Fill a Valid IRS W-9 Template

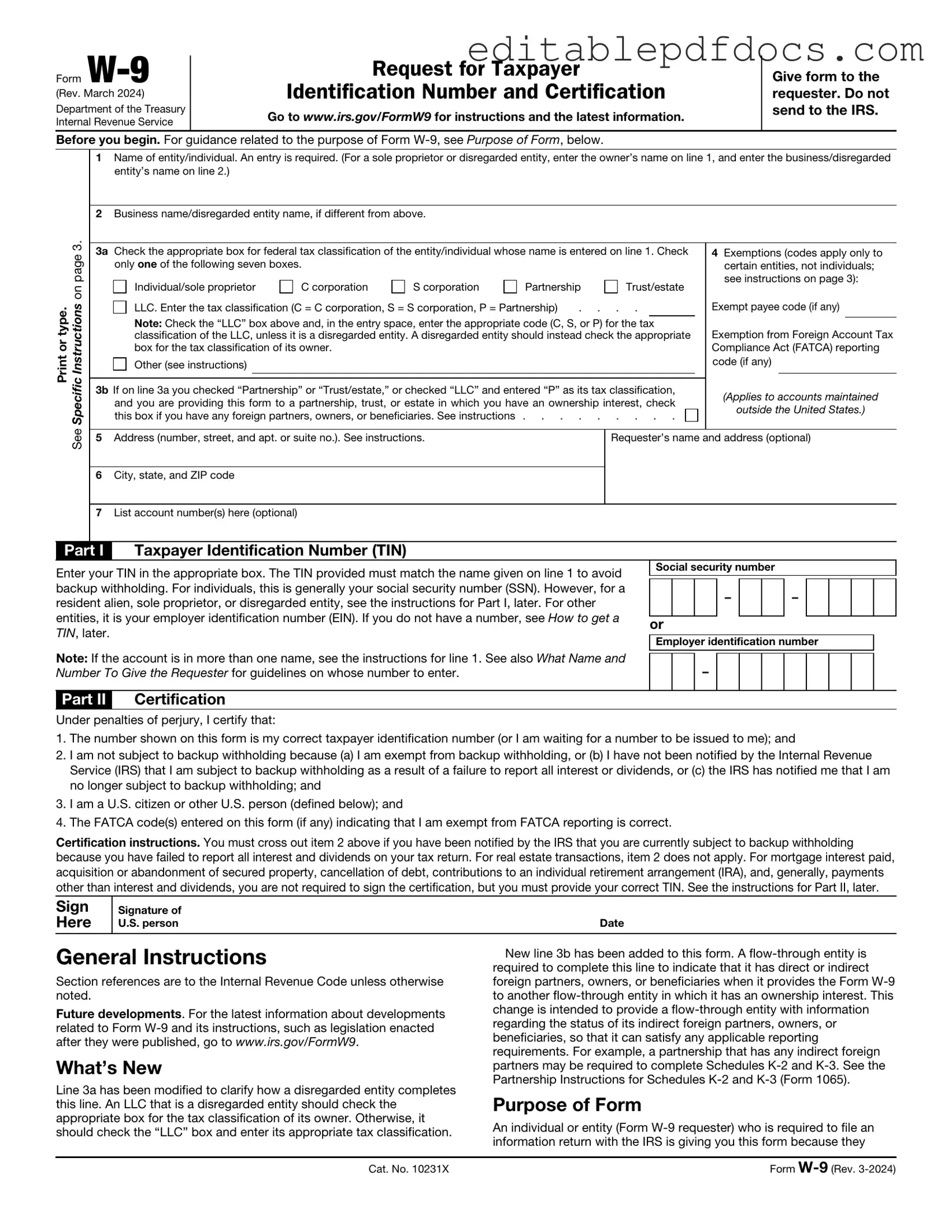

The IRS W-9 form plays a crucial role in the financial interactions between individuals and businesses in the United States. This form is primarily used by taxpayers to provide their taxpayer identification information to entities that are required to report certain payments made to them. Commonly, freelancers, independent contractors, and vendors utilize the W-9 to furnish their name, address, and Social Security Number or Employer Identification Number to clients. The information collected on the W-9 is essential for the issuance of Form 1099, which reports income to the Internal Revenue Service. Additionally, the W-9 serves as a means for the requester to confirm that the payee is not subject to backup withholding, an important consideration for both parties involved. Understanding the purpose and proper completion of the W-9 form is vital for ensuring compliance with tax regulations and avoiding potential penalties. Furthermore, the form's straightforward design allows for easy submission, making it accessible for users across various sectors.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The W-9 form is used to provide taxpayer information to businesses or individuals who are required to report income paid to you. |

| Who Uses It | Independent contractors, freelancers, and vendors typically complete the W-9 form when working with a business that needs to report payments to the IRS. |

| Information Required | The form requires your name, business name (if applicable), address, taxpayer identification number (TIN), and certification of your TIN. |

| Submission | The completed W-9 form is submitted to the requestor, not to the IRS. It is often kept on file by the requestor for tax reporting purposes. |

| State-Specific Forms | Some states may require their own version of the W-9 form or additional documentation. Check state laws for specifics, such as California's requirement under the California Revenue and Taxation Code. |

Dos and Don'ts

When filling out the IRS W-9 form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of dos and don’ts:

- Do provide your legal name as it appears on your tax return.

