Fill a Valid IRS Schedule C 1040 Template

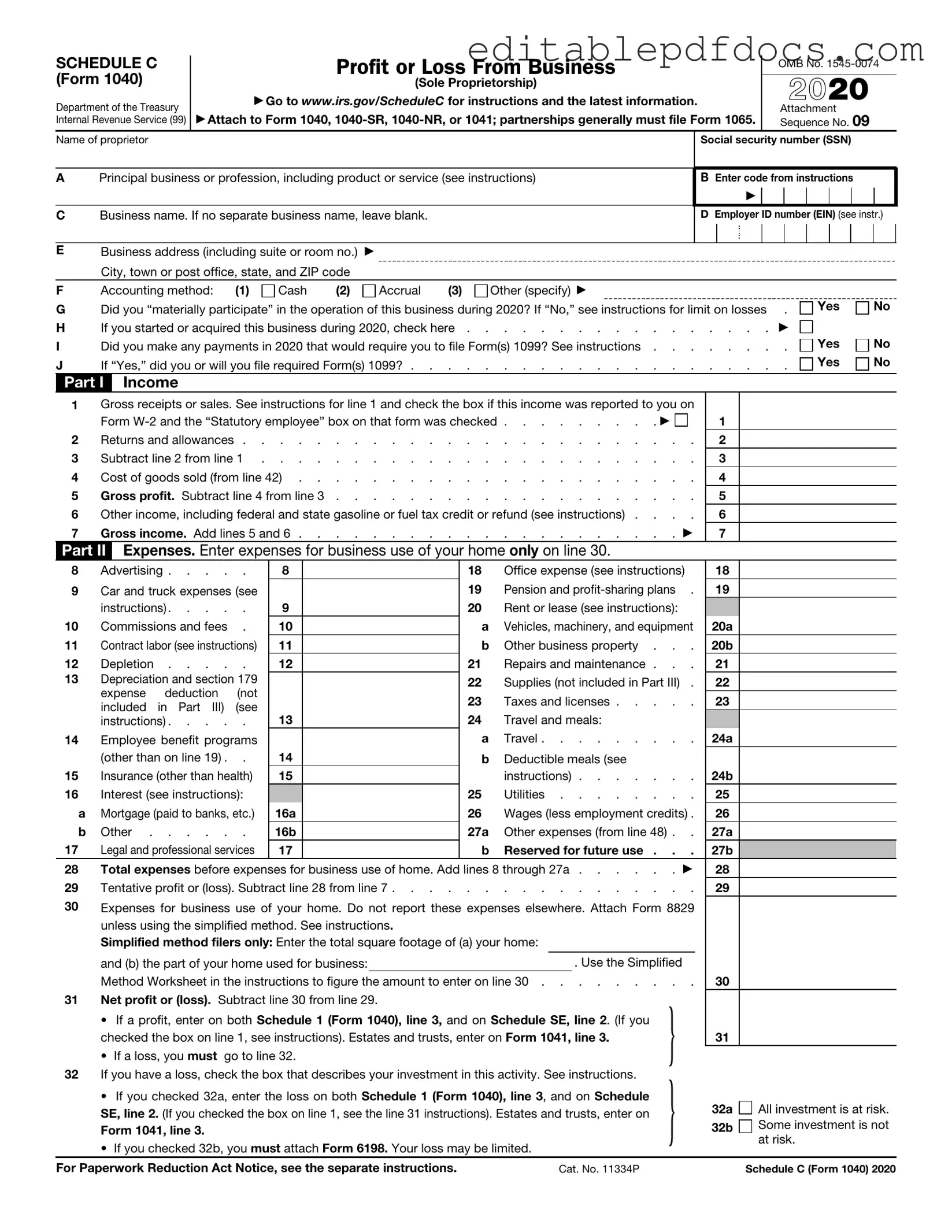

The IRS Schedule C (Form 1040) is an essential document for many individuals who run their own businesses or work as freelancers. This form allows self-employed individuals to report their income and expenses, providing a clear picture of their business’s financial health. By detailing earnings and deducting allowable expenses, taxpayers can determine their net profit or loss for the year. Key aspects of the Schedule C include sections for reporting gross receipts, cost of goods sold, and various business expenses, such as advertising, utilities, and travel costs. Understanding how to accurately fill out this form can significantly impact tax liabilities and potential refunds. Additionally, the Schedule C must be filed alongside the individual’s personal income tax return, making it a crucial part of the overall tax filing process for self-employed individuals. Whether you’re a seasoned entrepreneur or just starting out, navigating the Schedule C can help ensure compliance with tax laws while maximizing your deductions.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used to report income or loss from a business operated as a sole proprietorship. |

| Filing Requirement | Taxpayers must file Schedule C if they have net earnings of $400 or more from self-employment. |

| Income Reporting | All business income, including cash and credit sales, must be reported on Schedule C. |

| Deductible Expenses | Common deductible expenses include supplies, utilities, and business travel costs. |

| Net Profit Calculation | Net profit or loss is calculated by subtracting total expenses from total income. |

| Self-Employment Tax | Net earnings from Schedule C may be subject to self-employment tax, reported on Schedule SE. |

| State-Specific Forms | Some states require additional forms for business income. Check state laws for specifics. |

Dos and Don'ts

When filling out the IRS Schedule C (Form 1040), it is essential to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

- Do gather all necessary financial records, including income and expenses, before starting the form.

- Do report all sources of income accurately to avoid discrepancies with the IRS.

- Do claim all eligible business expenses to reduce taxable income effectively.

