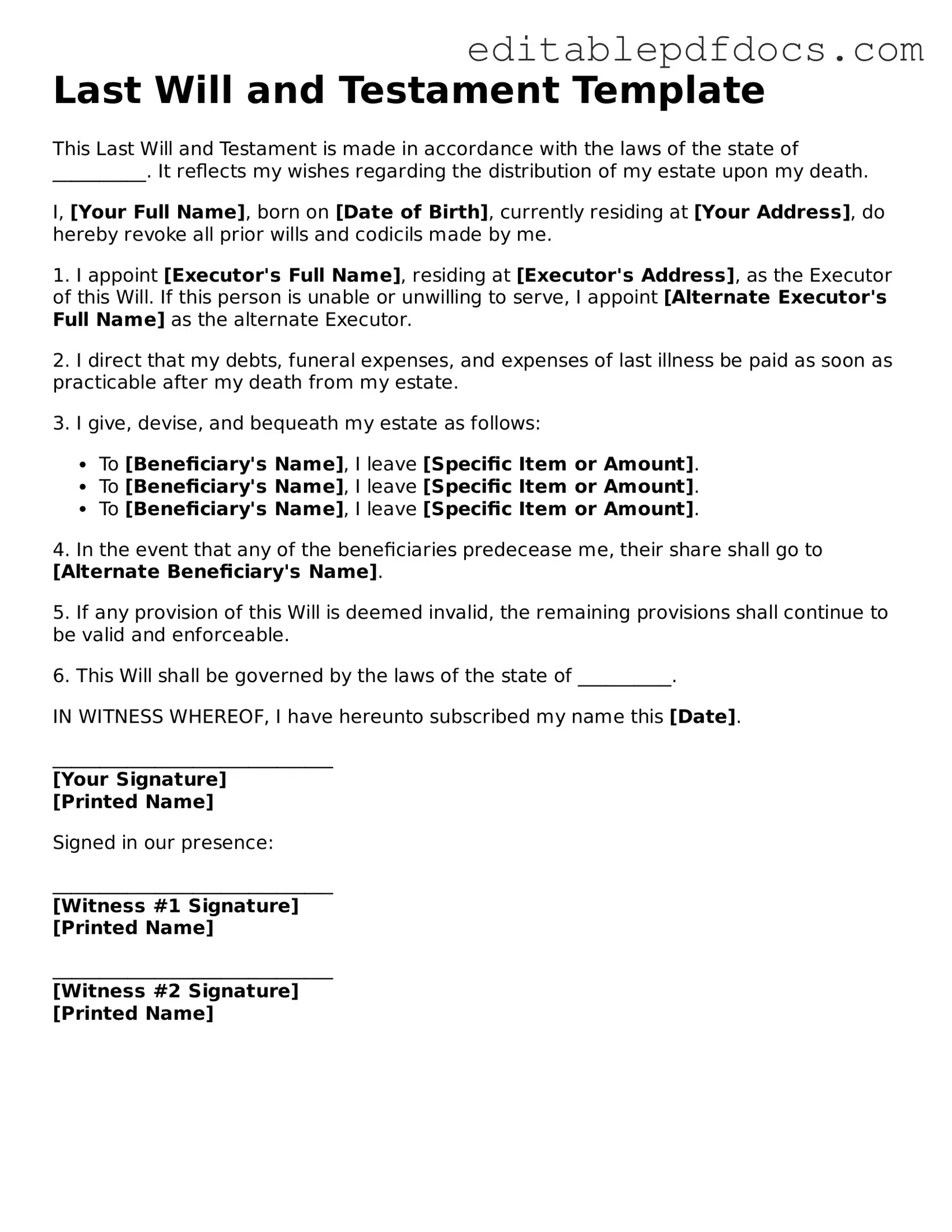

Free Last Will and Testament Document

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. This legal document serves as a guide for distributing your assets, appointing guardians for minor children, and designating an executor to manage your estate. A well-structured will outlines who will inherit your property, how debts and taxes will be settled, and any specific bequests you wish to make. Additionally, it can address the care of dependents and pets, ensuring that your loved ones are taken care of according to your preferences. Understanding the essential components of a Last Will and Testament, such as the need for proper signatures and witnesses, is vital for its validity. By taking the time to draft this document, you can provide clarity and peace of mind for your family during a challenging time, making it an important aspect of responsible estate planning.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Legal Capacity | The person creating the will, known as the testator, must be of legal age and sound mind to ensure the will is valid. |

