Fill a Valid Goodwill donation receipt Template

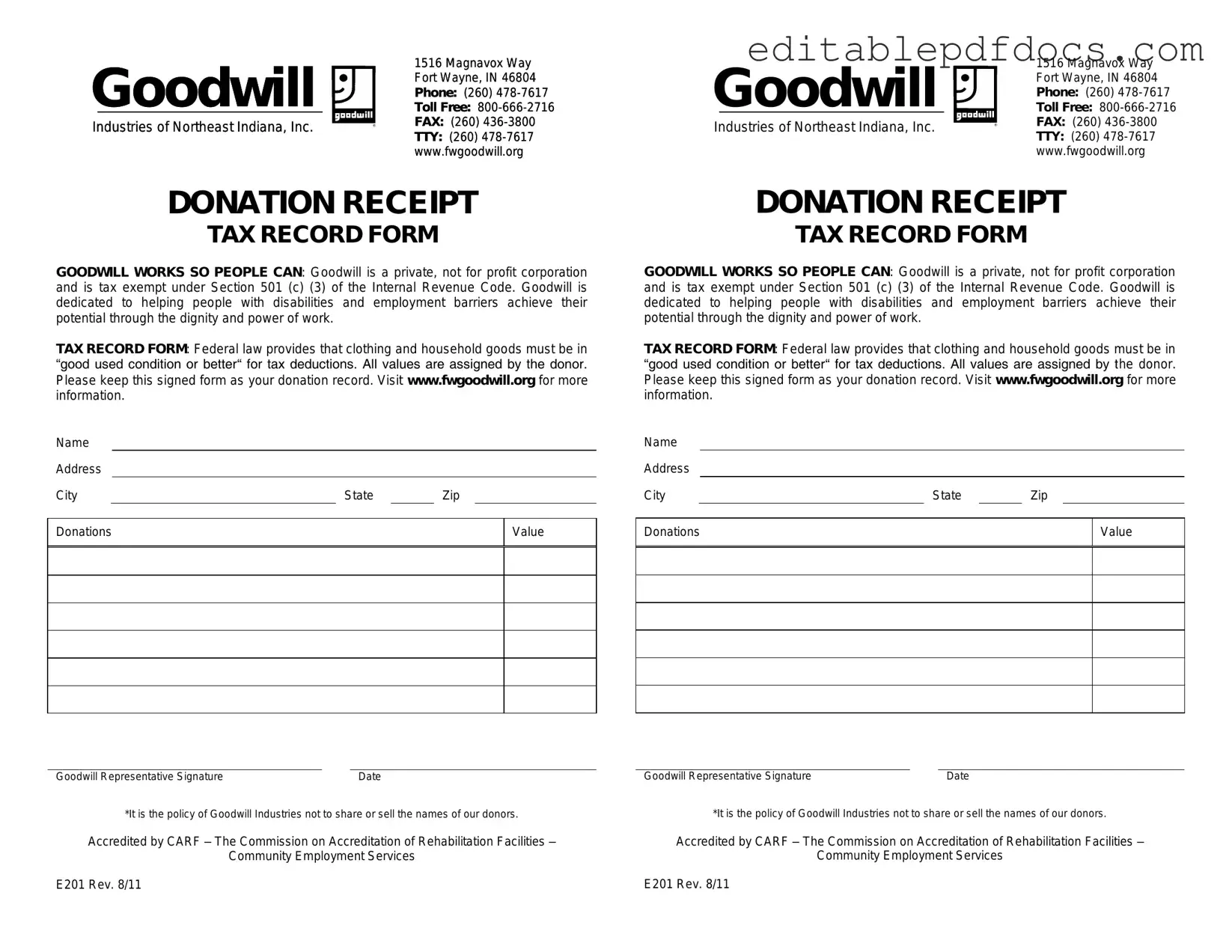

When you donate items to Goodwill, you not only help those in need but also have the opportunity to claim a tax deduction. A crucial part of this process is the Goodwill donation receipt form, which serves as proof of your contribution. This form typically includes essential details such as the date of the donation, a description of the items donated, and their estimated value. It’s important to fill out this form accurately to ensure you have the necessary documentation for your tax records. Goodwill provides this receipt to donors at no cost, making it easy to keep track of your charitable contributions. Remember, the more precise your records, the smoother the tax filing process will be. Additionally, understanding how to properly use this receipt can maximize your potential deductions and support your financial planning efforts. As you prepare to donate, having this form ready can streamline your experience and ensure that you meet all necessary requirements.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Goodwill donation receipt form serves as proof of donation for tax purposes. |

| Tax Deduction | Donors may be eligible for tax deductions based on the fair market value of donated items. |

| Itemization | Donors should list the items donated, including a description and estimated value. |

| State-Specific Forms | Some states may have specific requirements for donation receipts, governed by local tax laws. |

| Record Keeping | It is important for donors to keep the receipt for their records and potential tax audits. |

Dos and Don'ts

When filling out a Goodwill donation receipt form, there are several important dos and don'ts to keep in mind. These tips can help ensure that your donation is processed smoothly and that you receive the appropriate acknowledgment for your contribution.

- Do provide accurate information about the items you are donating.

