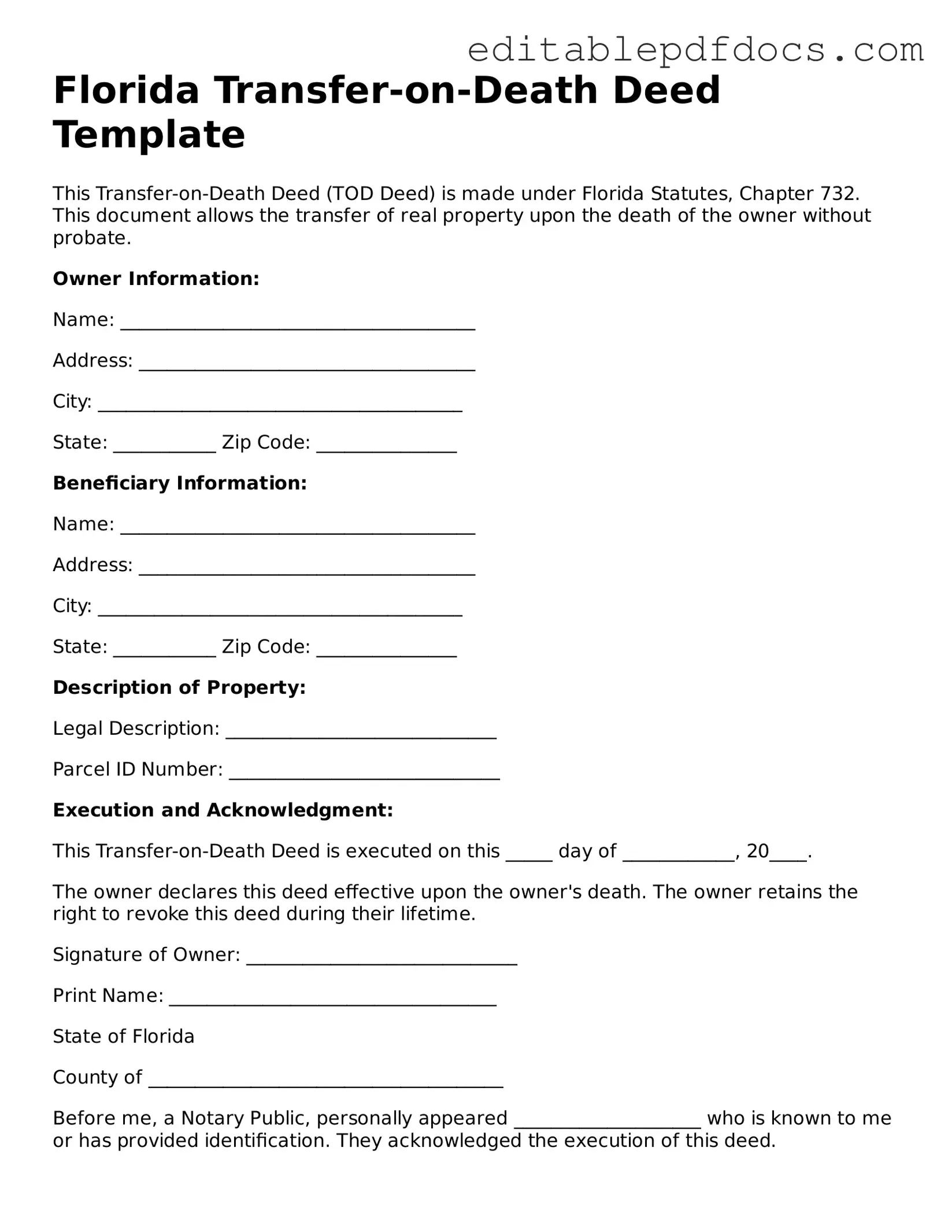

Transfer-on-Death Deed Document for Florida

In the state of Florida, the Transfer-on-Death Deed (TODD) offers a unique and efficient way for property owners to ensure their real estate is transferred to designated beneficiaries without the need for probate. This legal tool allows individuals to name one or more beneficiaries who will automatically receive ownership of the property upon the owner's death. By utilizing this form, property owners can maintain control over their real estate during their lifetime while simplifying the transfer process for their heirs. The TODD can be particularly beneficial for those looking to streamline estate planning and reduce the complexities often associated with property transfer after death. Additionally, this deed is revocable, meaning that the owner can change beneficiaries or revoke the deed entirely at any time before their passing. Understanding how to properly complete and file the Transfer-on-Death Deed is crucial, as it ensures that the owner's wishes are honored and that the transfer occurs seamlessly. This article will explore the essential aspects of the Florida Transfer-on-Death Deed, including its advantages, requirements, and the steps involved in executing this valuable estate planning tool.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Florida Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Florida Statutes, specifically Chapter 732.4015. |

| Eligibility | Any individual who owns real property in Florida can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can name one or more beneficiaries. If multiple beneficiaries are named, they will share the property equally unless stated otherwise. |

| Revocation | The deed can be revoked at any time before the owner's death by filing a new deed or a revocation form. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded with the county clerk in the county where the property is located to be effective. |

| Tax Implications | There are no immediate tax consequences for the property owner when creating a Transfer-on-Death Deed. |

| Legal Assistance | While legal assistance is not required, it is often recommended to ensure the deed is properly executed and recorded. |

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure accuracy and legality. Here are some dos and don'ts to consider:

- Do provide accurate property information, including the legal description of the property.

- Do ensure that all owners sign the deed if there are multiple owners.

- Do have the deed notarized to validate the document.

- Do file the deed with the appropriate county clerk’s office to make it effective.

- Don't use vague language when describing the property.

- Don't forget to include the names of the beneficiaries clearly.

- Don't leave the form incomplete or unsigned.

