Free Loan Agreement Document

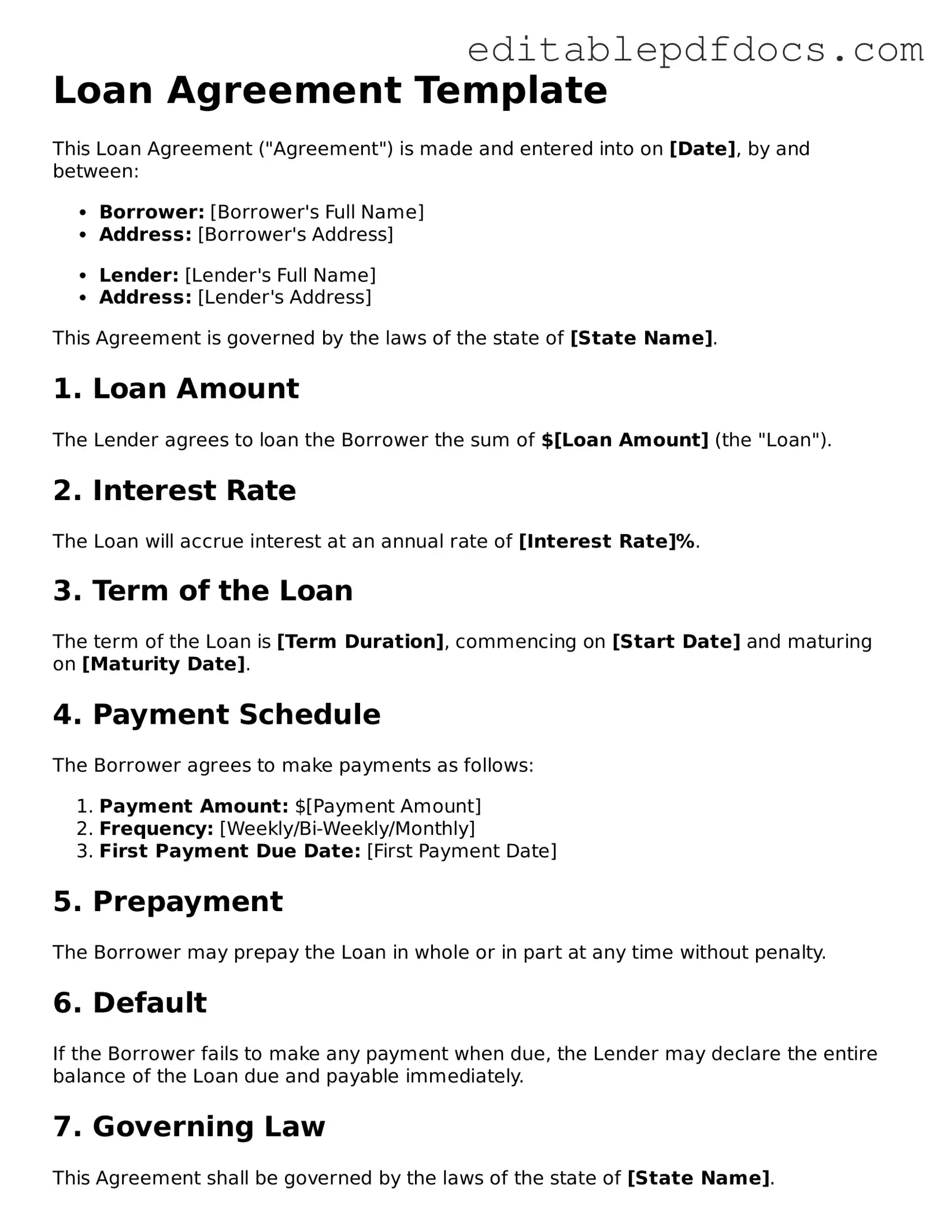

A Loan Agreement form serves as a crucial document in the lending process, outlining the terms and conditions agreed upon by both the lender and the borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It also specifies the rights and responsibilities of each party, ensuring transparency and mutual understanding. Additionally, the agreement may address potential penalties for late payments or defaults, offering a clear framework for dispute resolution. By clearly stating the expectations and obligations, the Loan Agreement form helps protect both parties and fosters a sense of trust in the financial transaction.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a contract between a borrower and a lender outlining the terms of a loan. |

| Parties Involved | The agreement typically involves two parties: the borrower and the lender. |

| Loan Amount | The document specifies the total amount of money being borrowed. |

| Interest Rate | The interest rate is outlined, detailing how much the borrower will pay in addition to the loan amount. |

| Repayment Terms | The agreement includes the repayment schedule, including due dates and payment amounts. |

| Governing Law | The form may specify the state laws that govern the agreement, such as California Civil Code or New York General Obligations Law. |

| Default Clause | A section usually details what constitutes a default and the lender's rights in such an event. |

| Collateral | If applicable, the agreement may list any collateral securing the loan. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

Loan Agreement - Adapted for Each State

Loan Agreement Types

Dos and Don'ts

When filling out a Loan Agreement form, attention to detail is crucial. Here are some important dos and don'ts to consider:

- Do read the entire agreement carefully before signing.