- Do keep a copy of the receipt for your records.

- Do estimate the fair market value of your donated items.

- Do sign and date the receipt to validate your donation.

- Do check for any specific requirements from Goodwill regarding the form.

- Don't leave any fields blank on the receipt form.

- Don't undervalue your items; be honest about their condition.

- Don't forget to ask for a detailed breakdown of your donation if needed.

- Don't assume that verbal donations are sufficient; always fill out the form.

- Don't lose the receipt; it may be needed for tax purposes.

Documents used along the form

When making a donation to Goodwill or any charitable organization, several documents can accompany the Goodwill donation receipt form. Each of these documents serves a specific purpose, ensuring that both the donor and the charity maintain clear records of the transaction. Here’s a list of forms and documents that are often used alongside the donation receipt.

- Charitable Contribution Statement: This document outlines the donor's contributions over a specific period, often used for tax purposes.

- IRS Form 8283: Required for non-cash donations exceeding $500, this form provides the IRS with details about the donated items.

- California Motorcycle Bill of Sale: This document is essential for motorcycle transactions in California, serving to protect both buyer and seller. To create or obtain the necessary form, consider visiting Fillable Forms.

- Donation Inventory List: A detailed list of items donated, including descriptions and estimated values, which helps in tracking and reporting donations.

- Tax Deduction Worksheet: This worksheet helps donors calculate potential tax deductions based on their contributions, simplifying the tax filing process.

- Goodwill Donation Guidelines: This document outlines what items are acceptable for donation, ensuring donors provide suitable goods.

- Thank You Letter: A formal acknowledgment from Goodwill, expressing gratitude for the donation, which can also serve as a receipt for tax purposes.

- Proof of Donation: A document or receipt that confirms the donation was made, useful for record-keeping and tax filings.

- Appraisal Form: If items are valued over a certain amount, this form may be necessary to establish the fair market value of the donated goods.

Having these forms and documents in order can simplify the donation process and enhance your record-keeping. It’s always a good idea to keep copies of everything for your personal records, especially when tax season approaches.

Popular PDF Forms

W9 2023 - Tax identification numbers may be a Social Security Number or an Employer Identification Number.

The New York Motorcycle Bill of Sale form is a legal document that records the transfer of ownership of a motorcycle between a seller and a buyer. This form serves as proof of sale, outlining essential details such as the purchase price, vehicle information, and the signatures of both parties. For more information and to access the form, visit https://topformsonline.com. Understanding its components is crucial for ensuring a smooth transaction and proper title transfer.

Wage and Tax Statement - The form is a critical piece of documentation for self-employment tax calculations.

Similar forms

- Charitable Contribution Receipt: Similar to the Goodwill donation receipt, this document acknowledges a donation made to a charitable organization. It includes the donor's name, the amount donated, and the date of the donation.

- Tax Deduction Receipt: This receipt serves as proof for taxpayers to claim deductions on their income tax returns. It outlines the donation details and confirms that the recipient organization is qualified under IRS guidelines.

- Donation Acknowledgment Letter: A letter from a nonprofit organization thanking the donor for their contribution. It typically includes the donation amount and a statement regarding the organization’s tax-exempt status.

- In-Kind Donation Receipt: This receipt is issued for non-cash donations, such as goods or services. It provides details about the items donated and their estimated value for tax purposes.

- End-of-Year Giving Statement: This document summarizes all donations made by an individual to a nonprofit throughout the year. It helps donors track their contributions for tax filing.

- New York Certificate of Incorporation: This document is essential for legally establishing a corporation in New York and includes necessary details like the corporation's name and purpose, similar to the requirements found in https://nyforms.com/new-york-certificate-template.

- Gift Receipt: A receipt provided for gifts made to individuals or organizations. It outlines the gift details and can be used for personal record-keeping or tax purposes.

Common mistakes

When donating items to Goodwill, many people appreciate the opportunity to receive a donation receipt for tax purposes. However, some common mistakes can lead to complications down the line. One frequent error occurs when donors fail to provide accurate descriptions of the items donated. A vague description, such as simply stating "clothes" instead of detailing the types of clothing, can create issues when it comes time to claim deductions on taxes.

Another mistake is not estimating the value of the donated items correctly. Many individuals underestimate the worth of their donations. It's essential to have a reasonable valuation based on the condition and type of items. For example, a gently used designer jacket holds more value than an old t-shirt. Donors should take the time to research or consult valuation guides to ensure their estimates are fair and accurate.

In addition, some donors neglect to keep a copy of the receipt for their records. This oversight can be problematic during tax season when documentation is required to support deductions. Keeping a copy of the receipt not only helps in case of an audit but also serves as a reminder of the charitable contributions made throughout the year.

Another common mistake is failing to sign and date the receipt. While it may seem trivial, a missing signature or date can render the receipt ineffective for tax purposes. Donors should ensure that they complete all required fields on the receipt to avoid any potential issues later.

Lastly, some people forget to ask for a receipt altogether. While it might seem unnecessary at the time, having that documentation can provide peace of mind and financial benefits later on. Always request a receipt when making a donation, regardless of the size or value of the items. This simple step can make a significant difference come tax season.