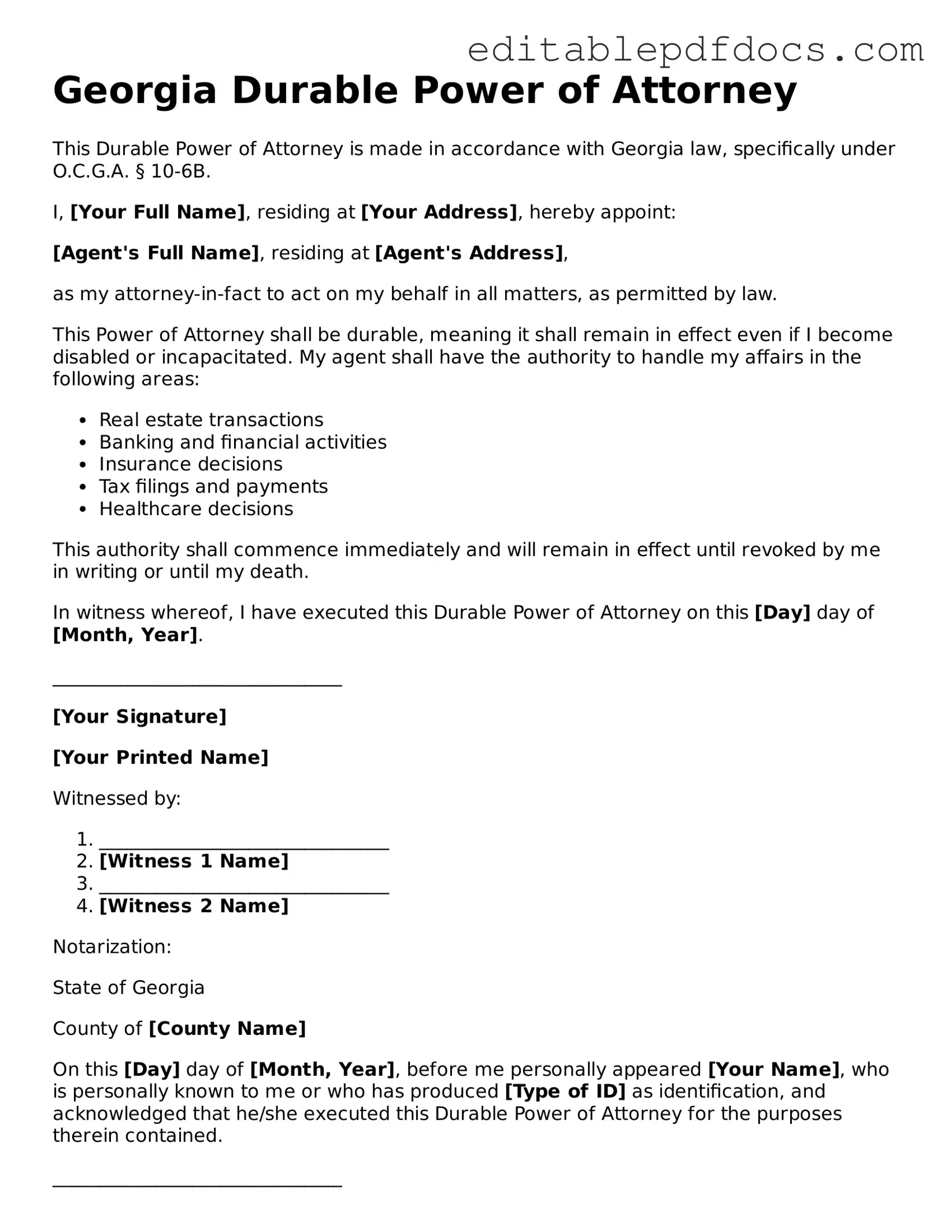

Durable Power of Attorney Document for Georgia

When it comes to planning for the future, understanding the Georgia Durable Power of Attorney (DPOA) form is essential. This legal document empowers a trusted individual, often referred to as an agent or attorney-in-fact, to make important financial and legal decisions on your behalf if you become unable to do so yourself. The DPOA remains effective even if you lose the capacity to make decisions, providing peace of mind that your affairs will be handled according to your wishes. In Georgia, the form must be signed in the presence of a notary public and can be customized to fit your specific needs, allowing you to specify the extent of the powers granted. It's crucial to choose someone you trust completely, as this person will have significant authority over your financial matters, including managing bank accounts, selling property, and paying bills. Additionally, the DPOA can be tailored to become effective immediately or only upon the onset of incapacity, giving you flexibility in how you want it to function. Understanding these key aspects will help you navigate the process with confidence and ensure that your interests are protected.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Georgia Durable Power of Attorney allows an individual (the principal) to designate another person (the agent) to make financial decisions on their behalf. |

| Governing Law | The form is governed by the Georgia Uniform Power of Attorney Act, found in O.C.G.A. § 10-6B-1 et seq. |

| Durability | This power of attorney remains effective even if the principal becomes incapacitated. |

| Agent's Authority | The agent can manage financial matters, including banking, real estate transactions, and tax filings. |

| Execution Requirements | The form must be signed by the principal and witnessed by two individuals or notarized. |

| Revocation | The principal can revoke the power of attorney at any time as long as they are mentally competent. |

| Limitations | Certain powers, such as making medical decisions, require a separate document, like a healthcare power of attorney. |

| Agent's Duties | The agent must act in the best interest of the principal and keep accurate records of transactions. |

| Use of Form | The form is commonly used for estate planning and ensuring financial management during incapacity. |

Dos and Don'ts

When filling out the Georgia Durable Power of Attorney form, it is important to follow certain guidelines to ensure that the document is valid and effective. Below is a list of ten things to do and not to do during this process.

