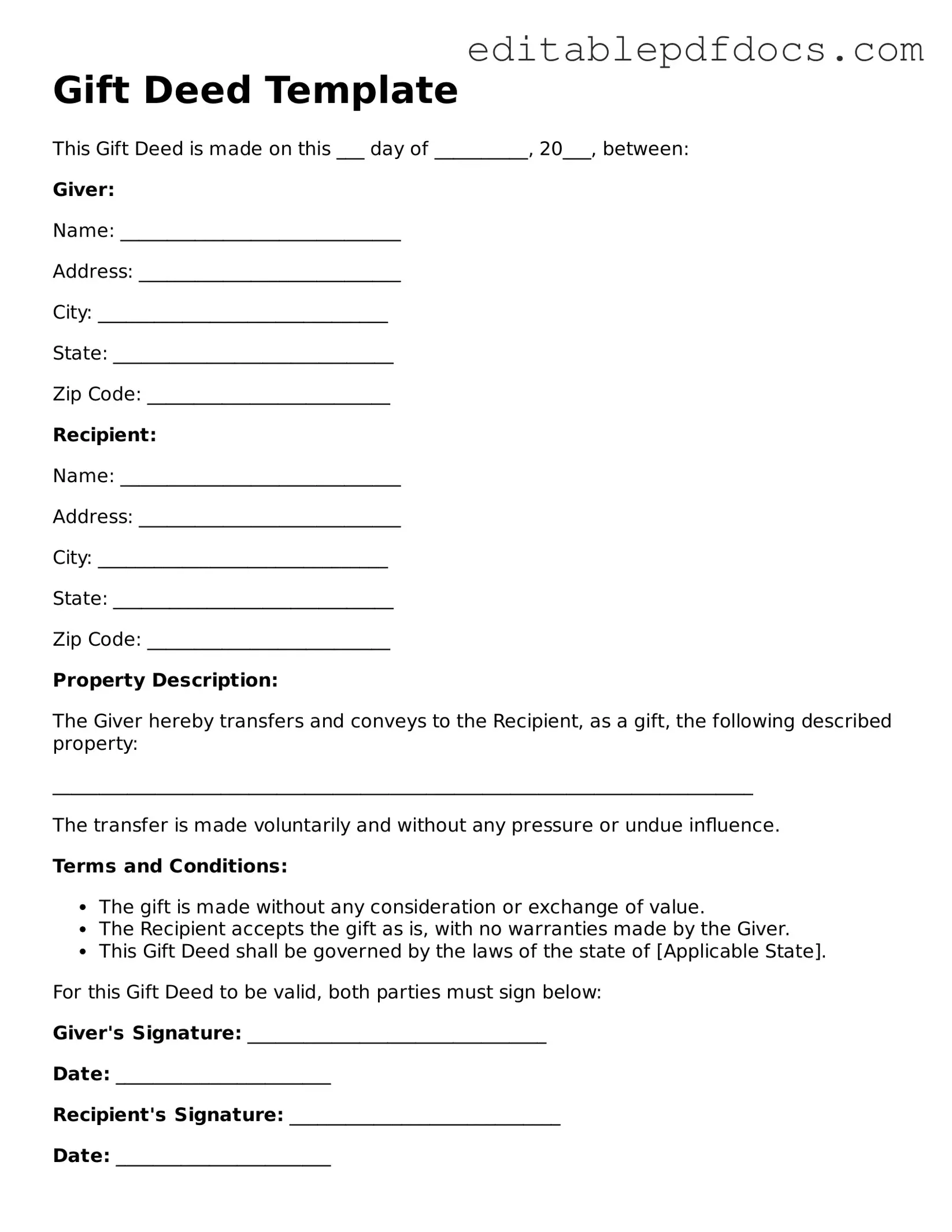

Free Gift Deed Document

A Gift Deed form serves as a crucial legal document that facilitates the transfer of property or assets from one individual to another without any exchange of monetary compensation. This form is essential for clearly outlining the intentions of the donor—the person giving the gift—and ensuring that the recipient, known as the donee, receives full ownership rights. The document typically includes key details such as the names and addresses of both parties, a precise description of the property or asset being gifted, and any conditions that may apply to the transfer. Additionally, the Gift Deed may require the signatures of witnesses to validate the transaction, ensuring that it adheres to legal standards. Understanding the components and requirements of a Gift Deed is vital for anyone considering making a significant gift, as it helps prevent future disputes and provides a clear record of the transfer. By utilizing this form, individuals can express their generosity while also protecting their legal interests and those of the recipient.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. |

| Consideration | Unlike other property transfers, a Gift Deed does not require consideration; the transfer is made voluntarily and without compensation. |

| Governing Law | The laws governing Gift Deeds vary by state. For instance, in California, the California Civil Code Section 1146 applies. |

| Requirements | To be valid, a Gift Deed typically must be in writing, signed by the donor, and delivered to the recipient. |

| Revocation | A Gift Deed can be revoked by the donor at any time before it is delivered to the recipient, depending on state laws. |

| Tax Implications | Gifts may have tax implications for both the donor and recipient. The IRS allows a certain amount to be gifted tax-free each year. |

| Witness Requirement | Some states require witnesses to sign the Gift Deed for it to be valid, while others do not. |

| Recordation | It is advisable to record the Gift Deed with the appropriate local government office to provide public notice of the transfer. |

Gift Deed - Adapted for Each State

Dos and Don'ts

When filling out a Gift Deed form, it's important to follow certain guidelines to ensure the document is valid and effective. Here’s a list of things you should and shouldn't do:

- Do: Provide accurate information about the donor and the recipient.

- Do: Clearly describe the gift being transferred.

- Do: Include the date of the gift.

- Do: Sign the document in the presence of a notary public.

- Do: Keep a copy of the signed Gift Deed for your records.

