Fill a Valid Independent Contractor Pay Stub Template

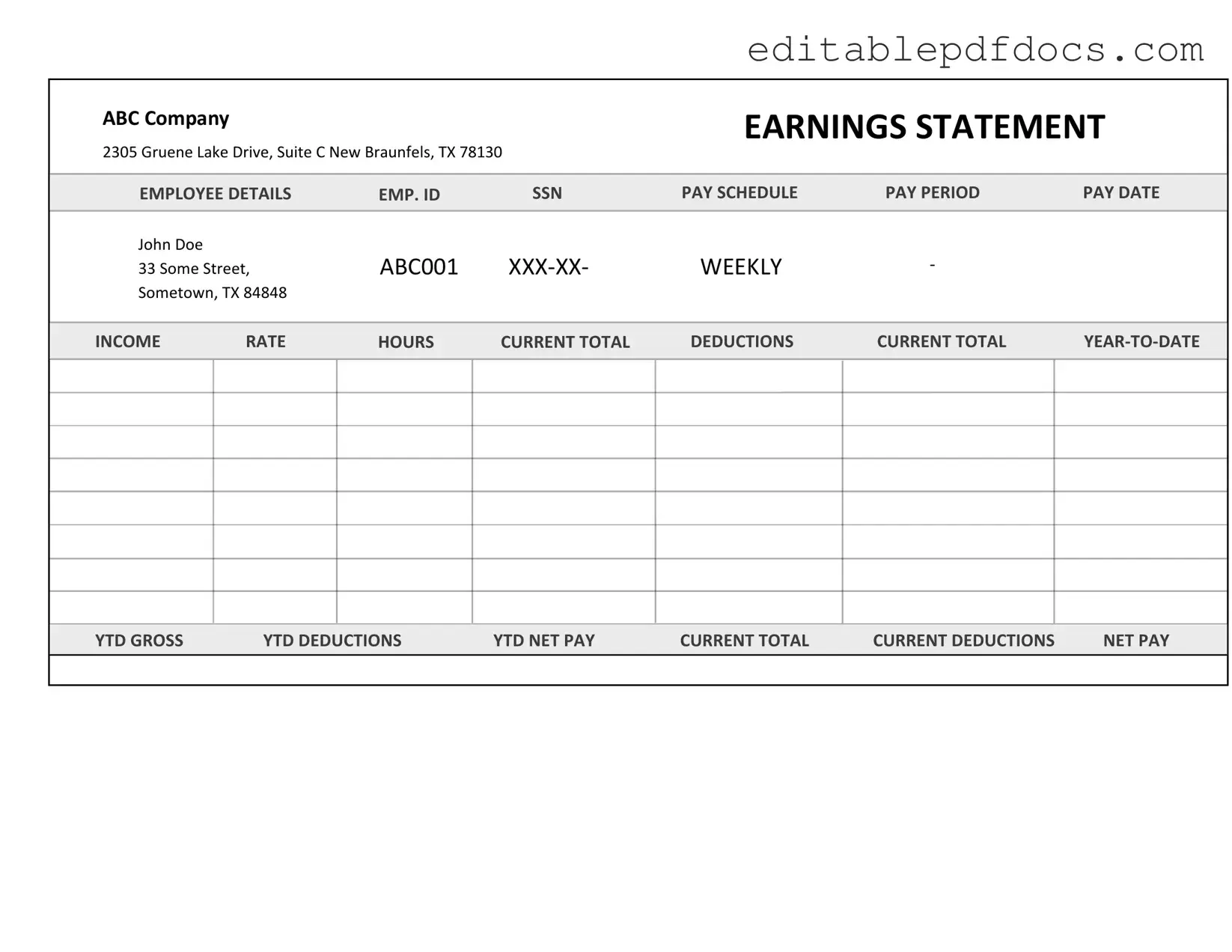

When it comes to managing finances as an independent contractor, having the right documentation is crucial. One essential tool in this process is the Independent Contractor Pay Stub form. This form serves as a detailed record of earnings, deductions, and hours worked, providing both contractors and clients with clarity and transparency. It typically includes vital information such as the contractor's name, payment period, and the total amount earned. Additionally, it outlines any deductions for taxes or other expenses, ensuring that contractors can easily track their income and understand their financial obligations. By utilizing this pay stub, independent contractors can maintain organized records, which is particularly helpful come tax season. Understanding how to properly fill out and use this form can empower contractors to manage their finances more effectively and foster better communication with clients.

