Fill a Valid Generic Direct Deposit Template

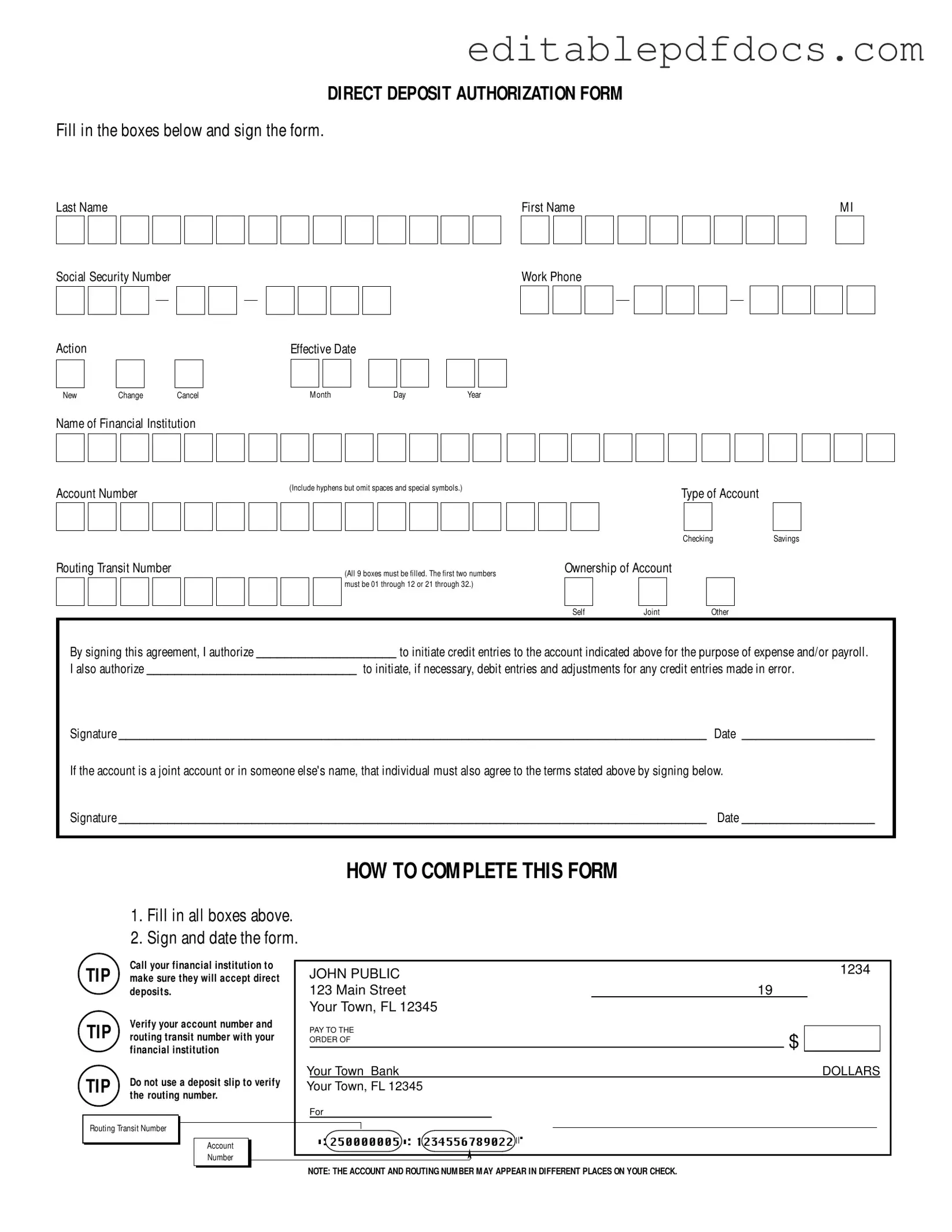

The Generic Direct Deposit form is an essential tool for individuals looking to streamline their payment process. By using this form, you can authorize your employer or other entities to deposit funds directly into your bank account, which simplifies receiving payments such as wages or reimbursements. The form requires you to provide your personal information, including your name, Social Security number, and contact details, ensuring that your payments are accurately directed to you. You will also need to specify the financial institution where your account is held, along with the account number and routing transit number. These details are crucial, as they ensure that the funds reach the correct destination without delay. Additionally, you have the option to indicate whether the account is a joint account or solely in your name, which is important for compliance with banking regulations. Signing the form signifies your consent for your employer to initiate deposits and, if necessary, make adjustments for any errors. Completing the form is straightforward, but it is vital to verify all information with your bank to avoid complications. This form not only enhances the convenience of receiving payments but also provides peace of mind, knowing that your funds will be handled efficiently and securely.

Document Details

| Fact Name | Description |

|---|---|

| Form Purpose | This form authorizes the direct deposit of funds into a specified bank account. |

| Required Information | Individuals must provide their name, Social Security number, and account details. |

| Account Types | Depositors can choose between a savings or checking account for the direct deposit. |

| Routing Number | The routing transit number must consist of 9 digits and must be verified with the financial institution. |

| Ownership Types | Account ownership can be designated as self, joint, or other. |

| Signatures Required | Both the account holder and any joint account holders must sign the form. |

| Effective Date | The form allows for new, change, or cancellation of direct deposit, effective from the specified date. |

| Verification Tips | Individuals should verify account and routing numbers with their financial institution before submission. |

| Governing Laws | Direct deposit regulations are governed by the Electronic Fund Transfer Act (EFTA) and applicable state laws. |

Dos and Don'ts

When filling out the Generic Direct Deposit form, it's crucial to ensure accuracy and clarity. Here’s a list of things you should and shouldn’t do to avoid any issues:

- Do fill in all boxes completely to prevent delays in processing your deposit.

