Fill a Valid Gift Letter Template

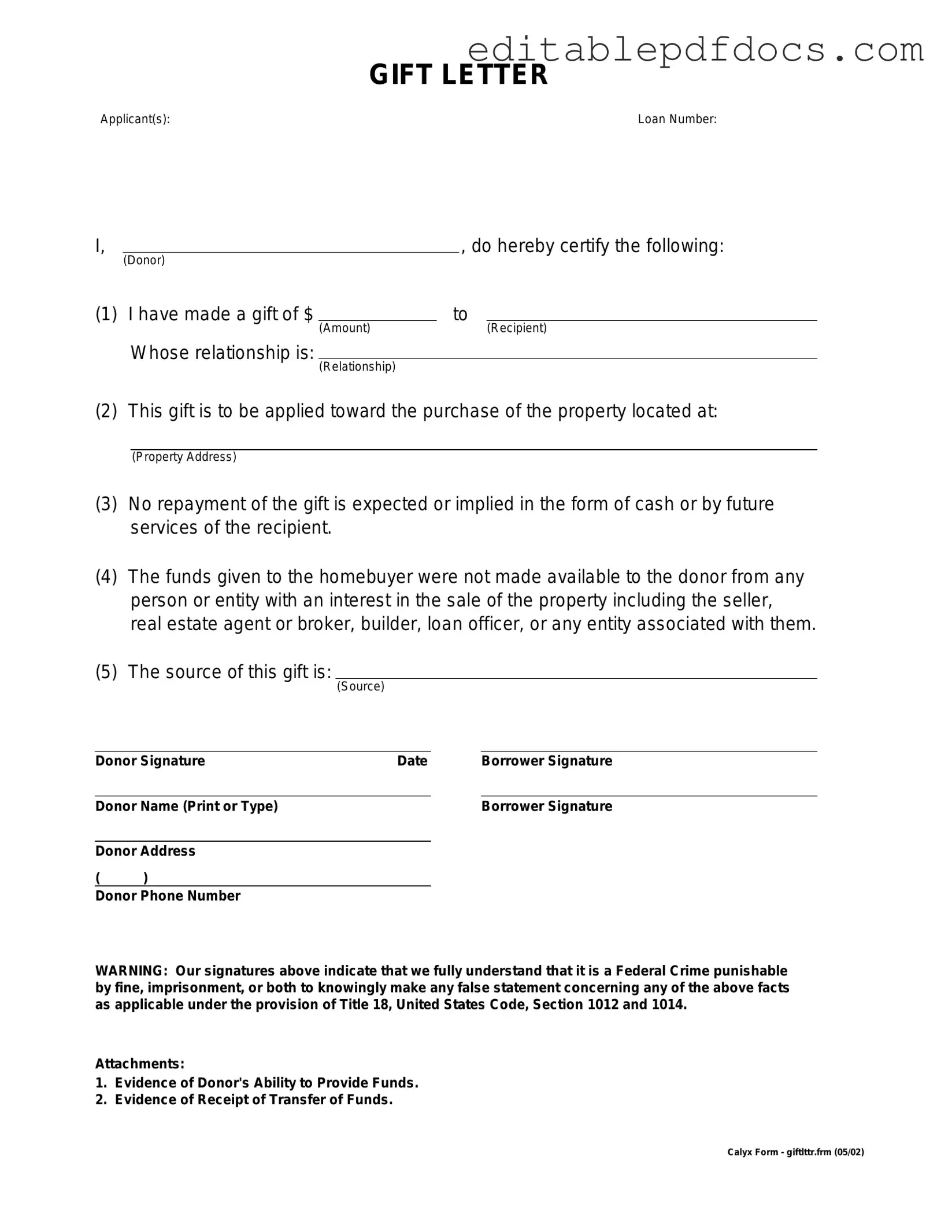

When it comes to purchasing a home, financial support from family or friends can make a significant difference. A Gift Letter form serves as a crucial document in these situations, providing clarity and transparency about the funds being gifted. This form outlines the details of the gift, including the amount, the relationship between the giver and the recipient, and a statement confirming that the money does not need to be repaid. Lenders often require this documentation to ensure that the funds are indeed a gift and not a loan, which could impact the buyer's financial qualifications. Understanding the importance of the Gift Letter form can help streamline the home-buying process and prevent potential complications down the line. By properly completing this form, both the giver and the recipient can protect their interests while facilitating a smoother transaction.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | A Gift Letter form is used to document financial gifts, often for real estate transactions, to clarify that the funds do not need to be repaid. |

| Donor and Recipient | The form typically includes information about the donor (the person giving the gift) and the recipient (the person receiving the gift). |

| Tax Implications | Gifts over a certain amount may have tax implications for the donor, and the IRS requires reporting for gifts exceeding $17,000 (as of 2023). |

| State-Specific Forms | Some states have specific requirements for gift letters, particularly in real estate transactions. For example, California requires adherence to the California Civil Code. |

| Signature Requirement | Both the donor and the recipient typically need to sign the Gift Letter to validate the transaction and confirm the nature of the gift. |

| Use in Mortgage Applications | Lenders often require a Gift Letter as part of the mortgage application process to ensure that the funds are a gift and not a loan. |

| Format Flexibility | The Gift Letter can be a simple written statement or a more formal document, but it should clearly state the intent and details of the gift. |

Dos and Don'ts

When filling out a Gift Letter form, it’s crucial to ensure accuracy and compliance with regulations. Here’s a list of essential dos and don’ts to guide you through the process.

