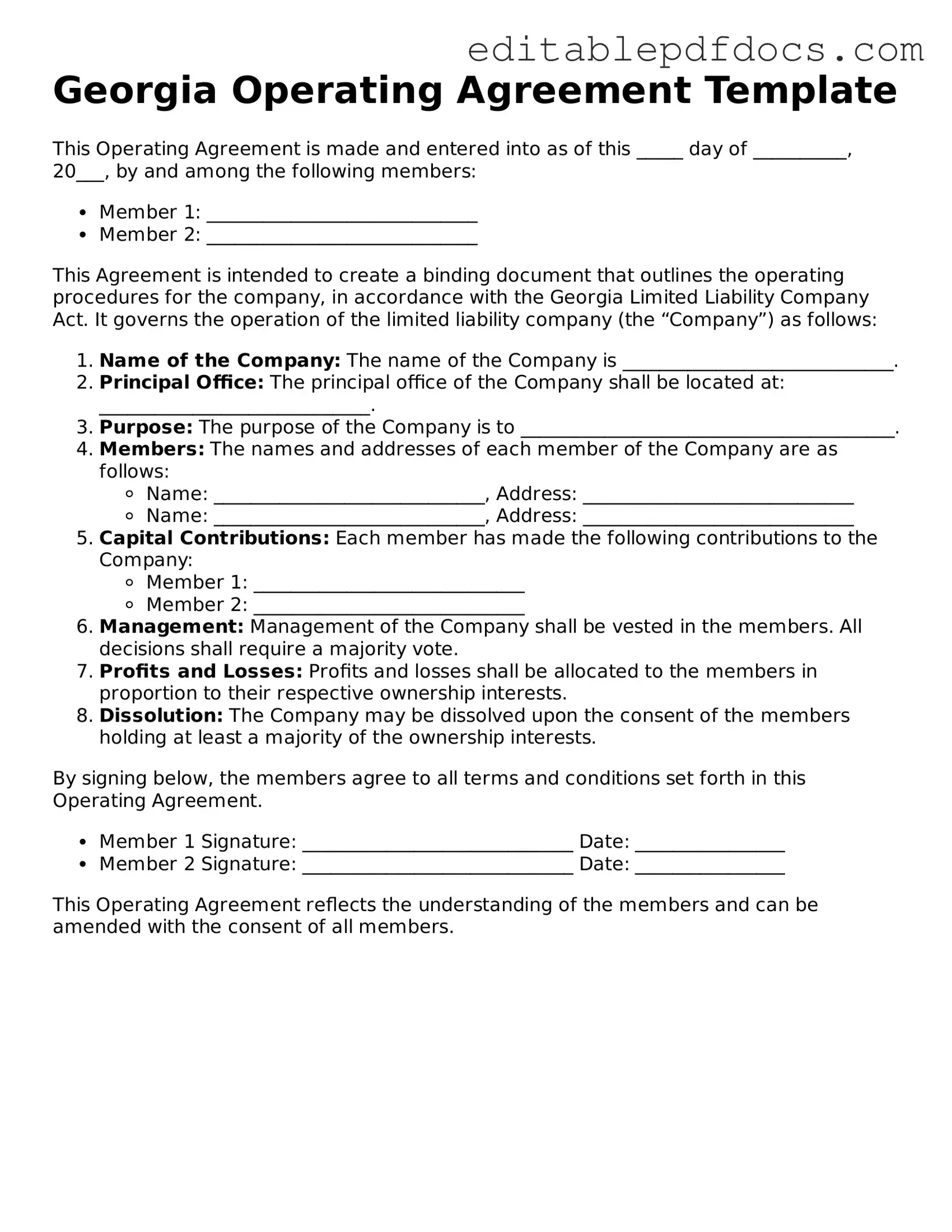

Operating Agreement Document for Georgia

The Georgia Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating in the state. This form outlines the internal rules and regulations governing the management and operations of the LLC, ensuring clarity among members about their rights and responsibilities. Key aspects of the agreement include the distribution of profits and losses, member voting rights, and procedures for adding or removing members. Additionally, the document addresses how decisions are made and specifies the roles of each member in the company's daily operations. By establishing these guidelines, the Georgia Operating Agreement helps prevent misunderstandings and disputes, fostering a more cohesive business environment. Understanding the importance of this document is essential for any LLC owner looking to maintain a well-structured and legally compliant business.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Georgia Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC). |

| Governing Law | The agreement is governed by the laws of the State of Georgia, specifically under the Georgia Limited Liability Company Act. |

| Members | The agreement can include one or more members, who are the owners of the LLC. |

| Management Structure | It allows for either member-managed or manager-managed structures, depending on the preferences of the members. |

| Capital Contributions | The agreement should specify the initial capital contributions made by each member and any future contributions required. |

| Profit Distribution | It outlines how profits and losses will be distributed among the members, which can be based on their ownership percentages or other agreed-upon methods. |

| Amendments | Members can amend the agreement as needed, but typically require a majority or unanimous consent, depending on the terms set in the agreement. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members, such as mediation or arbitration processes. |

Dos and Don'ts

When filling out the Georgia Operating Agreement form, it's important to approach the task with care. Below is a list of things you should and shouldn't do to ensure that your document is completed accurately and effectively.