| Witness Requirements | Most states require at least two witnesses to sign the will, affirming that the testator was of sound mind and not under duress. |

| Revocation | A will can be revoked at any time by the testator, typically by creating a new will or destroying the original. |

| State-Specific Forms | Each state has its own requirements for a valid will, governed by state probate laws. For example, California Probate Code Section 6100 governs wills in California. |

| Executor Role | The will should designate an executor, the person responsible for managing the estate and ensuring the wishes of the testator are carried out. |

| Probate Process | After death, the will must go through probate, a legal process that validates the will and oversees the distribution of assets. |

| Digital Wills | Some states now recognize electronic wills, but specific requirements must be met to ensure they are legally binding. |

Last Will and Testament - Adapted for Each State

Last Will and Testament Types

Dos and Don'ts

When filling out a Last Will and Testament form, it’s essential to approach the process with care and attention. Here are ten important do's and don'ts to consider:

- Do ensure that you are of sound mind and at least 18 years old.

- Do clearly identify yourself, including your full name and address.

- Do specify how you want your assets distributed among your beneficiaries.

- Do appoint an executor who will carry out your wishes after your passing.

- Do sign and date the will in the presence of witnesses, if required by your state.

- Don't use ambiguous language that could lead to confusion about your intentions.

- Don't forget to update your will after major life events, such as marriage or the birth of a child.

- Don't leave out any required signatures or witness information.

- Don't attempt to make changes to the will without following proper legal procedures.

- Don't assume that a verbal agreement will suffice; always document your wishes in writing.

Taking the time to follow these guidelines can help ensure that your Last Will and Testament accurately reflects your wishes and minimizes potential disputes among your loved ones.

Documents used along the form

A Last Will and Testament is an essential document for outlining how a person's assets should be distributed after their passing. However, several other forms and documents often accompany a will to ensure that a person's wishes are honored and that their estate is managed effectively. Below is a list of common documents that may be used alongside a Last Will and Testament.

- Living Will: This document specifies a person's wishes regarding medical treatment and end-of-life care. It guides healthcare providers and loved ones in making decisions when the individual is unable to communicate their preferences.

- Durable Power of Attorney: This form allows someone to appoint a trusted person to make financial or legal decisions on their behalf if they become incapacitated. It provides peace of mind knowing that someone will manage affairs according to the individual's wishes.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this document specifically grants someone the authority to make medical decisions on behalf of the individual. It ensures that healthcare choices align with the person’s values and desires.

- Trust Agreement: A trust can be established to manage assets during a person's lifetime and after their death. This document outlines the terms of the trust, including how assets will be distributed and who will manage them.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, often require a separate designation of beneficiaries. These designations dictate who will receive these assets upon the individual's passing, bypassing the will.

- Inventory of Assets: This document provides a detailed list of a person's assets, including property, bank accounts, and personal belongings. It helps the executor manage the estate and ensures that all assets are accounted for during the distribution process.

- Letter of Intent: Although not a legally binding document, this letter can provide guidance to the executor or family members regarding the deceased's wishes, including funeral arrangements and specific bequests.

- Florida Motor Vehicle Bill of Sale: This essential document serves as proof of the sale and transfer of ownership for a vehicle in Florida, ensuring that both buyers and sellers have a valid record of the transaction. For further assistance, you can visit PDF Documents Hub.

- Affidavit of Heirship: This document may be used to establish the rightful heirs of a deceased person's estate, especially in cases where there is no will or when the will is contested.

