Promissory Note Document for Georgia

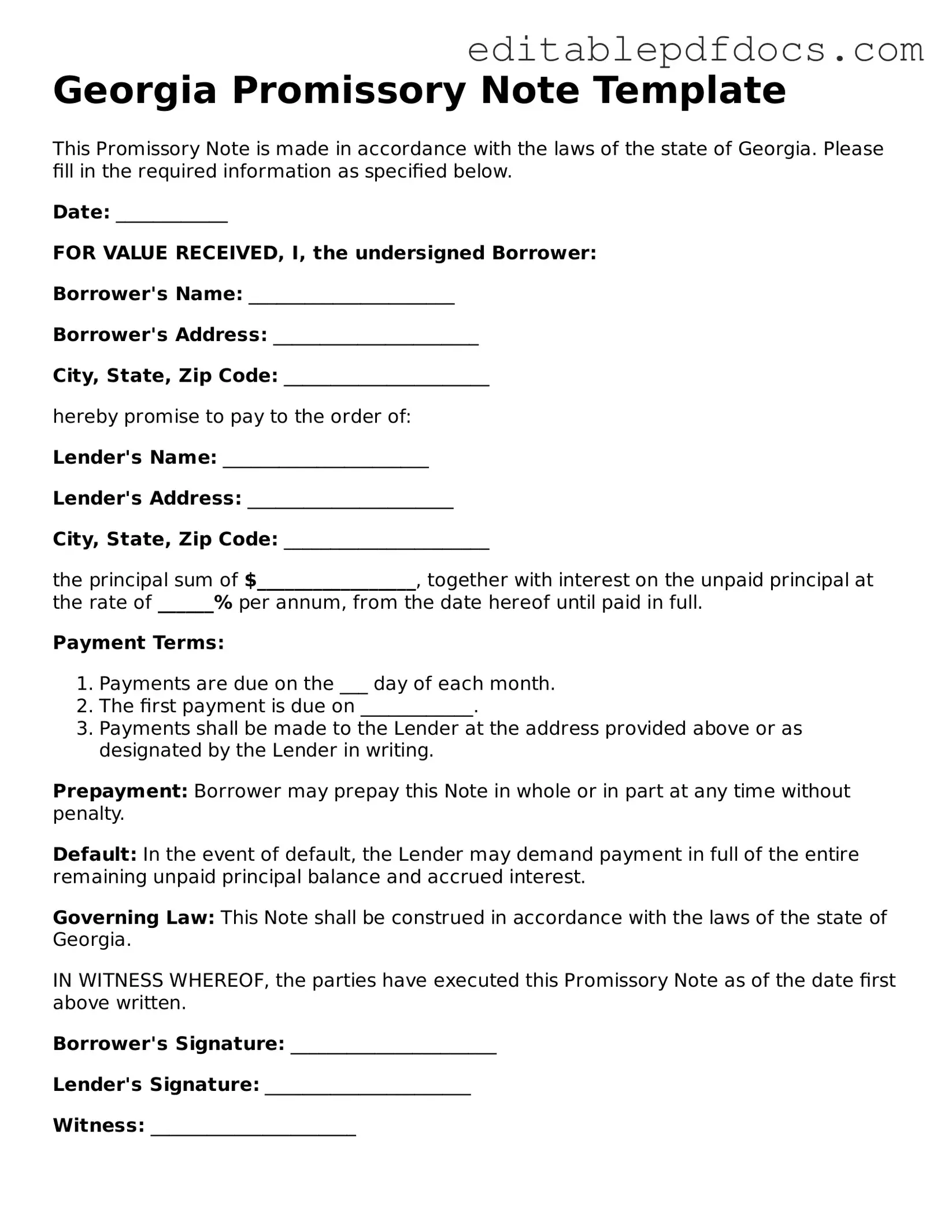

The Georgia Promissory Note form is a crucial document in financial transactions, serving as a written promise to repay a specified amount of money under agreed-upon terms. This form outlines essential details, including the principal amount, interest rate, repayment schedule, and any applicable late fees. It is vital for both lenders and borrowers, as it provides clarity and legal protection for both parties involved. The document can be tailored to meet specific needs, ensuring that all terms are mutually understood and accepted. In Georgia, the enforceability of a promissory note hinges on its adherence to state laws, making it important to understand the required elements. By utilizing this form correctly, individuals can foster trust and accountability in their financial dealings, thereby minimizing potential disputes in the future.

