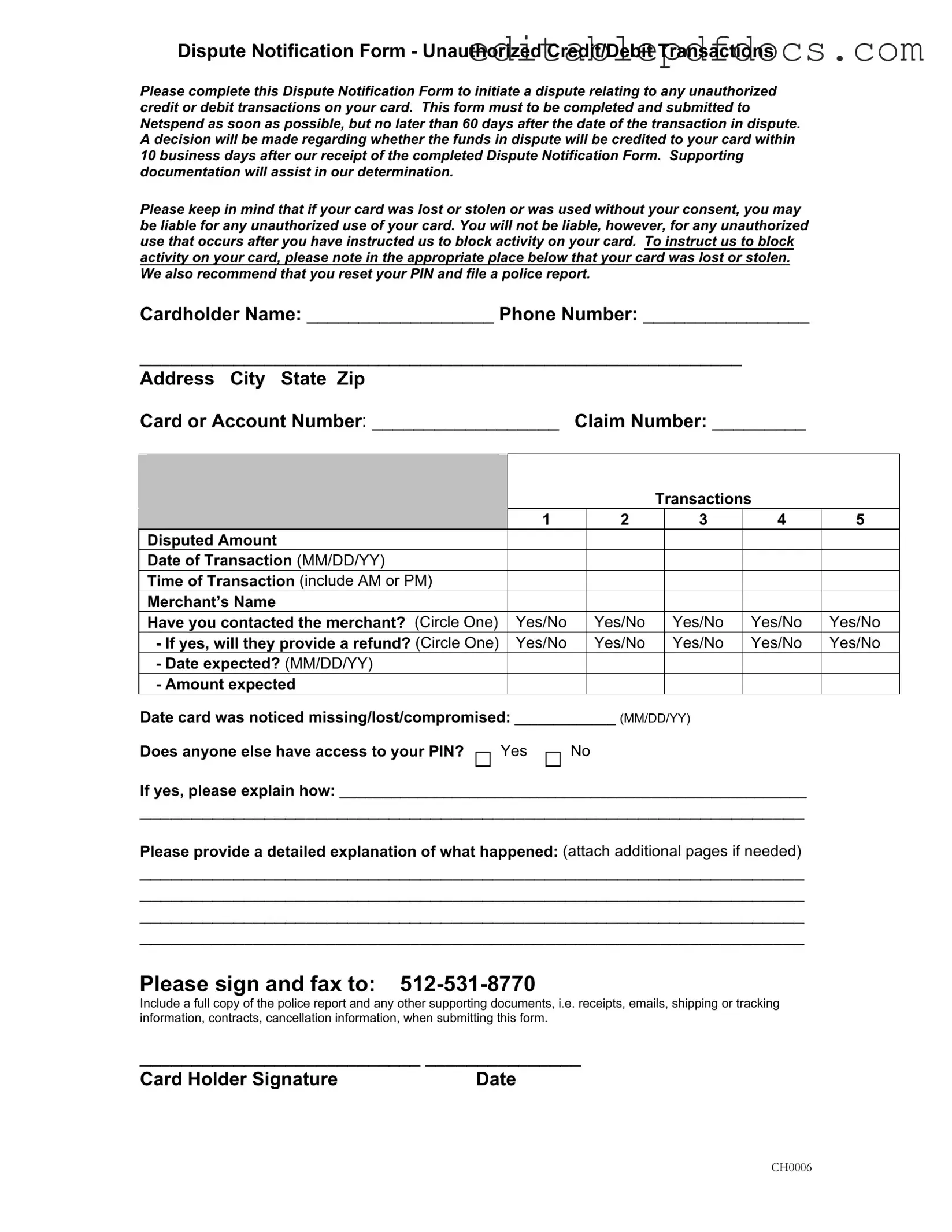

The Netspend Dispute Notification Form serves as a crucial tool for cardholders who need to address unauthorized credit or debit transactions. This form allows individuals to formally initiate a dispute, ensuring that their concerns are acknowledged and acted upon. It is essential to complete and submit the form promptly, ideally within 60 days of the disputed transaction, to facilitate a timely resolution. Once the completed form is received, Netspend commits to making a decision regarding the disputed funds within 10 business days. To strengthen the case, providing supporting documentation is highly encouraged. Cardholders should be aware of their responsibilities, particularly in cases where a card has been lost or stolen. While liability for unauthorized transactions may exist, it ceases once a request to block activity on the card has been made. The form requires key details such as the cardholder's name, contact information, and specific transaction information, including the merchant's name and the amounts in question. Additionally, it prompts users to provide a thorough explanation of the situation, which can be vital in supporting their claim. By following the outlined steps and submitting all necessary documentation, cardholders can navigate the dispute process with greater ease and confidence.

Document Details

| Fact Name | Details |

|---|---|

| Purpose | This form initiates a dispute for unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | Complete and submit the form within 60 days from the date of the disputed transaction. |

| Decision Timeline | Netspend will make a decision on the dispute within 10 business days after receiving the completed form. |

| Liability for Unauthorized Use | Cardholders may be liable for unauthorized transactions if the card was lost or stolen, unless they reported it and requested to block the card. |

| Documentation Requirement | Supporting documents, such as a police report, are recommended to assist in the dispute resolution process. |

| State-Specific Governing Law | For disputes, applicable laws may vary by state. Check local regulations for specific guidance. |

Dos and Don'ts

When filling out the Netspend Dispute form, it is crucial to approach the task with care and attention to detail. Below are some important dos and don'ts to consider:

- Do complete the form as soon as possible, ideally within the 60-day window from the transaction date.

- Do provide accurate and detailed information for each disputed transaction, including the date, time, and merchant's name.

- Do include supporting documentation, such as receipts or a police report, to strengthen your case.

