Fill a Valid IRS 2553 Template

The IRS Form 2553 is a crucial document for small business owners looking to elect S Corporation status. This form allows eligible corporations and limited liability companies (LLCs) to be taxed as an S Corporation, which can provide significant tax benefits. To qualify, businesses must meet specific criteria, including a limit on the number of shareholders and restrictions on the types of shareholders allowed. Completing the form accurately is essential, as it requires detailed information about the business, including its name, address, and tax identification number. Additionally, the form must be filed within a certain timeframe to ensure the election is effective for the current tax year. Understanding the nuances of Form 2553 can help business owners make informed decisions that impact their tax obligations and overall financial health.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 2553 is used by small businesses to elect to be taxed as an S Corporation. |

| Eligibility | Only domestic corporations can file Form 2553. Certain restrictions apply regarding the number and type of shareholders. |

| Filing Deadline | The form must be filed within 75 days of the corporation's formation or by March 15 for existing corporations. |

| Shareholder Requirements | All shareholders must consent to the S Corporation election, which is indicated by their signatures on the form. |

| Tax Year | By default, an S Corporation must adopt a calendar year unless a valid business purpose for a different year is provided. |

| State-Specific Forms | Some states require separate forms to elect S Corporation status. For example, California uses Form 100S. |

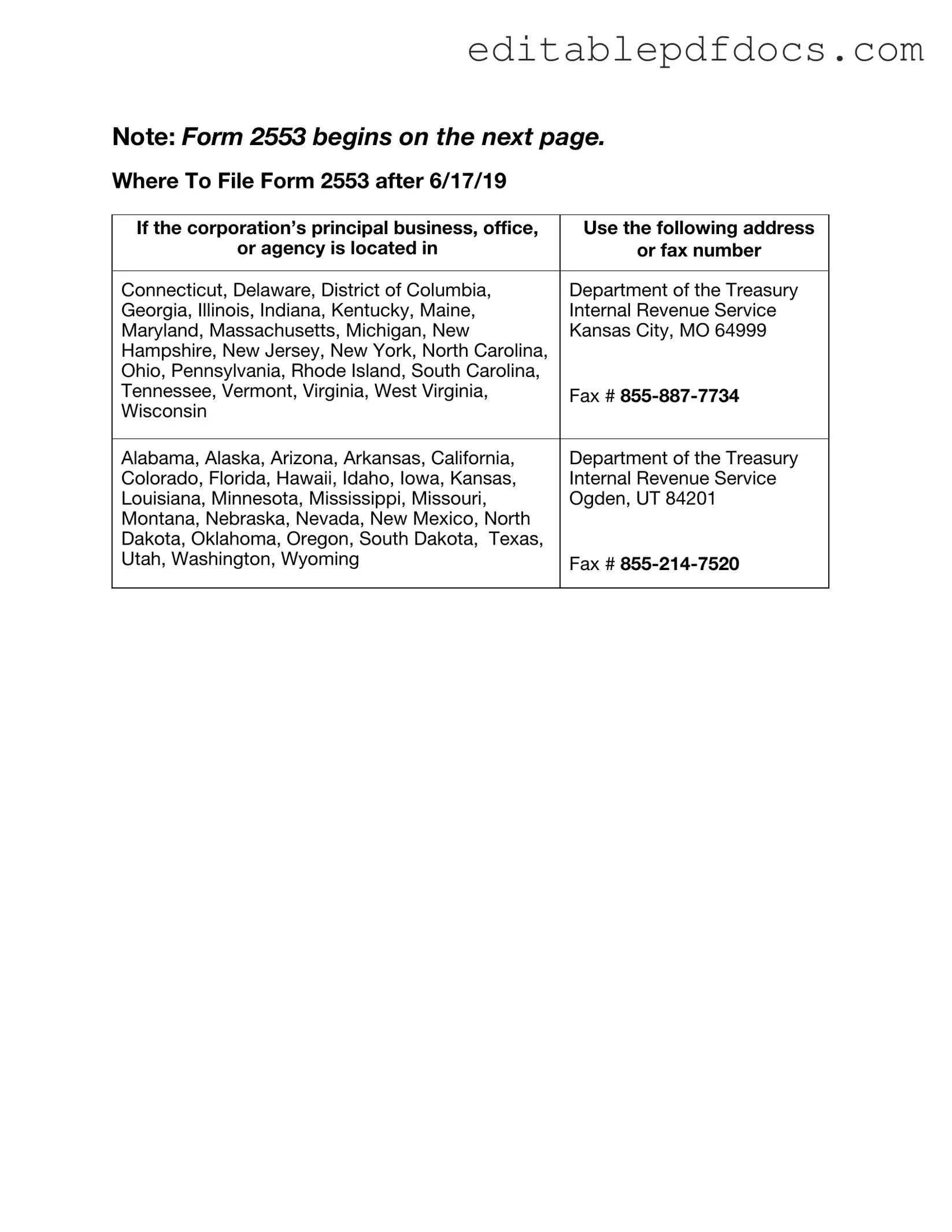

| Filing Location | Form 2553 can be filed by mail or fax, depending on the situation and the number of shareholders. |

| Revocation | An S Corporation can revoke its election by filing a statement with the IRS, but this may have tax implications. |

| IRS Guidance | The IRS provides specific instructions and guidance for completing Form 2553, which can be found on their website. |

| Consequences of Non-filing | If Form 2553 is not filed correctly, the corporation may be taxed as a regular C Corporation, leading to double taxation. |

Dos and Don'ts

When filling out the IRS Form 2553, it's important to follow certain guidelines to ensure your application is processed smoothly. Here’s a list of things to do and avoid:

- Do read the instructions carefully before starting the form.

