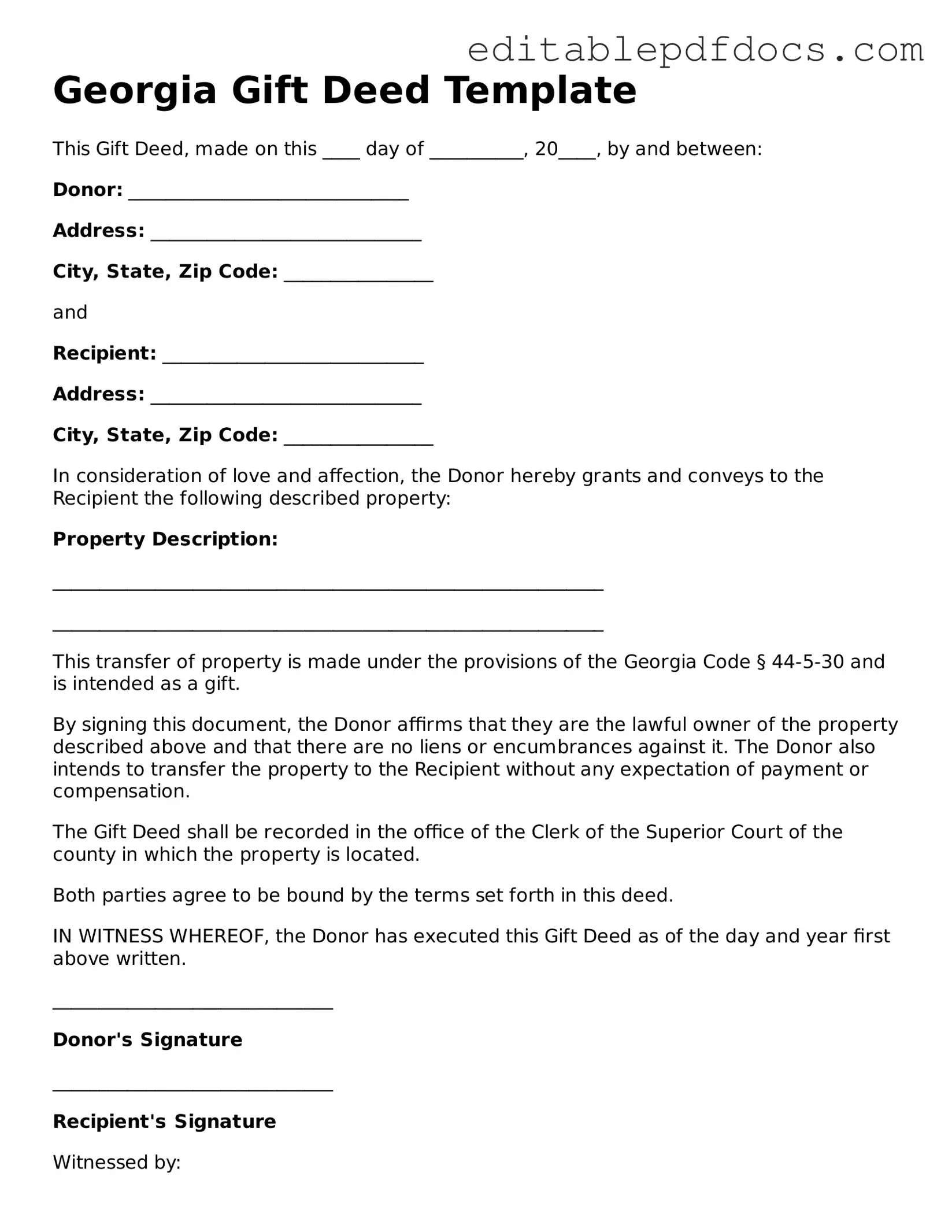

Gift Deed Document for Georgia

The Georgia Gift Deed form serves as a crucial legal instrument for transferring property ownership without the exchange of monetary compensation. This document allows individuals to convey real estate or personal property as a gift, ensuring that the transfer is executed with clear intent and proper documentation. Essential components of the form include the names of both the donor and the recipient, a detailed description of the property being gifted, and the signatures of all parties involved. Additionally, the form may require notarization to validate the transaction, providing an extra layer of authenticity. Understanding the implications of a gift deed is vital, as it can impact tax liabilities and future ownership rights. Whether it’s a family heirloom or a piece of real estate, using the Georgia Gift Deed form helps ensure that the transfer of ownership is legally recognized and honored.

File Information

| Fact Name | Description |

|---|---|

| Purpose | A Georgia Gift Deed is used to transfer property ownership as a gift without any exchange of money. |

| Governing Laws | This deed is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-5-30 et seq. |

| Requirements | The form must be signed by the donor and notarized to be legally valid. |

| Tax Implications | Gift deeds may have tax consequences, and it is advisable to consult a tax professional. |

Dos and Don'ts

When filling out the Georgia Gift Deed form, it is crucial to approach the process with care to ensure that all necessary information is accurately provided. Below are some important dos and don'ts to consider:

- Do ensure that the names of the donor and the recipient are clearly stated.

- Do include a complete legal description of the property being gifted.

- Do sign the form in the presence of a notary public to validate the deed.

- Do check for any applicable taxes or fees that may arise from the gift transfer.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank; incomplete forms can lead to delays.

- Don't forget to provide the date of the gift; this is essential for legal purposes.

- Don't use vague terms to describe the property; clarity is key.