- Do indicate if your card was lost or stolen, and request to block any further activity on it.

- Don't leave any sections of the form blank; incomplete forms may delay the processing of your dispute.

- Don't submit the form without reviewing it for accuracy and clarity, as errors can lead to complications.

By adhering to these guidelines, you can enhance the likelihood of a successful resolution to your dispute.

Documents used along the form

The Netspend Dispute form is a crucial document for cardholders seeking to address unauthorized transactions. However, it is often accompanied by several other forms and documents that can strengthen a dispute claim and facilitate the resolution process. Below is a list of these commonly used documents.

- Police Report: A formal report filed with law enforcement when a card is lost or stolen. This document serves as evidence of the incident and can support a claim of unauthorized use.

- Transaction Receipts: Proof of the transactions in question. These receipts can help verify the details of the disputed charges and provide context for the dispute.

- Email Correspondence: Any emails exchanged with the merchant regarding the disputed transaction. This documentation can demonstrate attempts to resolve the issue directly with the merchant.

- Notice to Quit: In cases related to eviction, ensure you have a proper nyforms.com/notice-to-quit-template/ to initiate the process legally and appropriately.

- Shipping or Tracking Information: If the dispute involves goods or services that were not received, this information can help substantiate the claim.

- Cancellation Confirmation: Documentation showing that a service or order was canceled. This is relevant if the dispute is related to a transaction that should not have occurred.

- Identity Verification Documents: Copies of identification, such as a driver's license or passport, may be required to verify the identity of the cardholder during the dispute process.

- Claim Number Documentation: Any previous correspondence or documentation that includes the claim number associated with the dispute. This helps track the status of the dispute.

- Detailed Explanation of Events: A written account from the cardholder detailing the circumstances surrounding the dispute. This narrative can clarify the situation and support the claim.

By gathering these documents, cardholders can enhance their chances of a favorable outcome in their dispute with Netspend. Each piece of documentation plays a role in providing a comprehensive view of the situation, making it easier for the company to assess the claim effectively.

Popular PDF Forms

What Is a General Background Check - Make sure to provide the most up-to-date contact information for references.

When navigating the complexities of mobile home transactions, understanding the Ohio Mobile Home Bill of Sale form is crucial. This form not only facilitates the legal transfer of ownership but also ensures that all transaction details are clearly documented. For those seeking guidance, a thorough overview can be found on the importance of the necessary components of a Mobile Home Bill of Sale.

Uscis Form I-9 - An employer must complete a new I-9 if an employee changes their name legally.

Similar forms

- Chargeback Request Form: Similar to the Netspend Dispute form, a Chargeback Request Form is used to dispute a transaction with a bank or credit card issuer. It requires details about the transaction and typically needs to be submitted within a specific timeframe.

- Fraud Report Form: This form is designed for reporting fraudulent activity on an account. Like the Netspend Dispute form, it collects information about unauthorized transactions and may require supporting documentation.

- Unauthorized Transaction Report: This report allows consumers to formally notify their bank about unauthorized charges. It shares similarities in the need for timely submission and detailed transaction information.

- Identity Theft Report: When identity theft occurs, individuals can use this report to document the theft and dispute fraudulent transactions. It often requires a detailed account of the events, much like the Netspend Dispute form.

- Consumer Complaint Form: This form is used to file a complaint regarding financial services. It parallels the Netspend Dispute form in that it seeks to resolve issues related to unauthorized transactions or poor service.

- Merchant Dispute Form: This form allows consumers to dispute a charge directly with the merchant. It requires similar information to the Netspend Dispute form, including transaction details and reasons for the dispute.

- Employment Verification Form: This form is essential for confirming a job applicant's credentials and employment history. It typically includes details such as job title and employment dates, ensuring that candidates meet the necessary qualifications for the position they are applying for. For more information, you can find a Fillable Forms.

- Bank Statement Dispute Form: Used to dispute errors on bank statements, this form collects information about transactions in question. It aligns with the Netspend Dispute form in its need for clarity and supporting evidence.

Common mistakes

Filling out the Netspend Dispute form can be straightforward, but many people make common mistakes that can delay the resolution of their disputes. One major error is not submitting the form within the required timeframe. The form must be completed and sent to Netspend within 60 days of the disputed transaction. Failing to adhere to this deadline can result in the dispute being denied outright.

Another frequent mistake is incomplete or inaccurate personal information. The form requires details such as the cardholder's name, phone number, and address. Omitting any of this information can lead to processing delays or complications in verifying the identity of the cardholder.

Many individuals also neglect to provide all necessary transaction details. The form allows for up to five disputed transactions, yet some users may only fill out a few or skip essential fields like the date or amount of the transaction. This lack of thoroughness can hinder Netspend's ability to investigate the dispute effectively.

In addition, failing to indicate whether the card was lost or stolen can be problematic. If the cardholder does not mark this section, Netspend may not take the necessary precautions to block further unauthorized transactions. This oversight can leave the account vulnerable to additional fraud.

Another mistake involves not including supporting documentation. Submitting the form without a police report or other relevant documents can weaken the case. Providing clear evidence, such as receipts or email correspondence with the merchant, can significantly aid in the resolution process.

Some users also forget to answer key questions, such as whether anyone else has access to their PIN. This information is crucial for assessing the security of the account. Not addressing this can raise red flags and complicate the investigation.

Additionally, individuals may overlook the importance of a detailed explanation of the dispute. The form includes a section for the cardholder to describe what happened. A vague or incomplete explanation can lead to misunderstandings and may result in a denial of the claim.

Finally, failing to sign and date the form is a common oversight. Without a signature, the form is not valid, and Netspend cannot process the dispute. Ensuring all sections are completed, including the signature, is essential for a successful submission.