- Don't assume that the deed is effective without proper filing.

Documents used along the form

When considering the Florida Transfer-on-Death Deed, it's essential to understand that several other documents may also be relevant in the process of transferring property. Each of these documents serves a specific purpose and can help ensure a smooth transition of ownership. Below is a list of commonly used forms and documents that complement the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines an individual's wishes regarding the distribution of their assets upon death. It can include specific bequests, guardianship designations for minor children, and other important instructions.

- Living Trust: A living trust is a legal entity that holds and manages an individual's assets during their lifetime and specifies how those assets should be distributed after death. This can help avoid probate and provide greater control over asset distribution.

- Beneficiary Designation Forms: These forms are used for financial accounts, retirement plans, and insurance policies. They allow individuals to designate beneficiaries who will receive assets directly upon death, bypassing probate.

- ATV Bill of Sale: This form is a crucial document for anyone buying or selling an all-terrain vehicle in California, providing legal protection for both parties involved. For those interested, Fillable Forms are available to simplify the process.

- Property Deed: The property deed is the legal document that establishes ownership of real estate. It may need to be updated to reflect the transfer of ownership as specified in the Transfer-on-Death Deed.

- Affidavit of Heirship: This document can help establish the identity of heirs when a person dies without a will. It provides a sworn statement regarding the deceased’s family relationships and can assist in the transfer of property to heirs.

Understanding these documents and their roles in the estate planning process can significantly impact the efficiency of property transfers. It is advisable to consult with a legal professional to ensure all necessary forms are correctly completed and filed, safeguarding your interests and those of your beneficiaries.

Consider Some Other Transfer-on-Death Deed Templates for US States

Washington Tod Deed - Property owners can also specify conditions under which the property will be transferred, adding another layer of control.

Transfer on Death Deed Pennsylvania - This deed circumvents traditional probate, saving time and money for heirs.

How to Transfer a Land Deed - This form is particularly useful for those who wish to simplify the transfer of family homes or investment properties.

For those looking to empower someone to make financial decisions on their behalf, a General Power of Attorney form is essential. This legal document, which can be found at nyforms.com/general-power-of-attorney-template, outlines the responsibilities and powers granted to the agent, ensuring clarity and understanding for both parties involved.

Trust Avoid Probate - A Transfer-on-Death Deed is a straightforward way to ensure your property is distributed according to your wishes after your death.

Similar forms

- Will: A will outlines how a person’s assets will be distributed after their death. Like a Transfer-on-Death Deed, it serves to transfer property, but a will typically goes through probate, while a Transfer-on-Death Deed does not.

-

Commercial Lease Agreement: A Florida Commercial Lease Agreement form is essential for establishing rental terms between a landlord and tenant for commercial properties. To ensure proper completion, be sure to print and fill out the form, which outlines important details such as rent, duration, and responsibilities of both parties.

- Living Trust: A living trust allows individuals to manage their assets during their lifetime and specify how those assets will be distributed after death. Both documents avoid probate, but a living trust can also provide management of assets during incapacity.

- Beneficiary Designation: Commonly used for financial accounts and insurance policies, a beneficiary designation allows individuals to name someone who will receive assets upon death. Similar to a Transfer-on-Death Deed, it transfers assets directly to the named beneficiary without going through probate.

- Joint Tenancy: This form of property ownership allows two or more people to own property together. When one owner dies, their share automatically transfers to the surviving owner(s), similar to how a Transfer-on-Death Deed works.

- Payable-on-Death Account: This type of bank account allows the account holder to designate a beneficiary who will receive the funds upon the account holder's death. Like a Transfer-on-Death Deed, it bypasses probate and ensures a smooth transfer of assets.

- Life Estate: A life estate grants someone the right to use a property during their lifetime, with the property passing to another person upon their death. Both documents facilitate a transfer of property, but a life estate involves ongoing rights to use the property.

- Transfer-on-Death Registration: This is often used for vehicles or securities, allowing the owner to designate a beneficiary who will receive the asset after their death. Similar to a Transfer-on-Death Deed, it enables a direct transfer without the need for probate.

Common mistakes

When individuals decide to use a Transfer-on-Death (TOD) deed in Florida, they often aim to simplify the process of transferring property upon death. However, several common mistakes can complicate this otherwise straightforward procedure. Awareness of these pitfalls can help ensure that the deed serves its intended purpose.

One frequent error occurs when people fail to properly identify the property being transferred. The deed must contain a precise legal description of the property. Relying on informal descriptions or addresses can lead to confusion and disputes among heirs. It is essential to refer to the official property records to ensure accuracy.

Another mistake involves the selection of beneficiaries. Some individuals may neglect to clearly specify who will inherit the property. If the beneficiaries are not named explicitly, or if there are ambiguities in their identification, the deed may not be enforceable. This can result in unintended consequences, such as property being subject to probate or being divided among multiple parties in ways not originally intended.

Additionally, many people overlook the requirement for signatures. A Transfer-on-Death deed must be signed by the property owner, and in Florida, it must also be notarized. Failing to meet these formalities can render the deed invalid. It is crucial to ensure that all necessary parties are present and that the deed is executed according to the state’s legal requirements.

Another common oversight is not recording the deed with the appropriate county office. A Transfer-on-Death deed must be recorded to be effective. If the deed is not filed, it may not be recognized after the owner’s death, leading to complications in the transfer of property. Timely recording is essential to ensure that the wishes of the property owner are honored.

Lastly, some individuals may mistakenly believe that a Transfer-on-Death deed can replace a will. While a TOD deed can effectively transfer property outside of probate, it does not address other assets or debts. Relying solely on a TOD deed without a comprehensive estate plan can lead to confusion and unintended consequences. It is advisable to consider how the TOD deed fits into the broader context of one’s estate planning.