- Do read the instructions carefully before starting. Understanding the requirements can save you time and frustration.

- Do provide accurate information. Double-check names, addresses, and any other details to ensure they are correct.

- Do include all members' names and roles. This clarity helps define responsibilities and ownership.

- Do consult with a legal professional if you have questions. Getting expert advice can help you avoid mistakes.

- Don't leave any sections blank. Incomplete forms may be rejected or delayed, so fill in every required field.

- Don't use vague language. Be specific about terms, conditions, and agreements to avoid misunderstandings later.

- Don't forget to sign and date the document. An unsigned agreement may not be legally binding.

By following these guidelines, you can ensure that your Georgia Operating Agreement form is filled out correctly and meets all necessary requirements.

Documents used along the form

When forming a limited liability company (LLC) in Georgia, several important documents accompany the Georgia Operating Agreement. Each of these documents serves a specific purpose and contributes to the overall structure and compliance of the LLC.

- Articles of Organization: This is the foundational document filed with the Georgia Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and registered agent.

- Member Agreement: This document outlines the rights and responsibilities of the members of the LLC. It often details how profits and losses will be distributed among members and the process for admitting new members.

- New York MV-51 Form: This essential document is required for the certification of sale or transfer of vehicles from 1972 or older, or any other non-titled vehicles. It must be accompanied by bills of sale and emphasizes verifying liens through the County Clerk’s Office before purchase. More details can be found here: https://nyforms.com/new-york-mv51-template/

- Bylaws: While not required for LLCs, bylaws can provide a framework for the internal management of the company. They typically address governance issues, such as how meetings are conducted and how decisions are made.

- Operating Procedures: This document sets forth the day-to-day operational guidelines for the LLC. It can cover everything from financial management to employee roles and responsibilities.

- Tax Identification Number (TIN) Application: An LLC must apply for a TIN from the IRS. This number is essential for tax purposes and is often required when opening a business bank account.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They can be issued to document each member's investment and share in the company.

These documents, alongside the Georgia Operating Agreement, help ensure that the LLC operates smoothly and complies with state regulations. Understanding each document's role is crucial for effective management and legal compliance.

Consider Some Other Operating Agreement Templates for US States

Creating an Operating Agreement - The Operating Agreement often includes financial reporting requirements.

Acquiring a Doctors Excuse Note is crucial for those needing to justify their absences due to medical reasons, and it can often be facilitated by resources such as Fillable Forms. This official documentation plays a key role in confirming a patient's illness and ensuring that work or school obligations are appropriately addressed during recovery.

Creating an Operating Agreement - An Operating Agreement can address the handling of intellectual property owned by the LLC.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the rules and procedures for the management of a corporation. They cover aspects like meetings, voting, and the roles of officers.

- Room Rental Agreement: When renting a room in New Jersey, make sure to utilize the official Room Rental Agreement guidelines to ensure all terms are legally established and understood.

- Partnership Agreement: This document details the terms of a partnership, including profit sharing, responsibilities, and decision-making processes, much like how an Operating Agreement does for LLCs.

- Shareholders Agreement: This agreement is used by corporations and defines the rights and obligations of shareholders. It can address issues like voting rights and transfer of shares, similar to how an Operating Agreement addresses member rights.

- Joint Venture Agreement: This outlines the terms of a partnership between two or more parties for a specific project. It specifies contributions and responsibilities, akin to an Operating Agreement's focus on member roles.

- Membership Certificate: This document serves as proof of membership in an LLC. While it doesn't govern operations, it complements an Operating Agreement by confirming ownership.

- Non-Disclosure Agreement (NDA): While not directly related to management, an NDA protects sensitive information shared among members. This is important for maintaining confidentiality, similar to the protective measures in an Operating Agreement.

- Articles of Organization: This document is filed with the state to formally create an LLC. It lays the foundation for the business, while the Operating Agreement details how it will operate.

Common mistakes

Filling out the Georgia Operating Agreement form can be straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is not including all members of the LLC. Every member should be listed with their respective ownership percentages. Omitting a member can lead to disputes and confusion regarding ownership and decision-making authority.

Another mistake is failing to define the management structure of the LLC. The form should clearly state whether the LLC will be member-managed or manager-managed. This distinction is crucial because it determines who has the authority to make decisions on behalf of the company. Without this clarity, members may have differing expectations about their roles.

Many people also neglect to specify the purpose of the LLC. The Operating Agreement should outline the business activities the LLC will engage in. A vague or missing purpose can create issues with compliance and may affect the LLC's standing with the state.

Inaccurate information can also lead to problems. For instance, providing incorrect addresses for members or the LLC itself can result in missed communications and legal notices. It is essential to double-check all details to ensure they are accurate and current.

Lastly, some individuals forget to include provisions for amendments to the Operating Agreement. Life circumstances change, and the agreement should include a clear process for making updates. Without this, members may struggle to adapt the agreement to new situations, potentially leading to conflicts down the line.