- Don't: Leave any sections blank; fill out all required fields.

- Don't: Use vague language when describing the gift.

- Don't: Forget to have witnesses sign if required by your state.

- Don't: Assume verbal agreements are sufficient; a written deed is necessary.

Documents used along the form

When engaging in the process of gifting property, several important forms and documents often accompany the Gift Deed. These documents help ensure that the transaction is legally sound and clearly understood by all parties involved. Below is a list of common documents that may be required alongside a Gift Deed.

- Gift Letter: This is a simple letter that outlines the intent of the gift. It typically includes the names of the donor and recipient, a description of the property being gifted, and a statement confirming that the gift is made voluntarily.

- Affidavit of Gift: This is a sworn statement made by the donor affirming their intention to gift the property. It serves as a legal declaration that the transfer is genuine and without coercion.

- Title Deed: This document proves ownership of the property being gifted. It is essential for establishing that the donor has the right to transfer ownership to the recipient.

- Property Tax Records: These records show the assessed value of the property and any outstanding taxes. They are important for ensuring that the recipient understands any financial obligations associated with the property.

- Dog Bill of Sale: This form is essential for documenting the sale or transfer of ownership of a dog in California and can be found through Fillable Forms.

- Identification Documents: Both the donor and recipient may need to provide valid identification, such as a driver’s license or passport. This helps verify their identities and confirms their legal capacity to engage in the transaction.

- Transfer Tax Form: Depending on the jurisdiction, a transfer tax may apply when property changes hands. This form ensures that any applicable taxes are calculated and paid appropriately.

- Notarization Certificate: Many jurisdictions require the Gift Deed to be notarized. This certificate confirms that the signatures on the document are authentic and that the parties signed willingly.

In summary, these documents play crucial roles in facilitating a smooth and legally compliant transfer of property through a Gift Deed. Ensuring that all necessary paperwork is completed can help prevent disputes and misunderstandings in the future.

Consider Popular Types of Gift Deed Templates

Correction Deed California - A Corrective Deed is essential for maintaining clear property titles.

