Fill a Valid Intent To Lien Florida Template

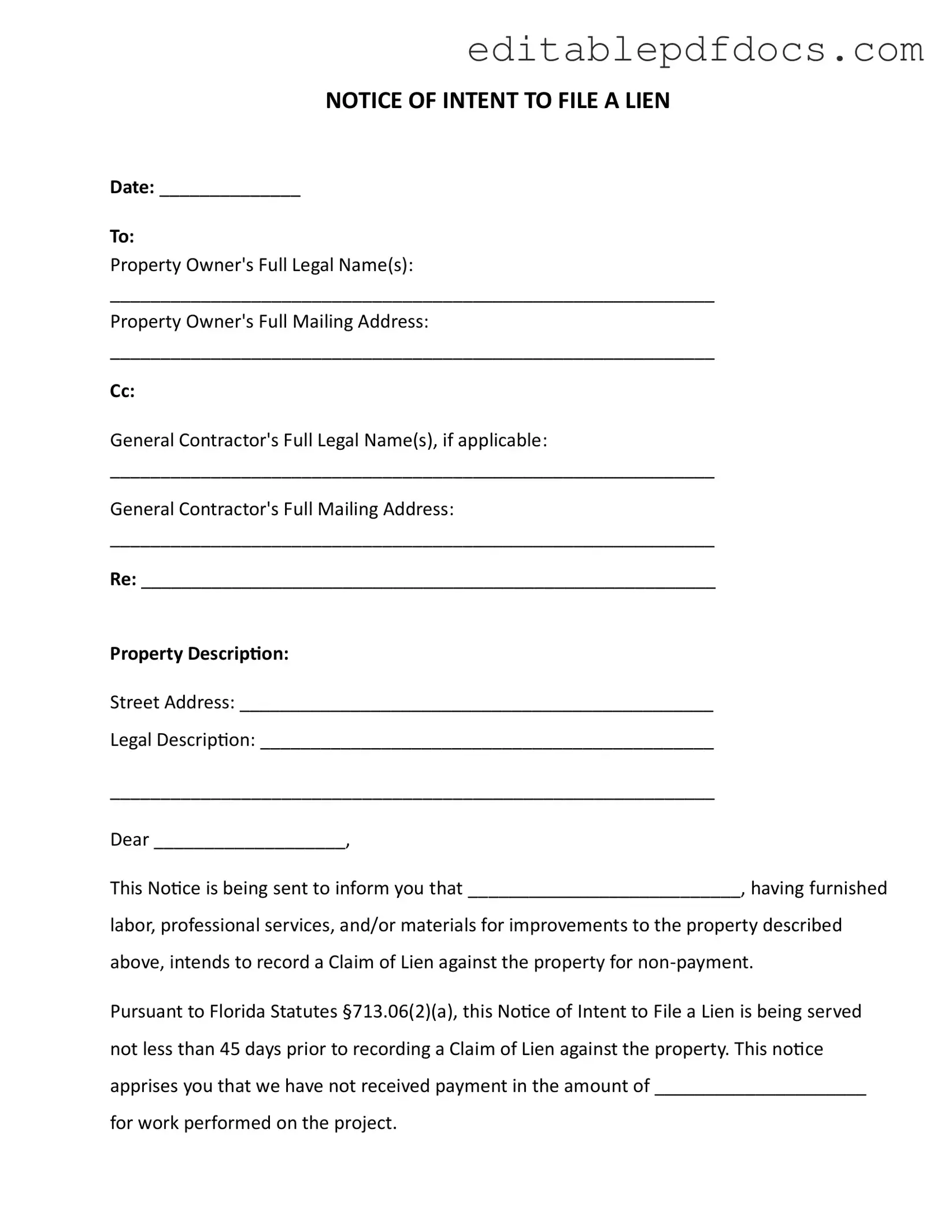

The Intent to Lien Florida form is a crucial document for anyone involved in construction or property improvement projects. This form serves as a formal notice to property owners that a contractor or supplier intends to file a lien against their property due to non-payment for services rendered or materials provided. It includes essential information such as the date of the notice, the names and addresses of the property owner and general contractor, and a detailed description of the property in question. The form also specifies the amount owed and highlights the urgency of the situation, stating that if payment is not received within 30 days, the contractor may proceed with filing a lien. This action could lead to serious consequences for the property owner, including potential foreclosure and additional legal fees. By sending this notice, the contractor aims to resolve the payment issue amicably and avoid further legal action. Immediate attention to this matter is strongly encouraged to prevent escalation and ensure compliance with Florida's lien laws.

Document Details

| Fact Name | Details |

|---|---|

| Date of Notice | The form requires the date the notice is sent to be filled in at the top. |

| Property Owner Information | Full legal name and mailing address of the property owner must be included. |

| General Contractor Details | If applicable, the full legal name and mailing address of the general contractor should be provided. |

| Property Description | The form requires both the street address and legal description of the property. |

| Governing Law | This form is governed by Florida Statutes §713.06(2)(a) and §713.06(2)(b). |

| Payment Notification | The notice states the amount owed for work performed, which must be specified. |

| Response Timeframe | Property owners have 30 days to respond before a lien may be recorded. |

| Consequences of Non-Payment | Failure to pay may lead to foreclosure proceedings and additional costs. |

Dos and Don'ts

When filling out the Intent To Lien Florida form, there are important steps to follow to ensure compliance and clarity. Below are four essential do's and don'ts to keep in mind.

