Fill a Valid Louisiana act of donation Template

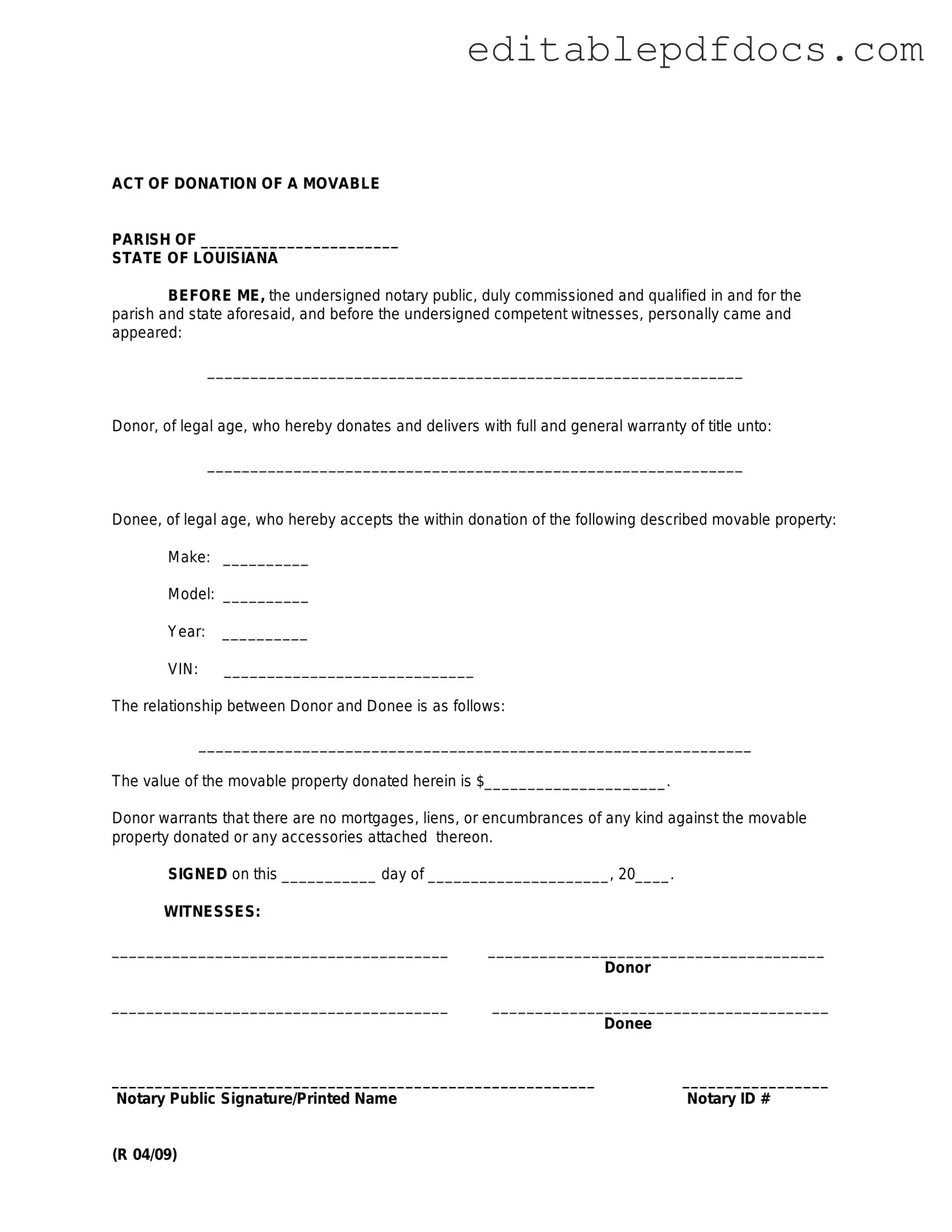

The Louisiana Act of Donation form plays a crucial role in the transfer of property between individuals, particularly in the context of gifts. This legal document outlines the intentions of the donor, ensuring that the transfer is clear and binding. It typically includes essential details such as the names and addresses of both the donor and the recipient, a description of the property being donated, and any conditions or stipulations that may apply to the donation. By using this form, individuals can avoid potential disputes in the future, as it provides a formal record of the transaction. Additionally, the form must be signed and, in some cases, notarized to be legally effective. Understanding the nuances of this document is vital for anyone considering making a significant gift, as it safeguards the interests of both parties involved.

Document Details

| Fact Name | Details |

|---|---|

| Definition | The Louisiana act of donation form is a legal document used to transfer ownership of property as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1466-1476. |

| Types of Donations | Donations can be either inter vivos (between living persons) or mortis causa (effective upon death). |

| Requirements | The form must be in writing and signed by both the donor and the donee. |

| Notarization | While notarization is not always required, it is recommended to ensure the document's validity. |

| Tax Implications | Gifts may have tax implications for both the donor and the donee, including potential gift tax obligations. |

| Revocation | A donation can be revoked under certain conditions, such as if the donee fails to fulfill obligations. |

| Record Keeping | It is advisable to keep a copy of the signed act of donation for personal records and future reference. |

| Legal Advice | Consulting with a legal professional is recommended to navigate the complexities of property donation. |

Dos and Don'ts

When filling out the Louisiana act of donation form, it is essential to follow certain guidelines to ensure the process goes smoothly. Below are nine important do's and don'ts to consider.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Do consult with a legal professional if you have questions.

