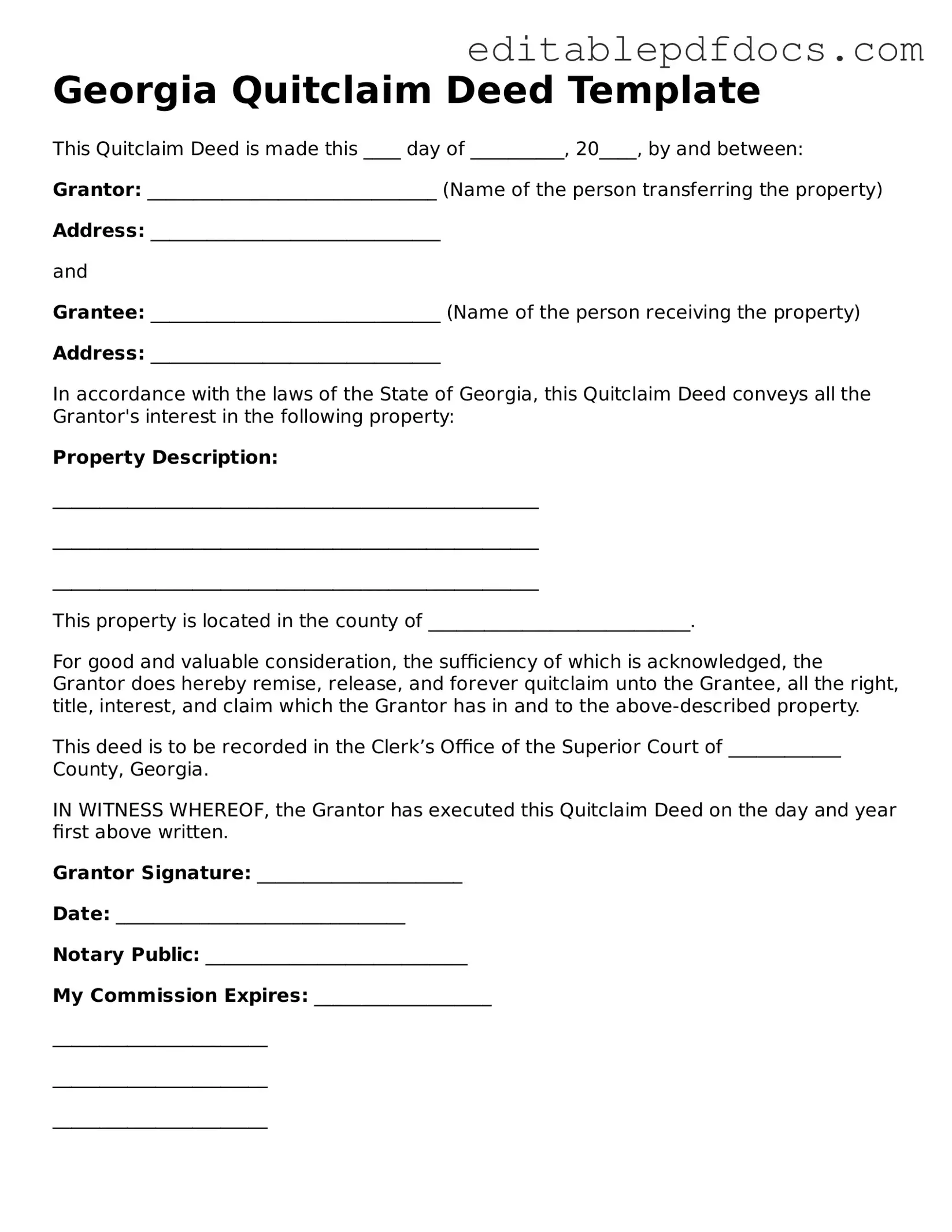

Quitclaim Deed Document for Georgia

The Georgia Quitclaim Deed form serves as a crucial tool for property owners looking to transfer their interest in real estate quickly and with minimal complications. This form allows an individual, known as the grantor, to convey their rights to a property to another party, referred to as the grantee, without making any guarantees about the property’s title. It is particularly useful in situations such as transferring property between family members, settling an estate, or clearing up title issues. Unlike warranty deeds, which provide assurances about the title's validity, a quitclaim deed offers no such protections, making it essential for both parties to understand the implications of the transfer. The form must be completed with specific details, including the names of the parties involved, a legal description of the property, and the date of the transfer. Once executed, the quitclaim deed must be filed with the county clerk’s office to ensure that the transaction is officially recorded and recognized. Understanding how to properly use the Georgia Quitclaim Deed form can help streamline property transfers and avoid potential disputes in the future.

File Information

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed transfers ownership interest in property without guaranteeing that the title is clear. |

| Governing Law | The quitclaim deed is governed by Georgia law, specifically O.C.G.A. § 44-5-30. |

| Parties Involved | The grantor (seller) and grantee (buyer) are the primary parties involved in the transaction. |

| Use Cases | Commonly used in property transfers between family members or to clear up title issues. |

| Document Requirements | The deed must be in writing, signed by the grantor, and must include a legal description of the property. |

| Recording | It is advisable to record the quitclaim deed with the county clerk to protect the grantee’s interest. |

| Consideration | Consideration can be nominal, as the deed does not require a specific payment amount. |

| Limitations | The quitclaim deed does not guarantee that the grantor has valid title to the property. |

Dos and Don'ts

When filling out the Georgia Quitclaim Deed form, it is crucial to follow certain guidelines to ensure accuracy and compliance. Below are important dos and don'ts to keep in mind.

- Do provide accurate property descriptions.

