Quitclaim Deed Document for Florida

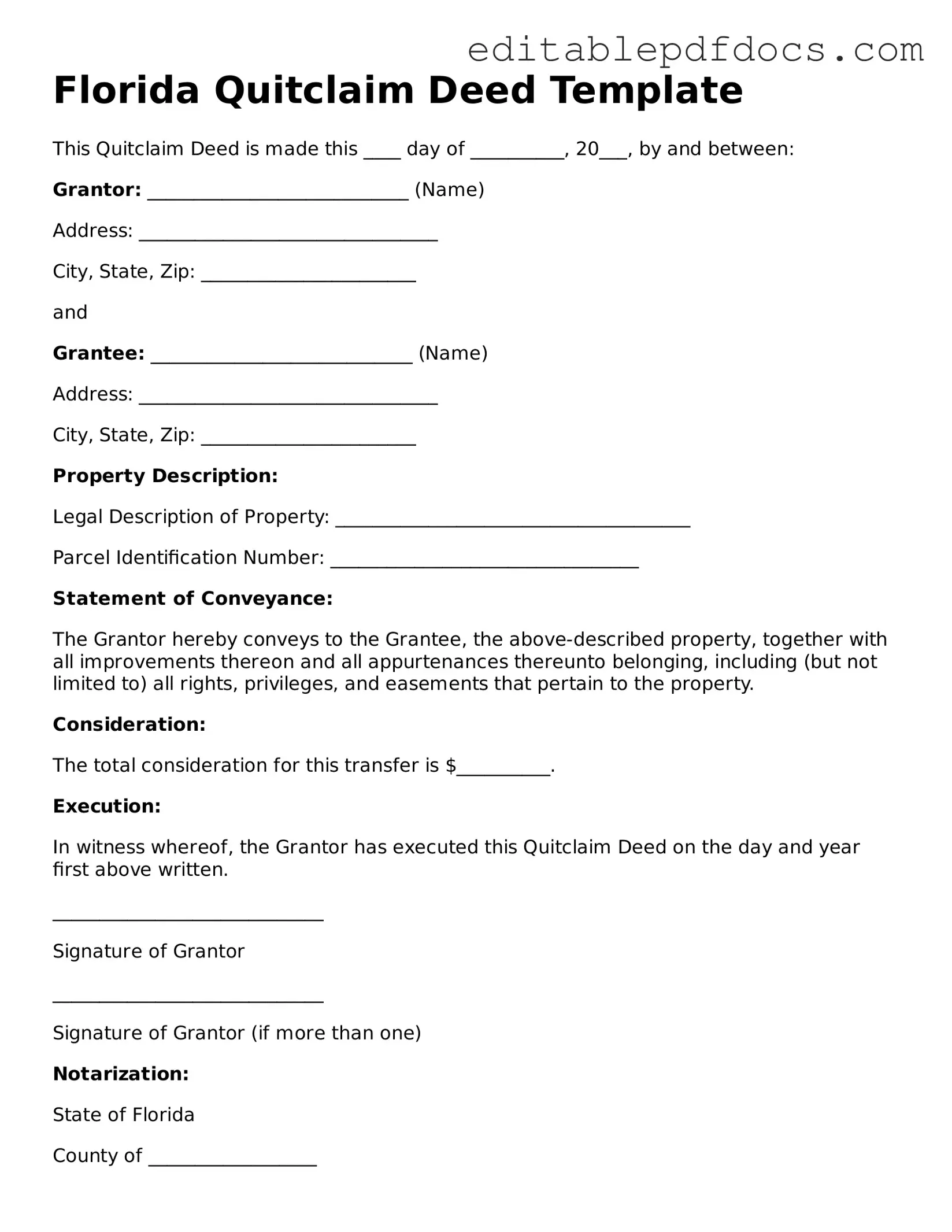

The Florida Quitclaim Deed form serves as a vital tool for property transfers, allowing individuals to convey their interest in real estate without making any guarantees about the title's validity. This form is particularly useful in situations where the transferor may not have complete ownership rights or when the parties involved are familiar with each other, such as family members or friends. By utilizing a Quitclaim Deed, the grantor relinquishes any claim to the property, effectively transferring whatever interest they hold to the grantee. It's important to note that this type of deed does not offer any warranties or assurances, which can lead to potential complications if title issues arise. Completing the form requires specific information, including the names of the parties, a legal description of the property, and the signature of the grantor, often necessitating notarization. Understanding the implications of using a Quitclaim Deed is crucial for anyone considering this option, as it can have significant legal and financial consequences. Whether you're looking to resolve a property dispute, transfer property as part of a divorce settlement, or simply wish to gift real estate, knowing how to properly execute a Florida Quitclaim Deed is essential for a smooth transaction.

File Information

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the title. |

| Governing Law | The Florida Quitclaim Deed is governed by Florida Statutes, specifically Chapter 689, which outlines the requirements for property conveyances. |

| Purpose | This form is commonly used among family members, in divorce settlements, or to clear up title issues. |

| Warranties | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor holds clear title to the property. |

| Consideration | While some quitclaim deeds may involve payment, they can also be executed without any monetary exchange. |

| Execution Requirements | The deed must be signed by the grantor and may require notarization for it to be legally binding. |

| Recording | To protect the interests of the grantee, it is advisable to record the quitclaim deed with the local county clerk's office. |

| Tax Implications | Transfer taxes may apply depending on the value of the property being transferred, and it is important to consult local regulations. |

| Limitations | A quitclaim deed does not remove any liens or encumbrances on the property, which may still affect the new owner. |

Dos and Don'ts

When filling out the Florida Quitclaim Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do during this process.

