Fill a Valid IRS 941 Template

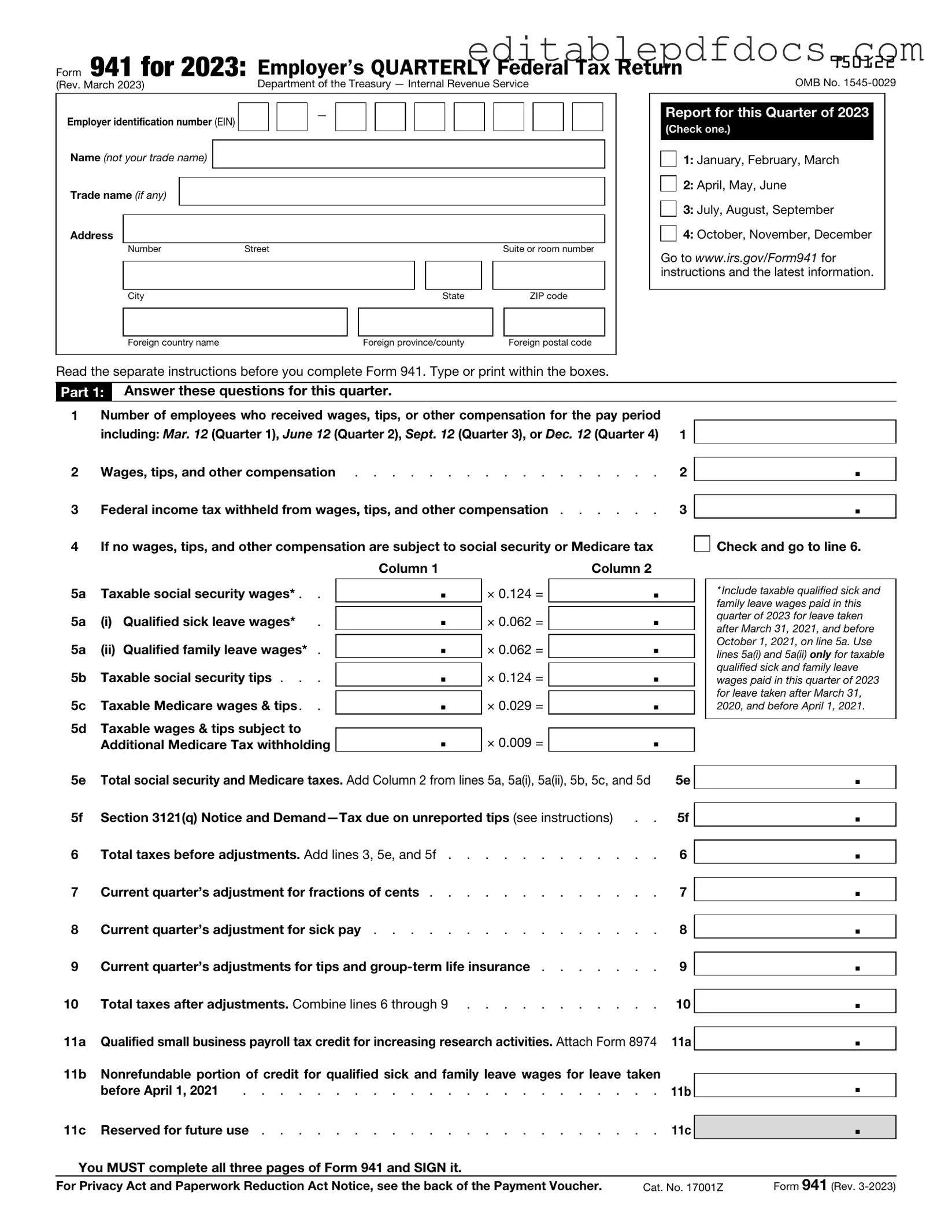

The IRS 941 form plays a crucial role in the world of payroll taxes for employers in the United States. This quarterly form is used to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Employers must file it every three months, ensuring they accurately reflect the wages paid and the taxes withheld. Additionally, the form helps employers calculate their share of Social Security and Medicare taxes. Understanding the nuances of the 941 form is essential for maintaining compliance with federal tax laws. It also allows businesses to report any adjustments for prior quarters, which can be vital for accurate tax reporting. By staying informed about the requirements and deadlines associated with the IRS 941 form, employers can avoid penalties and ensure their payroll processes run smoothly.

Document Details

| Fact Name | Detail |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. |

| Filing Frequency | This form must be filed quarterly, with specific deadlines for each quarter throughout the year. |

| Who Must File | Any employer who pays wages to employees must file Form 941, regardless of the size of their payroll. |

| Penalties for Late Filing | Failure to file Form 941 on time can result in penalties, which may increase the longer the form is overdue. |

| State-Specific Requirements | Some states may have their own versions of this form, governed by state laws regarding payroll taxes. |

| Electronic Filing | Employers can file Form 941 electronically through the IRS e-file system, which is encouraged for faster processing. |

| Record Keeping | Employers are required to maintain accurate records of all wages paid and taxes withheld for at least four years. |

| Estimated Taxes | Employers may need to make estimated tax payments throughout the year, which can be reported on Form 941. |

| Amending the Form | If errors are found after filing, employers can amend Form 941 using Form 941-X to correct any mistakes. |

| Final Return | If an employer stops doing business or no longer has employees, they must indicate this on their final Form 941. |

Dos and Don'ts

When filling out the IRS 941 form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do double-check your employer identification number (EIN) for accuracy.

- Do report all wages, tips, and other compensation accurately.

- Do ensure that the form is signed and dated by an authorized individual.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; fill in all required information.

- Don't forget to calculate and report any adjustments to your tax liability.

- Don't submit the form late; adhere to the filing deadlines.

