Fill a Valid Free And Invoice Pdf Template

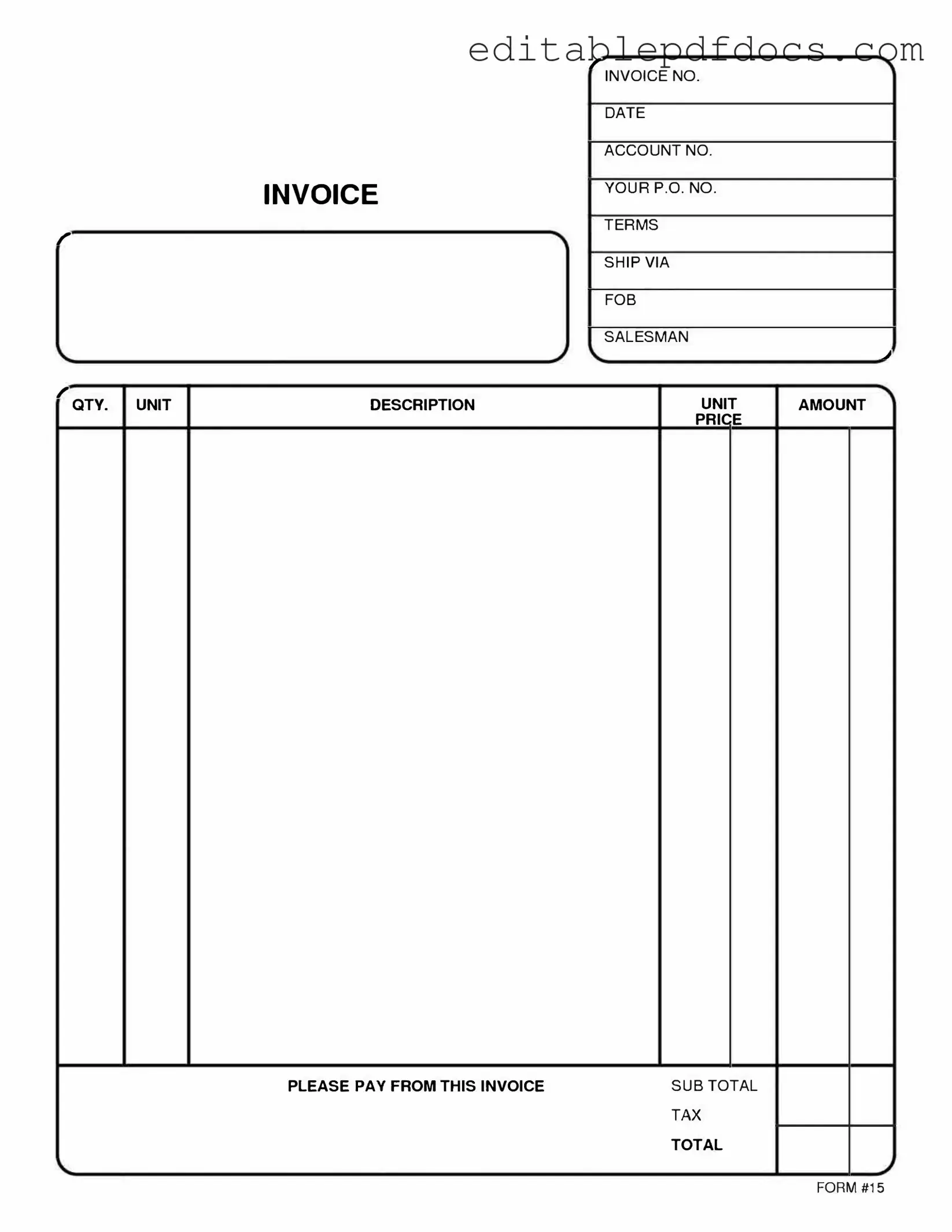

The Free And Invoice PDF form serves as a vital tool for individuals and businesses alike, streamlining the process of billing and payment collection. This form typically encompasses essential details such as the seller's and buyer's contact information, a clear description of the goods or services provided, and the total amount due. Users can customize the form to include terms of payment, due dates, and any applicable taxes, ensuring clarity and transparency in financial transactions. By utilizing this form, both parties can maintain a professional appearance while keeping accurate records of their exchanges. Furthermore, the PDF format allows for easy sharing and printing, making it accessible for various purposes. Whether for freelancers, small business owners, or large enterprises, the Free And Invoice PDF form simplifies invoicing, promotes efficient communication, and aids in financial management.

Document Details

| Fact Name | Details |

|---|---|

| Purpose | The Free And Invoice PDF form is designed to facilitate the creation and management of invoices for businesses and freelancers. |

| Accessibility | This form is available online, allowing users to easily download and fill it out as needed. |

| Customization | Users can customize the form to include their business logo, contact information, and specific payment terms. |

| Governing Laws | In the United States, invoice forms are generally governed by state-specific commercial laws, including the Uniform Commercial Code (UCC) applicable in each state. |

Dos and Don'ts

When filling out the Free And Invoice Pdf form, it is important to follow certain guidelines to ensure accuracy and efficiency. Here are five things you should and shouldn't do:

- Do: Double-check all information for accuracy before submitting.

