Fill a Valid IRS 433-F Template

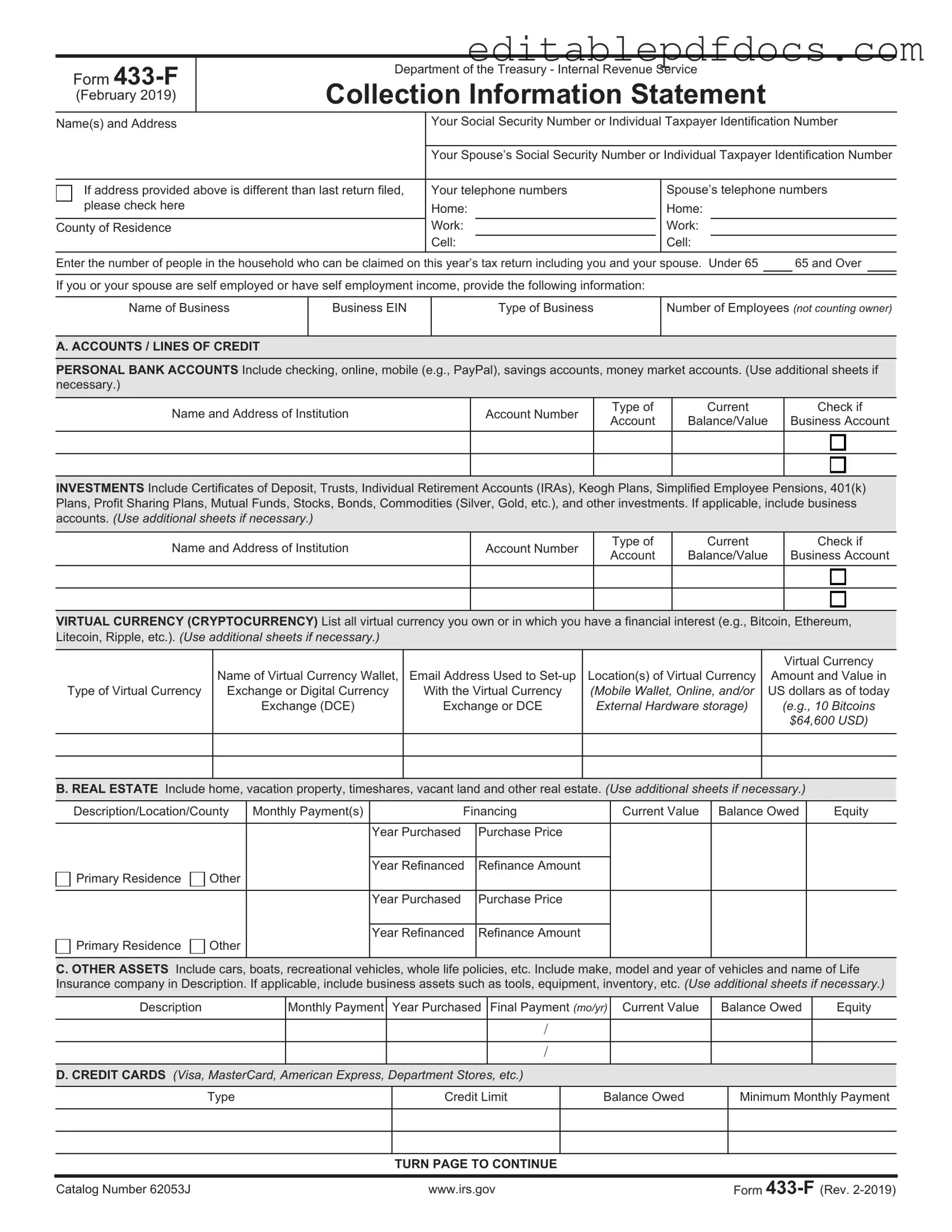

The IRS 433-F form plays a crucial role for individuals and businesses facing tax liabilities. This form is primarily used to collect financial information from taxpayers who are negotiating a payment plan or an offer in compromise with the Internal Revenue Service. By providing a comprehensive snapshot of your financial situation, the IRS 433-F helps the IRS determine your ability to pay and the most appropriate course of action. It requires details about your income, expenses, assets, and liabilities, ensuring that the IRS has a clear understanding of your financial landscape. Completing this form accurately is essential, as it can significantly impact your negotiations with the IRS. Understanding the nuances of the IRS 433-F form can empower you to navigate your tax obligations more effectively and work towards a resolution that fits your financial circumstances.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The IRS 433-F form is used to gather financial information from taxpayers who owe back taxes. |