- Don't use pencil or erasable ink; always use a pen with permanent ink.

Documents used along the form

The IRS Form 941 is essential for employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. However, it’s not the only document you’ll encounter in the payroll process. Here’s a list of other forms and documents that often accompany the 941, helping to ensure compliance and smooth operations.

- Form W-2: This form reports an employee’s annual wages and the taxes withheld from their paycheck. Employers must provide a W-2 to each employee by January 31 each year.

- Form W-3: This is a summary form that accompanies the W-2s when filing with the Social Security Administration. It provides totals of all W-2s issued and is due by the end of February.

- Form 940: This form is used to report and pay federal unemployment taxes (FUTA). Employers file it annually, detailing the unemployment taxes owed for the year.

- Form 1099-MISC: Independent contractors receive this form to report income received throughout the year. It’s crucial for ensuring that all income is reported to the IRS.

- Form 1096: This is a summary form that accompanies the 1099-MISC when filing with the IRS. It provides a summary of the information returns being submitted.

- Form SS-4: Employers use this form to apply for an Employer Identification Number (EIN), which is necessary for tax reporting purposes.

- Form 8822: This form is used to notify the IRS of a change of address for an individual or business. Keeping your address updated is important for receiving tax documents.

- Form 941-X: If you need to correct errors on a previously filed Form 941, this form is used to make adjustments to your reported payroll taxes.

- Trailer Bill of Sale: When transferring ownership of a trailer, it's crucial to utilize a properly executed form such as the Templates and Guide to ensure all necessary details are accurately documented.

- Payroll Records: While not a specific IRS form, maintaining accurate payroll records is vital. These records support the information reported on forms like the 941 and W-2.

- Form 4506-T: This form allows taxpayers to request a transcript of their tax return. It can be useful for verifying income and tax information when needed.

Staying organized with these documents can significantly ease the burden of payroll reporting and compliance. By understanding each form's purpose, employers can navigate the complexities of tax reporting with confidence and clarity.

Popular PDF Forms

Miscellaneous Information - Form 1099-MISC must be delivered to recipients by January 31st each year.

An Employee Handbook form serves as a comprehensive document that outlines a company's policies, procedures, and expectations for its employees. It is essential for fostering a positive workplace culture and ensuring compliance with legal obligations. Providing clear guidelines helps employees understand their rights and responsibilities within the organization, and further information can be found at https://topformsonline.com/.

Hiv Elisa Test Normal Range - It simplifies communication of results between clients and healthcare providers.

How Do You Get the $16728 Social Security Bonus? - Filing the SSA-44 can ease the financial burden related to healthcare premiums.

Similar forms

- IRS Form 940: This form is used to report annual Federal Unemployment Tax Act (FUTA) taxes. Like Form 941, it is submitted to the IRS and helps employers report their tax obligations related to employee wages.

- IRS Form W-2: Employers use this form to report annual wages and taxes withheld for each employee. Similar to Form 941, it provides the IRS with information about employee earnings and tax withholdings.

- Durable Power of Attorney: This document allows an individual to appoint a trusted person to oversee financial decisions on their behalf when they are unable to do so, similar to the importance of tax forms in managing financial matters. More information can be found at https://nyforms.com/durable-power-of-attorney-template/.

- IRS Form W-3: This is a summary form that accompanies the W-2. It aggregates the information from all W-2 forms issued by an employer, similar to how Form 941 summarizes quarterly tax liabilities.

- IRS Form 1099-MISC: This form is used to report payments made to independent contractors. While Form 941 focuses on employee wages, both forms report tax-related information to the IRS.

- IRS Form 944: This form is for smaller employers to report annual payroll taxes instead of quarterly. It serves a similar purpose as Form 941 but is filed less frequently.

- IRS Form 945: Used to report federal income tax withheld from nonpayroll payments. Like Form 941, it is a reporting tool for tax obligations, but it focuses on different types of payments.

- IRS Form 1095-C: Employers use this form to report information about health coverage offered to employees. It is similar to Form 941 in that it provides important information to the IRS regarding employee benefits.

- IRS Form 1094-C: This is the transmittal form that summarizes the information reported on Form 1095-C. It serves a similar role to Form 941 by consolidating data for IRS review.

Common mistakes

Filling out the IRS Form 941 can be a daunting task for many business owners. This quarterly form is essential for reporting income taxes, Social Security tax, and Medicare tax withheld from employees’ paychecks. However, mistakes can lead to penalties or delays in processing. Here are five common errors to avoid when completing this important document.

One frequent mistake is incorrect employee counts. Some people miscount the number of employees for the quarter. This error can lead to incorrect tax calculations and potential fines. Always double-check your employee roster for accuracy before submitting the form. It’s crucial to ensure that you account for all employees who received wages during the reporting period.

Another common pitfall is misreporting wages. This can happen when employers forget to include certain types of compensation, such as bonuses or overtime pay. Each dollar matters when it comes to tax reporting. Make sure to review your payroll records thoroughly to capture all forms of employee compensation accurately.

Many individuals also fail to calculate tax liabilities correctly. The IRS Form 941 requires precise calculations of federal income tax withheld, as well as Social Security and Medicare taxes. Errors in these calculations can lead to discrepancies that may raise red flags with the IRS. Utilizing payroll software or consulting with a tax professional can help ensure accuracy.

Another mistake involves not signing the form. It may seem simple, but forgetting to sign can delay processing. The IRS requires a signature to validate the form. Always remember to sign and date the form before submission. This small step can prevent unnecessary complications.

Finally, some people neglect to keep copies of their submitted forms. It’s essential to maintain records of what you’ve filed, in case of future audits or discrepancies. Keeping copies of your IRS Form 941 not only helps in tracking your submissions but also serves as a reference for future filings. Good record-keeping can save time and stress down the road.