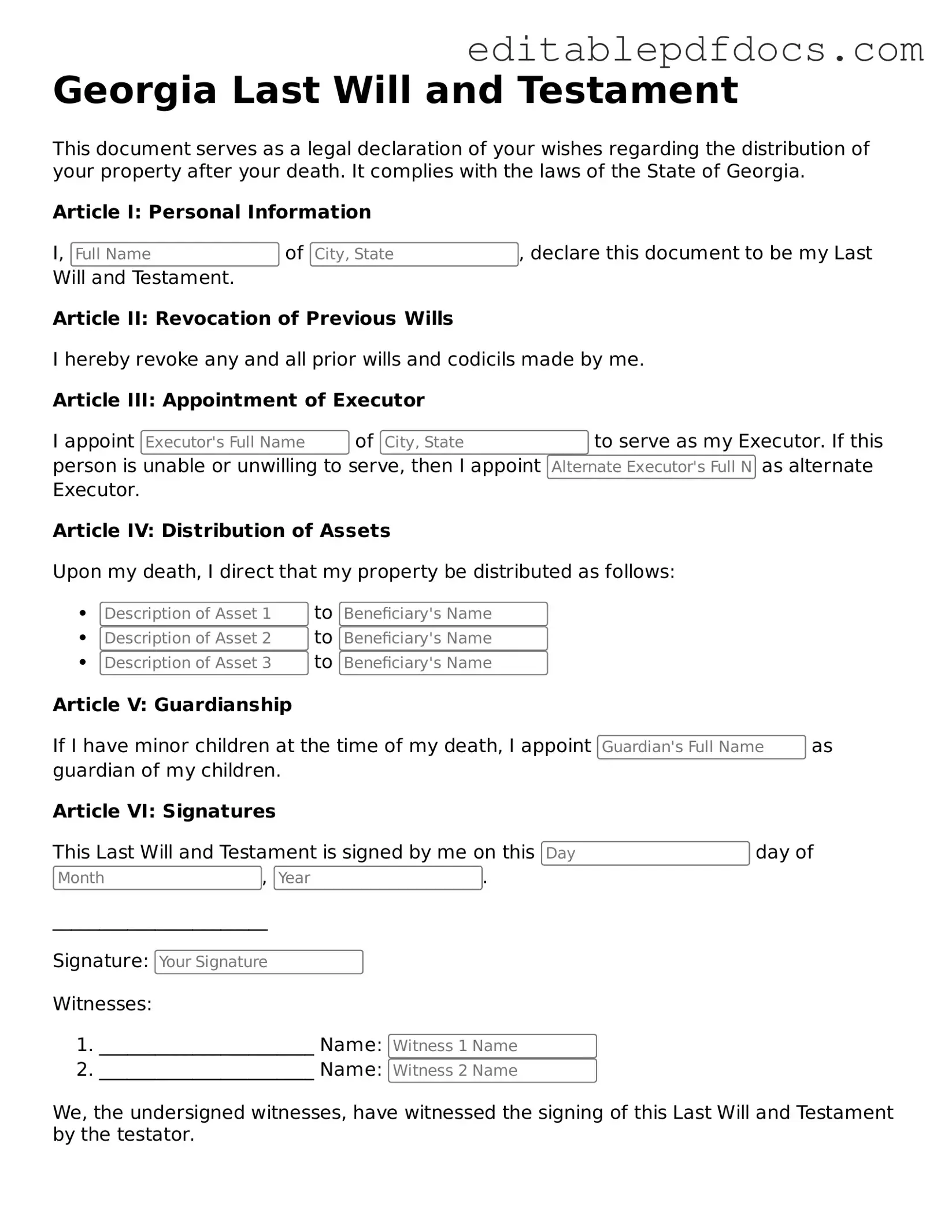

Last Will and Testament Document for Georgia

The Georgia Last Will and Testament form serves as a crucial document for individuals looking to outline their wishes regarding the distribution of their assets after death. This form allows a person, known as the testator, to specify how their property should be divided among beneficiaries, ensuring that their intentions are honored. In addition to asset distribution, the form can designate guardians for minor children, providing peace of mind for parents concerned about their children's future. It also includes provisions for the appointment of an executor, the individual responsible for managing the estate and ensuring that the terms of the will are carried out. Completing this form correctly is essential, as it must adhere to Georgia's legal requirements, including proper signatures and witnesses. Understanding these key aspects can help individuals navigate the process of creating a will, ultimately securing their legacy and providing clarity for loved ones during a difficult time.

File Information

| Fact Name | Description |

|---|---|

| Legal Requirement | In Georgia, a Last Will and Testament must be in writing to be valid. |

| Age Requirement | The testator must be at least 14 years old to create a valid will in Georgia. |

| Witness Requirement | Two witnesses are required to sign the will for it to be considered valid. |

| Self-Proving Wills | A will can be made self-proving in Georgia by including a notarized affidavit from the witnesses. |

| Revocation | A will can be revoked by the testator at any time, provided it is done with clear intent. |

| Holographic Wills | Holographic wills, which are handwritten and signed by the testator, are recognized in Georgia. |

| Testamentary Capacity | The testator must have the mental capacity to understand the nature of making a will. |

| Governing Law | The Georgia Probate Code governs the creation and execution of wills in the state. |

| Executor Appointment | The testator can appoint an executor to manage the estate after their passing. |

| Distribution of Assets | The will should clearly outline how the testator's assets will be distributed among beneficiaries. |

Dos and Don'ts

When filling out the Georgia Last Will and Testament form, it's crucial to be careful and thorough. Here are nine important dos and don'ts to keep in mind:

- Do clearly state your full name and address at the beginning of the document.

- Do appoint an executor who you trust to carry out your wishes.

