Free Letter of Intent to Purchase Business Document

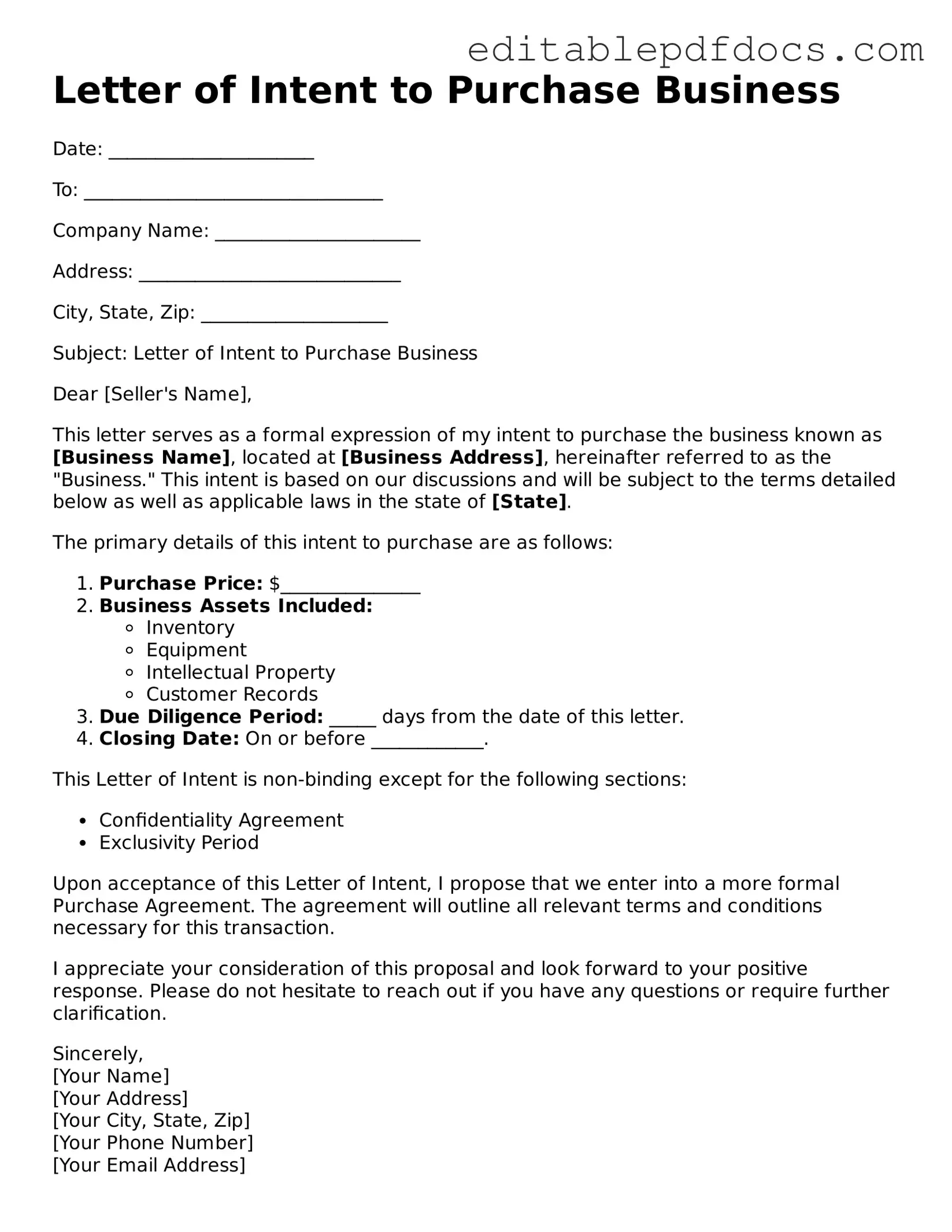

When considering the purchase of a business, a Letter of Intent (LOI) serves as a crucial first step in the negotiation process. This document outlines the preliminary terms and conditions that both the buyer and the seller agree upon before entering into a formal purchase agreement. Typically, an LOI includes essential details such as the purchase price, payment terms, and any contingencies that may affect the transaction. It also addresses the timeline for due diligence and closing, as well as any exclusivity periods that might prevent the seller from negotiating with other potential buyers during this time. While the LOI is generally non-binding, it establishes a framework for the negotiations and helps to ensure that both parties are on the same page. By clearly articulating the intentions and expectations of each party, the LOI can help facilitate a smoother transition into more detailed discussions and ultimately lead to a successful business acquisition.

File Information

| Fact Name | Description |

|---|---|

| Purpose | A Letter of Intent to Purchase Business outlines the preliminary agreement between a buyer and seller, indicating a serious interest in a potential business transaction. |

| Non-Binding Nature | Typically, a Letter of Intent is non-binding, meaning that it does not legally obligate either party to complete the purchase, though certain provisions may be binding. |

| State-Specific Considerations | In states like California, the governing law may include the California Commercial Code, which influences how such letters are interpreted and enforced. |

| Confidentiality Clauses | Many Letters of Intent include confidentiality clauses to protect sensitive information shared during negotiations, ensuring that proprietary details remain secure. |

Dos and Don'ts

When filling out a Letter of Intent to Purchase a Business, it's crucial to approach the process with care. Here are ten important do's and don'ts to keep in mind:

- Do clearly state your intent to purchase the business.

- Do include your contact information for follow-up.

- Do outline the proposed purchase price and terms.

- Do specify any conditions that must be met before the purchase.

- Do consult with a lawyer to ensure everything is in order.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to include a timeline for the transaction.

- Don't ignore confidentiality; protect sensitive information.

- Don't rush through the document; take your time to review.

- Don't overlook the importance of signatures from all parties involved.