- Do sign and date the form to validate your authorization.

- Do verify your account number and routing transit number with your financial institution.

- Do ensure that the routing number is correct; it should be all nine digits without any spaces or special symbols.

- Don't use a deposit slip to verify the routing number, as this can lead to mistakes.

- Don't forget to include your Social Security Number, as it is often required for identification purposes.

- Don't leave any boxes blank; incomplete forms may be rejected or delayed.

Documents used along the form

When completing the Generic Direct Deposit form, several other forms and documents may be required to ensure a smooth process. Each of these documents serves a specific purpose in facilitating direct deposit and maintaining accurate financial records.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from paychecks.

- Bank Verification Letter: A letter from the financial institution confirming the account details, such as account number and routing number. This document ensures that the correct account is used for direct deposits.

- Employee Information Form: This form collects personal details about the employee, such as contact information and emergency contacts, which may be necessary for payroll and HR purposes.

- Payroll Authorization Form: This document authorizes the employer to process payroll and make direct deposits into the employee's account. It outlines the employee's payment preferences.

- Tax Identification Number (TIN) Form: This form is used to provide the employer with the employee’s TIN, which is necessary for tax reporting purposes.

- Change of Direct Deposit Form: If an employee wishes to change their direct deposit details, this form allows them to update their bank account information while ensuring that payments continue without interruption.

- Vehicle Sale Receipt: A critical document for those transferring vehicle ownership, ensuring that all details are accurately recorded and both parties are protected. It can be accessed here: Vehicle Sale Receipt.

- Direct Deposit Cancellation Form: This form is used to cancel an existing direct deposit arrangement. It ensures that no further deposits are made to the specified account.

- Consent to Electronic Communications: This document grants permission for the employer to send payroll information and other communications electronically, facilitating timely updates and notifications.

Having these documents ready can streamline the direct deposit setup process and help avoid any potential issues. Ensure that each form is filled out accurately and submitted as required to facilitate a smooth transition to direct deposit.

Popular PDF Forms

I864 - The form helps assess the likelihood of financial stability for new immigrants.

To streamline your delivery experience, using the FedEx Release Form can be highly beneficial, as it allows you to authorize package deliveries without a signature. This form not only enables you to specify a preferred drop-off location but also ensures that you won't miss your delivery when you're not home. For those looking to simplify the process, there are helpful resources available, including Fillable Forms that you can utilize for convenience.

Credit Application Form - Indicate your desired credit limit to establish your financing needs.

Similar forms

- W-4 Form: This form is used by employees to inform their employer of their tax withholding preferences. Like the Direct Deposit form, it requires personal information and signatures to authorize actions regarding payments.

- Non-disclosure Agreement Form: To safeguard sensitive information, refer to the necessary Non-disclosure Agreement details to ensure proper confidentiality measures are in place.

- Bank Account Application: When opening a new bank account, individuals must provide similar details, such as their name, Social Security number, and account preferences. Both forms require verification of the account holder's identity.

- Payroll Authorization Form: This document allows employees to authorize their employer to pay them via direct deposit. It also includes personal information and requires a signature, similar to the Direct Deposit form.

- Expense Reimbursement Form: Employees use this form to request reimbursement for work-related expenses. Like the Direct Deposit form, it requires a signature and may include banking information for processing payments.

- Direct Deposit Change Form: This form is specifically for individuals who wish to change their direct deposit information. It is similar to the Generic Direct Deposit form in that it collects account details and requires a signature to authorize changes.

Common mistakes

Filling out a Generic Direct Deposit form may seem straightforward, but there are several common mistakes that individuals often make. Awareness of these errors can help ensure a smooth process when setting up direct deposit for payroll or expenses.

One frequent mistake is failing to fill in all the required boxes. Each section of the form must be completed, including names, Social Security numbers, and account details. Omitting any information can lead to delays or even rejection of the application.

Another common error involves the routing transit number. This number is critical for directing funds to the correct bank account. People sometimes misread this number or fail to verify it with their financial institution. It is important to ensure that all nine digits are entered correctly, as even one incorrect digit can cause funds to be misdirected.

Additionally, individuals may confuse the account number with the routing number. Each serves a different purpose and must be entered in the correct field. Double-checking both numbers with the bank can prevent this mix-up.

Some people also forget to indicate the type of account—whether it is a checking or savings account. This selection is essential, as it informs the financial institution where to deposit the funds. Leaving this blank can lead to confusion and potential errors in processing.

Another mistake occurs when individuals do not sign and date the form. A signature is a necessary part of the authorization process. Without it, the financial institution cannot process the direct deposit request. This step is often overlooked, especially if someone is in a hurry to submit the form.

In cases where the account is a joint account, both account holders must sign the form. Failing to obtain the necessary signature from the other party can result in the form being rejected. It is important to communicate with all account holders to ensure compliance with this requirement.

Some individuals rely on deposit slips to verify their account information. However, this is not advisable, as deposit slips can sometimes contain different routing numbers or account numbers. Instead, contacting the financial institution directly for verification is the best approach.

Lastly, people may neglect to check the effective date of the action they are requesting. Whether it is a new direct deposit setup, a change, or a cancellation, ensuring that the effective date is accurate is crucial. An incorrect date can lead to funds being deposited at the wrong time or not at all.

By being mindful of these common mistakes, individuals can help ensure that their Generic Direct Deposit forms are completed correctly, facilitating a smooth and efficient process for receiving funds.