- Do provide accurate property descriptions.

- Do include the names of all parties involved.

- Do sign the deed in the presence of a notary public.

- Do check for any specific requirements in your county.

- Don't leave any sections blank; fill in all required fields.

- Don't forget to record the deed with the county clerk after signing.

By adhering to these guidelines, you can help ensure that the Quitclaim Deed is properly executed and legally binding.

Documents used along the form

When transferring property ownership in Florida, the Quitclaim Deed is a common document used. However, several other forms and documents often accompany this deed to ensure a smooth and legally sound transaction. Below is a list of these documents, each serving a specific purpose in the property transfer process.

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. It provides more protection to the buyer compared to a quitclaim deed.

- Affidavit of Title: This sworn statement confirms the seller's ownership and asserts that there are no liens or claims against the property, providing additional assurance to the buyer.

- Property Transfer Tax Form: This form is required by the state to assess any transfer taxes due upon the sale of the property. It helps ensure compliance with local tax regulations.

- Title Insurance Policy: This insurance protects the buyer from any future claims against the title that may arise, such as undiscovered liens or ownership disputes.

- Closing Statement: Also known as a HUD-1, this document outlines all costs and fees associated with the property transaction, ensuring transparency for both parties involved.

- Power of Attorney: If one party cannot be present at the closing, this document allows another person to act on their behalf, facilitating the transaction without delays.

- Motorcycle Bill of Sale: To ensure a proper transfer of ownership, utilize the comprehensive motorcycle bill of sale documentation for accurate record-keeping and legal compliance.

- Notice of Sale: This document informs interested parties of the sale, which can be important for ensuring that all parties are aware of the transfer and any associated rights or claims.

Each of these documents plays a vital role in the property transfer process in Florida. Ensuring that all necessary forms are completed and filed correctly can help prevent disputes and protect the interests of both the buyer and the seller.

Consider Some Other Quitclaim Deed Templates for US States

Tennessee Quitclaim Deed - It is advisable to perform a title search before executing a Quitclaim Deed.

For a seamless shipping experience, utilizing the FedEx Bill of Lading form is vital, and you can find easy access to necessary resources such as Fillable Forms that simplify the process. This form serves as a crucial document for shipping goods, providing a detailed record of the shipment. It outlines the terms and conditions, as well as the responsibilities of the shipper and carrier, ensuring proper handling and delivery of cargo. Understanding this document is essential for anyone involved in freight shipping, as it sets the groundwork for a successful transaction.

Arizona Quit Claim Deed Form - The form requires signatures from the current owner, called the grantor.

Similar forms

- Warranty Deed: A warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, it offers more protection to the buyer, ensuring that if any title issues arise, the seller will be responsible for resolving them.

Last Will and Testament: This legal document outlines how an individual's assets and affairs will be handled after their death. It ensures that your wishes are respected and provides clear instructions for your loved ones. To learn more, you can download the Last Will and Testament form.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and includes assurances that the property has not been sold to anyone else. However, it does not guarantee against all title defects, which makes it less protective than a warranty deed but still more secure than a quitclaim deed.

- Special Purpose Deed: This type of deed is used for specific situations, such as transferring property between family members or in a divorce. Like a quitclaim deed, it often lacks warranties, focusing instead on the specific purpose of the transfer.

- Deed of Trust: A deed of trust involves three parties: the borrower, the lender, and a trustee. It secures a loan by transferring the property title to the trustee until the borrower repays the loan. While it serves a different function, it also involves the transfer of property rights.

- Transfer on Death Deed: This document allows an individual to transfer property to a beneficiary upon their death without going through probate. While it is a straightforward transfer like a quitclaim deed, it includes the added benefit of avoiding probate, which can be a lengthy process.

- Bill of Sale: Although primarily used for personal property, a bill of sale serves as a document of transfer. It outlines the sale of items such as vehicles or equipment. Like a quitclaim deed, it signifies the transfer of ownership, but it does not deal with real estate.

Common mistakes

Filling out a Florida Quitclaim Deed can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is not including the correct legal description of the property. This description should be precise and match the one found in public records. If it’s vague or inaccurate, it can create confusion or disputes in the future.

Another mistake is failing to include all necessary parties. Each person involved in the transaction must be listed correctly. If a spouse or co-owner is omitted, it could invalidate the deed. Always double-check that everyone who has a legal interest in the property is accounted for.

Many people overlook the importance of signatures. The Quitclaim Deed must be signed by the grantor, the person transferring their interest. If the grantor does not sign, the deed is not valid. Additionally, if the deed requires notarization, ensure that this step is completed. A notary public must witness the signing to make the document legally binding.

Another common pitfall is neglecting to record the deed with the county clerk’s office. After completing the form, it’s essential to file it. Recording the deed protects the new owner's rights and provides public notice of the property transfer. Without this step, the transaction may not be recognized legally.

Lastly, many people forget to check for any outstanding liens or encumbrances on the property. Before transferring ownership, it’s crucial to ensure that the property is free of debts that could affect the new owner. Conducting a title search can help avoid future issues.