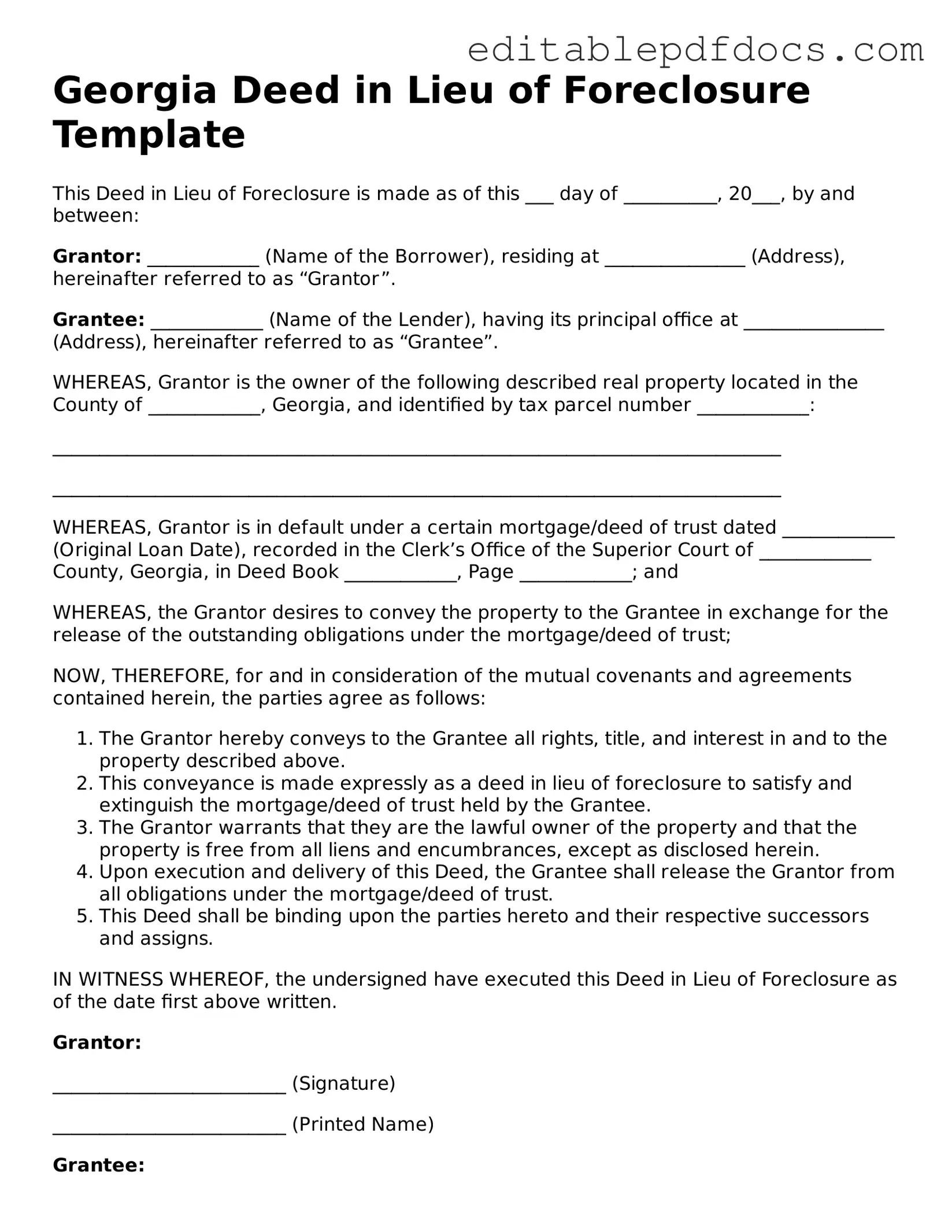

Deed in Lieu of Foreclosure Document for Georgia

In Georgia, homeowners facing financial difficulties may find relief through the Deed in Lieu of Foreclosure process. This option allows a homeowner to voluntarily transfer their property to the lender, thereby avoiding the lengthy and often stressful foreclosure process. By signing a Deed in Lieu of Foreclosure, the homeowner relinquishes their ownership rights, while the lender agrees to cancel the mortgage obligation. This arrangement can be beneficial for both parties: the homeowner can escape the burden of an unmanageable mortgage, and the lender can recover the property without the need for court proceedings. It’s important to understand the implications of this form, including potential impacts on credit scores and tax liabilities. Additionally, the process typically requires the homeowner to demonstrate their financial hardship and may involve negotiations regarding any remaining debt after the transfer. Overall, the Deed in Lieu of Foreclosure serves as a viable alternative for those seeking to navigate the challenges of homeownership in difficult economic times.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | In Georgia, the process is governed by state laws related to real estate and foreclosure, primarily found in O.C.G.A. § 44-14-162. |

| Benefits | This option can help borrowers avoid the lengthy and costly foreclosure process, protecting their credit score more than a foreclosure would. |

| Requirements | Borrowers must typically demonstrate financial hardship and may need to obtain the lender's approval to proceed with a Deed in Lieu of Foreclosure. |

Dos and Don'ts

When filling out the Georgia Deed in Lieu of Foreclosure form, it’s important to approach the process carefully. Here are some things you should and shouldn't do:

- Do ensure all information is accurate and complete.

