Deed Document for Georgia

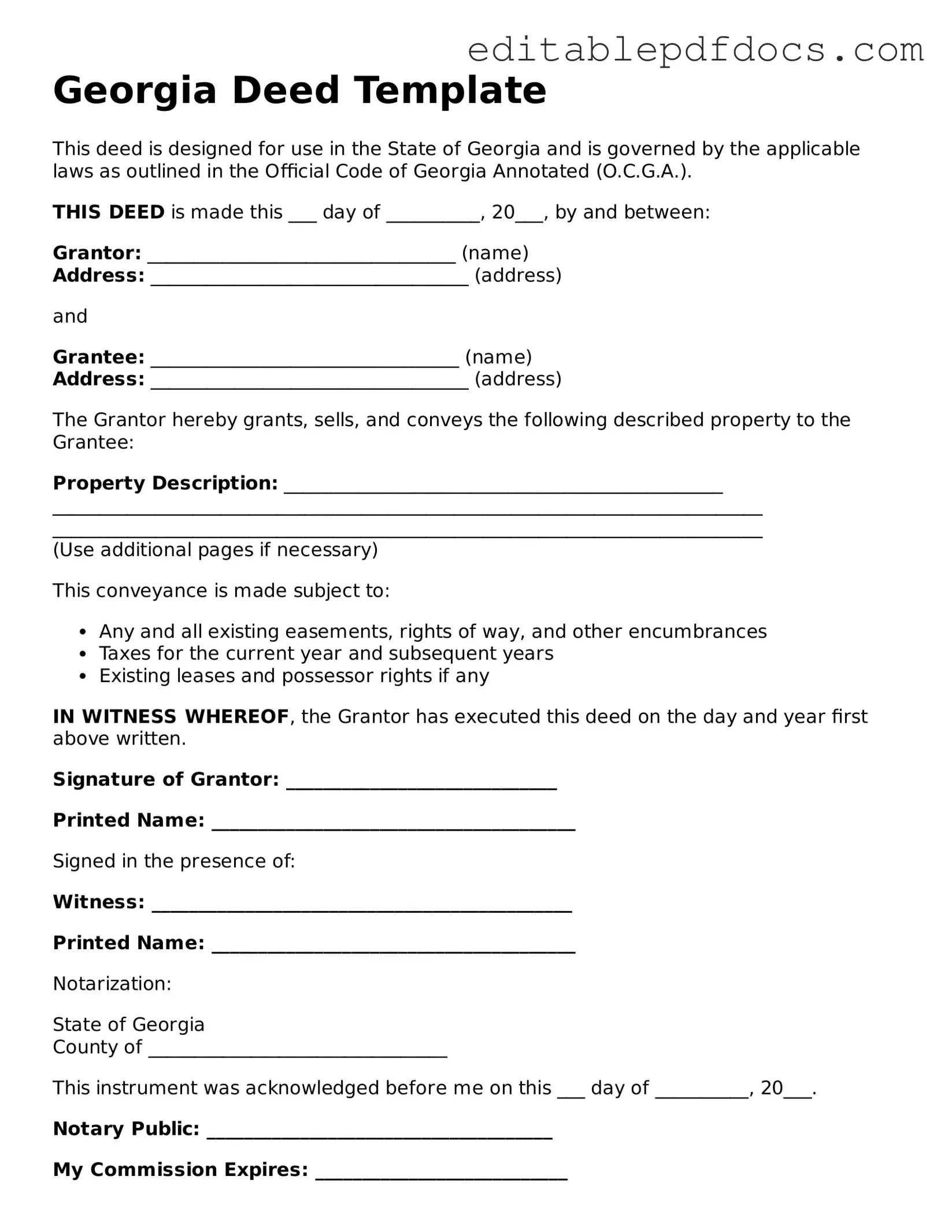

The Georgia Deed form is a crucial legal document used in real estate transactions within the state of Georgia. It serves as a formal instrument to transfer ownership of property from one party to another. Understanding the key elements of this form is essential for both buyers and sellers. The deed typically includes details such as the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a description of the property being conveyed, and any relevant terms or conditions of the transfer. It may also specify the type of deed being used, such as a warranty deed or a quitclaim deed, each offering different levels of protection for the grantee. Additionally, the form must be signed and notarized to be legally valid, and it often requires recording with the county clerk to provide public notice of the change in ownership. Navigating the Georgia Deed form correctly is vital to ensure a smooth transaction and protect the interests of all parties involved.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Deed form is used to transfer ownership of real property from one party to another. |

| Governing Law | This form is governed by the laws of the State of Georgia, specifically under O.C.G.A. § 44-2-1 et seq. |

| Types of Deeds | Common types of deeds in Georgia include warranty deeds, quitclaim deeds, and security deeds. |

| Recording | To ensure legal protection, the completed deed must be recorded in the county where the property is located. |

Dos and Don'ts

When filling out the Georgia Deed form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check all names and addresses for accuracy.

- Do use clear and legible handwriting or type the information.

- Do include the correct legal description of the property.

- Do sign the deed in front of a notary public.

- Don't leave any blank spaces on the form.

- Don't forget to include the date of the transaction.