| Eligibility | This form is typically required for individuals or businesses seeking to set up a payment plan or settle tax debts. |

| Sections | The form includes sections for personal information, income, expenses, and assets. |

| Submission Method | Taxpayers can submit the form via mail or online through the IRS website. |

| Frequency of Use | Taxpayers may need to fill out this form each year they apply for a payment plan or an offer in compromise. |

| Supporting Documents | Additional documents may be required, such as pay stubs, bank statements, and proof of expenses. |

| State-Specific Forms | Some states have their own forms for financial disclosure; for example, California uses the FTB 3567 form. |

| Governing Law | The IRS 433-F is governed by federal tax law, while state-specific forms are governed by state tax laws. |

| Deadline | There is no strict deadline for submitting the form, but it should be completed as soon as possible to avoid penalties. |

| Importance | Completing the form accurately can lead to more favorable payment terms with the IRS. |

Dos and Don'ts

When filling out the IRS 433-F form, it is essential to approach the task with care and attention to detail. This form is used for financial disclosure and can significantly impact your dealings with the IRS. Below are some guidelines on what to do and what to avoid.

- Do provide accurate information. Ensure that all details about your income, expenses, assets, and liabilities are correct.

- Do include all sources of income. List every source, including wages, self-employment income, and any other earnings.

- Do be thorough in listing your expenses. Include all necessary living expenses to provide a complete picture of your financial situation.

- Do review the form carefully. Check for any errors or omissions before submitting the form to the IRS.

- Don't underestimate your assets. Be honest and comprehensive when disclosing your assets; underreporting can lead to complications.

- Don't leave any sections blank. If a section does not apply, indicate that clearly rather than skipping it.

- Don't ignore deadlines. Submit the form promptly to avoid penalties or delays in processing your request.

- Don't fabricate information. Providing false information can result in serious legal consequences, including penalties and fines.

Documents used along the form

The IRS 433-F form is commonly used for financial disclosure to the Internal Revenue Service, particularly in cases involving installment agreements or offers in compromise. Alongside this form, several other documents may be required to provide a comprehensive view of an individual's financial situation. Below is a list of forms and documents that are often utilized in conjunction with the IRS 433-F form.

- IRS Form 1040: This is the individual income tax return form that taxpayers must file annually. It provides detailed information about income, deductions, and tax liability.

- IRS Form 4506-T: This form allows taxpayers to request a transcript of their tax return. It can be useful for verifying income and tax payments.

- IRS Form 656: This form is used to submit an offer in compromise, allowing taxpayers to settle their tax debts for less than the full amount owed.

- IRS Form 433-A: Similar to the 433-F, this form is used for financial disclosure but is typically required for individuals with more complex financial situations, such as businesses or self-employed individuals.

- IRS Form 9465: This form is used to request an installment agreement, allowing taxpayers to pay their tax liabilities over time rather than in a lump sum.

- Bank Statements: Recent bank statements provide evidence of income and expenses, helping to paint a clearer picture of an individual's financial health.

- Pay Stubs: Recent pay stubs are necessary to verify current income, especially for those who are employed and receive regular wages.

- Asset Documentation: This includes records of any significant assets, such as property deeds, vehicle titles, or investment statements, to assess net worth.

- California Dog Bill of Sale: This form documents the sale or transfer of ownership of a dog in California, ensuring a smooth transfer and protecting the rights of both parties involved. It outlines critical details such as buyer and seller information, the dog's description, and any health guarantees. For more information, you can access Fillable Forms.

- Expense Documentation: Detailed records of monthly living expenses, such as rent, utilities, and groceries, are important for understanding an individual's financial obligations.

Each of these documents plays a critical role in providing the IRS with a thorough understanding of an individual’s financial circumstances. Together with the IRS 433-F form, they contribute to a clearer assessment of a taxpayer's ability to meet their obligations.

Popular PDF Forms

Da-31 - This form should be retained according to Army documentation policies.