- Do keep copies of the completed form and supporting documents for your records.

- Do review the form thoroughly for any errors before submission.

- Don't underestimate your income; ensure that all figures are precise and truthful.

- Don't mix personal and business expenses; this can lead to complications during audits.

- Don't ignore deadlines for filing to avoid penalties and interest.

- Don't forget to sign and date the form before submission.

- Don't rely solely on estimates; accurate records are crucial for compliance.

Documents used along the form

The IRS Schedule C (Form 1040) is essential for self-employed individuals to report income and expenses from their business. However, several other forms and documents are often used in conjunction with Schedule C to ensure accurate reporting and compliance with tax regulations. Below is a list of these important documents.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. It serves as the main document for reporting personal income, including income from self-employment.

- Schedule SE: This form is used to calculate self-employment tax. Self-employed individuals must file this form to report their earnings and determine their contributions to Social Security and Medicare.

- Form 4562: This form is used to claim depreciation and amortization of business assets. It helps businesses deduct the cost of these assets over time, reducing taxable income.

- Form 8829: This form allows self-employed individuals to claim expenses for business use of their home. It provides a detailed calculation of the home office deduction.

- Form 1099-NEC: This form is used to report non-employee compensation. If a business pays independent contractors, it must issue this form to report payments made during the year.

- Form W-2: Employers use this form to report wages paid to employees and the taxes withheld. Self-employed individuals may need this form if they have employees.

- Ohio Medical Power of Attorney Form: When planning for healthcare decisions, consider our essential Medical Power of Attorney form options to ensure your wishes are respected.

- Receipts and Invoices: Maintaining detailed receipts and invoices is crucial for substantiating income and expenses reported on Schedule C. These documents provide evidence of business transactions.

- Bank Statements: Monthly bank statements help track business income and expenses. They are useful for reconciling financial records and ensuring accuracy in reporting.

Utilizing these forms and documents alongside the IRS Schedule C (Form 1040) helps ensure that self-employed individuals accurately report their financial activities and comply with tax obligations. Proper documentation is vital for substantiating claims and minimizing the risk of errors during tax filing.

Popular PDF Forms

Rental Verification Form Pdf - Requesting confirmation of the rental history for verification purposes.

Free Insurance Card Template - Be aware of the content to avoid misunderstandings in an accident.

The Employment Application PDF form is a standardized document used by employers to collect essential information from potential candidates during the hiring process. This form typically requires details about the applicant's work history, education, and skills. By utilizing this format, employers streamline the evaluation of applicants and ensure a consistent approach to recruitment. For added convenience, candidates can access a range of customizable options through Fillable Forms.

W3schools Download - Employers should distribute W-2 forms to employees before submitting the W-3.

Similar forms

The IRS Schedule C (Form 1040) is a key document for self-employed individuals. It's used to report income and expenses from a business. Here are four other documents that are similar to Schedule C, along with how they relate:

- Form 1065: This form is used by partnerships to report income, deductions, and other financial information. Like Schedule C, it provides a detailed breakdown of business earnings and expenses.

- Employment Verification Form: This essential document is designed to confirm an individual's employment status and history, making it a key resource for employers and lenders. For more details, you can visit PDF Documents Hub.

- Form 1120: Corporations use this form to report their income and pay taxes. Similar to Schedule C, it details revenue and expenses, but it's specifically for C Corporations, which are taxed separately from their owners.

- Form 1040 Schedule E: This form is for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. It shares the same purpose of detailing income and expenses, but focuses on passive income sources rather than active business income.

- Form 1040 Schedule F: Farmers use this form to report their farming income and expenses. Like Schedule C, it captures the financial performance of a business, but it is tailored specifically for agricultural activities.

Common mistakes

When filling out the IRS Schedule C (Form 1040), many people make common mistakes that can lead to issues with their tax returns. One frequent error is not reporting all income. It's crucial to include every source of income related to your business. Missing even a small amount can raise red flags with the IRS.

Another mistake is incorrectly categorizing expenses. People often misclassify business expenses, which can lead to an inaccurate calculation of net profit. Understanding the difference between deductible and non-deductible expenses is essential for accurate reporting.

Many individuals also overlook the importance of keeping detailed records. Failing to maintain receipts and documentation can make it difficult to substantiate claims if the IRS questions your deductions. Organized records help ensure that you can back up your reported figures.

Some filers forget to take advantage of all available deductions. For example, home office deductions or vehicle expenses can significantly reduce taxable income. Not including these deductions can result in paying more tax than necessary.

Another common error involves not using the correct business structure. Whether you operate as a sole proprietor, LLC, or corporation affects how you fill out the form. Ensure that you understand your business structure to complete the form accurately.

People sometimes make mathematical errors when calculating totals. Simple addition or subtraction mistakes can lead to incorrect figures. Double-checking calculations can prevent these errors from impacting your tax return.

Failing to sign and date the form is another oversight. A Schedule C without a signature is not valid. Always make sure to sign and date the form before submitting it to the IRS.

Some individuals neglect to review the instructions for the Schedule C. The IRS provides specific guidance that can clarify how to fill out the form correctly. Taking the time to read the instructions can help avoid confusion.

Many filers also forget to report losses from previous years. If you had a loss in a prior year, you might be able to use it to offset income in the current year. Not doing so can mean missing out on valuable tax benefits.

Lastly, people often underestimate the importance of filing on time. Late submissions can incur penalties and interest. Staying aware of deadlines is crucial for avoiding unnecessary fees.