- Do check the appropriate box for your tax classification.

- Do include your correct taxpayer identification number (TIN).

- Do sign and date the form to validate your information.

- Don't use a nickname or any name other than your legal name.

- Don't leave any required fields blank.

- Don't forget to update your W-9 if your information changes.

By adhering to these guidelines, you can avoid common mistakes and ensure that your W-9 is processed smoothly.

Documents used along the form

The IRS W-9 form is commonly used by individuals and businesses to provide their taxpayer identification information to another party. It is essential for various financial and tax-related purposes. Alongside the W-9, several other forms and documents often come into play. Below is a list of these related documents, each serving a specific function.

- IRS 1099 Form: This form is used to report income received by individuals who are not employees. It is often issued to freelancers or independent contractors to document payments made to them throughout the year.

- IRS 1040 Form: This is the standard individual income tax return form used by U.S. taxpayers. It allows individuals to report their annual income, claim deductions, and calculate their tax liability.

- IRS 941 Form: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is filed quarterly and is essential for payroll tax compliance.

- Bill of Sale Form: For those engaging in transactions, access our comprehensive bill of sale form resources to facilitate legally binding agreements.

- IRS 1120 Form: Corporations use this form to report their income, gains, losses, deductions, and credits. It is crucial for corporate tax reporting and compliance with federal tax obligations.

- IRS SS-4 Form: This application is used to apply for an Employer Identification Number (EIN). Businesses need an EIN for tax reporting and to open a business bank account.

Understanding these forms and their purposes is vital for ensuring compliance with tax regulations. Each document plays a significant role in the broader context of financial reporting and tax obligations.

Popular PDF Forms

Construction Project Proposal - Use this form to showcase previous similar projects completed successfully.

Donation Slips - Goodwill's acknowledgment of your support to the community.

The FedEx Release Form is an essential document that allows you to authorize the delivery of your package when you are unable to be home. By filling out this form, you enable FedEx to leave your package at a specified location, provided that the requirements are met. For further details on how to complete the process, you can refer to the PDF Documents Hub to ensure a smooth delivery experience—click the button below to fill out the form now.

Aoausa - Current balances for checking and savings accounts are requested.

Similar forms

- Form W-4: This form is used by employees to inform their employer about how much tax to withhold from their paycheck. Like the W-9, it collects personal information but focuses on withholding allowances instead of taxpayer identification.

- Form 1099-MISC: This document reports income received by independent contractors and freelancers. Similar to the W-9, it requires the recipient’s taxpayer identification number for accurate reporting.

- Last Will and Testament Form: To ensure your final wishes are honored, complete the necessary Last Will and Testament documentation for proper estate management.

- Form 1099-NEC: This form is specifically for reporting non-employee compensation. It parallels the W-9 in that it also requires the recipient's information for tax purposes.

- Form SS-4: Used to apply for an Employer Identification Number (EIN), this form is similar to the W-9 in that it requires identifying information about the business or individual.

- Form 1040: The individual income tax return requires personal information similar to the W-9. It summarizes all income, including that reported on W-9 and other forms.

- Form 4506-T: This form allows taxpayers to request a transcript of their tax return. Like the W-9, it requires personal information to verify identity.

- Form 8821: This document authorizes an individual to receive confidential tax information. It shares similarities with the W-9 in that it involves the disclosure of taxpayer identification.

- Form 1098: Used to report mortgage interest paid, this form collects taxpayer information like the W-9, which is necessary for accurate tax reporting.

- Form 1065: This is a partnership return that requires information about the partners, similar to how the W-9 gathers information about individuals or entities receiving payments.

Common mistakes

Filling out the IRS W-9 form can be straightforward, but many people make common mistakes that can lead to delays or issues with tax reporting. One frequent error is providing an incorrect name. The name on the form must match the name on the taxpayer's Social Security card or the IRS records. If there is a discrepancy, it can cause confusion and delays in processing.

Another mistake often seen is the failure to check the correct box for the tax classification. Individuals may overlook the options for sole proprietorship, corporation, or partnership, among others. Selecting the wrong classification can lead to incorrect tax withholding and reporting by the payer, which may result in penalties or additional taxes owed later.

Many people also forget to include their taxpayer identification number (TIN). The TIN is crucial for the IRS to properly identify the individual or business entity. If the TIN is missing or incorrect, it can lead to backup withholding, where the payer must withhold a portion of payments for tax purposes. This can create financial strain and complicate tax filings.

Lastly, neglecting to sign and date the form is a common oversight. A W-9 form is not valid unless it is signed by the individual or authorized representative. Without a signature, the form cannot be processed, leading to delays in payments or reporting. Ensuring all sections are complete and accurate is essential for a smooth transaction.