Free Investment Letter of Intent Document

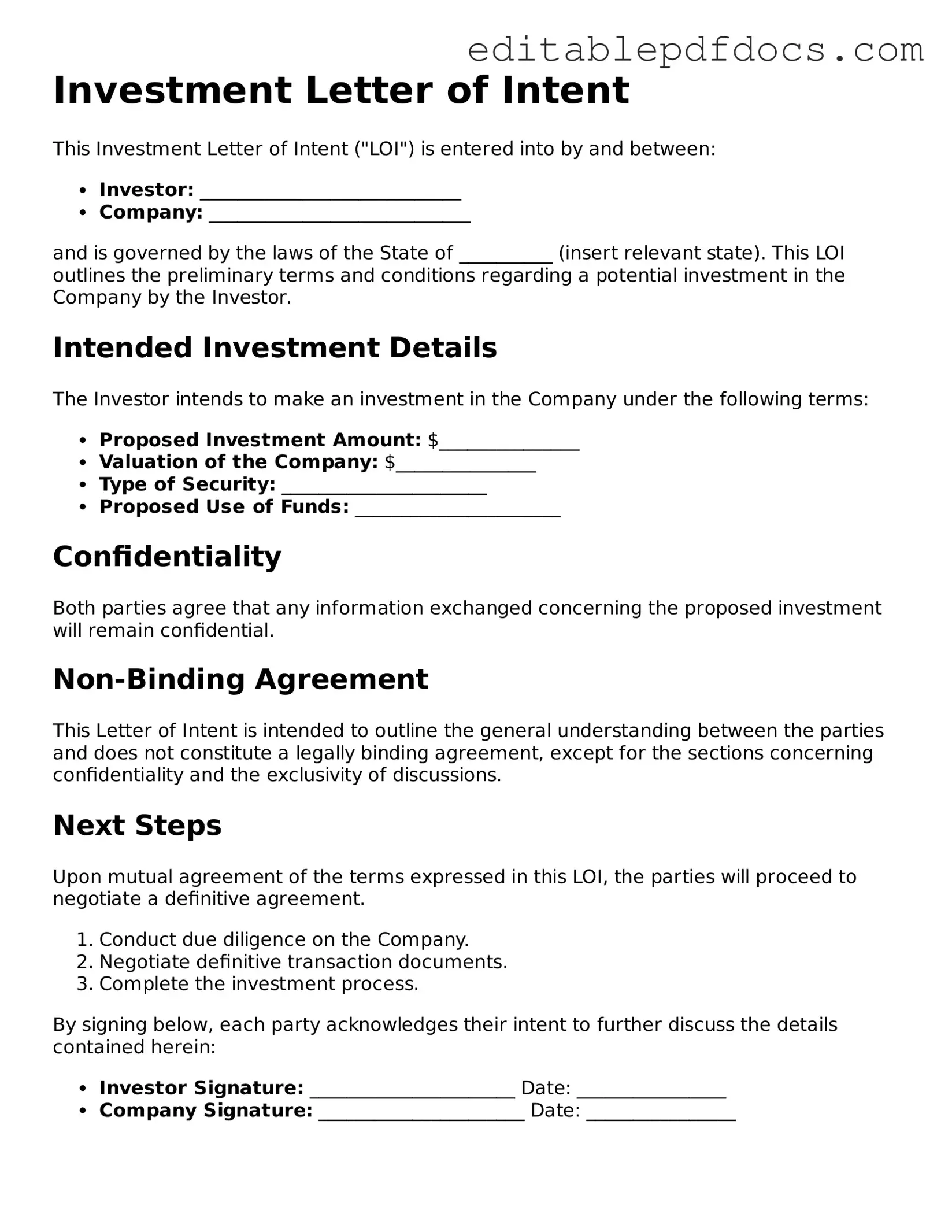

The Investment Letter of Intent form serves as a crucial document for individuals and entities looking to outline the preliminary terms of a potential investment. This form typically includes essential details such as the names of the parties involved, the amount of investment being considered, and the intended use of the funds. Additionally, it often highlights the timeframe for completing the investment and any conditions that must be met before finalizing the deal. By laying out these key aspects, the form helps to establish a mutual understanding between the investor and the recipient of the funds, paving the way for further negotiations and formal agreements. Importantly, while the Investment Letter of Intent is not legally binding, it signifies a serious commitment to move forward, making it a vital step in the investment process. Understanding the components and purpose of this form can help both parties navigate the complexities of investment discussions with greater clarity and confidence.

File Information

| Fact Name | Description |

|---|---|

| Purpose | An Investment Letter of Intent outlines the preliminary terms and conditions of an investment agreement between parties. It sets the stage for further negotiations. |

| Binding Nature | Generally, an Investment Letter of Intent is non-binding, meaning it does not create a legal obligation to proceed with the investment. However, certain provisions may be binding. |

| Governing Law | Depending on the state, the governing law may vary. For example, in California, the laws of California govern the interpretation of the letter. |

| Key Components | Common components include the amount of investment, the timeline for the investment, and any due diligence requirements that need to be fulfilled. |

| Importance of Clarity | Clear and precise language is crucial in an Investment Letter of Intent. Ambiguities can lead to misunderstandings and disputes later on. |

Dos and Don'ts

When filling out the Investment Letter of Intent form, it is crucial to approach the task with care and attention to detail. Below is a list of recommended practices as well as common pitfalls to avoid.