- Don't overlook the need for witnesses if required by local laws.

- Don't assume that verbal agreements are sufficient; written documentation is necessary.

Documents used along the form

When preparing a Georgia Gift Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. Each of these documents serves a specific purpose and helps clarify the details of the gift. Below is a list of commonly used forms that accompany a Gift Deed.

- Warranty Deed: This document guarantees that the grantor has clear title to the property and has the right to transfer it. It provides reassurance to the recipient about the ownership status.

- Quitclaim Deed: Unlike a warranty deed, this form transfers whatever interest the grantor has in the property without any guarantees. It’s often used when the relationship between parties is trust-based.

- Property Transfer Affidavit: This affidavit provides information about the property transfer to the local tax office. It helps ensure that the property records are updated accurately.

- Gift Tax Return (Form 709): If the value of the gift exceeds a certain amount, the donor may need to file this federal tax form. It reports gifts made during the year and calculates any potential gift tax owed.

- Title Search Report: This report details the property’s ownership history and any liens or encumbrances. It helps confirm that the property is free of legal issues before the transfer.

- Affidavit of Identity: This document verifies the identity of the parties involved in the transaction. It can help prevent fraud and ensure that all parties are who they claim to be.

- Notarized Signature: A notary public must witness the signing of the Gift Deed. This adds a layer of authenticity and can be required for the deed to be legally binding.

- Property Description: A detailed description of the property being gifted is often included. This ensures that there is no confusion about what is being transferred.

- Affidavit of Correction: This document is essential for rectifying any small errors in Texas official records, such as those found in titles or deeds. For more information and to access the form, visit https://texasformspdf.com/fillable-affidavit-of-correction-online/.

- Letter of Intent: Although not always required, this letter can express the donor’s wishes regarding the gift. It may clarify the purpose of the gift and any conditions attached.

Having these documents ready can simplify the process of transferring property as a gift. Each form plays a vital role in ensuring that the transaction is clear, legal, and secure for all parties involved.

Consider Some Other Gift Deed Templates for US States

Transfer Deed to Family Member - Each petty circumstance in a transaction can influence the terms of the deed.

The New York Mobile Home Bill of Sale form serves as a legal document recording the sale and transfer of ownership of a mobile home from the seller to the buyer. It outlines the details of the transaction, ensuring both parties are clear about the terms and conditions. For those looking for a template to facilitate this process, the form can be found at nyforms.com/mobile-home-bill-of-sale-template/. This form is essential for the legality of the mobile home sale, providing proof of purchase and ownership change.

Similar forms

Warranty Deed: This document transfers ownership of property and guarantees that the title is clear. Like a gift deed, it requires the consent of both parties but offers more protection to the buyer.

Quitclaim Deed: This type of deed transfers whatever interest the grantor has in the property without any warranties. It is similar to a gift deed in that it is often used for family transfers or gifts.

Transfer on Death Deed: This document allows property to pass directly to a beneficiary upon the owner's death, similar to a gift deed in that it facilitates the transfer of property without going through probate.

Bill of Sale: This document transfers ownership of personal property. Like a gift deed, it can be used to document a transfer without payment, ensuring clarity in ownership.

Trust Agreement: A trust can hold property for the benefit of others, similar to how a gift deed transfers property for no consideration. Both documents serve to clarify ownership and intentions.

Lease Agreement: While primarily for renting, a lease can sometimes include provisions for gifting property rights. Both documents require mutual consent and outline the terms of the transfer.

Power of Attorney: This document allows one person to act on another's behalf, which can include transferring property. Like a gift deed, it involves the voluntary transfer of rights.

Affidavit of Heirship: This document can establish the heirs of a deceased person and facilitate the transfer of property without a will. It shares similarities with a gift deed in terms of property transfer without monetary exchange.

- California Lease Agreement: The Fillable Forms can assist landlords and tenants in creating a legally binding contract that outlines the specifics of the rental arrangement, ensuring clear communication and reducing potential conflicts.

Deed of Trust: This secures a loan with real property and involves three parties. While it is primarily for securing debt, it also involves the transfer of property rights, akin to a gift deed.

Assignment Agreement: This document allows one party to transfer their rights or obligations under a contract to another party. Like a gift deed, it involves a voluntary transfer of interests.

Common mistakes

Filling out a Georgia Gift Deed form can be a straightforward process, but several common mistakes can lead to complications. One frequent error is failing to include the full legal names of both the donor and the recipient. It is essential to ensure that the names match the names on their respective identification documents. Omitting or misspelling names can create confusion and may invalidate the deed.

Another mistake often made is neglecting to provide a complete and accurate description of the property being gifted. The description should include not just the address, but also any specific details that clearly identify the property. Without this information, the deed may not properly convey ownership, leading to potential disputes in the future.

Some individuals overlook the importance of having the Gift Deed notarized. In Georgia, a Gift Deed must be signed in the presence of a notary public to be legally binding. Failing to obtain a notarization can result in the deed being considered invalid, which means the gift may not be recognized by the state.

Additionally, people sometimes forget to include the date of the gift. This date is crucial as it establishes when the transfer of ownership occurs. Without a clear date, there may be uncertainty regarding the timing of the gift, which could affect tax implications or the rights of other parties.

Lastly, individuals may not be aware of the tax implications associated with gifting property. While there may be no immediate tax due upon the transfer, it is important to understand any potential future tax liabilities. Consulting with a tax professional can provide clarity and ensure that all parties are informed of their responsibilities.