- Do provide accurate information to avoid delays.

- Do sign and date the form before submission.

- Do submit the form within the required timeframe.

- Don't leave any sections blank; fill in all applicable fields.

- Don't use correction fluid on the form; make corrections neatly.

- Don't forget to keep a copy of the submitted form for your records.

Following these tips will help ensure a smoother process when submitting your IRS Form 2553.

Documents used along the form

The IRS Form 2553 is essential for small businesses electing to be taxed as an S Corporation. However, several other forms and documents may be necessary to ensure compliance with tax regulations and to support the election process. Below is a list of commonly used forms and documents that often accompany the IRS 2553.

- Form 1120S: This is the U.S. Income Tax Return for an S Corporation. It reports the income, deductions, and credits of the S Corporation, and is filed annually.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It is used to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks.

- Form W-2: This form reports wages paid to employees and the taxes withheld from them. Employers must provide this form to employees and file it with the Social Security Administration.

- Form W-3: This is the Transmittal of Wage and Tax Statements. It summarizes all W-2 forms issued by an employer for a given tax year.

- ADP Pay Stub Form: Understanding your pay details is essential for managing your finances effectively. For a comprehensive record of your earnings and deductions, make sure to utilize the Adp Pay Stub form.

- Form 1065: This is the U.S. Return of Partnership Income. If the business has partners, this form may be necessary to report income, deductions, and profits.

- Form SS-4: This is the Application for Employer Identification Number (EIN). An EIN is required for tax purposes and is needed to open a business bank account.

- Form 1040: This is the U.S. Individual Income Tax Return. Shareholders of an S Corporation report their share of the corporation's income on this form.

- Operating Agreement: While not a tax form, this document outlines the management structure and operating procedures of the S Corporation, and can be crucial for internal governance.

Understanding these forms and documents is vital for the successful operation and compliance of an S Corporation. Each plays a specific role in ensuring that the business meets its tax obligations and operates smoothly.

Popular PDF Forms

Sfa Age Range - This tool provides clarity on student needs and educational goals.

Understanding the importance of a proper FedEx Bill of Lading can greatly enhance your shipping experience, as it is vital for tracking and managing shipments effectively. To access the required forms and further information, you can visit PDF Documents Hub, which provides all the necessary resources to ensure smooth shipping operations.

Rental Contract California - Tenants must provide a forwarding address for the return of the security deposit.

Similar forms

The IRS Form 2553 is used by small businesses to elect S Corporation status. Several other forms share similarities in purpose or function. Here are four documents that are comparable to Form 2553:

- IRS Form 8832: This form allows a business entity to choose how it will be classified for federal tax purposes. Like Form 2553, it is used to make an election regarding the taxation of a business entity, although it is broader in scope and can apply to various entity types.

- IRS Form 1065: Partnerships use this form to report income, deductions, gains, and losses. While Form 2553 is about electing S Corporation status, Form 1065 is utilized after that status is established, focusing on the tax reporting requirements for partnerships.

- IRS Form 1120-S: This is the tax return form for S Corporations. After electing S Corporation status with Form 2553, a business must file Form 1120-S to report its income, deductions, and other tax-related information. Both forms are integral to the S Corporation process.

- Last Will and Testament Form: To ensure your wishes are honored, consult the comprehensive Last Will and Testament resources for clear guidelines on asset distribution and legal requirements.

- IRS Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. While Form 2553 is about entity classification, Form 941 is about ongoing tax obligations for employers, which is relevant once S Corporation status is elected.

Common mistakes

Filing the IRS Form 2553 can be a crucial step for small business owners looking to elect S Corporation status. However, many individuals make common mistakes that can delay or even invalidate their election. Understanding these pitfalls can help ensure a smooth filing process.

One frequent mistake is not meeting the timely filing requirement. The IRS requires that Form 2553 be filed within 75 days of the beginning of the tax year for which the election is to take effect. Failing to submit the form on time can result in the loss of S Corporation status for that year, which can have significant tax implications.

Another common error involves incorrect or incomplete information. This includes misspelling names, providing the wrong Employer Identification Number (EIN), or failing to include all shareholders' signatures. Each piece of information is crucial for the IRS to process the form correctly. Double-checking all entries can help avoid unnecessary complications.

Some people overlook the requirement for all shareholders to consent to the S Corporation election. If even one shareholder does not sign the form, the election may be rejected. It’s essential to communicate with all shareholders to ensure everyone is on board and has provided their signature.

Additionally, individuals often fail to understand the eligibility requirements for S Corporations. For instance, certain entities, like corporations with non-resident alien shareholders or more than 100 shareholders, cannot elect S Corporation status. Misunderstanding these rules can lead to wasted time and effort.

Another mistake is neglecting to keep a copy of the submitted Form 2553. It is vital to retain a copy for your records. This documentation can be helpful if there are any questions or issues regarding your election in the future.

Lastly, some filers do not follow up with the IRS after submission. If there are any issues or if the election is not processed, it is important to contact the IRS to resolve the situation. Proactive communication can prevent misunderstandings and ensure that your business is recognized as an S Corporation.