- Do: Read the instructions thoroughly before starting to fill out the form. Understanding the requirements can prevent mistakes.

- Do: Provide accurate and complete information. Double-check all entries to ensure that they reflect your true intentions and financial status.

- Do: Keep a copy of the completed form for your records. This will be useful for future reference or follow-up communications.

- Do: Seek assistance if needed. Consulting with a financial advisor or legal professional can help clarify any uncertainties.

- Don't: Rush through the form. Taking your time can help you avoid errors that could delay the process.

- Don't: Leave any sections blank unless instructed otherwise. Omitting information can raise red flags and complicate your application.

- Don't: Use vague language. Clearly articulate your intentions to avoid misunderstandings.

- Don't: Ignore deadlines. Submitting the form on time is essential to ensure your investment proposal is considered.

Documents used along the form

When engaging in investment opportunities, the Investment Letter of Intent (LOI) serves as a crucial starting point. However, it is often accompanied by several other important documents that help clarify the terms of the investment and outline the responsibilities of each party involved. Below are some of the key forms and documents typically used alongside the Investment LOI.

- Confidentiality Agreement: This document ensures that sensitive information shared between parties remains private. It establishes the obligations of each party to protect proprietary information, fostering trust and security in the negotiation process.

- Term Sheet: A term sheet outlines the key terms and conditions of the investment deal. It serves as a summary of the agreement, detailing aspects such as valuation, investment amount, and rights of the investors, providing a clear framework for the final agreement.

- Due Diligence Checklist: This checklist is used to guide the investigation process of the investment opportunity. It typically includes a list of documents and information that the investor needs to review, ensuring that all relevant aspects of the investment are thoroughly examined.

- Subscription Agreement: This agreement is signed by the investor to confirm their intention to purchase shares or interests in the investment. It outlines the terms of the investment, including the amount being invested and the rights associated with the investment.

- Operating Agreement: For investments in limited liability companies (LLCs), the operating agreement governs the management structure and operational procedures of the company. It defines the roles and responsibilities of the members, ensuring clarity in governance.

- Shareholder Agreement: This document is crucial for corporations, as it outlines the rights and obligations of shareholders. It addresses issues such as voting rights, dividend distribution, and procedures for transferring shares, protecting the interests of all parties involved.

Understanding these documents is essential for anyone looking to navigate the investment landscape successfully. Each document plays a vital role in ensuring that all parties are aligned and that the investment process proceeds smoothly. By familiarizing oneself with these forms, investors can make informed decisions and foster successful partnerships.

Consider Popular Types of Investment Letter of Intent Templates

Letter of Intent to Buy a Business - It highlights the buyer's willingness to move forward with the deal.

Sample Letter of Intent to Purchase Real Estate - List preliminary conditions and considerations for the purchase.

Similar forms

- Memorandum of Understanding (MOU): Like the Investment Letter of Intent, an MOU outlines the intentions of parties to collaborate on a project. It is often non-binding and serves as a framework for future agreements.

- Term Sheet: A term sheet summarizes the key terms and conditions of an investment. It is similar in purpose to the Investment Letter of Intent, providing an overview of the proposed deal before formal agreements are drafted.

- Purchase Agreement: This document details the terms of a sale or investment. While more formal than an Investment Letter of Intent, both documents establish essential terms that guide the transaction.

- Confidentiality Agreement (NDA): Both documents may include confidentiality clauses. An NDA protects sensitive information shared during negotiations, similar to how an Investment Letter of Intent may address confidentiality in the context of investment discussions.

- Partnership Agreement: A partnership agreement outlines the terms of a partnership. Like the Investment Letter of Intent, it sets the stage for collaboration, detailing roles, responsibilities, and expectations.

- Letter of Intent (LOI): An LOI expresses a party's intention to enter into a formal agreement. It shares many similarities with the Investment Letter of Intent, as both documents signal commitment and outline preliminary terms.

Common mistakes

Filling out an Investment Letter of Intent form can be a straightforward process, but many people make mistakes that can lead to delays or complications. One common error is providing incomplete information. When applicants skip sections or fail to include necessary details, it can slow down the review process. Make sure to read each section carefully and provide all requested information.

Another frequent mistake is not double-checking for accuracy. Typos or incorrect figures can undermine the credibility of your application. Always verify that your financial details, names, and addresses are correct before submitting the form. A simple error could result in misunderstandings or even rejection.

People often overlook the importance of signatures. Failing to sign the form or forgetting to include a date can render the document invalid. Ensure that you sign in the designated areas and include the date to confirm your intent.

Some individuals neglect to follow the specific instructions provided with the form. Each investment opportunity may have unique requirements, and failing to adhere to these can result in your application being dismissed. Pay close attention to any guidelines or additional documents that may be required.

Another mistake is submitting the form without reviewing deadlines. Missing a deadline can mean missing out on investment opportunities. Always check when the form is due and plan to submit it well in advance.

People sometimes forget to keep copies of their submitted forms. Having a record of what you submitted can be incredibly useful if there are questions or issues later on. Make sure to keep a copy for your own reference.

Lastly, some applicants fail to seek help when needed. If you’re unsure about any part of the form, don’t hesitate to ask for clarification. Reaching out for assistance can save you time and prevent mistakes that could jeopardize your investment intentions.