- Do specify how you want your assets distributed among your beneficiaries.

- Do sign the will in the presence of at least two witnesses.

- Do have your witnesses sign the will at the same time you do.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to date the will to establish its validity.

- Don't leave out any significant assets or debts that could impact your estate.

- Don't attempt to make changes without following proper legal procedures.

Documents used along the form

When preparing a Last Will and Testament in Georgia, several other documents may be useful to ensure that your wishes are clearly expressed and legally upheld. Each of these documents serves a specific purpose and can help streamline the estate planning process.

- Durable Power of Attorney: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become incapacitated. It remains effective even if you are unable to make decisions for yourself.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment and appoints a healthcare agent to make decisions on your behalf if you are unable to communicate your wishes. It ensures that your healthcare choices are respected.

- Emotional Support Animal Letter: If you have a mental health condition, obtaining a document like the Fillable Forms can help provide necessary support from your emotional support animal, enhancing your well-being and companionship.

- Revocable Living Trust: A revocable living trust is a legal entity that holds your assets during your lifetime and allows for their distribution upon your death. It can help avoid probate and provide privacy for your estate.

- Beneficiary Designations: Many assets, such as life insurance policies and retirement accounts, allow you to designate beneficiaries directly. Ensuring these designations are up-to-date can help streamline the transfer of your assets upon death.

Incorporating these documents into your estate planning can provide clarity and security for both you and your loved ones. Each serves a unique role in ensuring that your wishes are honored and that your affairs are managed according to your preferences.

Consider Some Other Last Will and Testament Templates for US States

Does an Attorney Have to Prepare a Will - May include provisions for pets and animal care after death.

A New York Non-disclosure Agreement (NDA) form is a legally binding document used to protect sensitive information from being disclosed. By signing this form, parties agree not to share proprietary knowledge, trade secrets, or other confidential data with unauthorized individuals. It serves as a critical tool for businesses and individuals aiming to safeguard their competitive edge and privacy in various transactions and interactions within New York. For more information, you can visit nyforms.com/non-disclosure-agreement-template/.

Florida Will Requirements - Provides an opportunity to express gratitude or acknowledgments to individuals or organizations.

Writing a Will in Tennessee - A means to ensure your pets are cared for after you are gone.

Similar forms

- Living Will: A living will outlines an individual’s preferences regarding medical treatment in case they become incapacitated. Both documents express personal wishes, but a living will focuses on healthcare decisions rather than asset distribution.

- Power of Attorney: This document grants someone the authority to make financial or legal decisions on behalf of another person. Like a will, it involves planning for the future, but a power of attorney is effective during the individual’s lifetime, while a will takes effect after death.

- Trust Agreement: A trust agreement allows a person to place assets in a trust for the benefit of others. Both documents deal with asset management, but a trust can be used to avoid probate and may provide more control over how assets are distributed.

- Advance Healthcare Directive: This document combines a living will and a power of attorney for healthcare. It specifies preferences for medical treatment and designates someone to make healthcare decisions, similar to how a will dictates the distribution of assets.

- Letter of Instruction: This informal document provides guidance to loved ones regarding personal wishes, funeral arrangements, and asset distribution. While a will is legally binding, a letter of instruction serves as a supplementary tool to communicate personal preferences.

-

Sample Tax Return Transcript: The Sample Tax Return Transcript form provides a summary of an individual’s tax information as filed with the Internal Revenue Service. This document includes crucial data, such as income, adjustments, and tax credits, which can be essential for various financial processes. Understanding the details outlined in the transcript can help taxpayers ensure accuracy in future filings or secure loans and benefits that require proof of income. For more information, visit topformsonline.com.

- Codicil: A codicil is an amendment or addition to an existing will. It allows changes to be made without drafting an entirely new will, maintaining the original document’s validity while updating specific provisions.

- Beneficiary Designation: This document specifies who will receive certain assets, like life insurance or retirement accounts, upon death. Similar to a will, it directs asset distribution but operates outside of the probate process, taking precedence over the will.

Common mistakes

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. However, many people make mistakes when filling out the Georgia Last Will and Testament form, which can lead to complications and disputes later on. One common mistake is failing to clearly identify the beneficiaries. It’s important to specify who will inherit your assets, as vague terms or general references can create confusion and lead to disagreements among family members.

Another frequent error is neglecting to name an executor. The executor is responsible for carrying out the instructions in your will, and if you do not appoint one, the court may have to appoint someone for you. This can lead to delays and additional legal costs. It’s advisable to choose someone trustworthy and capable of managing the responsibilities associated with this role.

People often overlook the importance of signing the will properly. In Georgia, a will must be signed by the testator (the person making the will) and witnessed by at least two individuals. If these signatures are missing or not executed correctly, the will may be deemed invalid. Ensuring that all signatures are in place can save loved ones from unnecessary legal challenges.

Another mistake involves not updating the will when life changes occur. Major life events such as marriage, divorce, the birth of a child, or the death of a beneficiary should prompt a review of your will. Failing to update your will can result in unintended consequences, such as leaving assets to someone who is no longer part of your life.

In addition, many individuals forget to include specific bequests. While it’s common to leave general instructions about dividing assets, specifying particular items or amounts can help avoid confusion. For example, stating that a family heirloom goes to a specific person can prevent disputes among heirs.

People also sometimes fail to consider tax implications when drafting their wills. Understanding how estate taxes may affect the distribution of your assets is essential. Consulting with a financial advisor or an attorney can provide clarity on how to structure your will to minimize tax burdens on your beneficiaries.

Lastly, neglecting to store the will in a safe and accessible location is a mistake that can lead to complications. If your loved ones cannot find your will after your passing, they may face challenges in executing your wishes. Consider keeping the document in a secure place, such as a safe deposit box, and inform trusted family members about its location.