Following these guidelines can help prevent delays or issues with the deed. Make sure to review everything carefully before submission.

Documents used along the form

When dealing with property transactions in Georgia, it's essential to have a complete set of documents to ensure a smooth process. Alongside the Georgia Deed form, there are several other important forms that often come into play. Here’s a brief overview of some of these documents.

- Property Disclosure Statement: This document provides potential buyers with information about the condition of the property. Sellers must disclose any known issues, which helps buyers make informed decisions.

- Closing Disclosure: This form outlines the final terms of the loan and the closing costs associated with the property purchase. It must be provided to the buyer at least three days before closing.

- Non-disclosure Agreement: When handling confidential information, ensure legal protection with a thorough Non-disclosure Agreement template to safeguard sensitive data.

- Title Search Report: A title search report verifies the legal ownership of the property and identifies any liens or claims against it. This document is crucial for ensuring that the seller has the right to sell the property.

- Bill of Sale: This document transfers ownership of personal property associated with the real estate, such as appliances or fixtures. It serves as proof of the transaction between the buyer and seller.

Having these documents ready can help streamline the property transaction process. Each plays a vital role in ensuring that both parties are protected and informed throughout the sale.

Consider Some Other Deed Templates for US States

Florida Deed Form - Used to convey title from one party to another.

The Free And Invoice PDF form is a simple and effective tool designed to assist individuals and businesses in creating professional-looking invoices. This form streamlines the billing process, making it easier to track payments and manage finances. For those seeking enhanced functionality, incorporating Fillable Forms can provide additional customization options, ensuring clarity and efficiency in communication.

How to Transfer Property Title in Washington State - May be revised or updated under certain conditions.

Blank Deed Form - Pdf - Some property transactions may require special types of deeds to comply with specific legal needs.

Similar forms

The Deed form is a crucial document in property transactions, but it shares similarities with several other legal documents. Each of these documents serves a unique purpose while also facilitating the transfer or acknowledgment of rights and ownership. Below is a list of documents that are similar to the Deed form, along with a brief explanation of how they relate.

- Title Insurance Policy: This document provides protection against any claims or disputes regarding ownership of the property. Like a deed, it confirms the ownership rights and ensures that the buyer has clear title to the property.

- Bill of Sale: Often used for personal property transactions, a bill of sale serves as proof of transfer of ownership. Similar to a deed, it outlines the details of the transaction and the parties involved.

- Quitclaim Deed: This type of deed transfers whatever interest the grantor has in the property without any warranties. It is similar to a standard deed but is often used in situations where the parties know each other well, such as family transfers.

- Warranty Deed: This document guarantees that the grantor holds clear title to the property and has the right to sell it. It is similar to a deed but offers additional protections to the buyer regarding potential claims against the property.

- Lease Agreement: A lease outlines the terms under which one party can use another party's property. While it does not transfer ownership, it establishes rights similar to those conveyed in a deed for the duration of the lease.

- Asset Transfer Form: The transfer of personal property is formalized through a Bill of Sale, enabling clear ownership documentation, similar to the Asset Transfer Form.

- Power of Attorney: This document grants one person the authority to act on behalf of another in legal matters. It can be used in property transactions, similar to a deed, to facilitate the transfer of ownership when the owner cannot be present.

- Trust Agreement: A trust can hold property on behalf of beneficiaries. While a deed transfers ownership, a trust agreement specifies how property is managed and distributed, highlighting the relationship between ownership and control.

- Affidavit of Heirship: This document establishes the heirs of a deceased person and their rights to the property. It serves a similar purpose to a deed in that it clarifies ownership and rights, especially when formal probate is not pursued.

Common mistakes

Filling out a Georgia Deed form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is not including the correct names of the parties involved. Ensure that the names of the grantor (the seller) and grantee (the buyer) are spelled correctly and match the names on their identification documents. Omitting or misspelling a name can invalidate the deed.

Another mistake is failing to provide a complete legal description of the property. This description should be precise and detailed, allowing anyone to identify the property without ambiguity. Relying on vague terms or general descriptions can cause issues down the line, especially if disputes arise regarding property boundaries.

Many individuals also overlook the requirement for notarization. A Georgia Deed must be signed in the presence of a notary public to be legally binding. Skipping this step can render the document ineffective. Always check that the notary has signed and stamped the document before submission.

Additionally, people often forget to include the date of the transaction. The date is essential for establishing the timeline of ownership and can affect the validity of the deed. Be sure to write the date clearly in the designated space on the form.

Another common oversight is neglecting to pay the appropriate transfer tax. Georgia requires a tax to be paid when a deed is recorded. Not including this payment can delay the recording process and may lead to additional fees. Always verify the current tax rates to ensure compliance.

Some filers mistakenly believe that a single copy of the deed is sufficient. It is crucial to retain copies for personal records and to provide one to each party involved in the transaction. Keeping accurate records can prevent misunderstandings and provide proof of ownership.

Finally, individuals sometimes fail to file the deed with the appropriate county office. After completing the form, it must be recorded in the county where the property is located. Not filing can lead to complications in establishing ownership and may affect future transactions. Always confirm that the deed has been properly recorded.