- Do provide complete and accurate information regarding the property owner and the property itself. This includes the full legal name, mailing address, and a detailed property description.

- Do clearly state the amount owed for the work performed. This transparency helps in avoiding misunderstandings and potential disputes.

- Do send the notice at least 45 days before you intend to file a lien. Adhering to this timeline is crucial to ensure your claim is valid under Florida law.

- Do keep a copy of the notice for your records. Documenting your actions can be beneficial in case of future disputes or legal proceedings.

- Don't leave any sections of the form blank. Incomplete information can lead to delays or rejection of your lien claim.

- Don't underestimate the importance of timely communication. If you do not receive payment, follow up promptly to avoid escalation.

- Don't ignore the legal implications of filing a lien. Ensure you understand the process and the potential consequences for the property owner.

- Don't forget to properly certify the service of the notice. This step is essential to prove that the property owner was informed.

Documents used along the form

When dealing with the Intent To Lien Florida form, several other documents may be necessary to ensure compliance with state laws and to protect your rights. Understanding these documents can help you navigate the lien process more effectively.

- Claim of Lien: This document is filed to formally assert a lien against the property. It must include specific details about the debt owed and the work performed. Filing this document can lead to foreclosure if payment is not made.

- Power of Attorney Form: When appointing someone to make decisions on your behalf, consider consulting the comprehensive Power of Attorney directive resources to ensure clarity and legal validity.

- Notice of Non-Payment: This notice is sent to inform the property owner that payment has not been received for services rendered. It serves as a precursor to filing a lien and provides the owner with an opportunity to rectify the situation.

- Waiver of Lien: This document is used to relinquish a lien claim. It can be partial or full and is often provided in exchange for payment. It's essential to ensure that the waiver is properly executed to avoid future claims.

- Certificate of Service: This document certifies that the Notice of Intent to File a Lien has been delivered to the property owner. It includes details about the method of delivery and is crucial for establishing that proper notice was given.

Having these documents ready and understanding their purpose can streamline the process and help prevent disputes. Always consider consulting with a legal expert to ensure that you are following the correct procedures.

Popular PDF Forms

Aircraft Bill of Sale Example - The AC 8050-2 can help expedite the registration process with the FAA.

Navpers 1336 3 - Digital signatures utilizing CAC are accepted for authenticity.

In addition to the essential details provided in the California Motorcycle Bill of Sale, it is beneficial for buyers and sellers to utilize resources such as Fillable Forms to ensure a smooth and legally compliant transaction.

Aoausa - Contact numbers for various California branches of AOA are provided.

Similar forms

- Notice of Lien: This document is the formal claim filed against a property when payment has not been received. It serves as an official record of the creditor's interest in the property, similar to the Intent to Lien, which alerts the property owner of impending action.

- Motorcycle Bill of Sale: This document is essential for recording the sale of a motorcycle in New York, providing proof of purchase and ensuring legal ownership transfer. More details can be found at nyforms.com/motorcycle-bill-of-sale-template/.

- Notice of Non-Payment: This notice informs property owners that payment for services rendered or materials supplied has not been made. Like the Intent to Lien, it serves to notify the property owner of potential legal actions due to non-payment.

- Claim of Lien: This is the document that is ultimately filed if payment issues are not resolved. It outlines the amount owed and the basis for the claim, much like the Intent to Lien which serves as a precursor to this more formal filing.

- Pre-Lien Notice: This document acts as an early warning to property owners about potential liens. It shares similarities with the Intent to Lien in that both documents aim to prompt payment before legal actions escalate.

- Mechanic's Lien: This is a specific type of lien placed by contractors or suppliers who have not been paid for work done on a property. The Intent to Lien serves as a preliminary step before this more formal lien is recorded.

- Demand for Payment: This document requests payment for services rendered or materials provided. It is similar to the Intent to Lien in that both emphasize the urgency of resolving payment issues before further legal actions are taken.

Common mistakes

When completing the Intent to Lien Florida form, individuals often make several common mistakes that can jeopardize the effectiveness of the notice. One significant error is failing to provide the correct property owner's full legal name. This information must match the name on the property deed. An incorrect name can lead to complications in enforcing the lien.

Another frequent mistake involves the mailing address of the property owner. Inaccurate or incomplete addresses can result in non-delivery of the notice, rendering the lien invalid. It is essential to verify that the mailing address is up-to-date and correctly formatted.

Additionally, individuals sometimes neglect to include the specific amount owed for the work performed. This figure should be clearly stated in the notice. Omitting this detail can create confusion and may weaken the claim, as the property owner may not understand the basis for the lien.

Moreover, many people overlook the requirement to serve the notice at least 45 days prior to filing the lien. This timeframe is mandated by Florida law. Failing to adhere to this timeline can invalidate the lien, making it crucial to plan ahead and ensure timely delivery.

Another common oversight is the lack of a proper certificate of service. This section confirms that the notice was delivered to the property owner. Without this certification, there may be challenges in proving that the notice was properly served, which can affect the enforceability of the lien.

Finally, individuals often forget to sign the notice. The absence of a signature can lead to questions about the authenticity of the document. A signature not only validates the notice but also provides a point of contact for the property owner to address the matter directly.