By following these guidelines, you can create a clear and effective Letter of Intent that sets the stage for a successful business purchase.

Documents used along the form

When preparing to purchase a business, several key documents often accompany the Letter of Intent to Purchase Business. These documents serve to clarify intentions, outline terms, and protect the interests of both parties. Below is a list of common forms and documents you may encounter in this process.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains private. It protects both the buyer and seller from potential leaks that could harm their interests.

- Purchase Agreement: Once terms are agreed upon, this formal contract outlines the specific details of the sale. It includes the purchase price, payment terms, and any contingencies that must be met before the sale is finalized.

- Investment Letter of Intent: This document serves as a preliminary agreement between the parties and outlines essential terms, facilitating further negotiations and laying the groundwork for a more formal agreement. For additional information, you can visit documentonline.org/.

- Due Diligence Checklist: This list helps the buyer assess the business's financial health and operational viability. It includes items like financial statements, tax returns, and employee contracts that need review before closing the deal.

- Asset Purchase Agreement: If the buyer intends to acquire specific assets rather than the entire business, this document details which assets are included in the sale. It clarifies ownership and any liabilities associated with those assets.

- Letter of Intent (LOI): While it is the central document in this context, the LOI outlines the preliminary understanding between buyer and seller. It sets the stage for negotiations and usually includes key terms such as price and timelines.

- Financing Agreement: If the buyer requires financing to complete the purchase, this document outlines the terms of the loan. It includes interest rates, repayment schedules, and any collateral involved.

- Non-Compete Agreement: Often included in the sale, this agreement prevents the seller from starting a competing business for a specified period. It protects the buyer’s investment by limiting competition.

- Transition Plan: This document outlines how the business will transition from the seller to the buyer. It may include details on training, customer handover, and operational continuity to ensure a smooth changeover.

Understanding these documents can facilitate a smoother transaction and help protect your interests. Each plays a critical role in the overall process of buying a business, ensuring that all parties are on the same page and that the transaction proceeds as intended.

