Promissory Note Document for Florida

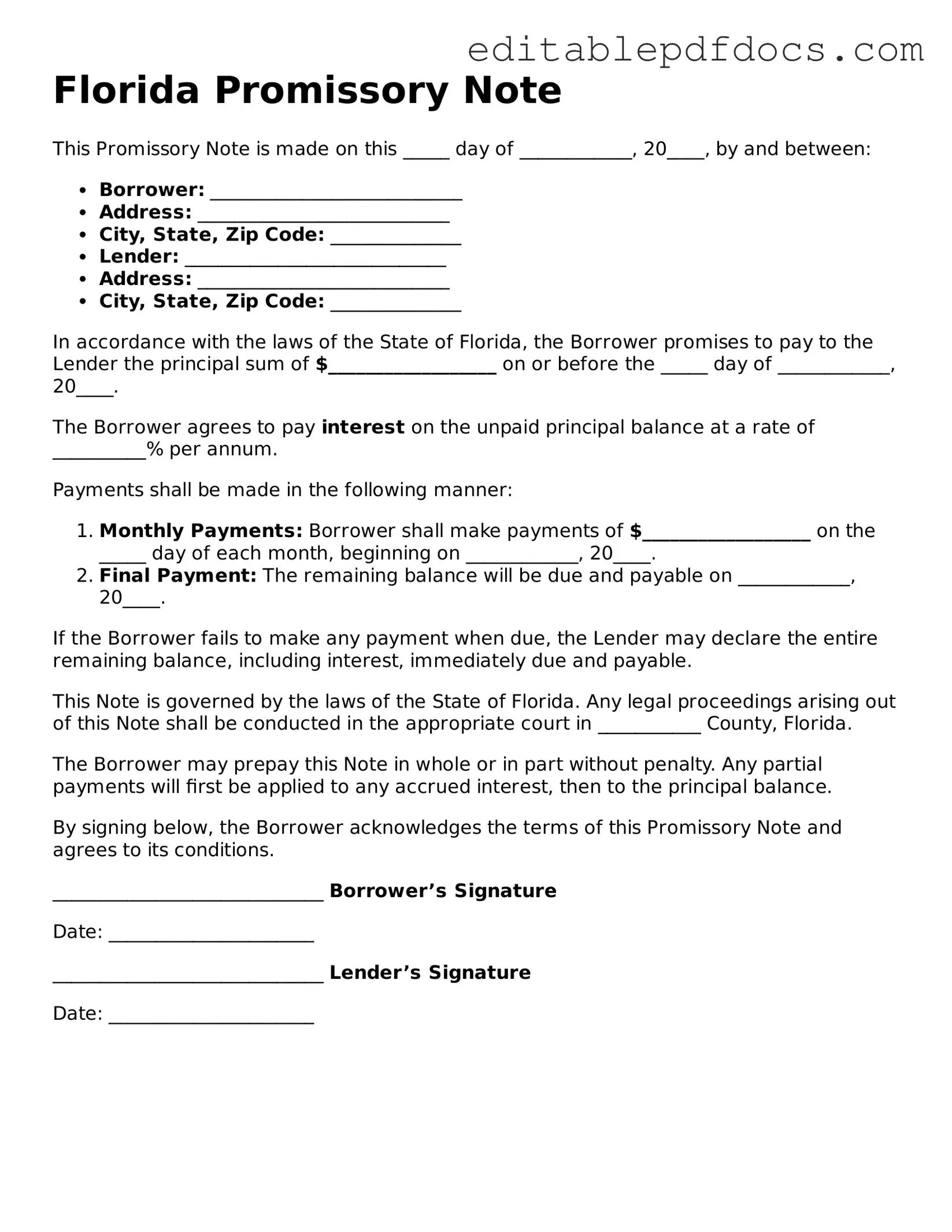

The Florida Promissory Note form serves as a crucial financial instrument that outlines the terms of a loan between a borrower and a lender. This document specifies the amount borrowed, the interest rate, and the repayment schedule, ensuring clarity and mutual understanding. Additionally, it may include provisions for late fees and default consequences, protecting the interests of both parties involved. By detailing the obligations of the borrower, the form establishes a legal framework that can be enforced in court if necessary. Furthermore, it is important to recognize that this form can vary based on the specific needs of the transaction, allowing for customization while adhering to Florida's legal requirements. Understanding the nuances of the Promissory Note can help individuals navigate their financial agreements with confidence and security.

File Information

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. |

| Governing Law | The Florida Promissory Note is governed by Florida Statutes, specifically Chapter 673, which pertains to the Uniform Commercial Code (UCC). |

| Parties Involved | Typically, there are two parties: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable, depending on the agreement between the parties. |

| Payment Terms | Payment terms outline when and how payments will be made, including the due date and acceptable payment methods. |

| Default Conditions | The document should include conditions under which the borrower is considered in default, along with potential remedies for the lender. |

| Signatures Required | Both parties must sign the promissory note for it to be legally binding, and it is advisable to have it witnessed or notarized. |

| Enforceability | If properly executed, the promissory note is a legally enforceable document in Florida courts. |

Dos and Don'ts

When filling out the Florida Promissory Note form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn’t do:

- Do read the instructions carefully before starting. Understanding the requirements will help avoid mistakes.

- Do provide accurate and complete information. Ensure all names, addresses, and amounts are correct.

- Do sign and date the document where required. A missing signature can invalidate the note.

