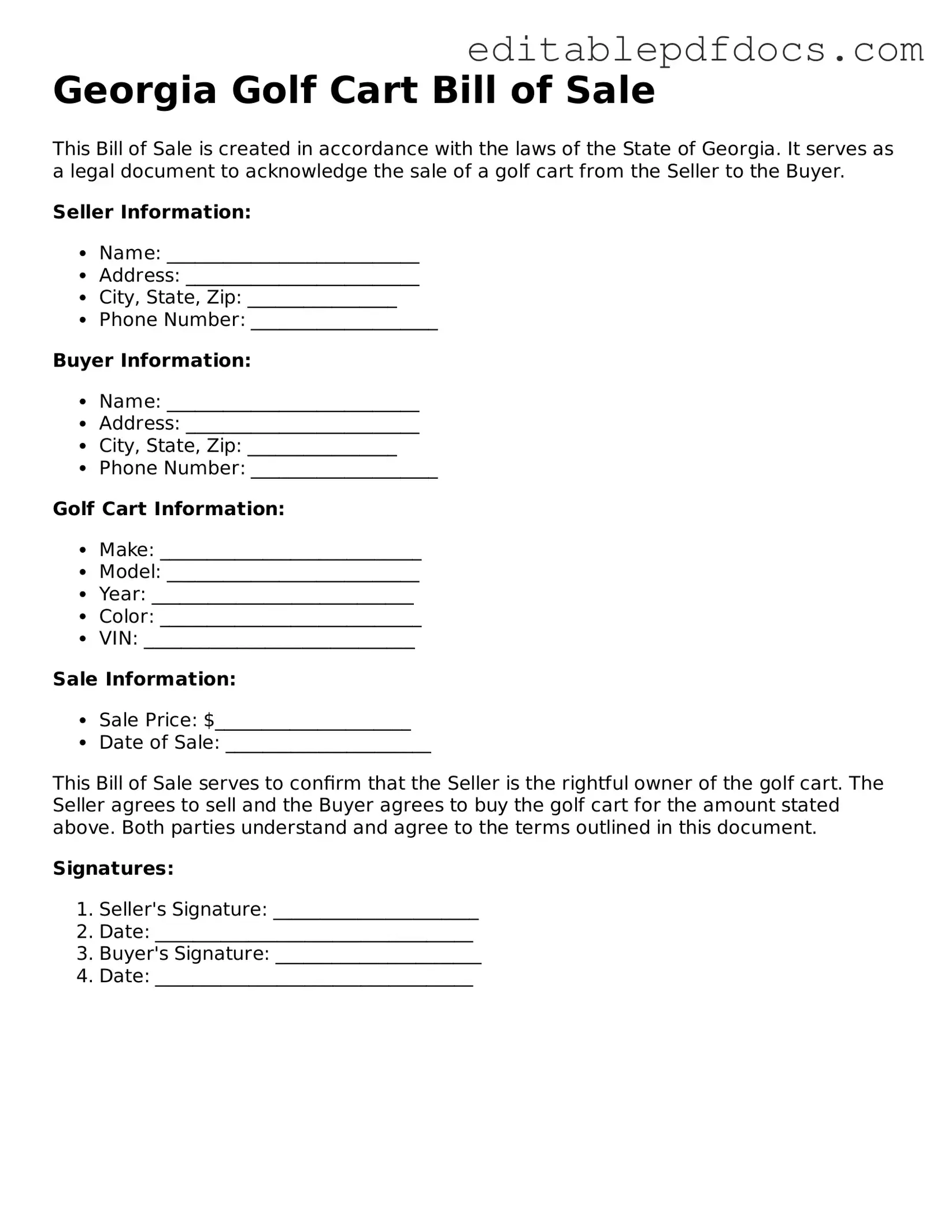

Golf Cart Bill of Sale Document for Georgia

In the vibrant world of golf cart ownership in Georgia, having a clear and concise Golf Cart Bill of Sale form is essential for both buyers and sellers. This document serves as a crucial record of the transaction, detailing important aspects such as the identification of the parties involved, a thorough description of the golf cart, and the agreed-upon sale price. Additionally, it often includes vital information like the vehicle identification number (VIN) and any warranties or conditions related to the sale. By providing a transparent account of the transaction, this form not only protects the interests of both parties but also helps ensure compliance with local regulations. Understanding the significance of this document can make the process smoother and more secure, whether you’re a seasoned golf cart enthusiast or a first-time buyer looking to navigate the market with confidence.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Golf Cart Bill of Sale form is used to document the sale and transfer of ownership of a golf cart in Georgia. |

| Requirements | The form typically requires details such as the seller's and buyer's names, addresses, and the golf cart's make, model, and identification number. |

| Governing Law | The sale of golf carts in Georgia is governed by state laws regarding personal property transactions. |

| Signature | Both the seller and buyer must sign the form to validate the transaction and ensure legal transfer of ownership. |

Dos and Don'ts

When filling out the Georgia Golf Cart Bill of Sale form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are four things you should and shouldn't do:

- Do provide accurate information about the golf cart, including make, model, year, and VIN.

- Do include the full names and addresses of both the buyer and the seller.

- Don't leave any fields blank. Every section of the form should be completed.