For businesses operating as Limited Liability Companies (LLCs) in New Jersey, having a solid understanding of an Operating Agreement template is vital for success. This document not only delineates the responsibilities and roles of members but also establishes clear guidelines to facilitate smooth operations and decision-making processes.

Free Trust Amendment Form - Maintaining clear records of amendments is important for future reference.

Similar forms

The IRS Form 433-F is a crucial document for individuals dealing with tax issues, particularly when negotiating payment arrangements with the IRS. It provides a comprehensive overview of a taxpayer's financial situation. Several other forms and documents serve similar purposes, either by gathering financial information or by facilitating negotiations with tax authorities. Here are ten documents that share similarities with Form 433-F:

- IRS Form 433-A: This form is used for individuals who owe more than $50,000 in taxes. Like the 433-F, it collects detailed financial information, but it is more comprehensive, including additional assets and liabilities.

- IRS Form 433-B: Designed for businesses, this form collects financial information similar to the 433-F but focuses on business assets and liabilities. It helps the IRS understand a business's ability to pay taxes.

- IRS Form 9465: This is an installment agreement request form. While it doesn’t gather as much financial detail as the 433-F, it is often submitted alongside it to propose a payment plan based on the financial information provided.

- Florida Divorce Settlement Agreement: This form serves as a crucial blueprint for outlining the terms of a divorce between two parties. It details the division of assets, debts, and, if applicable, the allocation of parental responsibilities and rights. To learn more about the form, read here.

- IRS Form 656: This form is used for an Offer in Compromise, which allows taxpayers to settle their tax debt for less than the full amount owed. The financial information required is similar, as it assesses the taxpayer's ability to pay.

- IRS Form 1040: The standard individual income tax return. While not specifically for payment arrangements, it provides essential financial information that can be relevant in negotiations with the IRS.

- IRS Form 8821: This form authorizes a third party to receive and inspect your tax information. It can be used alongside the 433-F when a taxpayer wants to involve a tax professional in their negotiations.

- Bankruptcy Petition: When individuals file for bankruptcy, they must disclose their financial situation. This document serves a similar purpose in revealing assets and liabilities, which can influence tax debt negotiations.

- Financial Statements: These documents, often required by lenders, summarize an individual’s financial position. They provide a snapshot of income, expenses, and assets, much like the 433-F.

- Debt Settlement Agreement: This is a legal document outlining terms between a debtor and creditor. It often requires financial disclosures similar to those on the 433-F to establish the debtor's financial situation.

- Wage Garnishment Notice: This document details the amount of money that can be taken from a taxpayer's paycheck to satisfy a debt. It often reflects the taxpayer’s financial situation, similar to the 433-F.

Each of these documents plays a role in understanding a taxpayer's financial landscape, just as the IRS Form 433-F does. By gathering this information, taxpayers can better navigate their obligations and find suitable resolutions with the IRS.

Common mistakes

Filling out the IRS 433-F form can be a daunting task, and many people make mistakes that can lead to delays or complications in their tax matters. One common error is failing to provide complete and accurate information. When you leave out details or provide incorrect figures, it can create confusion and may result in the IRS rejecting your submission. Always double-check your entries to ensure they are correct.

Another frequent mistake is not including all sources of income. The IRS wants a full picture of your financial situation. If you neglect to report income from side jobs, investments, or other sources, it could lead to penalties or even an audit. Transparency is key when dealing with tax forms.

Some people overlook the importance of documenting their expenses. The IRS 433-F form requires you to outline your monthly living expenses. If you underestimate these costs or fail to provide supporting documents, you risk being seen as less credible. Keep receipts and records handy to substantiate your claims.

Additionally, individuals often forget to sign and date the form. It may seem like a small detail, but an unsigned form is considered incomplete. Make sure to review the entire document before submission to ensure you haven’t missed this crucial step.

Another mistake is miscalculating your assets. The IRS requires a thorough accounting of your assets, including property, savings, and investments. If you undervalue or overvalue these items, it can lead to discrepancies that may complicate your case. Take the time to assess your assets accurately.

Finally, many people fail to follow up after submitting the form. Once you send in the IRS 433-F, it’s important to monitor the status of your submission. Not doing so can lead to missed communications from the IRS, which could further delay your resolution. Stay proactive and check in regularly.