Free LLC Share Purchase Agreement Document

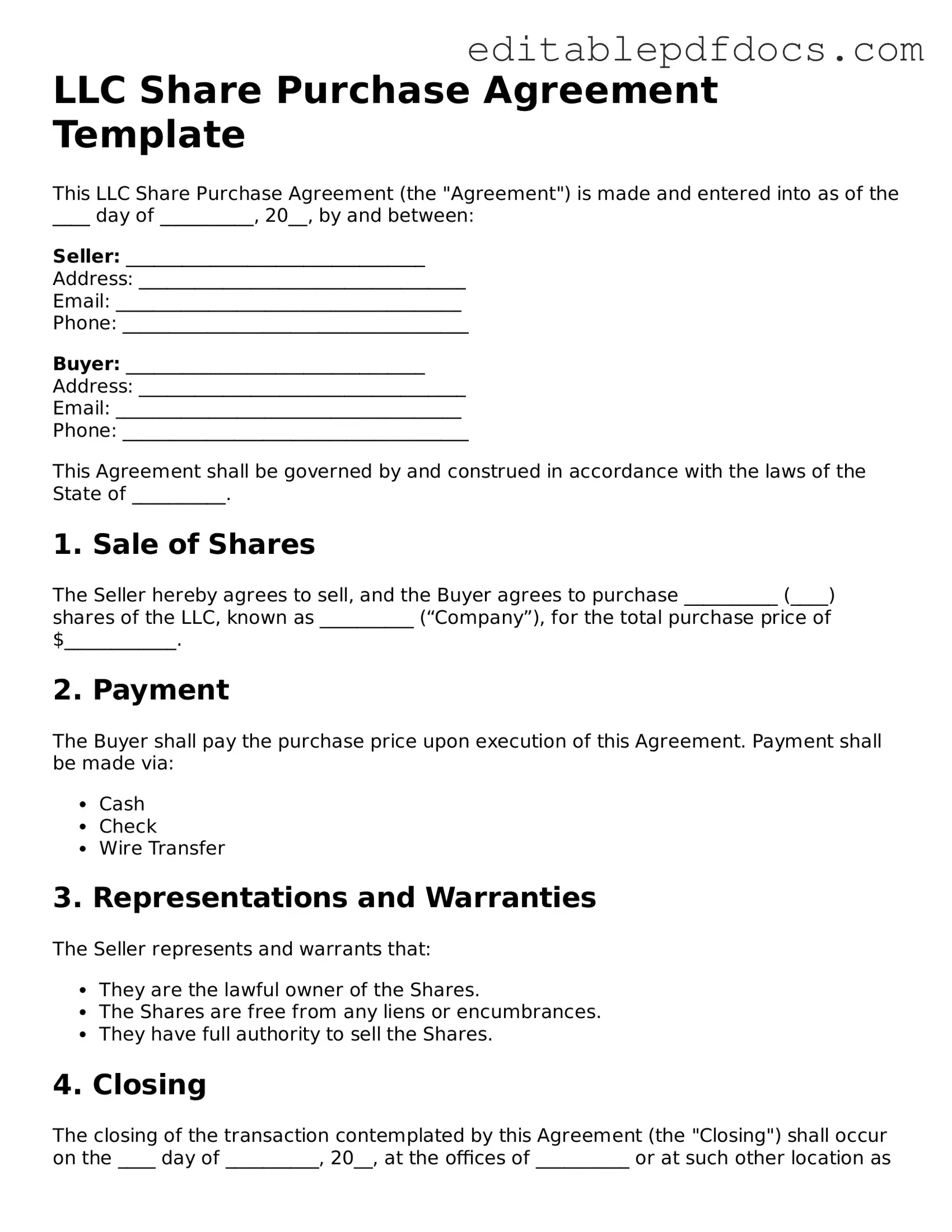

When entering into a transaction involving the purchase or sale of shares in a Limited Liability Company (LLC), having a well-structured LLC Share Purchase Agreement is crucial. This document outlines the terms and conditions agreed upon by both the buyer and the seller, ensuring clarity and legal protection for all parties involved. Key aspects of the agreement include the purchase price, payment terms, and the number of shares being transferred. Additionally, it addresses representations and warranties, which are essential for assuring the buyer about the company's status and the seller's authority to sell the shares. The agreement also covers conditions precedent, which are necessary steps that must be fulfilled before the transaction can be completed. By clearly defining these elements, the LLC Share Purchase Agreement helps to prevent misunderstandings and disputes, making it an indispensable tool for anyone involved in such transactions.

File Information

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement is a legal document used when a buyer purchases shares in a limited liability company (LLC). |

| Purpose | This agreement outlines the terms and conditions of the share purchase, ensuring clarity for both parties involved. |

| Key Components | It typically includes details such as the purchase price, payment terms, and representations and warranties from both the buyer and seller. |

| Governing Law | The governing law may vary by state; for example, an agreement executed in California would typically be governed by California law. |

| Transfer of Ownership | Upon execution of the agreement, ownership of the shares transfers from the seller to the buyer, subject to the terms outlined in the document. |

| Importance of Due Diligence | Both parties should conduct thorough due diligence to ensure that all aspects of the LLC are accurately represented before finalizing the agreement. |

| Legal Review | It is advisable for both parties to have the agreement reviewed by legal counsel to ensure compliance with applicable laws and regulations. |

Dos and Don'ts

When filling out the LLC Share Purchase Agreement form, it is important to approach the task with care. Here are seven things to keep in mind:

- Do read the entire agreement thoroughly before filling it out.

