Loan Agreement Document for Georgia

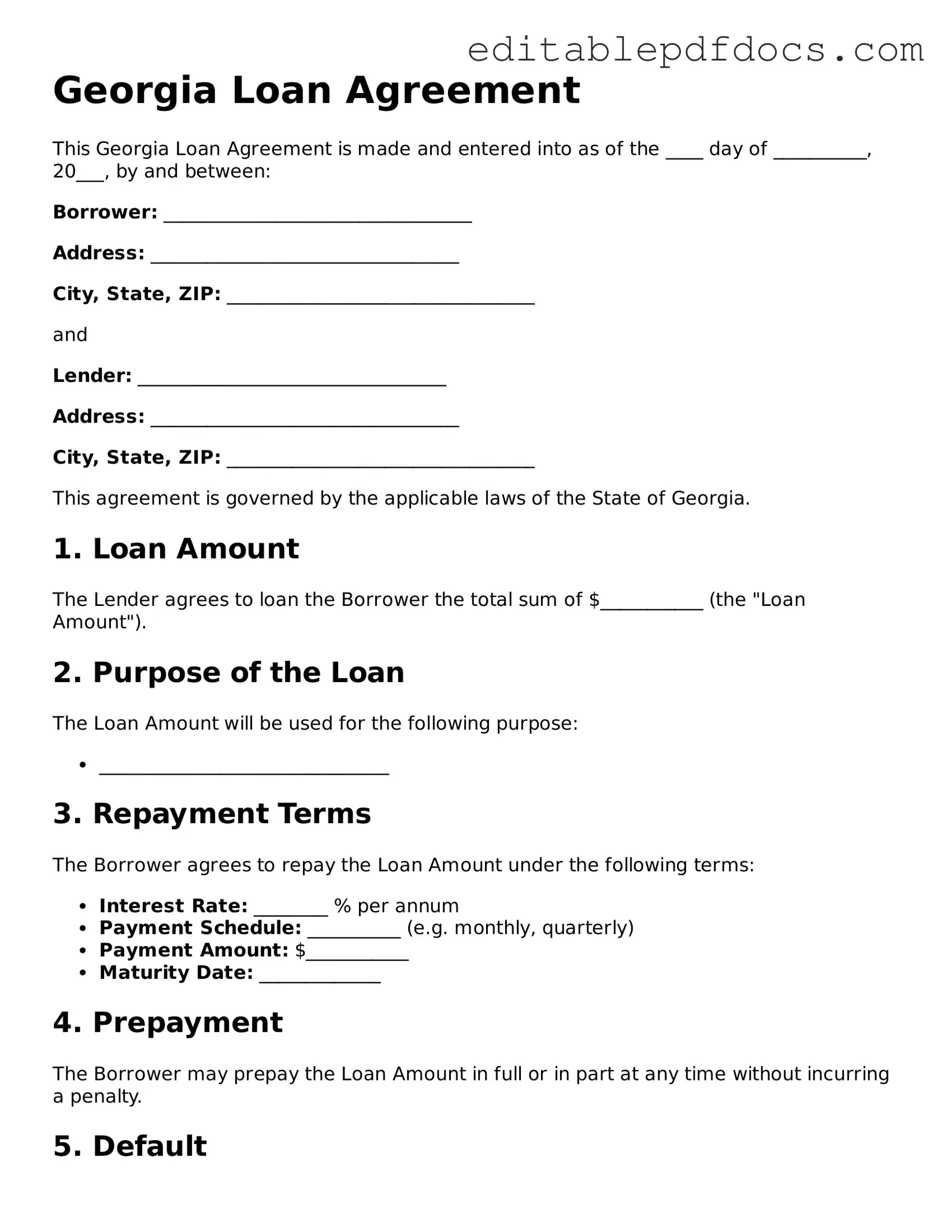

When entering into a loan agreement in Georgia, understanding the key components of the Loan Agreement form is crucial for both lenders and borrowers. This form serves as a written record of the terms and conditions surrounding the loan, ensuring that both parties are on the same page. It typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it outlines the rights and responsibilities of each party, helping to prevent misunderstandings down the line. Having a well-structured agreement can provide peace of mind, as it clarifies expectations and reduces the risk of disputes. Whether you are borrowing money for a personal project or lending funds to a friend, knowing how to navigate this form can make the process smoother and more transparent.

File Information

| Fact Name | Details |

|---|---|

| Governing Law | The Georgia Loan Agreement is governed by the laws of the State of Georgia. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Parties Involved | The agreement identifies the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The specific amount of money being borrowed is clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applicable to the loan, whether fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and payment amounts, are included. |

| Default Conditions | The agreement outlines what constitutes a default and the consequences of defaulting on the loan. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties. |

| Signatures | The agreement must be signed by both the lender and the borrower to be legally binding. |

Dos and Don'ts

When filling out the Georgia Loan Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some do's and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information in all sections.