- Don't leave any blank spaces. If a section does not apply, write "N/A" instead of leaving it empty.

- Don't use incorrect or outdated forms. Always ensure you are using the most current version of the Promissory Note.

Following these guidelines will help ensure that your Promissory Note is properly completed and legally binding. If you have any doubts, consider seeking assistance to clarify any uncertainties.

Documents used along the form

When entering into a loan agreement in Florida, a Promissory Note serves as a crucial document. However, it is often accompanied by various other forms and documents that help clarify the terms and protect the interests of all parties involved. Understanding these documents can enhance your knowledge of the lending process and ensure a smoother transaction.

- Loan Agreement: This document outlines the specific terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any conditions or covenants that must be met by the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral involved and the rights of the lender in case of default.

- Disclosure Statement: This document provides borrowers with important information about the loan, including the total cost of borrowing, fees, and the annual percentage rate (APR).

- Guaranty Agreement: In some cases, a third party may agree to guarantee the loan, providing additional security for the lender. This document outlines the guarantor's obligations.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular payments over time, showing how much of each payment goes toward principal and interest.

- Doctors Excuse Note: This form is an essential document that verifies a patient's medical condition and their need for time off from work or school. It is crucial for individuals who need proof of illness or appointments. You can find more information and access the form through Fillable Forms.

- Default Notice: Should the borrower fail to meet the terms of the loan, this notice formally informs them of the default and the potential consequences.

- Release of Lien: Once the loan is fully repaid, this document is issued to confirm that the lender relinquishes their claim on the collateral.

- Assignment of Rights: If the lender wishes to transfer their rights under the loan agreement to another party, this document formalizes that transfer.

- Loan Modification Agreement: If any terms of the original loan need to be changed, this document outlines the new terms agreed upon by both parties.

- Closing Statement: This document summarizes the final terms of the loan and any closing costs involved, ensuring both parties are on the same page before finalizing the agreement.

Familiarizing yourself with these forms and documents can empower you to navigate the lending landscape more effectively. Each document plays a unique role in the process, ensuring clarity and protection for both borrowers and lenders alike. Understanding them is essential for making informed financial decisions.

Consider Some Other Promissory Note Templates for US States

Washington Promissory Note - In case of disputes, the promissory note can serve as crucial evidence.

When dealing with the sale or transfer of older vehicles in New York, it's essential to understand the requirements for the MV-51 form. This form, also known as the certification of sale, must be properly filled out and is crucial for transactions involving vehicles from 1972 or earlier. Sellers need to ensure that they provide a clear bill of sale to accompany the form, verifying ownership and ensuring no liens exist. For further information on how to properly complete this process, visit nyforms.com/new-york-mv51-template/.

Promissory Note Template Arizona - Promissory notes can be secured with collateral or remain unsecured based on terms.

Promissory Note Template California Word - Both parties should retain copies of the signed promissory note for their records.

Georgia Promissory Note Template - Promissory notes provide clear evidence of a debt obligation.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of borrowing, including the amount, interest rate, and repayment schedule. However, it is typically more detailed and may include additional clauses regarding default and collateral.

- Vehicle Bill of Sale: Similar to other financial documents, a Vehicle Bill of Sale records the transfer of ownership of a vehicle, ensuring both parties have a detailed account of the transaction including the sale price and vehicle details. For more information, visit topformsonline.com/.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. It includes a promissory note as part of the overall documentation, detailing the borrower's promise to repay the loan used to purchase the property.

- Personal Guarantee: This document involves an individual agreeing to be responsible for another person's debt. Like a promissory note, it establishes a personal commitment to repay a loan, but it is often used in business contexts.

- Installment Agreement: An installment agreement allows for the payment of a debt in regular installments over time. It shares similarities with a promissory note by outlining payment terms, but it may cover various types of debts beyond loans.

- Security Agreement: This document is used to secure a loan with collateral. While a promissory note focuses on the promise to pay, a security agreement specifies what assets are at risk if the borrower defaults.

- Letter of Credit: A letter of credit is a financial document issued by a bank guaranteeing payment. It resembles a promissory note in that it represents a promise to pay, but it is typically used in international trade and business transactions.

- Debt Acknowledgment: This document confirms that a borrower acknowledges a debt exists. It serves a similar purpose to a promissory note by recognizing an obligation, but it may not include specific repayment terms.

Common mistakes

When filling out the Florida Promissory Note form, many individuals overlook crucial details that can lead to complications later. One common mistake is failing to accurately identify the parties involved. The borrower and lender must be clearly defined, including their full legal names and contact information. Incomplete or incorrect names can create confusion and may affect the enforceability of the note.

Another frequent error is neglecting to specify the loan amount and interest rate. It's essential to write these figures clearly and accurately. If the amounts are ambiguous or missing, it could lead to disputes about what was agreed upon. A precise figure ensures that both parties have a clear understanding of the financial obligations.

Additionally, people often forget to include the repayment terms. This includes the payment schedule, due dates, and any penalties for late payments. Without these details, the borrower may not know when payments are expected, and the lender may have difficulty enforcing the terms of the loan. Clarity in repayment terms is vital for a smooth transaction.

Lastly, many individuals neglect to sign and date the document properly. A Promissory Note is only valid if it is signed by both parties. Failing to sign or date the form can render it unenforceable. Ensuring that all signatures are present and dated correctly is a critical step in finalizing the agreement.