Free Mortgage Lien Release Document

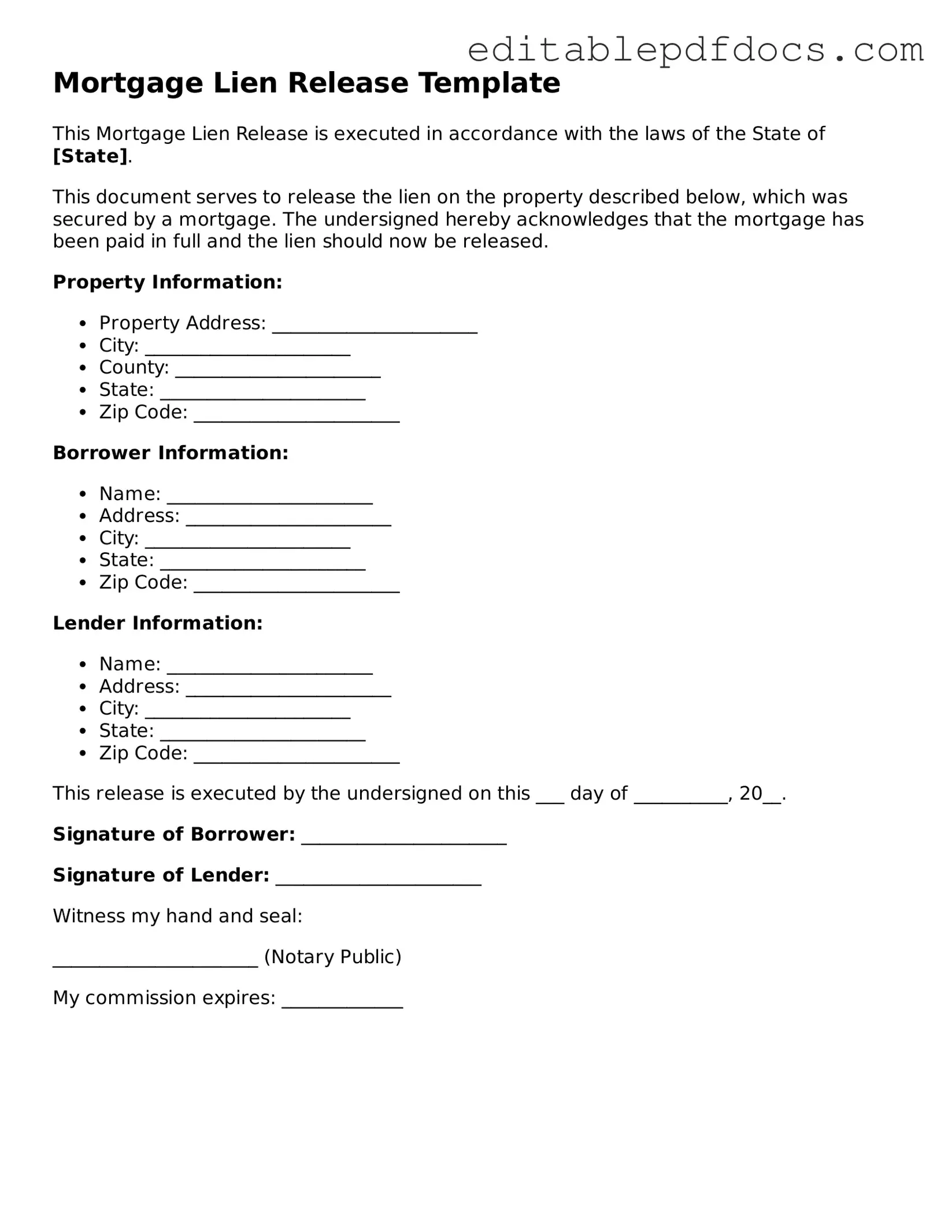

When a homeowner pays off their mortgage, it's crucial to formally release the lender's claim on the property. This is where the Mortgage Lien Release form comes into play. It serves as an official document that notifies the public and any interested parties that the mortgage obligation has been fulfilled. By completing this form, the lender relinquishes their rights to the property, effectively clearing the title for the homeowner. The process typically involves the lender providing a signature and sometimes notarization, ensuring that the release is legally binding. Once filed with the appropriate county office, this document not only protects the homeowner's interests but also enhances the property's marketability. Understanding the importance of this form can save homeowners from potential legal complications down the road, making it an essential step in the homeownership journey.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Mortgage Lien Release form is a legal document that removes a lien from a property once the mortgage has been paid in full. |

| Purpose | The primary purpose is to clear the title of the property, allowing the owner to sell or refinance without encumbrances. |

| Governing Law | In the United States, the laws governing mortgage lien releases vary by state. For example, in California, it is governed by Civil Code Section 2941. |

| Filing Requirement | Most states require the form to be filed with the county recorder's office to officially document the release. |

| Signatures | The form typically requires signatures from the lender and sometimes the borrower to validate the release. |

| Timeframe | States often have specific timeframes within which the lender must file the release after the mortgage is paid off. |

| Importance for Credit | Filing a Mortgage Lien Release is crucial for the borrower's credit report, as it shows that the debt has been satisfied. |

Dos and Don'ts

When filling out a Mortgage Lien Release form, attention to detail is crucial. Here’s a helpful list of things to do and avoid to ensure a smooth process.

- Do read the instructions carefully before starting.

