Fill a Valid IRS 1040 Template

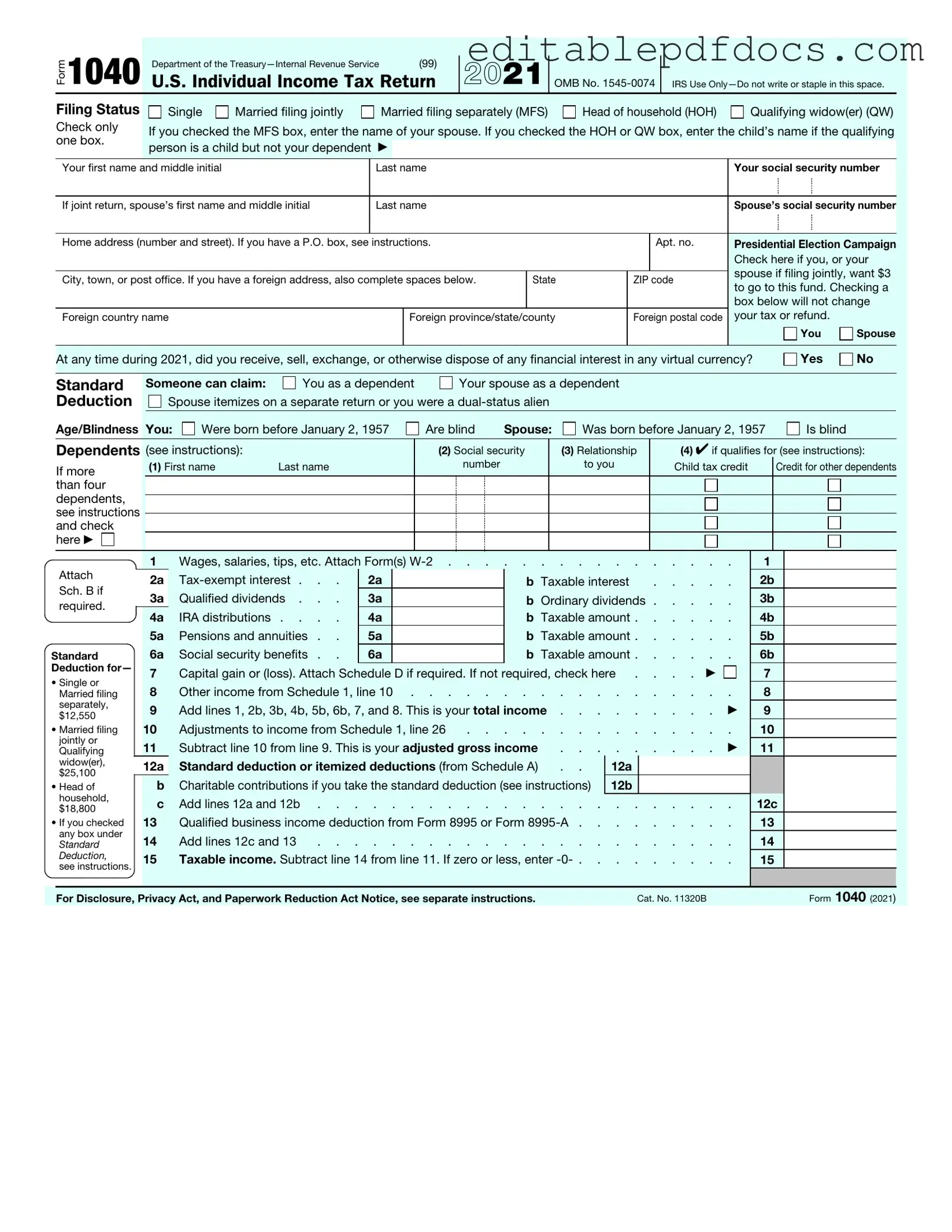

The IRS 1040 form is a crucial document for individuals filing their annual income tax returns in the United States. This comprehensive form allows taxpayers to report their income, claim deductions, and calculate their tax liability or refund. It accommodates various income types, including wages, dividends, and self-employment earnings. Additionally, the 1040 form provides space for taxpayers to report adjustments to income, such as contributions to retirement accounts or student loan interest. Taxpayers can also claim a range of credits, like the Earned Income Tax Credit or the Child Tax Credit, which can significantly reduce their overall tax burden. With the option to file either a standard deduction or itemized deductions, the 1040 offers flexibility to suit different financial situations. Understanding the various sections and requirements of the 1040 form is essential for accurate and efficient tax filing, ensuring compliance with IRS regulations while maximizing potential refunds.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1040 is used by individuals to file their annual income tax returns. |

| Filing Deadline | Typically, the deadline for submitting Form 1040 is April 15th of each year. |

| Income Reporting | Taxpayers must report all sources of income, including wages, dividends, and interest. |

| Deductions | Taxpayers can choose between taking the standard deduction or itemizing their deductions. |

| Tax Credits | Form 1040 allows taxpayers to claim various tax credits, which can reduce their tax liability. |

| State-Specific Forms | Many states have their own tax forms, governed by state tax laws, which must be filed in addition to Form 1040. |

| Filing Status | Taxpayers must select their filing status, such as single, married filing jointly, or head of household. |

| Electronic Filing | Form 1040 can be filed electronically, which often speeds up processing and refunds. |

| Amendments | If errors are found after filing, taxpayers can amend their return using Form 1040-X. |

Dos and Don'ts

When filling out the IRS 1040 form, attention to detail is crucial. Here are some guidelines to consider:

- Do double-check all personal information, such as your name, Social Security number, and address.