- Do double-check your entries for any spelling or numerical errors.

- Do sign and date the form where indicated.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use white-out or erase mistakes; instead, cross out errors and initial them.

Documents used along the form

When entering into a loan agreement in Georgia, several other forms and documents may be necessary to ensure clarity and compliance with state laws. These documents serve various purposes, from outlining the terms of the loan to providing necessary disclosures. Below are some commonly used forms that often accompany a Georgia Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and consequences of default.

- Security Agreement: If the loan is secured by collateral, this document specifies the collateral and the rights of the lender in case of default. It helps protect the lender's interests.

- Disclosure Statement: This form provides borrowers with important information about the loan, including fees, interest rates, and other costs associated with borrowing. It ensures transparency and helps borrowers make informed decisions.

- Loan Application: This document collects information about the borrower’s financial situation, credit history, and other relevant details. Lenders use this information to assess the borrower's creditworthiness.

- Closing Statement: At the conclusion of the loan process, this statement summarizes all financial transactions related to the loan, including fees and payments. It provides a clear overview of what the borrower owes.

- Last Will and Testament: It's important to have a Last Will and Testament prepared to ensure your wishes regarding the distribution of assets are honored; you can find a suitable template at nyforms.com/last-will-and-testament-template.

- Guaranty Agreement: If a third party guarantees the loan, this document outlines their obligations. It ensures that the lender has recourse if the primary borrower defaults.

Understanding these documents can help borrowers navigate the loan process more effectively. Each form plays a crucial role in protecting both the lender and the borrower, ensuring that all parties are aware of their rights and responsibilities.

Consider Some Other Loan Agreement Templates for US States

Loan Agreement Template California - The document should be carefully reviewed before signing.

When engaging in a dog sale, it is essential to utilize the California Dog Bill of Sale form to ensure clarity and legality in the transaction. This form acts as a crucial document by detailing the necessary information about the buyer, seller, and the dog itself. For those looking for a convenient way to acquire this form, you can find a comprehensive option at Fillable Forms, making the process simpler and more efficient.

Loan Agreement Template Florida - The form may address the possibility of refinancing options in the future.

Similar forms

-

Promissory Note: This document outlines the borrower's promise to repay the loan. It specifies the loan amount, interest rate, and repayment schedule, similar to the Loan Agreement in its focus on repayment terms.

-

Mortgage Agreement: This document secures the loan with collateral, usually real estate. Like the Loan Agreement, it details the obligations of both parties and the consequences of default.

-

Credit Agreement: This document governs the terms under which a lender extends credit to a borrower. It is similar to the Loan Agreement in that it includes terms regarding interest rates, repayment, and fees.

- IRS Form 2553: This application is essential for small businesses looking to elect S Corporation taxation, similar to how various agreements define specific terms in a Loan Agreement, and further information can be found at topformsonline.com.

-

Security Agreement: This document grants the lender a security interest in specific assets. It parallels the Loan Agreement by establishing the terms of collateral and the rights of the lender in case of default.

Common mistakes

Filling out a Georgia Loan Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure a smooth transaction. One frequent error is failing to provide accurate personal information. This includes names, addresses, and Social Security numbers. Inaccuracies can cause delays in processing the loan and may even result in the rejection of the application.

Another mistake often encountered is neglecting to read the terms and conditions thoroughly. Borrowers may sign the agreement without fully understanding the implications of the interest rates, repayment terms, and fees involved. This lack of attention can lead to unexpected financial burdens later on. It is crucial to grasp what is being agreed upon before finalizing the document.

Many applicants also overlook the importance of including all necessary documentation. Supporting documents, such as proof of income and identification, are typically required. Failing to attach these documents can stall the loan approval process or result in denial. Ensuring that all required paperwork is submitted can expedite the review process significantly.

In addition, some individuals may underestimate the significance of accurate loan amounts. Borrowers sometimes request more or less than they actually need, which can affect their ability to repay the loan. It's essential to carefully assess financial needs and only request what is necessary to avoid complications in repayment.

Another common error is not considering the repayment plan. Many people fill out the form without thinking about how they will manage repayments. Ignoring this aspect can lead to defaulting on the loan, which can have severe consequences. A clear repayment strategy should be established before signing the agreement.

Additionally, borrowers often fail to consult with a financial advisor or legal expert. While it may seem unnecessary, professional guidance can help individuals understand the nuances of the agreement and avoid potential pitfalls. Seeking advice can provide clarity and confidence in the decision-making process.

Lastly, many applicants do not keep copies of the completed Loan Agreement form. This oversight can lead to confusion later, especially if questions arise about the terms or if disputes occur. Keeping a record of all signed documents is essential for reference and accountability.