- Do ensure all personal information is accurate and up to date.

- Do ask questions if any part of the agreement is unclear.

- Do keep a copy of the signed agreement for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't rush through the process; take your time to understand the terms.

- Don't ignore the fine print; it often contains important details.

Documents used along the form

When entering into a loan agreement, several other forms and documents may be required to ensure clarity and compliance. Each of these documents plays a vital role in the loan process, protecting both the lender and the borrower.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, and repayment schedule.

- Loan Application: The borrower completes this form to provide personal and financial information. It helps the lender assess the borrower's creditworthiness and ability to repay the loan.

- Credit Report Authorization: This document allows the lender to obtain the borrower’s credit report. It is essential for evaluating the borrower's financial history and credit score.

- Georgia Sop form: The Georgia Sop form outlines the standard operating procedures for inmate visitation within the Georgia Department of Corrections, emphasizing that visitation is a privilege, not a right.

- Collateral Agreement: If the loan is secured, this document specifies the collateral being offered. It details what asset the lender can claim if the borrower defaults on the loan.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and any penalties for late payments. It ensures transparency between the parties.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for the loan if the borrowing entity defaults.

- Loan Closing Statement: This statement summarizes the final terms of the loan at closing. It includes the amounts due, fees, and the total cost of the loan.

Understanding these documents can help both borrowers and lenders navigate the loan process more effectively. Each form serves a specific purpose, contributing to a smooth transaction and minimizing potential disputes.

More Templates

Loan Note Template - Assists in building credit history for responsible borrowers.

For individuals seeking to understand the role of documentation in legal processes, the vital components of Notary Acknowledgement requirements offer essential guidelines. This form not only verifies signatures but also upholds the legal accuracy of various contracts, serving an important function in transactions.

How Much Electricity Load Required for Home - Useful for evaluating the impact of energy-efficient technologies.

Similar forms

-

Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details like the loan amount, interest rate, and repayment schedule, similar to the Loan Agreement.

-

Mortgage Agreement: A mortgage agreement secures a loan with real property. Like a Loan Agreement, it specifies the terms of the loan and the obligations of the borrower.

-

Security Agreement: This document establishes collateral for a loan. It functions similarly to a Loan Agreement by detailing the terms and responsibilities associated with the loan.

- Invoice Generator: An Invoice Generator offers users the ability to create customized invoices quickly and efficiently, ensuring they meet all necessary criteria for payment processing. Many users find the Fillable Forms especially helpful, as they provide a structured format to input essential information, making invoicing straightforward and professional.

-

Lease Agreement: A lease agreement outlines terms for renting property. It shares similarities with a Loan Agreement in that both specify obligations and rights of the parties involved.

-

Installment Sale Agreement: This document allows for the purchase of goods over time. Like a Loan Agreement, it includes payment terms and conditions for both the buyer and seller.

-

Credit Agreement: A credit agreement defines the terms under which credit is extended to a borrower. It resembles a Loan Agreement by detailing interest rates, repayment terms, and borrower obligations.

-

Debt Settlement Agreement: This document outlines the terms for settling a debt for less than the full amount. It is similar to a Loan Agreement in that it specifies obligations and terms for both parties.

-

Personal Loan Agreement: This is a specific type of loan agreement for personal loans. It shares the same structure and purpose as a general Loan Agreement, detailing the loan amount, interest, and repayment schedule.

Common mistakes

Filling out a Loan Agreement form can be a straightforward process, but mistakes can lead to complications down the line. One common error is failing to provide accurate personal information. Borrowers often overlook the importance of double-checking their name, address, and contact details. Incorrect information can delay the loan approval process or even result in denial.

Another frequent mistake is not specifying the loan amount clearly. Some borrowers might write an ambiguous figure or forget to include decimals. This lack of clarity can lead to misunderstandings between the lender and borrower, potentially resulting in disputes over the loan terms.

People sometimes neglect to read the terms and conditions thoroughly. Skimming through the fine print may seem tempting, but it can lead to unexpected fees or obligations. Understanding the repayment schedule, interest rates, and any penalties for late payments is crucial for making informed decisions.

Additionally, borrowers may fail to include necessary signatures or dates. A Loan Agreement is not legally binding until it is properly signed and dated by all parties involved. Omitting these elements can render the agreement void, causing significant delays in the loan process.

Another mistake involves not providing adequate documentation. Lenders often require proof of income, credit history, and other financial information. Failing to submit these documents can hinder the approval process or result in unfavorable loan terms.

Lastly, some individuals underestimate the importance of consulting with a financial advisor or legal expert. Relying solely on personal judgment can lead to errors in understanding the implications of the agreement. Seeking professional advice can help clarify any uncertainties and ensure that the Loan Agreement aligns with one’s financial goals.