Document Details

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for independent contractors, providing a clear record of payments made for services rendered. |

| Legal Requirements | In many states, including California and New York, independent contractors are not required to receive pay stubs, but providing one can help maintain transparency and clarity in financial transactions. |

| Contents | The pay stub typically includes the contractor's name, payment period, total earnings, itemized deductions, and net pay, ensuring that all financial information is easily accessible. |

| Importance | Having a pay stub can be crucial for independent contractors when filing taxes, as it serves as proof of income and can simplify the process of reporting earnings to the IRS. |

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, attention to detail is crucial. Here are some guidelines to help you navigate the process effectively.

- Do ensure that all personal information is accurate, including your name, address, and tax identification number.

- Don't leave any sections blank unless they are explicitly marked as optional.

- Do double-check the payment amount to ensure it reflects the agreed-upon rate for the services provided.

- Don't use abbreviations or shorthand that might confuse the reader.

- Do include the date of service to provide context for the payment.

- Don't forget to sign the pay stub if a signature is required.

- Do keep a copy of the completed pay stub for your records.

- Don't submit the form without reviewing it for any errors or typos.

- Do provide clear descriptions of the services rendered to justify the payment.

- Don't ignore any specific instructions provided for filling out the form.

Following these guidelines will help ensure that your Independent Contractor Pay Stub form is completed accurately and professionally.

Documents used along the form

The Independent Contractor Pay Stub form is an essential document for tracking payments made to independent contractors. It provides a clear record of earnings, deductions, and payment dates. However, several other forms and documents are often used in conjunction with this pay stub to ensure proper compliance and record-keeping. Below is a list of related documents that are commonly utilized.

- W-9 Form: This form is used by independent contractors to provide their taxpayer identification information to the hiring company. It is crucial for tax reporting purposes.

- 1099-MISC Form: This tax form is issued by the hiring company to report payments made to independent contractors. It summarizes total earnings for the year and is necessary for tax filing.

- Contract Agreement: This document outlines the terms of the working relationship between the contractor and the hiring company, including payment terms, project scope, and deadlines.

- Invoice: Independent contractors typically submit invoices to request payment for services rendered. This document details the work completed and the amount due.

- EDD DE 2501 Form: The EDD DE 2501 form is essential for applying for Disability Insurance benefits in California. Proper completion and submission can significantly impact the timely support you receive when facing a disability. For assistance, refer to Fillable Forms.

- Time Sheet: A time sheet tracks the hours worked by the contractor. It provides a record that can be referenced when preparing the pay stub.

- Direct Deposit Authorization Form: This form allows contractors to authorize electronic payments directly into their bank accounts, streamlining the payment process.

- Expense Reimbursement Form: Contractors may incur expenses while performing their duties. This form is used to request reimbursement for those costs.

- Confidentiality Agreement: This document protects sensitive information shared between the contractor and the hiring company, ensuring that proprietary information remains confidential.

- Termination Letter: If the working relationship ends, a termination letter formally documents the conclusion of the contract and outlines any final payment arrangements.

Utilizing these documents alongside the Independent Contractor Pay Stub form helps maintain clear communication and compliance throughout the contractor's engagement. It is important to ensure that all forms are completed accurately and stored properly for future reference.

Popular PDF Forms

Aaa International License - Application processing times can vary, so plan accordingly.

Batting Order Meaning - Enhances communication and clarity for everyone.