The Texas Affidavit of Correction form is a legal document used to correct minor errors on official Texas records, such as vehicle titles or property deeds. It serves an essential purpose by ensuring accuracy on important documents without the need for complete reissuance. For those needing to make corrections, please click the button below to begin filling out your form, or visit https://texasformspdf.com/fillable-affidavit-of-correction-online for assistance.

Similar forms

- Warranty Deed: A warranty deed transfers ownership of property and guarantees that the seller holds clear title. Like a gift deed, it requires the consent of the owner and formalizes the transfer of property rights.

- Quitclaim Deed: This document transfers whatever interest the grantor has in a property without making any guarantees about the title. Similar to a gift deed, it does not involve payment, and the transfer is often made between family members or friends.

- Trust Deed: A trust deed involves a property being held in trust for the benefit of another party. Both documents facilitate the transfer of property, though a trust deed often involves a third party and can include specific conditions.

- Bill of Sale: A bill of sale is used to transfer ownership of personal property. Like a gift deed, it documents the transfer without monetary exchange, although it typically applies to movable assets rather than real estate.

-

A Last Will and Testament not only dictates how assets will be distributed but also allows for the appointment of guardians for minor children, ensuring that your final wishes are respected. For templates and more information, visit https://nyforms.com/last-will-and-testament-template/.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. Similar to a gift deed, it can authorize the transfer of property, but it does not itself transfer ownership; rather, it grants the authority to do so.

- Sales Agreement: A sales agreement outlines the terms of a property sale. While it usually involves payment, it shares similarities with a gift deed in that it formalizes the transfer of ownership and details the responsibilities of both parties.

- Lease Agreement: A lease agreement allows one party to use property owned by another for a specified time in exchange for rent. Though it does not transfer ownership, it establishes rights and responsibilities similar to those in a gift deed.

- Deed of Trust: This document secures a loan with real property. While it is often used in financial transactions, it shares the characteristic of involving property transfer and establishing legal rights, much like a gift deed.

- Affidavit of Heirship: This document establishes the heirs of a deceased person and can facilitate the transfer of property without a will. It is similar to a gift deed in that it formalizes ownership transfer without a sale.

- Transfer on Death Deed: This deed allows property to be transferred to a beneficiary upon the owner's death. Like a gift deed, it involves a transfer of ownership but is contingent upon the death of the owner.

Common mistakes

Filling out a Gift Deed form can seem straightforward, but many individuals make common mistakes that can complicate the process. One frequent error is failing to include all necessary information about the donor and the recipient. Accurate names, addresses, and identification details are essential to establish the legitimacy of the transaction.

Another mistake is not specifying the property being gifted. Without a clear description, including boundaries and any identifying details, the deed may be deemed invalid. It is crucial to include precise information to avoid future disputes or confusion regarding the property.

Many people also overlook the requirement for signatures. Both the donor and the recipient must sign the Gift Deed for it to be legally binding. Additionally, some individuals fail to have the deed notarized, which can lead to challenges in proving its authenticity later on.

Inaccurate dates can pose another issue. It is vital to ensure that the date of execution is correct and reflects when the deed was signed. A discrepancy in dates can raise questions about the validity of the gift.

Omitting the consideration clause is another common mistake. While a Gift Deed typically involves no monetary exchange, it is still important to state that the gift is made without consideration to avoid any misunderstandings about the nature of the transfer.

Some individuals neglect to check local laws and regulations regarding gift transfers. Each state may have specific requirements or restrictions that must be adhered to, and failing to comply can result in complications.

Another error involves not keeping a copy of the completed Gift Deed. It is essential to retain a copy for personal records and to provide proof of the transfer if needed in the future.

Many people forget to inform relevant parties about the gift. Notifying tax authorities or other stakeholders can prevent unexpected tax implications or legal challenges down the line.

Finally, some individuals may not seek legal advice when necessary. Consulting with a legal professional can help clarify the process and ensure that all aspects of the Gift Deed are correctly addressed.