- Do ensure all information is accurate and complete.

- Do sign and date the form in the appropriate places.

- Do keep a copy of the completed form for your records.

- Do submit the form to the correct authority or lender.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't forget to check for any required attachments.

- Don't rush through the form; take your time to review.

- Don't ignore deadlines for submission.

Following these guidelines can help ensure that your Mortgage Lien Release form is processed without any issues.

Documents used along the form

When dealing with a Mortgage Lien Release form, several other documents often accompany it to ensure a smooth transaction and proper record-keeping. Understanding these forms can help clarify the process and protect the interests of all parties involved.

- Mortgage Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, and repayment schedule. It serves as the foundation for the mortgage and is critical for both the borrower and lender.

- Deed of Trust: This document secures the mortgage by transferring the property title to a trustee until the loan is repaid. It protects the lender's interests and provides a clear path for foreclosure if necessary.

- Release of Liability: This form documents that the borrower is released from any further obligations related to the mortgage once the debt is settled, safeguarding against potential future claims. Additionally, you can find Fillable Forms to assist in preparing this document.

- Payoff Statement: This statement provides the borrower with the exact amount needed to pay off the mortgage in full. It details any outstanding fees or interest and is essential for finalizing the release of the lien.

- Title Insurance Policy: This document protects the lender against potential defects in the title that could affect ownership. It ensures that the title is clear and that the lender has a valid claim to the property.

Having these documents in order can facilitate a smoother transaction and help avoid potential disputes. Each form plays a crucial role in the overall process of releasing a mortgage lien and ensuring that all parties are properly protected.

Consider Popular Types of Mortgage Lien Release Templates

Partial Lien Waiver Form - This document is vital for homeowners wanting to sell their property while ensuring compliance with lien obligations.

When considering how to protect yourself from future liabilities, the Missouri Release of Liability form plays a vital role. By signing this document, individuals can effectively waive their rights to pursue legal action in the event of any unforeseen accidents or injuries. It is crucial to understand the implications of this agreement, which can provide reassurance in both personal and business contexts. For more information and to access the form, visit missouriform.com/editable-release-of-liability-form, which can guide you through the necessary steps to safeguard your interests.

Similar forms

- Deed of Trust: This document serves as a security instrument for a loan. It outlines the terms under which the borrower pledges their property as collateral, similar to how a mortgage does.

- Mortgage Agreement: This agreement establishes the terms of the loan and the borrower's obligation to repay it. Like the Mortgage Lien Release, it involves the lender's interest in the property.

- Subordination Agreement: This document allows a new loan to take priority over an existing mortgage. It is similar to the Mortgage Lien Release in that it affects the order of claims against the property.

- Loan Modification Agreement: This document modifies the terms of an existing loan. It is akin to the Mortgage Lien Release in that it can change the lender's rights regarding the property.

- Quitclaim Deed: This deed transfers any interest the grantor has in the property without guaranteeing that the title is clear. It is similar in that it can affect the ownership rights related to the mortgage.

- Title Insurance Policy: This policy protects against losses due to defects in the title. It relates to the Mortgage Lien Release by ensuring that the lender's interest is properly documented and protected.

- Vehicle Release of Liability: This form protects the seller from future claims after vehicle ownership transfer, ensuring a smooth sale process. More details can be found at https://topformsonline.com.

- Property Settlement Agreement: Often used in divorce proceedings, this agreement outlines how property will be divided. It is similar to the Mortgage Lien Release in that it can affect ownership and rights to the property.

Common mistakes

Filling out a Mortgage Lien Release form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is not providing accurate property information. The property address should be complete and match what is recorded in public records. Omitting details like the city or ZIP code can create confusion and hinder the processing of the release.

Another common mistake is failing to sign the form. While it may seem obvious, some individuals forget to provide their signature, which is essential for validating the document. Additionally, if the form requires a witness or notarization, neglecting these steps can render the release invalid. Always check the requirements for your specific jurisdiction.

People also often overlook the importance of including the correct loan information. This includes the loan number and the lender's name. Providing incorrect or outdated information can lead to unnecessary back-and-forth communication with the lender, causing delays in the release process.

Some individuals mistakenly believe that they can submit the form electronically without checking if their lender accepts electronic submissions. Always confirm the submission method preferred by your lender. If they require a physical copy, sending an electronic version will only prolong the process.

Another pitfall is not keeping copies of submitted documents. It’s crucial to maintain a record of all paperwork sent to the lender. In case of any disputes or issues, having a copy can be invaluable for reference and proof of submission.

Timing can also be a significant factor. Some people submit the release form too soon after paying off the mortgage, assuming it will be processed immediately. However, lenders may have specific timelines for processing these requests. Patience is often necessary, but it’s also wise to follow up if you haven’t received confirmation within a reasonable time frame.

In addition, many forget to check for any outstanding fees or balances. Even a small unpaid amount can complicate the release process. Ensure that all financial obligations related to the mortgage are fully settled before submitting the form.

Another mistake is neglecting to verify the identity of the signer. If the form is signed by someone other than the borrower, it may not be accepted. This can be particularly relevant in cases of power of attorney or other legal arrangements. Always ensure that the correct individual is signing the document.

Lastly, people sometimes fail to follow up after submitting the Mortgage Lien Release form. Once sent, it’s important to confirm that the lender has received it and is processing it. A simple phone call can save you from potential issues down the line.