Free Lady Bird Deed Document

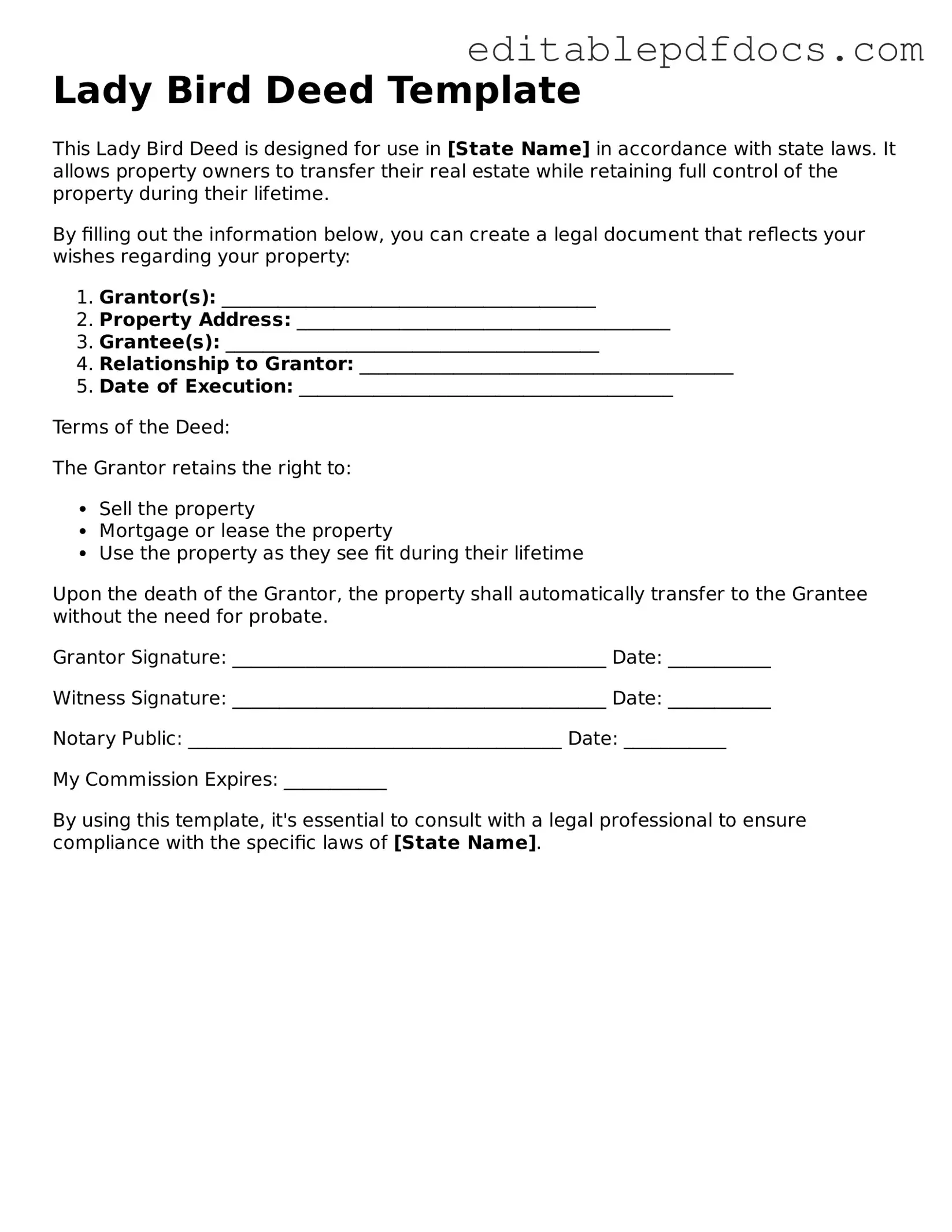

The Lady Bird Deed, a unique estate planning tool, offers homeowners a way to transfer property upon death while retaining control during their lifetime. This deed allows property owners to maintain the right to live in and use their property, even after designating a beneficiary. One of the most significant advantages of the Lady Bird Deed is its ability to bypass the often lengthy and costly probate process, ensuring that the property passes directly to the designated beneficiary without court intervention. Furthermore, it provides a level of protection against creditors, as the property may not be subject to claims after the owner's death. The form is particularly useful for individuals looking to simplify their estate planning, as it allows for a seamless transition of property to heirs, all while preserving the owner's rights and interests. Understanding the intricacies of this deed can empower homeowners to make informed decisions about their property and legacy.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of enhanced life estate deed that allows property owners to transfer real estate to their beneficiaries while retaining control during their lifetime. |

| Ownership Retention | The property owner retains the right to use, sell, or mortgage the property without the consent of the beneficiaries. |

| Automatic Transfer | Upon the owner's death, the property automatically transfers to the named beneficiaries without going through probate. |

| State-Specific Use | Lady Bird Deeds are recognized in several states, including Florida and Texas, under specific state laws governing property transfers. |

| Tax Benefits | This deed can provide tax advantages, as the property may not be considered a gift for tax purposes until the owner's death. |

| Medicaid Planning | Using a Lady Bird Deed can help in Medicaid planning, allowing property to be excluded from the owner's assets for eligibility purposes. |

| Revocability | The deed can be revoked or changed by the property owner at any time during their lifetime, providing flexibility. |

| Legal Considerations | It is advisable to consult with a legal professional to ensure compliance with state laws and to understand the implications of creating a Lady Bird Deed. |

Lady Bird Deed - Adapted for Each State

Dos and Don'ts

When filling out the Lady Bird Deed form, it's essential to approach the task with care. Here are some important dos and don'ts to keep in mind:

- Do ensure that all property information is accurate and up-to-date.

