Fill a Valid IRS 1120 Template

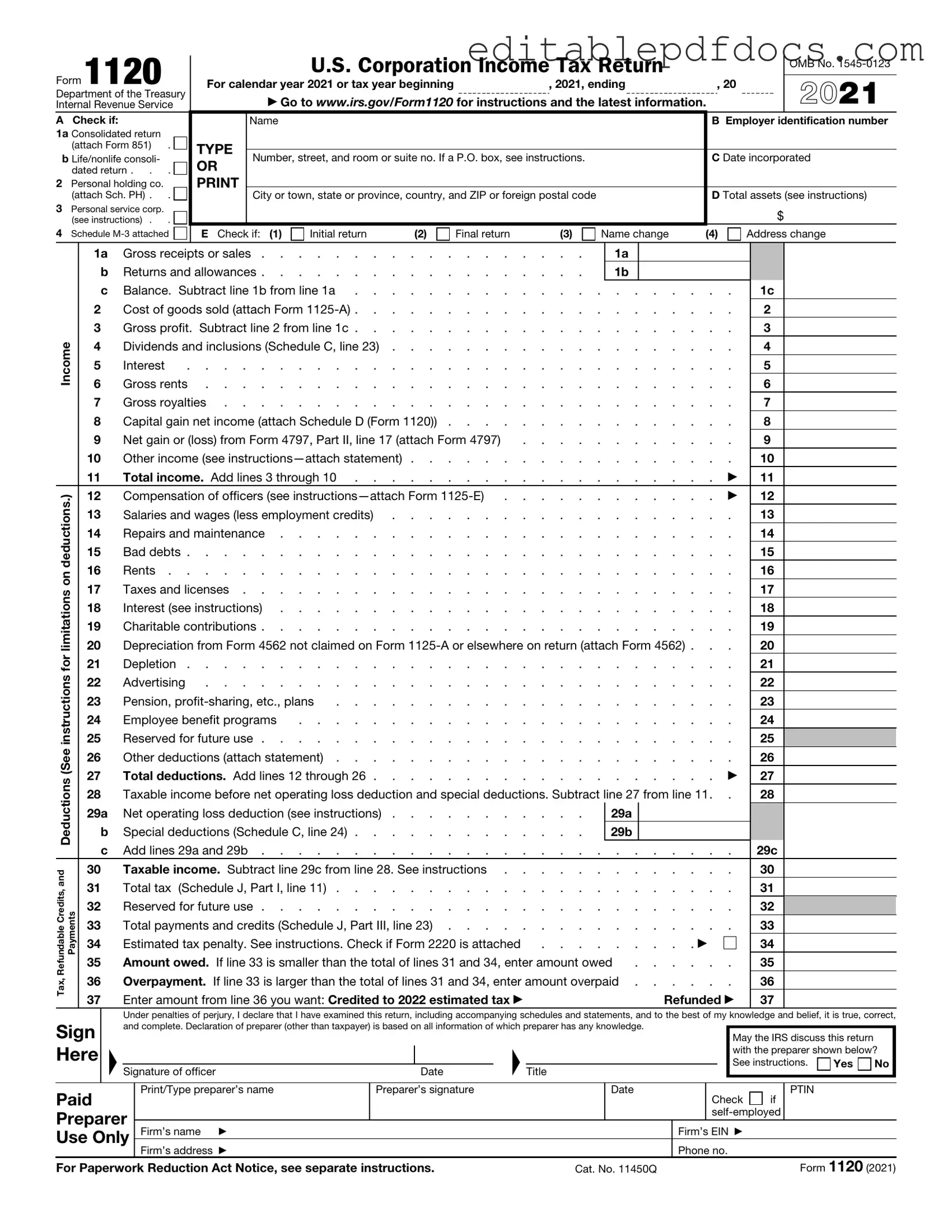

The IRS 1120 form plays a crucial role in the tax landscape for corporations operating within the United States. This form is primarily used by C corporations to report their income, gains, losses, deductions, and credits, ultimately determining their tax liability for the year. It includes various sections that require detailed financial information, such as the corporation’s gross receipts, cost of goods sold, and operating expenses. Additionally, the form facilitates the reporting of dividends received, tax credits, and other relevant financial activities. By accurately completing the 1120 form, corporations can ensure compliance with federal tax laws while also taking advantage of potential deductions and credits that may reduce their overall tax burden. Understanding the nuances of this form is essential for corporate financial management, as it impacts not only the current tax obligations but also future planning and strategic decisions.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. |

| Filing Deadline | Corporations must file Form 1120 by the 15th day of the fourth month after the end of their tax year, typically April 15 for calendar year filers. |

| State-Specific Forms | Many states require their own corporate tax forms. For example, California requires Form 100, governed by the California Revenue and Taxation Code. |

| Amendments | If a corporation needs to correct an error on a previously filed Form 1120, it can file Form 1120-X to amend the return. |

Dos and Don'ts

When completing the IRS 1120 form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do ensure all information is accurate and up-to-date.

- Do double-check your calculations to avoid errors.

- Do file the form on time to avoid penalties.

- Do keep a copy of the submitted form for your records.

- Do consult a tax professional if you have questions.

- Don't leave any required fields blank; provide all necessary information.

- Don't forget to sign the form before submitting it.

- Don't ignore deadlines; late submissions can lead to fines.

- Don't use outdated forms; always download the latest version from the IRS website.

Following these guidelines can help ensure a smoother filing process and reduce the risk of complications with your tax return.

Documents used along the form

When a corporation files its annual income tax return using the IRS Form 1120, several other documents and forms may also be required to ensure compliance with tax regulations. Each of these forms serves a specific purpose and helps provide a complete picture of the corporation's financial activities. Below is a list of commonly associated forms and documents.

