Fill a Valid Mortgage Statement Template

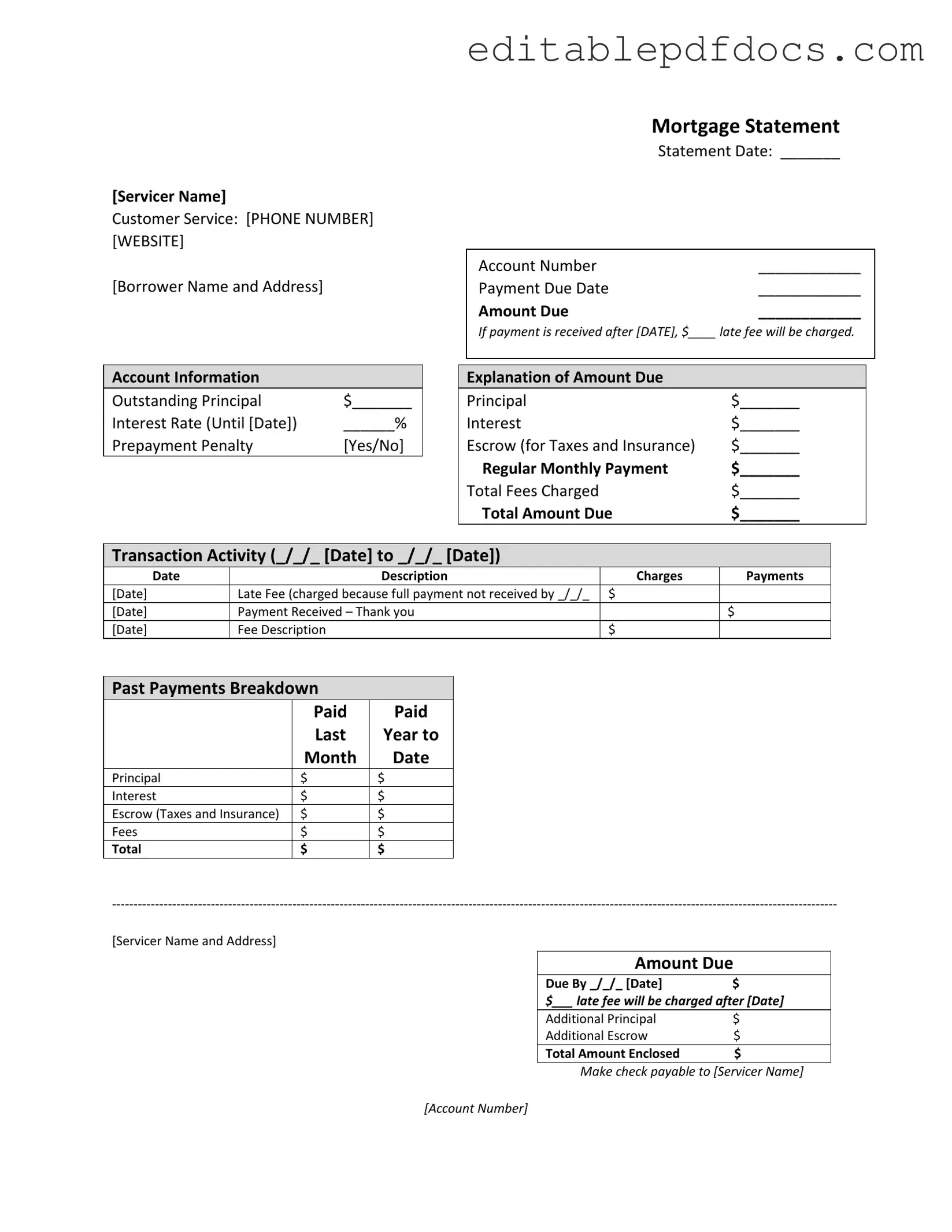

The Mortgage Statement form serves as a vital document for homeowners, providing a comprehensive overview of their mortgage account. This form includes essential details such as the servicer's name and contact information, the borrower's name and address, and key dates like the statement date and payment due date. Homeowners will find a breakdown of the total amount due, which encompasses principal, interest, and escrow for taxes and insurance. Additionally, the form outlines any late fees that may apply if payment is not received by a specified date. For those interested in their account history, the transaction activity section offers a clear record of charges and payments over a defined period. It also highlights any delinquency notices, informing borrowers of their current standing and the potential consequences of late payments. Furthermore, the form provides guidance for those facing financial difficulties, directing them to resources for mortgage counseling or assistance. Understanding this document is crucial for managing mortgage obligations effectively and maintaining financial health.

