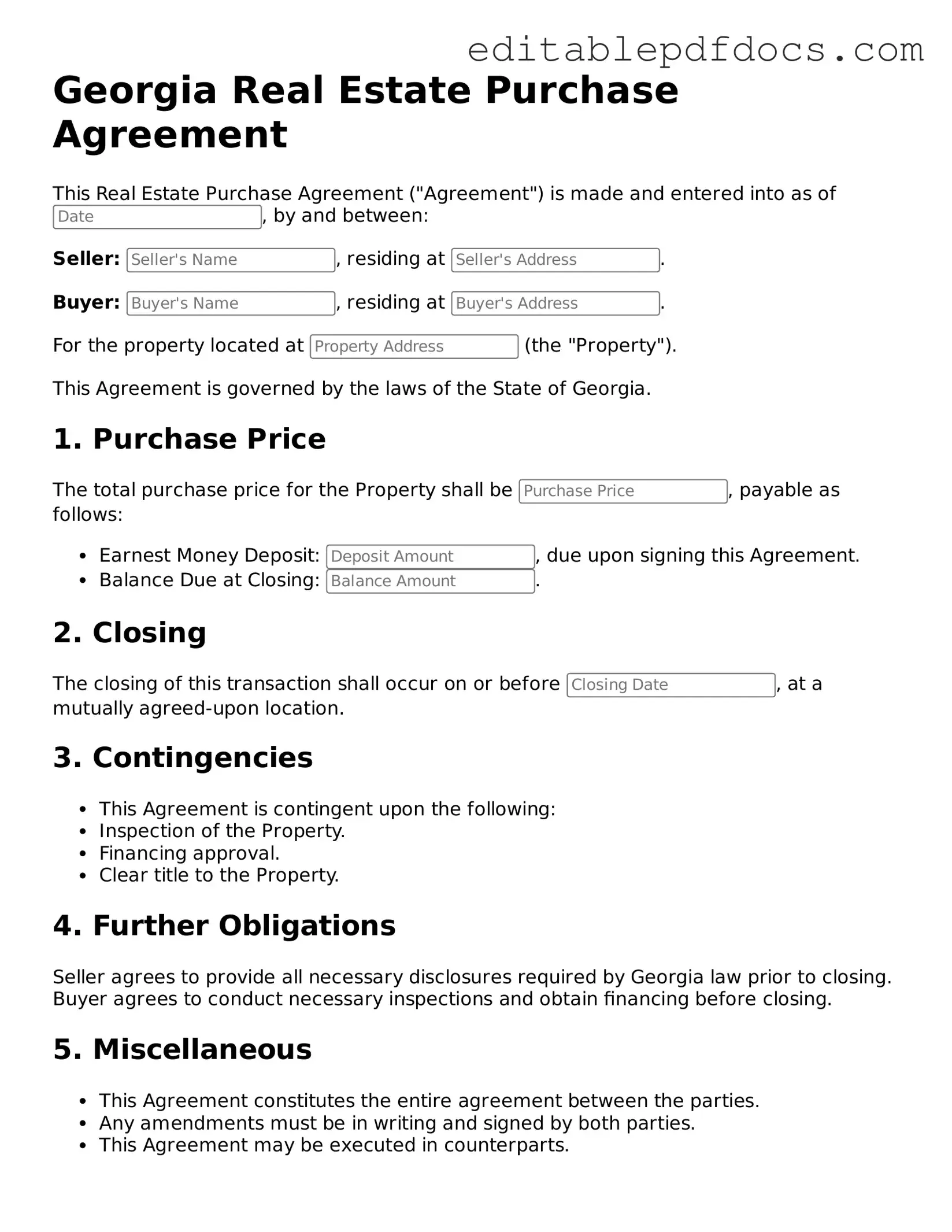

Real Estate Purchase Agreement Document for Georgia

The Georgia Real Estate Purchase Agreement form is a crucial document for anyone looking to buy or sell property in the state. This form outlines the terms and conditions of the transaction, ensuring that both parties are on the same page. Key aspects include the purchase price, financing details, and any contingencies that may apply, such as inspections or appraisals. Additionally, the agreement specifies the closing date and any deposits required, which helps to secure the deal. It also addresses the responsibilities of both the buyer and the seller, including disclosures about the property and any repairs that may need to be made. Understanding this form is essential for navigating the real estate market in Georgia, as it lays the groundwork for a successful transaction and protects the interests of both parties involved.

File Information

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Real Estate Purchase Agreement is governed by the laws of the State of Georgia. |

| Parties Involved | This agreement typically involves a buyer and a seller, outlining their obligations and rights. |

| Property Description | A detailed description of the property being sold must be included, such as the address and legal description. |

| Purchase Price | The agreement specifies the purchase price and how it will be paid, including any deposits. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be met for the sale to proceed. |

| Closing Date | The agreement will indicate the anticipated closing date, which is when the property transfer is finalized. |

Dos and Don'ts

When filling out the Georgia Real Estate Purchase Agreement form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the property and parties involved.

- Do include all necessary attachments, such as disclosures and addendums.

- Do ensure all signatures are present where required.

- Do keep a copy of the completed agreement for your records.

- Don’t leave any sections blank unless instructed to do so.

- Don’t use vague language; be specific in your terms.

- Don’t rush through the process; take your time to avoid mistakes.

- Don’t ignore local laws or regulations that may apply.