- Do consult with a lawyer if you have any questions.

- Do keep copies of all documents for your records.

- Do understand the implications of signing the deed.

- Do notify your lender before proceeding with the deed.

- Don't rush through the form; take your time to review it.

- Don't leave any sections blank unless instructed.

- Don't sign the document without reading it thoroughly.

- Don't ignore any potential tax consequences.

- Don't hesitate to ask for help if you’re unsure about any part of the process.

Taking these steps can help ensure that you fill out the form correctly and understand what you are agreeing to.

Documents used along the form

When navigating the process of a Deed in Lieu of Foreclosure in Georgia, several other forms and documents may be necessary. These documents help clarify the terms and protect the interests of all parties involved. Here’s a list of commonly used forms that accompany the Deed in Lieu of Foreclosure:

- Loan Modification Agreement: This document outlines any changes to the original loan terms. It can help borrowers keep their homes by adjusting payment amounts or interest rates.

- Notice of Default: This is a formal notice sent to the borrower when they have missed payments. It serves as a warning that foreclosure proceedings may begin.

- IRS Form 2553: This form is critical for small businesses aiming to elect S Corporation status, which can lead to significant tax benefits. For more information, visit https://topformsonline.com.

- Release of Liability: This document releases the borrower from any further obligation on the loan after the deed is transferred. It protects the borrower from future claims related to the mortgage.

- Property Condition Disclosure: This form details the condition of the property. It helps the lender assess the property's value and informs the borrower of any issues that need addressing.

- Title Search Report: This report confirms the ownership of the property and checks for any liens or claims against it. It ensures that the title is clear before the transfer takes place.

- Settlement Statement: This document outlines all financial transactions related to the deed transfer. It includes costs, fees, and any adjustments made during the process.

- Affidavit of Title: This sworn statement confirms that the seller has the right to transfer the property. It assures the buyer that there are no undisclosed issues with the title.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. It can be useful if the borrower cannot be present during the signing process.

Having these documents prepared can streamline the process and help ensure a smoother transition during a Deed in Lieu of Foreclosure. Each form plays a vital role in protecting both the borrower and the lender, making it essential to understand their purpose.

Consider Some Other Deed in Lieu of Foreclosure Templates for US States

Deed in Lieu of Mortgage - In many cases, a Deed in Lieu can help homeowners regain peace of mind as they move forward with their lives.

The importance of having a well-drafted New York Last Will and Testament cannot be overstated, as it provides peace of mind by ensuring that your wishes regarding the distribution of your estate are respected. This essential document not only specifies the allocation of your assets but also allows you to appoint a guardian for your minor children. For those looking to create their own will, a reliable resource can be found at nyforms.com/last-will-and-testament-template/.

California Voluntary Foreclosure Deed - This agreement is typically easier to negotiate than a foreclosure and often involves less paperwork.

Similar forms

The Deed in Lieu of Foreclosure is a significant document in the realm of real estate and mortgage agreements. It allows a homeowner to voluntarily transfer their property to the lender in exchange for the cancellation of their mortgage debt. Several other documents share similarities with this form. Here are five such documents:

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Like a Deed in Lieu, it helps avoid foreclosure, but it involves selling the property rather than transferring it directly to the lender.

- Loan Modification Agreement: This document changes the terms of an existing loan to make it more manageable for the homeowner. While it doesn’t involve transferring the property, both documents aim to prevent foreclosure by providing relief to the borrower.

- Forebearance Agreement: This is a temporary arrangement where the lender agrees to pause or reduce mortgage payments for a specified period. Both this agreement and a Deed in Lieu are tools to help borrowers avoid foreclosure, albeit through different means.

- Quitclaim Deed: This document allows a property owner to transfer their interest in a property to another party without any warranties. Similar to a Deed in Lieu, it involves transferring ownership, but it does not address the mortgage debt directly.

-

Employment Verification Form: The California Employment Verification form assists in confirming an individual's employment status, serving as proof of employment when required by prospective employers. Understanding this document is crucial for job seekers and employers alike in California's hiring landscape. For more details, you can refer to Fillable Forms.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a way to restructure debts. Like a Deed in Lieu, it aims to protect the homeowner from losing their property, but it involves a legal process rather than a direct transfer of ownership.

Understanding these documents can empower homeowners facing financial difficulties. Each option has its own implications, and knowing the differences can lead to better decisions during challenging times.

Common mistakes

Filling out the Georgia Deed in Lieu of Foreclosure form requires careful attention to detail. One common mistake is failing to provide accurate property information. This includes the correct legal description of the property and the proper address. Inaccuracies can lead to delays or even invalidate the deed.

Another frequent error is neglecting to include all necessary signatures. All parties involved in the transaction must sign the document. If a spouse or co-owner does not sign, it may create legal complications down the line. Ensuring that everyone’s signature is present is crucial.

Many people also overlook the importance of notarization. The deed must be notarized to be legally binding. Without a notary’s seal, the document may not be accepted by the lender or recorded by the county. It’s essential to have a qualified notary witness the signing of the deed.

Lastly, individuals often forget to check for any outstanding liens or encumbrances on the property. If there are existing debts tied to the property, the deed in lieu may not be sufficient to clear them. It’s wise to conduct a title search beforehand to avoid unexpected issues.