- Do provide clear and accurate information about the donor and recipient.

- Do specify the amount of the gift and the purpose of the gift clearly.

- Do include a statement that the gift is not a loan and does not need to be repaid.

- Do sign and date the letter to validate the information provided.

- Don't omit any required details, as this could lead to delays or issues.

- Don't use vague language; be specific to avoid misunderstandings.

Following these guidelines will help ensure that your Gift Letter is properly completed and accepted. Take the time to review your submission for accuracy and completeness before sending it off.

Documents used along the form

When preparing a Gift Letter, several other forms and documents may be needed to ensure a smooth process. Each of these documents serves a specific purpose in the context of gifting funds, especially in real estate transactions or financial assistance. Here’s a brief overview of these related documents.

- Loan Application: This document is completed by the borrower to apply for a mortgage or loan. It provides the lender with essential information about the borrower's financial situation.

- Bank Statement: A recent bank statement shows the donor's financial capacity to provide the gift. It helps verify that the funds are legitimate and available.

- Source of Funds Letter: This letter explains where the gifted funds are coming from. It provides transparency and can help prevent any issues during the loan approval process.

- Gift Tax Return (Form 709): This form is filed by the donor if the gift exceeds the annual exclusion limit. It documents the gift for tax purposes and ensures compliance with IRS regulations.

- Closing Disclosure: This document outlines the final terms of the mortgage loan, including costs and fees. It is provided to the borrower before closing on the property.

- Apartment Registration Form: This form, vital for rental compliance, registers units in NYC and requires details on the program, building, and landlord. For more information, visit https://nyforms.com/nyc-apartment-registration-template.

- Settlement Statement (HUD-1): This form details all the costs associated with the closing of a real estate transaction. It includes credits and debits for both the buyer and seller.

- Identification Documents: These may include a driver’s license or passport for both the donor and recipient. They verify identities and help prevent fraud.

Gathering these documents alongside the Gift Letter will facilitate a smoother transaction. Each piece plays a vital role in ensuring that all parties are protected and that the process adheres to legal and financial standards.

Popular PDF Forms

Salary Advance Agreement - Use this request to gain access to your wages sooner.

The Employment Verification form is a crucial document that employers use to confirm an individual's employment history and status. By utilizing the right resources, such as Fillable Forms, employers can streamline the process and ensure that job candidates meet the necessary qualifications for a position. Understanding the importance of this form can assist both employers and employees in navigating the hiring process smoothly.

Where Can I Get My Pay Stubs - ADP Pay Stubs can serve as a starting point for discussions on financial goals.

Alabama Title Transfer Application - It is important to maintain accurate records for vehicles.

Similar forms

- Affidavit of Support: This document is used to demonstrate financial support for an individual, often in immigration contexts. Like a Gift Letter, it provides assurance that the recipient will have sufficient funds available.

- Loan Agreement: A Loan Agreement outlines the terms of borrowing money, including repayment details. While a Gift Letter confirms a gift, a Loan Agreement indicates a financial transaction that requires repayment.

Motor Vehicle Bill of Sale: To ensure proper documentation during vehicle transactions, refer to our detailed Motor Vehicle Bill of Sale requirements to facilitate a smooth transfer of ownership.

- Promissory Note: This document serves as a written promise to pay a specified amount to a lender. Similar to a Gift Letter, it involves a transfer of funds, but it obligates the borrower to repay the loan.

- Transfer of Assets Form: Used to document the transfer of ownership of assets, this form is similar in that it formalizes the movement of value from one party to another, similar to how a Gift Letter formalizes a gift.

- Financial Statement: A Financial Statement provides an overview of an individual's financial status. It can accompany a Gift Letter to demonstrate the giver's ability to make the gift without financial strain.

- Gift Tax Return (Form 709): This form is required for reporting gifts that exceed the annual exclusion amount. Like a Gift Letter, it pertains to the transfer of assets but focuses on tax implications instead of the intent behind the gift.

Common mistakes

When filling out a Gift Letter form, it is crucial to provide accurate and complete information. One common mistake is failing to include the donor's full name and address. This information is essential for verifying the legitimacy of the gift. Without it, the recipient may face complications during the financial review process.

Another frequent error is neglecting to specify the relationship between the donor and the recipient. Lenders often require this information to assess whether the gift is appropriate and to avoid potential conflicts of interest. Omitting this detail can lead to delays or even rejection of the application.

Many individuals also forget to indicate the amount of the gift clearly. This figure should be precise and match any supporting documents. Inaccuracies can raise red flags, prompting further scrutiny from financial institutions.

Some people mistakenly use vague language when describing the purpose of the gift. It's important to be straightforward. Clearly stating that the funds are intended for a specific purpose, such as a home purchase, helps ensure that the gift is understood correctly.

Another pitfall is failing to sign and date the form. A signature is a crucial element that confirms the donor’s intent. Without it, the document may be deemed invalid, leading to unnecessary complications.

Individuals sometimes overlook the need for additional documentation. Providing bank statements or proof of funds can strengthen the legitimacy of the gift. If this information is missing, it may raise concerns during the review process.

Some people make the mistake of not keeping a copy of the completed Gift Letter form. Retaining a copy is important for personal records and can be useful if questions arise later.

Additionally, errors in the donor's contact information can cause significant delays. Ensure that phone numbers and email addresses are accurate. This allows lenders to reach the donor easily if needed.

Finally, not reviewing the completed form before submission is a common oversight. Taking the time to double-check for errors can prevent issues down the line. A careful review helps ensure that all information is correct and complete.