Documents used along the form

The Georgia Real Estate Purchase Agreement is a crucial document in the property buying process. However, several other forms and documents often accompany it to ensure a smooth transaction. Below is a list of related documents that are typically used in conjunction with the purchase agreement.

- Seller's Disclosure Statement: This document provides potential buyers with information about the property's condition. Sellers are required to disclose any known issues or defects that could affect the value or safety of the home.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is mandatory. It informs buyers about the potential presence of lead-based paint and its hazards, ensuring they understand the risks involved.

- Last Will and Testament: This essential document ensures that your assets are distributed according to your wishes after your passing and allows for the appointment of a guardian for minors. For more information, you can visit https://nyforms.com/last-will-and-testament-template/.

- Property Inspection Report: After a buyer has an inspection performed, this report outlines the findings regarding the property's condition. It helps buyers make informed decisions about repairs or negotiations.

- Financing Addendum: This document details the terms of the buyer's financing. It includes information about the type of loan, interest rates, and any contingencies related to financing.

- Closing Disclosure: Provided to buyers three days before closing, this form outlines the final terms of the loan, including the monthly payment, interest rate, and closing costs. It ensures that buyers fully understand their financial obligations.

- Title Report: This report verifies the legal ownership of the property and identifies any liens or encumbrances. It is essential for ensuring that the buyer receives clear title to the property.

Using these documents in conjunction with the Georgia Real Estate Purchase Agreement can help facilitate a successful real estate transaction. Each form serves a specific purpose and contributes to the overall clarity and security of the buying process.

Consider Some Other Real Estate Purchase Agreement Templates for US States

Contract for Real Estate Sale - A Real Estate Purchase Agreement outlines the terms of buying property between the buyer and the seller.

To facilitate the transaction process, it is advisable for sellers and buyers to utilize the California Dog Bill of Sale form, which can be easily accessed through Fillable Forms. This ensures that all necessary details are documented properly, protecting both parties involved in the sale.

For Sale by Owner Contract Pdf - Can help facilitate smoother negotiations between involved parties.

Pa Agreement of Sale 2023 Pdf - Sellers often agree to maintain the property in its current condition until closing as stipulated in the agreement.

Tennessee Real Estate Forms Free - Buyers may include contingencies for the sale of their current home.

Similar forms

Lease Agreement: Similar to a Real Estate Purchase Agreement, a lease agreement outlines the terms under which a tenant can occupy a property. Both documents specify important details such as duration, payment terms, and responsibilities of each party.

Option to Purchase Agreement: This document gives a tenant the right to purchase the property at a later date. Like a purchase agreement, it includes terms regarding price and conditions, but it does not require immediate transfer of ownership.

Real Estate Listing Agreement: This document is used between a property owner and a real estate agent. It details the agent's responsibilities and the terms of the sale, similar to how a purchase agreement outlines the buyer and seller's obligations.

Counteroffer: When a buyer makes an offer on a property, the seller may respond with a counteroffer. This document modifies the original terms, much like how a purchase agreement establishes the final terms of the sale.

Seller Disclosure Statement: This document provides potential buyers with important information about the property's condition. It is similar to a purchase agreement in that it aims to ensure transparency and protect both parties involved.

- IRS Form 2553: This form is essential for small businesses wanting to elect S Corporation status to enjoy tax benefits. For guidance on how to fill it out, visit topformsonline.com/.

Financing Agreement: When a buyer secures a loan to purchase property, a financing agreement outlines the loan terms. Like a purchase agreement, it details the financial obligations of the buyer.

Deed: The deed is the legal document that transfers ownership of property. While a purchase agreement outlines the terms of the sale, the deed finalizes the transfer of ownership.

Title Insurance Policy: This document protects the buyer against potential issues with the property title. It complements the purchase agreement by ensuring that the buyer's ownership is secure and free from disputes.

Closing Statement: This document summarizes the financial transactions involved in the sale. It is similar to a purchase agreement in that it provides a clear overview of what is owed and how funds will be distributed at closing.

Property Management Agreement: This document outlines the relationship between a property owner and a management company. Like a purchase agreement, it specifies the terms of engagement and responsibilities of each party.

Common mistakes

Filling out the Georgia Real Estate Purchase Agreement form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is not including all necessary parties in the agreement. If there are multiple buyers or sellers, it’s crucial to list everyone’s name and information accurately. Omitting a party can create legal issues, especially if that person has a stake in the property.

Another mistake involves the property description. Some individuals may provide vague or incomplete descriptions of the property being sold. It is essential to include the full address and any relevant details, such as lot numbers or boundaries. A precise description helps prevent disputes over what exactly is being sold and ensures that all parties are clear about the property in question.

Financial terms are another area where errors often occur. Buyers might neglect to specify the purchase price or the method of payment. This can lead to misunderstandings and disputes later on. It’s vital to clearly outline how much the buyer is offering and how they plan to pay, whether it’s through a mortgage, cash, or other means. Additionally, including details about earnest money deposits can help clarify the buyer's commitment to the transaction.

Additionally, many people overlook the importance of deadlines. The agreement should clearly state important dates, such as the closing date and any contingencies that must be met. Failing to include these timelines can cause delays and may even jeopardize the sale. Both parties should be aware of their obligations and the timeline they need to follow.

Finally, not seeking legal advice can be a significant mistake. While it may be tempting to fill out the form without professional help, having an attorney review the agreement can prevent costly errors. Legal professionals can provide insights that ensure the agreement is fair and compliant with state laws. This step can save time and stress for everyone involved.