Document Details

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for easy contact. |

| Borrower Details | It lists the borrower's name and address, ensuring clarity on who the statement belongs to. |

| Statement Date | The statement date indicates when the document was generated, which is crucial for tracking payments and due dates. |

| Payment Due Date | This date specifies when the next payment is due, helping borrowers manage their finances effectively. |

| Late Fees | If payment is received after a specified date, a late fee will be charged, which is clearly stated on the form. |

| Outstanding Principal | The statement shows the outstanding principal amount, giving borrowers a clear picture of their remaining loan balance. |

| Escrow Information | It includes details about escrow for taxes and insurance, which helps borrowers understand their total monthly obligations. |

| Transaction Activity | This section records recent transactions, including payments and any late fees charged, providing a history of account activity. |

| Delinquency Notice | A warning about late payments is included, informing borrowers of potential fees and the risk of foreclosure if payments are not made. |

Dos and Don'ts

When filling out the Mortgage Statement form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are six important things to do and avoid:

- Do double-check all personal information, including your name and address, for accuracy.

- Do clearly write the account number to avoid any confusion.

- Do note the payment due date and the amount due to ensure timely payment.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill out all required fields completely.

- Don't forget to sign and date the form before submission.

Following these guidelines will help prevent delays and ensure that your mortgage information is processed correctly.

Documents used along the form

When managing your mortgage, several important documents accompany the Mortgage Statement. Each of these documents plays a crucial role in understanding your mortgage obligations and ensuring compliance with your lender's requirements.

- Loan Agreement: This document outlines the terms of your mortgage, including the loan amount, interest rate, repayment schedule, and any fees associated with the loan. It serves as the foundational contract between you and your lender.

- Employment Verification Form: Essential for confirming the employment history and credentials of a job applicant, this form can be accessed through Fillable Forms.

- Payment History Statement: This statement provides a detailed record of all your mortgage payments, including dates, amounts, and any late fees incurred. It helps you track your payment behavior over time.

- Escrow Account Statement: If your mortgage includes an escrow account for property taxes and insurance, this statement details the contributions made to the account, disbursements, and the current balance. It ensures you are aware of your obligations regarding these payments.

- Notice of Default: If you fall behind on payments, this document is sent by your lender to inform you of your delinquency status. It outlines the steps you need to take to avoid further penalties or foreclosure.

- Foreclosure Notice: In the event that your mortgage remains unpaid for an extended period, this notice is issued to inform you of the lender's intent to initiate foreclosure proceedings. It is critical to take immediate action upon receiving this document.

Understanding these documents can help you stay informed about your mortgage status and protect your rights as a borrower. Always review them carefully and seek assistance if needed to ensure you are meeting your obligations and avoiding potential pitfalls.

Popular PDF Forms

Repair Estimate Template - Empower yourself with the knowledge of repair costs and options available.

For those looking to understand the necessary documentation for mobile home transactions, the informative mobile home bill of sale overview provides essential guidance on the legal requirements and the process of transferring ownership.

Da-31 - Personal information such as name and DOD ID is required in Part I.

Dnd 5e Form Fillable Character Sheet - Specify a character's sense of humor or outlook on life.

Similar forms

-

Billing Statement: Similar to a mortgage statement, a billing statement outlines the amounts owed for services or products, including due dates and payment history. It serves to inform the recipient of their financial obligations and any late fees incurred.