- Don't rush through the process; take your time to ensure accuracy.

- Do provide complete and accurate information about all parties involved.

- Don't leave any sections blank unless instructed to do so.

- Do consult with a legal advisor if you have any questions or concerns.

- Don't sign the agreement until you fully understand its terms and conditions.

- Do keep a copy of the completed agreement for your records.

Documents used along the form

When entering into an LLC Share Purchase Agreement, several other documents may be necessary to ensure a smooth transaction. These documents help clarify terms, protect the interests of all parties, and facilitate the transfer of ownership. Below is a list of commonly used forms and documents that accompany an LLC Share Purchase Agreement.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It details the rights and responsibilities of members, which can be crucial during a share transfer.

- Membership Interest Transfer Agreement: This agreement specifically addresses the transfer of membership interests from one member to another. It details the terms of the transfer, including any payment obligations.

- Vehicle Release of Liability: This form protects vehicle owners from legal claims arising from the use of their vehicle by another party. By signing it, individuals acknowledge the risks involved and agree not to hold the owner responsible for accidents or damages. For more information, visit My PDF Forms.

- Disclosure Statement: This document provides essential information about the LLC's financial status and operations. It helps the buyer make an informed decision by disclosing potential risks and liabilities.

- Consent of Members: If required, this document shows that existing members approve the share transfer. It may be necessary to comply with the LLC's operating agreement or state laws.

These documents work together to ensure clarity and legal compliance during the share purchase process. Properly preparing and reviewing each document can significantly reduce the risk of disputes and facilitate a successful transaction.

More Templates

Paystubs for Independent Contractor - Includes details necessary for filing taxes under self-employment.

Commercial Lease Proposal - This letter is often non-binding, meaning it does not obligate either party to finalize the lease.

When buying or selling a trailer in California, it's crucial to use the California Trailer Bill of Sale form, a legal document that facilitates the transfer of ownership. This form captures essential information about the trailer, including its make, model, identification number, and sale price. To simplify this process, you can access Fillable Forms that provide a convenient template for completing the transaction.

Lady Bird Deed Form - It’s essential for property owners to consult with legal professionals when considering a Lady Bird Deed.

Similar forms

- Stock Purchase Agreement: This document serves a similar purpose by outlining the terms under which shares of stock are bought and sold. Both agreements detail the purchase price, payment terms, and representations of the seller and buyer.

- Membership Interest Purchase Agreement: This is akin to the LLC Share Purchase Agreement, but it specifically pertains to the sale of membership interests in an LLC. It includes similar clauses regarding pricing, rights, and obligations of the parties involved.

- New Jersey Promissory Note Form: To ensure financial clarity in agreements, utilize the essential New Jersey promissory note documentation for binding loan contracts.

- Asset Purchase Agreement: While this document focuses on the purchase of specific assets rather than shares or membership interests, it also outlines the terms of sale, including the purchase price and any liabilities assumed by the buyer.

- Joint Venture Agreement: This agreement establishes a partnership between two or more parties to undertake a specific project. Like the LLC Share Purchase Agreement, it details the contributions of each party and how profits and losses will be shared.

Common mistakes

When filling out the LLC Share Purchase Agreement form, many people make common mistakes that can lead to confusion or legal issues later on. One frequent error is not including all the necessary parties involved in the transaction. It's important to clearly identify both the seller and the buyer. If anyone is left out, it could create complications down the line.

Another common mistake is failing to specify the purchase price. This detail is crucial for the agreement. Without it, the transaction lacks clarity, and disputes may arise regarding what was agreed upon. Always ensure that the price is clearly stated and agreed to by both parties.

Some individuals overlook the importance of including payment terms. It’s not just about the amount; how and when the payment will be made should also be detailed. This can prevent misunderstandings and ensure that both parties are on the same page.

Additionally, people often forget to include representations and warranties. These statements confirm that both parties are acting in good faith and provide assurances about the business's condition. Leaving this out can lead to significant risks for both the buyer and the seller.

Another mistake is not addressing the transfer of membership interests properly. This section should clearly outline how the ownership will change hands. If this is vague or missing, it could lead to disputes over ownership rights.

Many also neglect to include a section on governing law. Specifying which state laws will apply to the agreement is important. This can influence how any disputes are resolved, so it’s a detail that shouldn’t be overlooked.

People sometimes skip the signatures section. An agreement without signatures is not legally binding. Make sure both parties sign and date the document to ensure its validity.

Some individuals rush through the process and fail to review the entire agreement. It’s essential to read through every section carefully. Mistakes can easily be overlooked, and a thorough review can catch any errors before they become problematic.

Finally, many forget to keep a copy of the signed agreement. After all the hard work put into creating the document, having a physical or digital copy for your records is essential. This way, both parties can refer back to it if any questions or issues arise.