- Don't leave any sections blank unless instructed.

- Don't use white-out or any correction fluid on the form.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to check for any specific state requirements that may apply.

Following these guidelines can help prevent delays and ensure that your act of donation is valid and legally binding.

Documents used along the form

When preparing to use the Louisiana Act of Donation form, it is important to be aware of other related documents that may also be required or beneficial in the process. These forms can help clarify intentions, establish legal rights, and ensure that all parties are protected throughout the donation process. Below is a list of commonly used documents that accompany the Act of Donation.

- Donation Agreement: This document outlines the terms and conditions of the donation, including what is being donated, the rights of the donor and recipient, and any conditions attached to the donation.

- Affidavit of Identity: This sworn statement verifies the identity of the donor and may be required to prevent fraud or disputes regarding the donor's intent.

- Title Transfer Document: If the donation involves real property, this document is crucial for officially transferring ownership from the donor to the recipient.

- Power of Attorney: This legal document allows one person to act on behalf of another, which can be useful if the donor is unable to complete the donation process personally.

- Tax Exemption Certificate: Donors may need this certificate to ensure that the donation is exempt from certain taxes, depending on the nature of the gift and the recipient's status.

- Boat Bill of Sale: A crucial document for recording the transfer of boat ownership that protects both seller and buyer during the transaction. For more details, visit topformsonline.com/.

- Gift Tax Return: If the value of the donation exceeds certain limits, the donor may be required to file this form with the IRS to report the gift for tax purposes.

- Notice of Donation: This document serves to inform interested parties, such as family members or creditors, about the donation, which can help avoid future disputes.

Understanding these documents can empower individuals to navigate the donation process with confidence. Each form plays a unique role in ensuring that the intentions behind the donation are respected and legally upheld. When in doubt, consulting with a legal professional can provide additional guidance and peace of mind.

Popular PDF Forms

Car Title Copy - Ensure accuracy in the provided details, as this form serves as a public record regarding payment for construction services.

Commercial Roof Inspection Form - Alerts the property owner of potential issues that could arise from external factors.

To initiate the employment verification process in Florida, it is important for employers to utilize the necessary documentation that confirms an individual's eligibility to work. This essential step ensures compliance with legal requirements and supports a fair labor market. For more information on how to proceed, you can view the form that will assist in verifying employment status effectively.

Printable:5s6uydlipco= Living Will Template - It is recognized and valid in many states across the U.S.

Similar forms

- Gift Deed: Similar to the Louisiana act of donation, a gift deed transfers property ownership without any exchange of money. Both documents require the intent to give and acceptance by the recipient.

- Quitclaim Deed: This document transfers whatever interest the grantor has in a property. Like the act of donation, it does not guarantee clear title, and it can be used to donate property without financial compensation.

- Warranty Deed: A warranty deed provides a guarantee of clear title to the property. While the act of donation does not offer such guarantees, both documents serve to transfer ownership and require signatures from both parties.

- Trust Agreement: A trust agreement allows for the management and distribution of assets. Similar to the act of donation, it can facilitate the transfer of property, often for the benefit of a third party.

- Motor Vehicle Bill of Sale: This document is essential for transferring ownership of a vehicle in California, ensuring both parties have proof of the transaction. For easy access to the necessary forms, you can check out Fillable Forms.

- Power of Attorney: This document grants someone authority to act on another's behalf. While it does not transfer property directly, it can enable the donation of assets by allowing the appointed person to execute the act of donation.

- Bill of Sale: A bill of sale is used to transfer ownership of personal property. Like the act of donation, it documents the transfer of ownership, although it typically involves a sale rather than a gift.

- Real Estate Purchase Agreement: This agreement outlines the terms of a property sale. While it involves a financial transaction, both it and the act of donation require a clear understanding of the parties' intentions.

- Charitable Donation Receipt: This document acknowledges a donation made to a charity. Similar to the act of donation, it serves as proof of the transfer of property or funds without expectation of return.

- Estate Planning Documents: These documents, including wills and trusts, often include provisions for the donation of assets. They outline how property will be distributed, similar to how the act of donation formalizes a transfer.

- Transfer on Death Deed: This deed allows property to be transferred to a beneficiary upon the owner's death. Like the act of donation, it ensures that property is passed on without the need for probate, although it typically takes effect at death rather than during the owner's lifetime.

Common mistakes

Filling out the Louisiana act of donation form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error is not providing complete information. Each section of the form requires specific details, including names, addresses, and property descriptions. Omitting any of this information can delay the processing of the donation.

Another common mistake is failing to sign the form. Both the donor and the recipient must sign the document for it to be legally valid. Without these signatures, the act of donation cannot be recognized, which may cause unnecessary frustration and require the form to be filled out again.

People often overlook the importance of having witnesses present during the signing. In Louisiana, the act of donation requires the presence of two witnesses who can attest to the signing. Not including witnesses can render the document invalid, leading to potential disputes later on.

Additionally, individuals sometimes misinterpret the property description section. It is crucial to provide a clear and accurate description of the property being donated. Vague or unclear descriptions can create confusion and may result in legal challenges in the future.

Another mistake involves not understanding the implications of the donation. Some donors may not realize that donating property can have tax consequences. It is advisable to consult with a tax professional before completing the form to ensure that all financial implications are understood.

Lastly, people may forget to keep copies of the completed form. After submitting the act of donation, it is essential to retain a copy for personal records. This documentation can be vital if any questions or issues arise regarding the donation in the future.