-

Credit Card Statement: This document details the transactions made on a credit card account within a billing cycle. It includes the total balance due, minimum payment required, and interest rates, much like a mortgage statement provides a summary of the mortgage account.

-

Loan Statement: A loan statement provides information on personal loans, including principal, interest, and payment history. It serves a similar purpose to a mortgage statement by keeping borrowers informed about their loan status and payment obligations.

-

Utility Bill: This document shows the amount owed for utility services such as electricity, water, or gas. Like a mortgage statement, it includes due dates, total charges, and any applicable late fees, ensuring customers are aware of their payment responsibilities.

-

Lease Statement: A lease statement provides tenants with details about their rental payments, including due dates and any additional fees. It parallels a mortgage statement by tracking payment history and outstanding balances related to a property.

-

Insurance Statement: This document summarizes the premiums owed for insurance policies. Similar to a mortgage statement, it outlines payment amounts, due dates, and any penalties for late payments, helping policyholders stay informed about their financial commitments.

-

Bank Statement: A bank statement summarizes all transactions in a bank account over a specific period. It includes deposits, withdrawals, and fees, much like a mortgage statement summarizes the activity and balance of a mortgage account.

-

Student Loan Statement: This document details the amounts owed on student loans, including interest rates and payment schedules. It is similar to a mortgage statement in that it provides essential information about payment obligations and account status.

-

Property Tax Statement: This statement outlines the property taxes owed on real estate. Like a mortgage statement, it includes due dates and total amounts due, informing property owners of their financial responsibilities.

- New York City Apartment Registration Form: This form is essential for landlords to document rental units in NYC, providing necessary information about the building and landlord. For more details, visit nyforms.com/nyc-apartment-registration-template/.

-

Account Summary: An account summary provides an overview of various financial accounts, detailing balances, recent transactions, and due amounts. This document shares similarities with a mortgage statement by summarizing key financial information for the account holder.

Common mistakes

Filling out the Mortgage Statement form accurately is crucial to avoid complications with your mortgage. Many individuals make common mistakes that can lead to confusion or even financial penalties. Here are ten mistakes to watch out for when completing this important document.

First, one of the most frequent errors is neglecting to fill in the statement date. This date is essential as it indicates the timeframe of the mortgage statement. Without it, the servicer may not process the information correctly, leading to misunderstandings about payment deadlines.

Another common mistake is failing to provide the correct account number. This number is unique to your mortgage and must be accurate to ensure that payments are credited to the right account. Double-check this information to avoid unnecessary delays.

People often overlook the payment due date. This date is critical for ensuring timely payments. If you miss this date, you could incur late fees, which can add up quickly. Always confirm the due date listed on your statement.

Many individuals forget to include the amount due. This figure is essential for understanding how much you need to pay to stay current on your mortgage. If you leave this blank, it may lead to confusion about your financial obligations.

Another mistake involves misunderstanding the outstanding principal amount. This figure represents the remaining balance of your loan. Miscalculating this can result in incorrect payment amounts and could affect your loan's interest calculations.

Additionally, people sometimes fail to check the interest rate listed on the form. This rate can change over time, and it’s important to ensure that the figure is accurate. An incorrect interest rate can lead to miscalculations in your monthly payments.

Some individuals also neglect to indicate whether there is a prepayment penalty. This penalty applies if you pay off your mortgage early. Not marking this section can lead to unexpected fees later on.

When detailing the explanation of amount due, mistakes often occur in calculating the principal, interest, and escrow amounts. Each of these components contributes to the total payment due. Errors here can lead to underpayment or overpayment, both of which can have consequences.

Another frequent oversight is failing to review the transaction activity section. This area provides a history of your payments and any fees charged. Missing information here can lead to disputes about your payment history.

Lastly, individuals often ignore the important messages section, which contains crucial information about partial payments and delinquency notices. Understanding these messages can help you avoid serious consequences, such as foreclosure.

By being aware of these common mistakes, you can fill out your Mortgage Statement form with confidence and accuracy. Taking the time to review each section carefully will help ensure that your mortgage is managed effectively.