- Do clearly identify the principal and agent by providing full names and addresses.

- Do specify the powers granted to the agent in clear and understandable terms.

- Do ensure that the form is signed in the presence of a notary public.

- Do date the document to indicate when it was executed.

- Do keep a copy of the signed document for your records.

- Don't leave any sections of the form blank; fill in all required information.

- Don't use vague language that could lead to misunderstandings about the powers granted.

- Don't sign the form without understanding its implications and the powers being granted.

- Don't allow anyone else to sign on behalf of the principal unless authorized.

- Don't forget to review the document periodically to ensure it still meets your needs.

Documents used along the form

A Georgia Durable Power of Attorney is an important document that allows an individual to appoint someone else to make decisions on their behalf. However, there are other forms and documents that often complement this power of attorney. Below is a list of five commonly used documents.

- Advance Healthcare Directive: This document outlines a person's healthcare preferences and appoints a healthcare agent to make medical decisions if they are unable to do so.

- Living Will: A living will specifies a person's wishes regarding medical treatment in situations where they cannot communicate their desires, particularly at the end of life.

- Goods Transfer Receipt: When engaging in sales, it's important to document the transfer of ownership with a Goods Transfer Receipt, ensuring transparency and accountability in the transaction.

- Will: A will details how a person's assets should be distributed after their death and can name guardians for minor children.

- Revocable Living Trust: This trust allows an individual to manage their assets during their lifetime and specifies how those assets will be distributed after their death, avoiding probate.

- HIPAA Release Form: This form permits designated individuals to access a person's medical records and health information, ensuring that they can make informed decisions about healthcare.

These documents work together to provide comprehensive planning for personal, medical, and financial matters. It is advisable to consider these forms to ensure that your wishes are respected and that your affairs are managed according to your preferences.

Consider Some Other Durable Power of Attorney Templates for US States

Free Power of Attorney Form Tennessee - Emergency services can access your Durable Power of Attorney during a critical situation to guide their actions legally.

Completing the Florida Sales Tax form accurately is essential for compliance and to avoid penalties, making it important for taxpayers to understand the information required. For more detailed guidance on the form, you can read the document that provides comprehensive instructions on filling it out correctly.

Durable Power of Attorney Forms - This document serves to protect your assets and ensure they are managed according to your wishes.

How to File for Power of Attorney in Florida - Potential agents should understand the responsibilities they undertake and acknowledge their commitment to the principal's welfare.

Similar forms

- Health Care Proxy: This document allows an individual to appoint someone to make medical decisions on their behalf if they become unable to do so. Like the Durable Power of Attorney, it grants authority to another person, but it specifically focuses on health-related matters.

- Shipping Documentation: Proper documentation is vital in freight shipping, ensuring all parties understand their responsibilities and obligations; for example, the Fillable Forms provide essential templates for tasks such as creating a FedEx Bill of Lading, which is crucial for tracking and confirming shipments.

- Living Will: A Living Will outlines an individual's preferences regarding medical treatment in situations where they cannot express their wishes. While a Durable Power of Attorney can cover broader financial and legal matters, a Living Will specifically addresses end-of-life care and medical interventions.

- Financial Power of Attorney: This document is similar to the Durable Power of Attorney but is often more limited in scope. It grants authority to manage financial affairs, such as banking and property transactions. However, the Durable Power of Attorney can encompass a wider range of decisions, including health care and legal matters.

- Trust Agreement: A Trust Agreement allows an individual to place assets into a trust for the benefit of others. While the Durable Power of Attorney empowers someone to act on your behalf, a Trust Agreement involves the transfer of property and assets to a trustee, who manages them according to specified terms.

Common mistakes

Filling out a Georgia Durable Power of Attorney form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is not specifying the powers granted. When individuals simply check a box for “general powers,” they might overlook important details. It’s crucial to clearly outline what decisions the agent can make, whether it’s related to financial matters, healthcare, or property management.

Another mistake is failing to date the document. A Durable Power of Attorney is only valid if it is properly dated. Without a date, it may be questioned whether the form is current or if it reflects the most recent wishes of the principal. Always ensure that the date is clear and visible.

Some individuals neglect to sign the document in front of a notary public. In Georgia, notarization is a vital step in making the Durable Power of Attorney legally binding. Without this step, the document may not hold up in legal situations, leading to confusion and potential disputes.

Additionally, people often forget to designate a successor agent. Life can be unpredictable, and the person you choose as your primary agent may not always be available to act on your behalf. By naming a successor, you ensure that someone else can step in if needed.

Misunderstanding the role of the agent can also lead to mistakes. The agent is not merely a figurehead; they have significant responsibilities. It’s essential to choose someone trustworthy and capable of handling the tasks assigned to them. Failing to do so can result in mismanagement of your affairs.

Another common oversight is not discussing the Durable Power of Attorney with the chosen agent beforehand. It’s important for the agent to understand their responsibilities and be willing to accept the role. Open communication can help prevent misunderstandings and ensure that your wishes are honored.

Some people forget to review and update their Durable Power of Attorney as circumstances change. Life events such as marriage, divorce, or the death of a designated agent can affect your choices. Regularly reviewing the document ensures it reflects your current situation and intentions.

Finally, individuals sometimes overlook the importance of keeping copies of the completed form. After signing and notarizing, it’s wise to distribute copies to relevant parties, such as the agent, family members, or financial institutions. This ensures that everyone involved is aware of your wishes and can act accordingly when the time comes.