Consider Popular Types of Letter of Intent to Purchase Business Templates

Letter of Intent Investment - The document might outline the proposed timeline for closing the investment.

As you embark on your homeschooling journey, it's important to familiarize yourself with necessary documentation, including the Arizona Homeschool Letter of Intent form, which you can find more information about at https://legalpdfdocs.com/arizona-homeschool-letter-of-intent-template, ensuring you meet all state requirements effectively.

Similar forms

-

Purchase Agreement: This is a formal contract that outlines the terms and conditions of a sale. Like the Letter of Intent, it specifies the purchase price and details about the business being sold, but it is more binding and legally enforceable.

-

Memorandum of Understanding (MOU): An MOU serves as a preliminary agreement that outlines the intentions of both parties. Similar to a Letter of Intent, it expresses a commitment to negotiate but is generally less formal and not legally binding.

-

Term Sheet: This document summarizes the key terms and conditions of a proposed transaction. Like the Letter of Intent, it provides a framework for negotiation, focusing on essential aspects such as pricing and timelines.

-

Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document protects sensitive information shared during negotiations. It complements the Letter of Intent by ensuring that both parties maintain confidentiality throughout the purchasing process.

-

Due Diligence Checklist: This is a list of items to be reviewed before finalizing a purchase. It aligns with the Letter of Intent by outlining the necessary steps to evaluate the business thoroughly before proceeding with the sale.

-

Business Valuation Report: This document provides an assessment of the business's worth. Similar to the Letter of Intent, it plays a crucial role in determining the purchase price and justifying the financial aspects of the transaction.

-

Share Purchase Agreement: This agreement is specific to the purchase of shares in a corporation. Like the Letter of Intent, it defines the terms of the transaction but is more detailed and legally binding once signed.

-

Asset Purchase Agreement: This document outlines the terms for purchasing specific assets of a business rather than the entire business. Similar to the Letter of Intent, it helps clarify what is included in the sale.

- Homeschool Letter of Intent: This essential document must be filed with the local school district, officially notifying them of the intent to homeschool. For more information on how to properly complete this form, visit TopTemplates.info.

-

Letter of Intent to Lease: This document expresses interest in leasing property. It shares similarities with the Letter of Intent to Purchase Business by outlining intentions and key terms, though it pertains to leasing rather than buying.

-

Franchise Disclosure Document: This document provides important information about a franchise opportunity. Like the Letter of Intent, it serves as a preliminary step in the decision-making process, helping potential franchisees understand the terms before committing.

Common mistakes

When filling out a Letter of Intent to Purchase a Business, individuals often make several common mistakes that can lead to misunderstandings or complications down the line. One significant error is failing to include essential details about the business being purchased. This includes the business name, address, and specific assets involved in the transaction. Without this information, the intent may be unclear, leading to potential disputes later.

Another frequent mistake is not clearly outlining the terms of the sale. Buyers should specify the purchase price, payment structure, and any contingencies that might apply. Omitting these details can create confusion and may result in disagreements between the buyer and seller regarding the expectations of the transaction.

Additionally, many individuals neglect to include timelines for the transaction. Establishing a timeline helps both parties understand when certain actions must be completed, such as due diligence or closing dates. Without a clear timeline, the process can drag on unnecessarily, causing frustration for both the buyer and the seller.

In some cases, people fail to consult with professionals before submitting the Letter of Intent. Legal and financial advisors can provide valuable insights and help ensure that the document is comprehensive and accurate. Bypassing this step may result in overlooking critical aspects of the transaction.

Another common oversight is not addressing confidentiality. If sensitive information about the business is shared during negotiations, it is crucial to include a confidentiality clause in the Letter of Intent. This protects both parties and fosters a trusting environment for discussions.

Lastly, individuals sometimes forget to review the document thoroughly before submission. Errors in spelling, grammar, or factual information can undermine the professionalism of the Letter of Intent. Taking the time to proofread and ensure accuracy is vital for making a positive impression and setting the stage for a successful negotiation.