Entering into a New York Non-disclosure Agreement (NDA) is essential for protecting sensitive information and maintaining confidentiality in various professional relationships. This legally binding document ensures that parties involved do not disclose proprietary knowledge, trade secrets, or confidential data without permission. It is particularly important for businesses and individuals looking to secure their competitive advantage and privacy. For those seeking a reliable template to navigate this process, they can visit nyforms.com/non-disclosure-agreement-template for assistance.

Four Point Inspection Florida - Homeowners benefit from understanding potential issues that could affect their insurance eligibility.

Similar forms

The Independent Contractor Pay Stub form serves as a crucial document for both contractors and businesses. It provides a clear summary of earnings, deductions, and other essential financial details. Several other documents share similarities with the Independent Contractor Pay Stub, each serving specific purposes in financial reporting and record-keeping. Below is a list of these documents and how they relate to the pay stub.

- W-2 Form: This document is issued to employees and summarizes their annual wages and tax withholdings. Like the pay stub, it provides a breakdown of earnings and deductions, but it is used for employees rather than independent contractors.

- 1099-MISC Form: Independent contractors receive this form to report income earned from various clients. Similar to the pay stub, it details the total amount paid, but it is used for tax reporting rather than payment tracking.

- Invoice: Contractors often send invoices to clients for services rendered. Both invoices and pay stubs provide a record of work completed and payments due, but invoices are typically issued before payment is made.

- Payroll Summary: This document outlines the total payroll expenses for a company, including wages, taxes, and benefits. While it provides a broader overview, it shares the pay stub's purpose of summarizing financial transactions related to employment.

- Expense Report: Contractors may submit expense reports to claim reimbursements for business-related costs. Both documents track financial details, but the expense report focuses on expenditures rather than income.

- Commission Statement: Salespeople often receive commission statements detailing their earnings based on sales performance. Similar to pay stubs, these statements summarize earnings, but they focus specifically on commission income.

Transfer-on-Death Deed: For efficient estate planning, utilize the important Transfer-on-Death Deed resources to securely designate beneficiaries and simplify property transfers without probate complications.

- Payment Receipt: This document serves as proof of payment for services rendered. Like a pay stub, it confirms that a payment has been made, but it does not provide a detailed breakdown of earnings or deductions.

- Direct Deposit Notification: When payments are made through direct deposit, clients may provide notifications that summarize the deposit details. Both documents confirm payment, but the notification is typically simpler and does not include detailed earnings information.

- Contractor Agreement: This document outlines the terms of the working relationship between a contractor and a client. While it does not summarize payments, it is essential for understanding the context in which pay stubs are generated.

Understanding these documents can help both contractors and businesses maintain accurate financial records and ensure compliance with tax regulations. Each document plays a unique role in the overall financial landscape, contributing to clarity and transparency in financial transactions.

Common mistakes

When filling out the Independent Contractor Pay Stub form, many individuals overlook critical details that can lead to complications. One common mistake is failing to include accurate personal information. This includes the contractor's name, address, and Social Security number or Tax Identification Number. Inaccurate information can delay payments and create issues with tax reporting.

Another frequent error involves miscalculating earnings. Contractors should ensure that they accurately report the total amount earned during the pay period. Mistakes in calculations can lead to underpayment or overpayment, both of which can create problems with clients and tax authorities. Double-checking figures before submission can prevent these issues.

Additionally, some individuals neglect to itemize deductions correctly. The Independent Contractor Pay Stub should clearly outline any deductions for taxes, insurance, or retirement contributions. Failing to provide a detailed breakdown can confuse clients and may result in discrepancies when filing taxes.

Moreover, many people forget to keep a copy of the completed pay stub for their records. Retaining a copy is essential for personal bookkeeping and tax preparation. Without this documentation, it becomes challenging to track income and expenses accurately, potentially leading to financial mismanagement.

Lastly, individuals often submit the form without reviewing it thoroughly. A quick glance may miss critical errors or omissions. Taking the time to review the entire form ensures that all necessary information is present and correct. This step can save time and prevent future complications.