- Don't forget to sign and date the form. Both parties must provide their signatures.

Documents used along the form

The Georgia Golf Cart Bill of Sale form is an essential document for transferring ownership of a golf cart. However, several other forms and documents may be needed to ensure a smooth transaction. Below is a list of commonly used documents that complement the Golf Cart Bill of Sale.

- Title Transfer Document: This document officially transfers the title of the golf cart from the seller to the buyer. It is necessary for the buyer to register the cart in their name.

- Registration Application: This form is required to register the golf cart with the local Department of Motor Vehicles (DMV). It typically includes information about the cart and its new owner.

- New Jersey Promissory Note Form: For those in need of a clear financial agreement, the official New Jersey Promissory Note template outlines essential terms for repayment.

- Proof of Insurance: Most states require proof of insurance for golf carts. This document shows that the buyer has obtained insurance coverage for the vehicle.

- Odometer Disclosure Statement: If applicable, this statement confirms the current mileage on the golf cart at the time of sale. It helps prevent fraud related to the vehicle's mileage.

- Sales Tax Form: Depending on local regulations, a sales tax form may be needed to report the sale and pay any applicable taxes on the transaction.

Having these documents prepared and organized will facilitate the sale and help both the buyer and seller navigate the ownership transfer process more efficiently.

Consider Some Other Golf Cart Bill of Sale Templates for US States

Golf Cart Title - Can be signed by both the seller and buyer to make it official.

When engaging in a trailer sale, it is important to utilize the California Trailer Bill of Sale form to clearly document the transfer of ownership. This legal document requires critical information, including the trailer's make, model, identification number, and sale price. For convenience, you can access pre-prepared documentation through Fillable Forms, which assists both parties in ensuring a smooth transaction and proper registration.

Similar forms

The Golf Cart Bill of Sale form shares similarities with several other documents commonly used in transactions involving vehicles and personal property. Here’s a list of nine documents that are comparable:

- Vehicle Bill of Sale: This document is used for the sale of cars, trucks, and motorcycles. Like the Golf Cart Bill of Sale, it includes details about the buyer, seller, and the vehicle being sold.

- Boat Bill of Sale: Similar to the Golf Cart Bill of Sale, this form is used when transferring ownership of a boat. It contains information about the boat's specifications and the parties involved in the sale.

- ATV Bill of Sale: This document is for the sale of all-terrain vehicles. It outlines the details of the transaction, including the price and condition of the ATV, much like the golf cart form.

- Motorcycle Bill of Sale: Used for motorcycle transactions, this document captures essential details about the bike and the sale. Its structure mirrors that of the Golf Cart Bill of Sale.

- Trailer Bill of Sale: This form is utilized for the sale of trailers. It includes buyer and seller information and specifics about the trailer, paralleling the golf cart sale process.

- Personal Property Bill of Sale: This document can be used for various personal items, not just vehicles. It serves a similar purpose by detailing the transaction and the items sold.

-

Emotional Support Animal Letter: This essential document allows individuals to affirm their need for a pet's emotional support, facilitating housing arrangements and travel without discrimination. If you believe you could benefit from such support, consider filling out the form by visiting PDF Documents Hub.

- Real Estate Purchase Agreement: While typically more complex, this document outlines the sale of real property. It shares the fundamental purpose of documenting a transfer of ownership, akin to the Golf Cart Bill of Sale.

- Lease Agreement: This document outlines the terms for renting a vehicle or property. Like a bill of sale, it details the parties involved and the terms of use.

- Gift Receipt: When a vehicle is given as a gift, this document can be used to acknowledge the transfer. It serves a similar purpose to a bill of sale in documenting the change of ownership.

Each of these documents plays a crucial role in ensuring that ownership is transferred legally and that both parties have a record of the transaction.

Common mistakes

Filling out the Georgia Golf Cart Bill of Sale form can seem straightforward, but many people make common mistakes that can lead to issues later on. One frequent error is not including all required information. Buyers and sellers must provide details such as the names, addresses, and contact information of both parties. Omitting any of this information can create confusion and complicate the transaction.

Another mistake is failing to accurately describe the golf cart. The form requires a clear description that includes the make, model, year, and Vehicle Identification Number (VIN). If these details are incorrect or missing, it may lead to disputes or problems with registration.

Many people overlook the importance of signing the form. Both the buyer and seller must sign the Bill of Sale for it to be legally binding. A signature from just one party renders the document incomplete. Ensure both parties sign and date the form to avoid any potential issues.

Additionally, some individuals neglect to include the sale price. The Bill of Sale should clearly state the amount paid for the golf cart. This information is crucial for both tax purposes and for the buyer to prove ownership. Not including the sale price can lead to complications with local authorities.

Another common error is not keeping a copy of the completed form. After filling out the Bill of Sale, both parties should retain a copy for their records. This serves as proof of the transaction and can be helpful if any questions arise later.

Some individuals also fail to check for typos or errors before submitting the form. Simple mistakes can lead to misunderstandings or disputes down the line. Take the time to review the document carefully before finalizing it.

Lastly, many people do not understand the importance of notarization. While it’s not always required, having the Bill of Sale notarized can add an extra layer of legitimacy to the transaction. This can be especially helpful if there are any future disputes regarding the sale.