- Do: Use clear and legible handwriting if filling out a paper form.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or slang that may confuse the reader.

Documents used along the form

When managing financial transactions, several forms and documents complement the Free And Invoice PDF form. Each of these documents plays a crucial role in ensuring clarity and accountability in business dealings. Below is a list of commonly used forms that you may encounter.

- Purchase Order: This document is issued by a buyer to a seller, detailing the types, quantities, and agreed prices for products or services. It serves as a formal agreement before the transaction is completed.

- Receipt: After a payment is made, a receipt is provided to the buyer as proof of payment. It typically includes information such as the date, amount paid, and description of the goods or services purchased.

- Credit Note: This document is issued by a seller to a buyer, indicating a reduction in the amount owed. It is often used when goods are returned or when there is an overcharge.

- Statement of Account: A summary document that outlines all transactions between a buyer and seller over a specific period. It helps both parties keep track of outstanding balances and payments.

- Sales Agreement: This contract outlines the terms and conditions of a sale, including payment terms, delivery schedules, and warranties. It provides legal protection for both the buyer and seller.

- Power of Attorney: This legal document allows one person to designate another to make decisions on their behalf, covering various areas like finances and healthcare, making it essential for proper legal delegation. For more details or to create a POA, consider the options available.

- Delivery Note: Accompanying goods during delivery, this document confirms that the items have been shipped and includes details about the contents of the shipment.

- Tax Invoice: This is a specific type of invoice that includes tax information, such as sales tax or VAT. It is essential for compliance with tax regulations and for the buyer to claim tax credits.

Understanding these documents can enhance your financial management practices. Each serves a specific purpose, contributing to smoother transactions and better record-keeping. By familiarizing yourself with these forms, you can navigate your business dealings with greater confidence and efficiency.

Popular PDF Forms

Salary Advance Agreement - Manage your finances better by requesting an early paycheck advance.

Creating a well-structured document for your estate planning is vital; our resource offers a detailed guide on how to prepare your Last Will and Testament efficiently. This ensures that your intentions regarding asset distribution are clearly presented and legally valid, providing peace of mind for you and your family.

Gift Card Template - This gift certificate can be a delightful surprise for kids, teens, and adults alike.

Similar forms

The Free And Invoice PDF form serves as a useful tool in various financial and business transactions. Here are seven other documents that share similarities with it:

- Receipt: A receipt confirms that a payment has been made. Like the invoice, it details the transaction, including the amount, date, and services or products provided.

- Purchase Order: This document is a buyer's formal request to a seller for goods or services. It outlines the specifics of the transaction, similar to how an invoice does after the order is fulfilled.

- Bill of Sale: A bill of sale serves as proof of a transaction between a buyer and seller. It includes details about the item sold, much like an invoice outlines the services rendered or products sold.

- Estimate: An estimate provides a projected cost for services or products before they are provided. It is similar to an invoice in that it outlines expected charges but is issued prior to payment.

- FedEx Release Form - This essential document allows you to authorize the delivery of your package when you are unable to be home. By filling out this form, you enable FedEx to leave your package at a specified location. For detailed instructions, visit PDF Documents Hub.

- Credit Note: A credit note is issued to a buyer when goods are returned or a service is not satisfactory. It acts as a reversal of an invoice, providing a record of adjustments made.

- Statement of Account: This document summarizes all transactions between a buyer and seller over a specific period. It provides a broader view of financial interactions, similar to how an invoice details individual transactions.

- Contract: A contract outlines the terms of a business agreement. While it doesn't serve as a request for payment like an invoice, it establishes the obligations that lead to invoicing.

Common mistakes

Filling out the Free And Invoice PDF form can be straightforward, but many individuals make common mistakes that can lead to delays or complications. One frequent error is not providing complete contact information. Missing details such as phone numbers or email addresses can hinder communication and result in processing delays.

Another common mistake is failing to accurately enter financial information. Inaccuracies in amounts or miscalculations can lead to incorrect invoicing. It is crucial to double-check all figures before submission to ensure they reflect the intended amounts.

Some individuals overlook the importance of selecting the correct payment method. Each option may have different implications for processing times and fees. Selecting an incorrect payment method can cause confusion and may require additional steps to resolve.

Additionally, not including necessary documentation can be problematic. Attachments, such as receipts or proof of service, are often required to validate claims. Omitting these documents can result in the form being returned or rejected.

Another mistake is not reviewing the form for errors before submission. Typos or incorrect information can lead to misunderstandings. A thorough review can catch these mistakes and save time in the long run.

Individuals sometimes forget to sign or date the form. An unsigned or undated document is often considered incomplete and may not be processed. Ensuring that all required signatures are present is essential for a smooth submission.

Finally, failing to keep a copy of the submitted form can create issues later. Without a record, individuals may struggle to track the status of their submission or provide proof if needed. Keeping a copy helps maintain accurate records and facilitates follow-up if necessary.