File Information

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Georgia Promissory Note is governed by the Georgia Uniform Commercial Code (UCC), specifically Title 11, Article 3. |

| Parties Involved | Typically involves two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the note. |

| Payment Terms | Payment terms, including the due date and payment frequency, should be clearly outlined. |

| Default Clauses | Default provisions may be included, specifying what happens if the borrower fails to make payments. |

| Signatures Required | The note must be signed by the maker to be legally binding. |

| Witness or Notary | While not always required, having a witness or notary can add an extra layer of validity. |

| Amendments | Any changes to the note must be documented in writing and agreed upon by both parties. |

Dos and Don'ts

When filling out the Georgia Promissory Note form, it's essential to be thorough and accurate. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide complete and accurate information.

- Do clearly state the loan amount and interest rate.

- Do include the repayment terms, including due dates.

- Do sign and date the form where indicated.

- Don't leave any sections blank unless instructed.

- Don't use unclear or ambiguous language.

- Don't forget to keep a copy for your records.

- Don't ignore the importance of having a witness or notarization if required.

Documents used along the form

In Georgia, a Promissory Note is often accompanied by several other documents that help clarify the terms of the loan and protect the interests of both parties involved. Below is a list of common forms and documents that may be used in conjunction with a Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged to the lender. It establishes the lender's rights to the collateral in case of default.

- Durable Power of Attorney: This legal document allows individuals to designate someone they trust to manage their financial matters, ensuring their wishes are followed even if they're unable to make decisions, so it is essential to click to open and understand its importance.

- Guaranty Agreement: This document involves a third party who agrees to repay the loan if the borrower defaults. It provides additional security for the lender.

- Disclosure Statement: This statement provides borrowers with important information about the loan, including fees, interest rates, and the total cost of the loan. It ensures transparency in the lending process.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular installments, showing how much of each payment goes toward principal and interest over time. It helps borrowers understand their payment obligations.

These documents collectively enhance the clarity and security of the lending process, ensuring that both parties have a clear understanding of their rights and responsibilities.

Consider Some Other Promissory Note Templates for US States

Loan Note Template - Both parties should keep a signed copy of the promissory note for records.

When engaging in any motor vehicle transaction, having a properly filled out Motor Vehicle Bill of Sale is crucial for both buyers and sellers. This document not only verifies the ownership transfer but also captures vital information about the vehicle and the involved parties. To ensure you have the correct paperwork, you can visit topformsonline.com for guidance and templates that help facilitate a seamless and legally binding exchange.

Promissory Note Template Arizona - Promissory notes can also be used in informal settings, like family loans.

Similar forms

Loan Agreement: A loan agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. Like a promissory note, it serves as a legal document that binds the borrower to repay the lender.

Mortgage: A mortgage is a specific type of loan agreement that uses real property as collateral. Similar to a promissory note, it requires the borrower to repay the loan amount, often with interest, over a set period.

Credit Agreement: This document details the terms under which credit is extended to a borrower. It includes repayment terms and conditions, akin to those found in a promissory note.

Installment Agreement: An installment agreement outlines the terms for making payments over time for a debt. It parallels a promissory note in that it specifies the repayment schedule and total amount owed.

Power of Attorney: For individuals needing to delegate decision-making authority, the critical Power of Attorney document is essential for managing their affairs effectively.

Loan Modification Agreement: This document modifies the terms of an existing loan. It is similar to a promissory note because it requires the borrower’s commitment to the updated repayment terms.

Personal Guarantee: A personal guarantee is a promise made by an individual to repay a loan if the primary borrower defaults. This document shares similarities with a promissory note in its binding nature regarding repayment.

Security Agreement: A security agreement provides the lender with rights to specific collateral if the borrower defaults. Like a promissory note, it creates a legal obligation for repayment.

Common mistakes

Filling out a Georgia Promissory Note can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is neglecting to include all necessary information. The form requires specific details such as the names of the borrower and lender, the loan amount, and the repayment terms. Omitting even one piece of information can render the note invalid.

Another mistake is failing to clearly state the interest rate. If the interest rate is not specified, it can lead to misunderstandings or disputes later. It's essential to write out the interest rate in both numerical and written form to avoid any confusion.

Many individuals also overlook the importance of dates. The date the note is signed is crucial for establishing the timeline of the loan. Without this date, it can be challenging to determine when payments are due or when the loan is officially considered in default.

In addition, people often forget to include the payment schedule. Whether payments are to be made weekly, monthly, or annually should be clearly outlined. This clarity helps both parties understand their obligations and prevents potential conflicts.

Another common oversight is not having the document properly signed. Both the borrower and lender must sign the Promissory Note for it to be legally binding. Failing to obtain the necessary signatures can result in the note being unenforceable.

Some individuals also neglect to consider the need for witnesses or notarization. While not always required, having a witness or notarizing the document can provide additional legal protection. This step can be especially important if disputes arise in the future.

Finally, people sometimes do not keep a copy of the signed Promissory Note. It’s crucial to retain a copy for personal records. Without a copy, it can be difficult to prove the terms of the agreement if issues arise later.