Transfer-on-Death Deed Document for Georgia

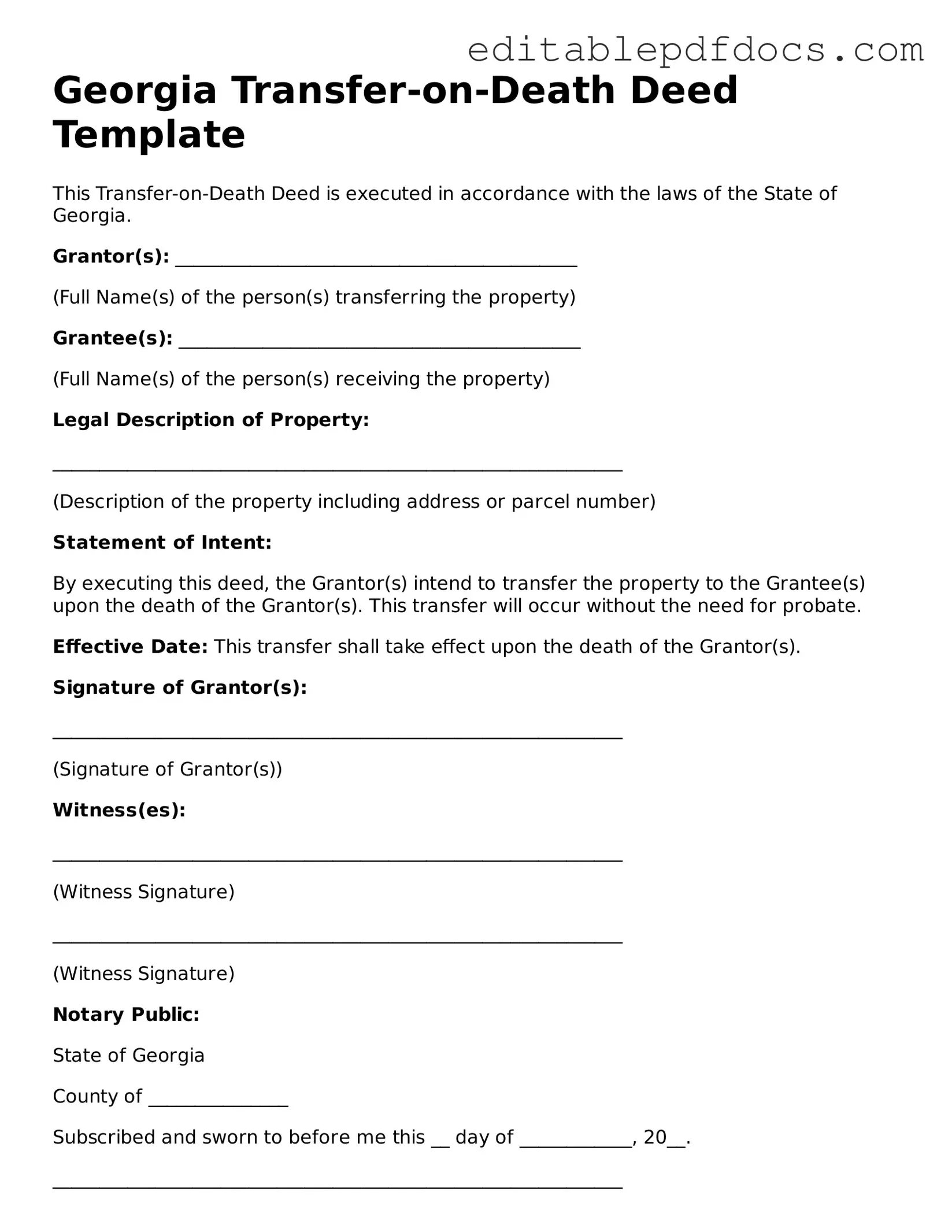

In Georgia, the Transfer-on-Death Deed form serves as a powerful tool for individuals looking to simplify the transfer of property upon their passing. This legal document allows property owners to designate beneficiaries who will automatically inherit their real estate without the need for probate. By completing this form, individuals can maintain full control of their property during their lifetime, ensuring that it passes directly to their chosen heirs after death. The process is straightforward, requiring the property owner to fill out the form with specific details about the property and the beneficiaries. Importantly, the deed must be properly executed and recorded with the county clerk’s office to be effective. This method not only streamlines the transfer process but also provides peace of mind, knowing that loved ones will receive the property without the complications often associated with estate administration. Understanding the nuances of the Transfer-on-Death Deed can empower property owners to make informed decisions about their estate planning, ensuring that their wishes are honored and their beneficiaries are protected.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Georgia to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Georgia Code § 44-6-16. |

| Eligibility | Any individual who owns real property in Georgia can create a Transfer-on-Death Deed. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time before their death by recording a new deed or a revocation document. |

| Beneficiary Designation | Multiple beneficiaries can be named, and they can receive equal shares or specified portions of the property. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals or notarized to be valid. |

| Filing | The Transfer-on-Death Deed must be recorded with the county clerk's office in the county where the property is located to take effect. |

Dos and Don'ts

When filling out the Georgia Transfer-on-Death Deed form, it’s essential to follow specific guidelines to ensure that the document is valid and effective. Here’s a list of things you should and shouldn’t do:

- Do ensure that the deed is signed in the presence of a notary public.

- Do include the legal description of the property accurately.

- Do check that all necessary information is filled out completely.

- Do record the deed with the county clerk’s office after signing.

- Don't leave any sections blank; incomplete forms can lead to issues.

- Don't forget to include your name as the grantor clearly.

- Don't use vague language when describing the property.