- Schedule C: This schedule is used to report the corporation's income, deductions, and credits. It provides detailed information about the company’s operations and financial performance.

- Schedule J: This form is essential for calculating the corporation's tax liability. It includes information on the tax rates and any applicable credits or payments made throughout the year.

- Schedule K: This schedule provides a summary of the corporation's income, deductions, and other tax-related items. It is particularly important for multi-member corporations or those with shareholders.

- Form 941: Employers must file this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is crucial for understanding payroll tax obligations.

- Bill of Sale: This document is crucial when transferring ownership of personal property, such as vehicles or equipment. It serves as a legal receipt for the transaction and provides proof of purchase. For detailed guidance, access the document here.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Corporations may need to issue 1099s to contractors or other payees.

- Form W-2: Employers use this form to report wages paid to employees and the taxes withheld. It is a vital document for employees when filing their personal tax returns.

- Form 4562: This form is necessary for claiming depreciation and amortization deductions. It helps corporations account for the wear and tear on their assets over time.

- Form 7004: Corporations may file this form to request an automatic extension of time to file their tax return. It is important to note that this extension does not apply to tax payments.

- Form 8862: If a corporation previously had its tax credits denied, this form is required to reapply for certain credits. It helps ensure that the corporation remains eligible for tax benefits.

Each of these forms plays a crucial role in the overall tax filing process for corporations. Understanding their purpose can help ensure that businesses remain compliant and can effectively manage their tax obligations. Properly completing and submitting these documents alongside Form 1120 can lead to smoother interactions with the IRS and potentially minimize tax liabilities.

Popular PDF Forms

Employer's Quarterly Federal Tax Return - Form 941 often requires cross-referencing with payroll records for accuracy.

In order to ensure a smooth transition of authority in financial matters, it is essential for individuals to have a clear understanding of the General Power of Attorney form, which can be accessed through resources such as nyforms.com/general-power-of-attorney-template/. This understanding helps in deciding who best to appoint as an agent, ensuring their actions align with the principal's wishes.

How to Design a Family Crest - An artistic expression of one’s philosophical beliefs.

Fedex Door Tag Authorizing Release - The form allows you to manage your deliveries according to your needs.

Similar forms

The IRS Form 1120 is primarily used by corporations to report their income, gains, losses, deductions, and credits. It serves as a crucial document for tax compliance. However, there are several other forms and documents that share similarities with Form 1120. Below are nine such documents, each with a brief explanation of how they relate to Form 1120.

- IRS Form 1120-S: This form is for S corporations, which are generally smaller corporations that pass income directly to shareholders to avoid double taxation. Like Form 1120, it reports income and deductions but is designed specifically for S corporations.

- IRS Form 1065: Partnerships use this form to report their income, deductions, and other tax-related information. Similar to Form 1120, it provides a way to report financial performance, but it is structured for partnerships rather than corporations.

- IRS Form 1040: Individual taxpayers use this form to report their personal income. While Form 1040 focuses on individual income, both forms require the reporting of income and deductions, albeit for different entities.

- IRS Form 990: Nonprofit organizations use this form to report their financial information to the IRS. Similar to Form 1120, it requires detailed reporting of income and expenses, although it is tailored for tax-exempt organizations.

- IRS Form 941: Employers use this form to report payroll taxes withheld from employee paychecks. While it focuses on payroll, both Form 941 and Form 1120 are essential for tax compliance and reporting financial information to the IRS.

- IRS Form 1065-B: This form is for electing large partnerships and serves a similar purpose to Form 1065. It reports income and deductions but is specific to larger partnerships, maintaining the same general structure as Form 1120.

- IRS Form 1120-F: Foreign corporations use this form to report their income effectively connected with a U.S. trade or business. Like Form 1120, it is designed for corporations but applies to foreign entities operating in the U.S.

- IRS Form 1120-POL: Political organizations use this form to report their income and expenses. While it serves a different purpose, it shares the same reporting structure as Form 1120, focusing on the financial activities of a specific type of organization.

-

USCIS Form I-864 - The USCIS I-864 form is essential for sponsors in the immigrant support process, as it legally binds them to provide financial assistance to immigrants unable to support themselves. For detailed instructions and templates, visit Templates and Guide.

- IRS Form 941-X: This is an adjusted version of Form 941, used to correct errors on previously filed payroll tax returns. Both forms are critical for accurate tax reporting, though Form 941-X focuses on amendments rather than initial reporting.

Understanding these forms can help clarify the different ways various entities report their financial information to the IRS. Each serves a specific purpose but shares a common goal: ensuring accurate and compliant tax reporting.

Common mistakes

Filling out the IRS Form 1120 can be a daunting task for many business owners. One common mistake is failing to report all income. It’s crucial to include all sources of revenue. Omitting even a small amount can lead to penalties and interest. Ensure that every dollar earned is accounted for, regardless of the source.

Another frequent error is misclassifying expenses. Businesses often categorize expenses incorrectly, which can affect taxable income. Understanding which expenses are deductible is essential. Make sure to review the IRS guidelines on allowable deductions to avoid this pitfall.

People also tend to overlook the importance of accurate calculations. Simple math errors can lead to incorrect tax liability. Double-check all calculations and consider using accounting software or consulting a tax professional. Accuracy is key to preventing issues with the IRS.

Additionally, many filers forget to sign and date the form. A missing signature can delay processing and result in unnecessary complications. Always take a moment to review the form before submission to ensure that all required fields, including the signature, are complete.

Finally, some individuals submit the form without including all necessary attachments. Supporting documents, such as schedules and statements, are often required. Failing to include these can lead to delays and additional inquiries from the IRS. Ensure that everything needed is attached before sending in the form.