- Do report all sources of income accurately, including wages, dividends, and interest.

- Don't leave any sections blank; if a question does not apply, write "N/A" instead.

- Don't forget to sign and date the form before submitting it.

Documents used along the form

When preparing your tax return, the IRS 1040 form is often accompanied by several other important documents. Each of these forms serves a specific purpose and helps ensure that your tax return is accurate and complete. Below is a list of commonly used forms and documents that you may need to consider.

- W-2 Form: This form reports your annual wages and the taxes withheld from your paycheck. Employers must provide this document to employees by the end of January each year.

- Employment Verification form: This document is essential for confirming an individual's employment history and status. Utilizing resources like Fillable Forms can simplify the process of obtaining this verification.

- 1099 Form: Used to report various types of income other than wages, salaries, and tips. There are several variations of the 1099 form, depending on the type of income received.

- Schedule A: This form is used to itemize deductions, such as mortgage interest, charitable contributions, and medical expenses, instead of taking the standard deduction.

- Schedule C: Self-employed individuals use this form to report income and expenses related to their business activities.

- Schedule D: This form is necessary for reporting capital gains and losses from the sale of assets, such as stocks or real estate.

- Form 8862: If you previously claimed the Earned Income Tax Credit (EITC) and it was disallowed, you must use this form to claim it again.

- Form 8889: Individuals with Health Savings Accounts (HSAs) use this form to report contributions, distributions, and deductions related to their accounts.

- Form 8962: This form is required if you received premium tax credits for health insurance purchased through the Health Insurance Marketplace.

Gathering these documents will help ensure that you have all the necessary information to complete your tax return accurately. Taking the time to organize these forms can make the filing process smoother and less stressful.

Popular PDF Forms

Texas Temporary Tag - This document is valid for a limited duration, usually up to 30 days.

Doctors Note for Work Template - Provides an official record of your medical condition and absence.

Fulfilling the requirements for the New York City Apartment Registration Form is essential for landlords, as it ensures compliance with local housing regulations and provides important information about each rental unit. To simplify the process, landlords can refer to resources available at nyforms.com/nyc-apartment-registration-template/, which outline the necessary details that must be submitted including information about the program, building, and unit.

Printable Medicare Abn Form 2023 - This notice is issued when a healthcare provider believes that Medicare may not pay for services rendered.

Similar forms

The IRS 1040 form is a key document for individual taxpayers in the United States. Several other documents serve similar purposes in different contexts. Here are four documents that share similarities with the IRS 1040 form:

- W-2 Form: This form reports wages and tax withheld by an employer. Like the 1040, it is essential for calculating annual income and tax obligations.

- Texas Motor Vehicle Power of Attorney Form: This form allows individuals to designate someone to handle vehicle-related tasks on their behalf, ensuring that their interests are represented. For more details, visit topformsonline.com/.

- 1099 Form: Used to report various types of income other than wages, salaries, and tips. The 1099 helps taxpayers declare income on their 1040 form.

- Schedule C: This form is for reporting income or loss from a business operated as a sole proprietorship. It is often attached to the 1040 to detail self-employment income.

- Form 4868: This is the application for an automatic extension of time to file the 1040. It allows taxpayers to delay filing while still estimating and paying any owed taxes.

Common mistakes

Filling out the IRS 1040 form can be a daunting task for many individuals. Mistakes can lead to delays in processing or even penalties. Here are nine common errors to avoid when completing this important tax document.

One frequent mistake is math errors. Simple addition or subtraction mistakes can change your tax liability significantly. Double-check all calculations, or consider using tax software that can help minimize these errors.

Another common issue arises from missing or incorrect Social Security numbers. Each taxpayer and dependent must have a valid Social Security number. If these numbers are incorrect or omitted, it can result in processing delays or even denial of credits.

Many people also forget to sign and date their forms. It may seem trivial, but an unsigned return is considered invalid. Always ensure that you have signed and dated your return before submitting it.

Claiming ineligible dependents is another mistake. It’s crucial to understand the IRS guidelines for dependents. Incorrectly claiming someone as a dependent can lead to penalties and additional taxes owed.

Some individuals overlook reporting all income. Every source of income, including side jobs or freelance work, must be reported. Failing to do so can raise red flags with the IRS and lead to audits.

Another pitfall is not taking advantage of deductions and credits. Many taxpayers miss out on valuable deductions that could reduce their tax liability. Research available deductions and credits to ensure you are maximizing your tax benefits.

Many people also neglect to keep copies of their returns. It’s essential to keep a copy of your completed tax return and any supporting documents for at least three years. This can be invaluable if the IRS has questions or if you need to amend your return.

Some individuals fail to check their filing status. Your filing status can affect your tax rate and eligibility for certain credits. Make sure you choose the correct status, whether it’s single, married filing jointly, or head of household.

Lastly, a common mistake is missing the filing deadline. Be aware of the tax deadlines to avoid penalties. If you need more time, consider filing for an extension, but remember that this does not extend the time to pay any taxes owed.

By avoiding these common mistakes, you can ensure a smoother tax filing experience. Take your time, double-check your work, and don’t hesitate to seek help if needed.