- Don't neglect to inform your beneficiaries about the deed.

Documents used along the form

The Georgia Transfer-on-Death Deed form is a valuable tool for property owners who wish to transfer real estate to beneficiaries without going through probate. However, several other documents are often used in conjunction with this deed to ensure a smooth transfer process and to address various legal and administrative needs. Below are some key forms and documents that may accompany the Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets, including property, should be distributed after their death. While the Transfer-on-Death Deed allows for direct transfer, a will provides a broader estate plan.

- Affidavit of Heirship: This document helps establish the identity of heirs when a property owner passes away without a will. It can clarify ownership and simplify the transfer process.

- New Jersey Promissory Note: To legally outline repayment terms, consider the essential New Jersey Promissory Note documents for your financial agreements.

- Property Title: The legal document that proves ownership of the property. It is essential to review and possibly update the title to reflect the new beneficiary after the transfer.

- Beneficiary Designation Form: Used for certain types of accounts or properties, this form allows the property owner to designate beneficiaries directly, ensuring assets transfer outside of probate.

- Quitclaim Deed: A legal document that transfers any interest the grantor has in the property to another party without guaranteeing that the title is clear. This can be used to transfer property among family members.

- Notice of Death: A formal notification that may be required to inform interested parties about the death of the property owner. This helps in initiating the transfer process and updating records.

Understanding these accompanying documents can help property owners navigate the complexities of estate planning and ensure that their wishes are honored. It is advisable to consult with a professional to determine which documents are necessary for your specific situation.

Consider Some Other Transfer-on-Death Deed Templates for US States

How to Transfer a Property Deed From a Deceased Relative in Florida - This deed can be revoked or altered by the property owner at any time before their death.

When engaging in a trailer sale in California, utilizing the California Trailer Bill of Sale is crucial for a clear transfer of ownership. This document not only captures key details about the trailer, such as make, model, identification number, and sale price, but also serves to protect both the buyer and seller. For convenience, you can access a digital version of the form through Fillable Forms, making it easier to fill out and ensure accuracy in your transaction.

Transfer on Death Deed Pennsylvania - Amending the deed is straightforward, should circumstances change over time.

Trust Avoid Probate - By designating a beneficiary, you minimize the chances of family disputes over what happens to your property after you’re gone.

Similar forms

- Last Will and Testament: Like a Transfer-on-Death Deed, a Last Will outlines how a person's assets will be distributed after their death. However, a will goes through probate, while a Transfer-on-Death Deed allows for direct transfer without probate.

- Living Trust: Both a Living Trust and a Transfer-on-Death Deed facilitate the transfer of property upon death. A Living Trust, however, requires more management during the person's lifetime and can provide additional benefits like privacy and asset management.

- Joint Tenancy with Right of Survivorship: This arrangement allows co-owners to inherit property automatically upon the death of one owner. Similar to a Transfer-on-Death Deed, it bypasses probate, but it requires co-ownership, which may not be suitable for everyone.

- Payable-on-Death (POD) Accounts: These accounts allow individuals to designate beneficiaries who will receive the funds upon their death. Like a Transfer-on-Death Deed, POD accounts avoid probate, but they apply specifically to bank accounts rather than real estate.

- Beneficiary Designations: Commonly used for retirement accounts and life insurance policies, these designations allow assets to pass directly to named beneficiaries. Similar to a Transfer-on-Death Deed, they bypass probate but are limited to specific types of assets.

-

New York Certificate of Incorporation: To legally establish a corporation in New York, one must file a Certificate of Incorporation, which includes essential details about the corporation. For more information about this important document, visit nyforms.com/new-york-certificate-template/.

- Life Estate Deed: This deed allows a person to retain the right to use a property during their lifetime while designating a beneficiary to inherit it after their death. It shares similarities with a Transfer-on-Death Deed, but a Life Estate Deed transfers ownership rights during the owner's life.

Common mistakes

Filling out a Georgia Transfer-on-Death Deed form can be straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is not including all required information. This form requires specific details about the property and the beneficiaries. Omitting even a small piece of information can render the deed invalid.

Another mistake involves incorrect property descriptions. The property must be clearly identified, including the address and legal description. Failing to provide accurate information can create confusion and may delay the transfer process.

People often overlook the need for signatures. Both the property owner and a witness must sign the deed for it to be valid. If either signature is missing, the deed may not be recognized by the court, which can lead to issues when trying to transfer ownership.

In addition, many forget to have the deed notarized. Notarization is a crucial step in the process. Without it, the deed may not be accepted by the county clerk's office, which can complicate matters when the time comes to transfer the property.

Another common oversight is failing to record the deed with the appropriate county office. After completing the form, it is essential to file it with the county where the property is located. If this step is skipped, the transfer may not be recognized, leaving beneficiaries without the intended property.

Some individuals mistakenly believe that the Transfer-on-Death Deed can be used for any type of property. However, this deed is only applicable to real estate. Using it for personal property or other assets can lead to confusion and potential legal issues.

Moreover, people sometimes choose beneficiaries without considering their financial situations. It’s important to think about how the transfer might impact the beneficiary’s finances or tax obligations. A little planning can save a lot of trouble later.

Additionally, many fail to update the deed after significant life changes, such as marriage or divorce. If the named beneficiary changes, it’s crucial to revise the deed accordingly. Otherwise, the original beneficiary may inherit the property, even if it no longer aligns with the owner's wishes.

Finally, some individuals do not seek legal advice when needed. While the form is designed to be user-friendly, consulting with a legal expert can help ensure that everything is filled out correctly. This can prevent costly mistakes and ensure that the transfer goes smoothly.