These documents can work together with a Last Will and Testament to create a comprehensive plan for managing an individual’s affairs and ensuring their wishes are respected. It is advisable to consult with a legal professional to determine which documents are most appropriate based on personal circumstances.

More Templates

Free Trust Amendment Form - Clarity in the amendment helps prevent future misunderstandings about the trust's terms.

The California Boat Bill of Sale form is a crucial document used to record the sale of a boat or watercraft in the state of California. This form not only provides legal protection for both the buyer and seller but also serves as proof of the transaction. To facilitate a smooth transfer of ownership and compliance with state regulations, it's essential to utilize the Boat Bill of Sale form, which helps clarify the terms of the sale.

Letter of Intent to Buy a Business - A clear Letter of Intent can increase a buyer's credibility with the seller.

Similar forms

- Living Will: A living will outlines your wishes regarding medical treatment in the event that you become incapacitated. While a Last Will and Testament deals with the distribution of your assets after death, a living will focuses on healthcare decisions while you are still alive.

- Durable Power of Attorney: This document allows you to appoint someone to make financial or legal decisions on your behalf if you are unable to do so. Like a Last Will and Testament, it involves the management of your affairs, but it is activated during your lifetime rather than after your passing.

- Trust Agreement: A trust agreement sets up a legal entity to hold and manage your assets for the benefit of your beneficiaries. Similar to a Last Will and Testament, it ensures your assets are distributed according to your wishes, but it can take effect during your lifetime and may help avoid probate.

- Chick Fil A Job Application: The Chick Fil A Job Application form is vital for those seeking employment at this popular fast-food chain, allowing candidates to present their qualifications and skills effectively.

- Advance Healthcare Directive: This document combines a living will and a durable power of attorney for healthcare. It provides guidance on your medical care preferences and designates someone to make decisions on your behalf, similar to how a Last Will and Testament ensures your wishes are followed after death.

- Codicil: A codicil is an amendment to an existing will. It allows you to make changes or updates without creating an entirely new document. Like a Last Will and Testament, a codicil must be executed according to specific legal requirements to be valid.

Common mistakes

Filling out a Last Will and Testament form is an important step in ensuring that your wishes are honored after you pass away. However, many people make mistakes during this process that can lead to confusion or disputes later on. Here are nine common mistakes to avoid.

One frequent error is not being specific about the distribution of assets. Vague language can lead to misunderstandings among heirs. It’s crucial to clearly state who gets what. For example, instead of saying “my belongings,” specify “my car, my jewelry, and my bank account.”

Another mistake is failing to update the will regularly. Life changes, such as marriage, divorce, or the birth of a child, can affect your wishes. If you don’t revise your will to reflect these changes, it may not accurately represent your intentions.

Many individuals overlook the importance of witnesses. Most states require at least two witnesses to sign the will. If this step is skipped, the will may be deemed invalid. Ensure that your witnesses are not beneficiaries to avoid potential conflicts.

Some people forget to include a self-proving affidavit. This document can help streamline the probate process by verifying the authenticity of the will without needing witnesses to testify later. Including this can save time and reduce complications.

Another common mistake is not signing the will properly. A will must be signed in accordance with state laws. If the signature is missing or not done correctly, the will may not be enforceable. Always check the specific requirements for your state.

Additionally, individuals sometimes neglect to appoint an executor. This person is responsible for carrying out the terms of the will. Without an appointed executor, the court may need to appoint someone, which can lead to delays and added stress for your loved ones.

Some people mistakenly assume that a handwritten will is always valid. While some states allow holographic wills, they must meet specific criteria. It’s often safer to use a formal template or consult with a professional to ensure legality.

Another error involves not considering tax implications. Inheritance and estate taxes can significantly impact what your beneficiaries receive. It’s wise to consult with a financial advisor or attorney to understand how your estate may be taxed.

Lastly, many individuals fail to communicate their wishes to their loved ones. Even with a well-drafted will, if family members are unaware of its existence or contents, confusion can arise. Discussing your plans can help ensure that everyone is on the same page.