- Do clearly identify the beneficiaries who will receive the property.

- Don't leave any sections of the form blank; incomplete forms can lead to delays.

- Don't forget to have the document notarized to ensure its validity.

Documents used along the form

A Lady Bird Deed is a useful estate planning tool that allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. When preparing this deed, there are several other forms and documents that may be relevant to ensure a smooth transfer and proper management of the property. Below is a list of documents often used in conjunction with a Lady Bird Deed.

- Durable Power of Attorney: This document grants someone the authority to make financial and legal decisions on your behalf if you become incapacitated. It is essential for managing your affairs when you can no longer do so.

- Will: A will outlines how your assets should be distributed upon your death. It can complement a Lady Bird Deed by addressing any remaining assets not covered by the deed.

- Trust Agreement: A trust can hold and manage your assets for your beneficiaries. It may be used alongside a Lady Bird Deed to provide additional control over how your property is handled after your passing.

- California Residential Lease Agreement: The Fillable Forms provide a useful resource for landlords and tenants to create a comprehensive lease that outlines the terms of the rental arrangement, ensuring both parties are informed and protected.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, upon your death. They work in tandem with the Lady Bird Deed to ensure all assets are accounted for.

- Property Tax Exemption Application: If you are transferring property to a family member, you may need to apply for a tax exemption. This application can help reduce the tax burden on your beneficiaries after the property transfer.

Using these documents alongside a Lady Bird Deed can help create a comprehensive estate plan. Each document serves a specific purpose, ensuring that your wishes are honored and your loved ones are taken care of in the future.

Consider Popular Types of Lady Bird Deed Templates

Quick Title Deed - Ideal for transferring property between family members.

To facilitate the incorporation process, obtaining a reliable template can be essential, and for those in New York, an excellent resource is available at https://nyforms.com/new-york-certificate-template. This template provides guidance on how to correctly fill out the New York Certificate of Incorporation, ensuring that all necessary details are accurately captured and submitted in accordance with state regulations.

Similar forms

-

Transfer on Death Deed (TODD): Similar to a Lady Bird Deed, a Transfer on Death Deed allows property owners to designate a beneficiary who will receive the property upon their death. This deed avoids probate, simplifying the transfer process, much like the Lady Bird Deed does.

- Motor Vehicle Bill of Sale: This document records the transfer of ownership of a vehicle, providing essential details about the vehicle and parties involved. For more information, visit https://topformsonline.com.

-

Life Estate Deed: A Life Estate Deed grants a person the right to use and benefit from a property during their lifetime, with the property passing to a designated beneficiary after their death. Like the Lady Bird Deed, it allows the original owner to retain control of the property while ensuring a smooth transfer upon death.

-

Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together. When one owner passes away, their share automatically transfers to the surviving owners. The Lady Bird Deed similarly facilitates the transfer of property without going through probate.

-

Will: A will outlines how a person wishes to distribute their assets after death. While a will requires probate to enforce, a Lady Bird Deed allows for direct transfer of property, bypassing this often lengthy process, providing a more immediate solution.

-

Revocable Trust: A revocable trust holds property for the benefit of the trust's beneficiaries. The grantor can modify or revoke the trust during their lifetime. Like the Lady Bird Deed, it offers flexibility and control over property, with a seamless transition upon the grantor's death.

Common mistakes

When filling out a Lady Bird Deed form, individuals often overlook important details that can lead to complications in the future. One common mistake is failing to include all necessary parties. It’s essential to ensure that all owners of the property are listed on the deed. Omitting a co-owner can create disputes later, especially if the omitted party has legal rights to the property.

Another frequent error involves the description of the property. People sometimes use vague or incomplete descriptions, which can lead to confusion or challenges in identifying the property in question. A precise legal description is crucial for clarity. It should include the property's address and any relevant parcel numbers to avoid ambiguity.

Additionally, individuals may neglect to specify the intended beneficiaries clearly. While the purpose of a Lady Bird Deed is to transfer property upon death without going through probate, failing to name beneficiaries or providing unclear instructions can complicate the transfer process. It is advisable to list beneficiaries explicitly to ensure the property passes as intended.

Some people also misunderstand the implications of the deed regarding tax implications. They might not realize that transferring property through a Lady Bird Deed can affect property taxes or eligibility for certain benefits. It's important to consult with a tax professional to understand how this deed could impact financial situations.

Finally, individuals often forget to sign the deed properly. A Lady Bird Deed must be signed by the property owner and witnessed according to state laws. Not adhering to these requirements can invalidate the deed, leading to significant issues in the future. It is critical to follow all procedural steps to ensure the deed is legally binding.