- Do include the names of all parties involved.

- Do sign the form in front of a notary public.

- Do check for any local filing requirements.

- Don't leave any fields blank unless specified.

- Don't use outdated forms; ensure you have the latest version.

- Don't forget to pay the required filing fees.

- Don't assume that a Quitclaim Deed is the same as a warranty deed.

Documents used along the form

When dealing with property transfers in Georgia, the Quitclaim Deed form is often accompanied by several other important documents. Each of these documents serves a unique purpose and helps ensure a smooth transaction. Here’s a list of forms that are frequently used alongside the Quitclaim Deed.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. It offers more protection to the buyer compared to a quitclaim deed.

- Last Will and Testament: For those planning their estates, the essential resources for Last Will and Testament preparation provide crucial guidance to ensure your final wishes are honored.

- Title Search Report: A title search report outlines the history of ownership and any liens or claims against the property. This report is crucial for confirming that the seller has the legal right to transfer ownership.

- Property Survey: A property survey provides a detailed map of the property boundaries. This document helps to clarify the exact dimensions and any encroachments or easements that may exist.

- Affidavit of Title: This sworn statement by the seller confirms that they are the rightful owner of the property and that there are no undisclosed liens or claims. It adds an extra layer of assurance for the buyer.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, closing costs, and any adjustments. It ensures that both parties are aware of their financial responsibilities.

- Transfer Tax Declaration: This form is used to report the transfer of property and calculate any applicable transfer taxes. It is often required by the county where the property is located.

- Power of Attorney: If the seller cannot be present at closing, a power of attorney allows someone else to act on their behalf. This document must be executed properly to be valid.

- Notice of Intent to Foreclose: In some cases, this notice is provided to inform parties of an impending foreclosure. It is important for buyers to be aware of any potential issues related to the property.

Having these documents prepared and organized can significantly streamline the property transfer process. Each plays a vital role in ensuring that both the buyer and seller are protected and informed throughout the transaction.

Consider Some Other Quitclaim Deed Templates for US States

Washington State Quit Claim Deed - Using a Quitclaim Deed can help facilitate estate transfers when dealing with co-owned real estate.

When dealing with the sale of a vehicle, it is essential to have the appropriate documentation in place, such as the Florida Motor Vehicle Bill of Sale. This form not only confirms the transaction but also facilitates the smooth transfer of ownership. To assist you in this process, you can find the necessary resources on PDF Documents Hub.

How to Do a Quick Claim Deed - This type of deed is often completed without the need for title insurance.

Similar forms

Warranty Deed: This document transfers property ownership and guarantees that the seller holds clear title to the property. Unlike a quitclaim deed, it offers protection against future claims.

Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership and includes assurances that the property has not been sold to anyone else. However, it does not provide as extensive a warranty as a warranty deed.

Deed of Trust: This document secures a loan by placing a lien on the property. While it transfers title to a trustee, it differs from a quitclaim deed, which transfers ownership without any lien considerations.

- Employment Verification Form: To verify your employment status, it’s important to utilize our necessary Employment Verification form resources for accurate documentation.

Lease Agreement: A lease allows a tenant to use a property for a specified time. Unlike a quitclaim deed, it does not transfer ownership but grants temporary rights to occupy the property.

Bill of Sale: This document transfers ownership of personal property, such as vehicles or equipment. Unlike a quitclaim deed, it does not apply to real estate but serves a similar purpose in transferring ownership.

Power of Attorney: This document allows one person to act on behalf of another in legal matters. While it does not transfer property, it can empower someone to execute a quitclaim deed on another's behalf.

Affidavit of Title: This sworn statement affirms the seller's ownership and the absence of liens. It complements a quitclaim deed by providing additional assurance about the property’s title.

Trust Agreement: This document establishes a trust to manage property for beneficiaries. While it involves property, it does not transfer ownership outright like a quitclaim deed.

Partition Deed: This document divides jointly owned property among co-owners. It is similar to a quitclaim deed in that it transfers interests but is specific to dividing ownership rather than simply relinquishing it.

Release of Lien: This document removes a lien from a property, freeing it from claims. While it does not transfer ownership, it is often used in conjunction with a quitclaim deed to clarify title.

Common mistakes

Filling out a Quitclaim Deed form in Georgia can seem straightforward, but many individuals make critical mistakes that can lead to complications down the line. One common error is failing to include the correct names of the parties involved. It is essential that the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are spelled correctly and match their legal documents. Any discrepancies can lead to confusion or even invalidate the deed.

Another frequent mistake is not providing a complete legal description of the property. The description must be precise and detailed, often requiring information such as the lot number, block number, and the name of the subdivision. Omitting this information can create ambiguity, making it difficult to identify the property in question.

Many people overlook the importance of notarization. In Georgia, a Quitclaim Deed must be signed in front of a notary public to be legally binding. Failing to have the document notarized can render it ineffective, meaning the transfer of property may not be recognized by the state.

Additionally, individuals often neglect to record the Quitclaim Deed with the county clerk’s office. Recording the deed is crucial for protecting the grantee's rights to the property. If the deed is not recorded, future buyers or creditors may not recognize the grantee’s ownership, leading to potential disputes.

Another mistake involves the omission of consideration. While a Quitclaim Deed can be executed without any money changing hands, it is still important to state the consideration, even if it is a nominal amount. This helps clarify the intent of the transfer and can prevent misunderstandings in the future.

Finally, many individuals fail to review the entire document before submission. It is vital to double-check all entries for accuracy and completeness. A simple oversight can lead to delays or legal challenges. Taking the time to ensure everything is correct can save significant headaches later on.